Checking in on ALFA

Shifting global growth expectations, geopolitical tensions and the evolving interest-rate environment are impacting equity markets, and these key themes are expected to persist through 2026.

The Australian equity market has been on a stellar run since in 2025, particularly after Liberation Day in April, with mid- and small-caps outperforming.

Recently, the Australian equities market experienced a solid, albeit volatile, August earnings update period with beats outpacing misses 4 to 3. The RBA’s recent rate cut and a pick-up in household spending have also been key catalysts in the recent rally.

However, with pockets of valuations appearing stretched and benign earnings growth forecast, particularly across large caps, it reinforces our view of the need to diversify away from the mega-caps but be selective to uncover the next growth opportunities.

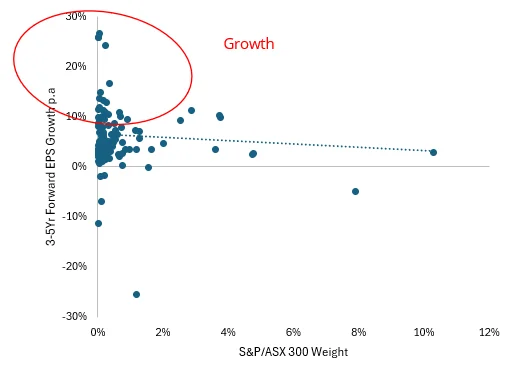

In Chart 1 below, each dot represents a company in the S&P/ASX300. The bigger the company, the further along the horizontal axis the company is. CBA, the largest company on ASX, is the dot farthest to the right. The size of the company is plotted against its 3 to 5-year forward earnings-per-share (EPS) growth estimates. You can see the companies with the highest expected growth tend to sit outside the top 10.

Chart 1: 3-5Yr Forward EPS Growth p.a. of S&P/ASX 300 companies

Source: Factset, VanEck. Bloomberg. September 2025.

So, growth is expected to come from smaller sized companies.

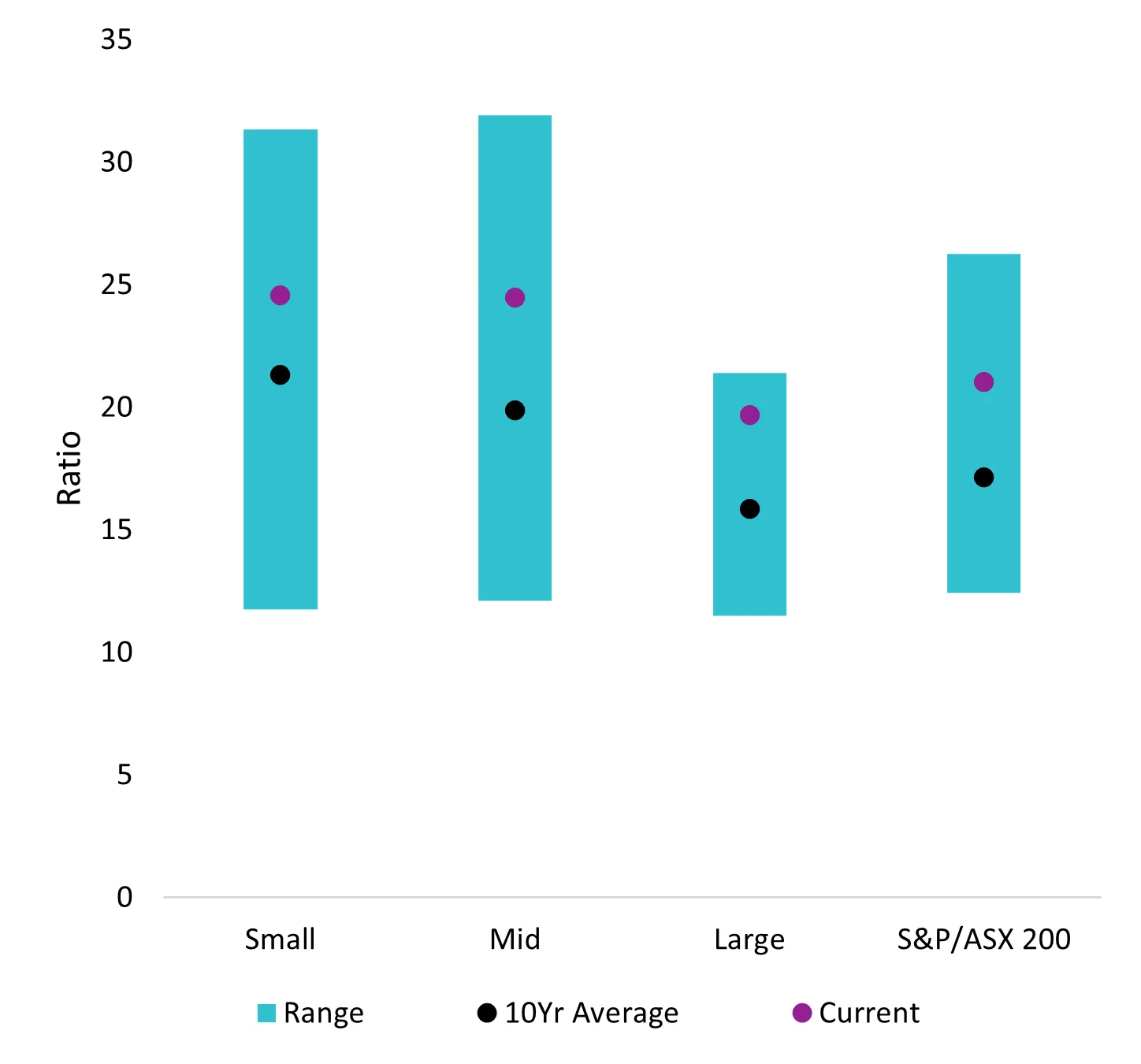

At the same time, large-cap valuations appear expensive and are at the upper bound of their 10-year historical range. The purple dot, representing the current valuation (as measured by Price to 12-month forward earnings) in the large-cap box below, is closer to the top than the small and mid-cap dots.

Chart 2: Price to 12m forward earnings

Source: Factset, VanEck. Bloomberg. Large cap is S&P/ASX 20 Index. Mid cap is S&P/ASX Midcap 50 Index. Small Cap is S&P/ASX Small Ordinaries Index.

How ALFA is taking advantage of these dynamics

True to its name, ALFA is a long short fund. Long short equity strategies are designed to profit from stocks that are going up as well as those that are going down. This approach has been around since the 1940s and is a common approach used by hedge funds and other actively managed funds.

Long positions: involve purchasing shares of companies identified as being poised to increase in price, profiting from their upward movement.

Short positions: involve borrowing shares at the current price and selling them, with the intention of buying them back later at a lower price. The strategy is profitable if the share price declines during this period.

The recent August reporting season highlights the benefits of ALFA’s approach; we also think it highlighted the vulnerability of Australian large caps.

A short position - CSL Ltd, an S&P/ASX 200 top 10 company, fell 16.89% after results, the sharpest single day move since 1999. At the time, it was one of the short positions in ALFA’s portfolio as reported in the Australian Financial Review by Gus McCubbing, “Why VanEck Australia’s ETF has doubled down on its CSL short”. As the price fell, having a short position benefited the fund.

A long position - We also benefited from strong positive price reactions across our long positions, including Eagers Automotive.

During the February 2025 ASX reporting season, Eagers did well by announcing that revenue would rise by $1 billion for the full year. It hit that target in six months. In August Eagers reported interim revenue of $6.5 billion, up 19%, and it is on track for full-year revenue of over $13 billion. This is around 50% more than the revenue it reported two years ago.

Eagers controls 31% of electric vehicle sales following its recently announced partnerships with Mitsubishi Corporation and BYD Australia. We think there is scope for further market expansion and earnings growth because of improving macro conditions and a broader push for EV adoption through initiatives such as novated leasing and other company tax breaks.

You can read the fund’s monthly commentary - here

Performance

ALFA has outperformed the S&P/ASX 200 by 730 basis points (bps) since inception.

Table 1: Performance to 30 September 2025. Noting this is a short period, and past performance should not be relied upon for future performance.

Performance to 30 September 2025

* ALFA Inception date is 21 January 2025. A copy of the factsheet is here.

Table 1 source: Bloomberg. The table above shows the past performance of ALFA from 21 January 2025. Results are calculated daily and assume immediate reinvestment of distributions. Past performance is not a reliable indicator of current or future performance, which may be lower or higher. ALFA results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. ALFA is an actively managed, high conviction, systematic long-short Australian equity strategy that aims to outperform the S&P/ASX 200 Accumulation Index over the medium to long term after fees and other costs. Click here for more details.

Under the hood

When we launched ALFA, we introduced it as a strategy that is systematic and deeply quantitative. ALFA’s process involves machine learning that analyses over 12,000 potential signals at any given time, and assesses their efficacy and statistical significance in achieving excess returns. VanEck has a distinguished history of harnessing technological advancement and advanced analysis to identify and unlock opportunities for Australian investors. For over a decade we have pioneered smart beta ETF strategies in Australia, with a vast number of our smart beta ETFs being the first of their kind on the ASX, offering investors the ability to construct portfolios with a targeted outcome in mind.

Using ALFA in a portfolio

We think ALFA complements core exposures such as broad large-cap active funds and passive Australian Equity ETFs, including smart beta, like our own, VanEck Australian Equal Weight ETF (MVW). Satellite exposures are typically concentrated by sector or by stock and allow investors to tilt their portfolio to access broader opportunities. It is a useful diversification tool.

The advantage that a long short satellite exposure has is that there may be times its returns are not correlated to the broader market it has exposure to. This may be due to its short positions, which will increase in value should the broad equity market fall, and vice versa.

Because ALFA is unconstrained and actively managed, it can sit alongside other satellite positions such as small companies portfolios or direct holdings in favoured mega-caps, with little or no cross-over.

Key risks: An investment in the Fund carries risk. The Fund is considered to have a higher investment risk than a comparable fund that does not engage in short selling and leverage. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an investment in the fund include those associated with short selling risk, leverage risk, prime broker risk, counterparties risk, concentration risk, operational risk and material portfolio information risk. See the VanEck Australian Long Short Complex ETF PDS and TMD for more details.

ALFA is likely to be appropriate for a consumer who is seeking capital growth, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 7 years and a very high risk/return profile.

Published: 02 October 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.