Dividend stocks beyond Australian blue chips

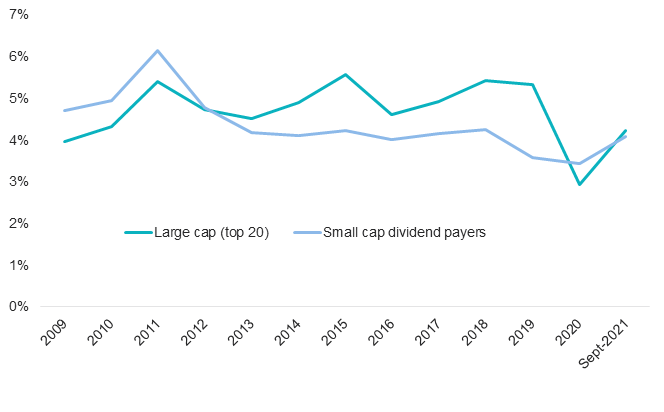

2020 was a difficult year for yield chasing investors as companies cancelled/reduced dividend payments to shore up cash flows in light of uncertainties navigating COVID-19. Large cap stocks, notably big four bank dividends for 2020 were on average 60% lower than 2019.

2020 was a difficult year for yield chasing investors as companies cancelled/reduced dividend payments to shore up cash flows in light of uncertainties navigating COVID-19. Large cap stocks, notably big four bank dividends for 2020 were on average 60% lower than 2019.

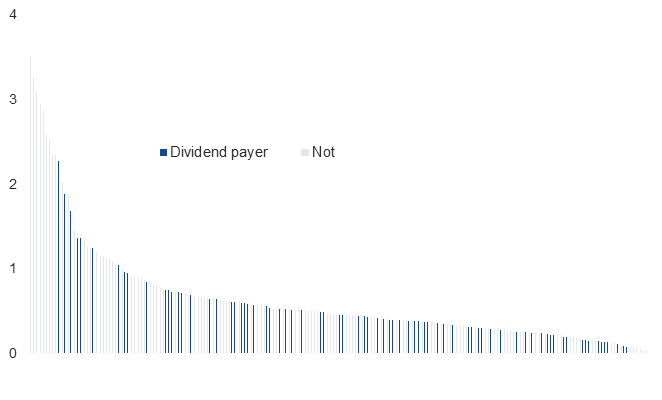

Small cap stock dividend payers on the other hand were less affected as shown by difference in dividend yields for 2020 in Chart 1.

Chart 1 - Australian large cap versus small cap dividend payers 12m trailing dividend yield

Source: Bloomberg, MVIS, 30 September 2021. Large cap (top 20) is S&P/ASX 20, Small Cap dividend payers as MVIS Australia small cap dividend payers index.

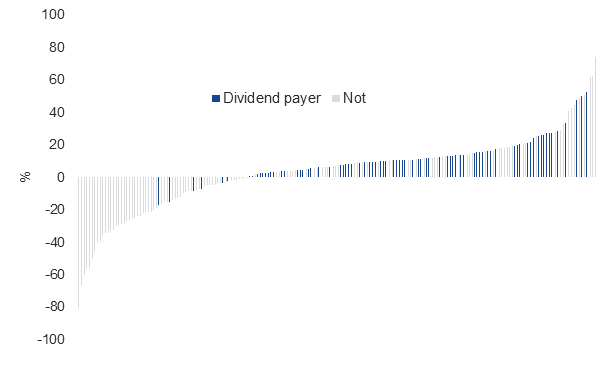

Small caps can offer attractive dividends and are considered a proxy for quality as dividends are generally sourced from sustainable earnings. Two charts below highlight that the return on equity and earnings stability of companies is generally higher for dividend payers in the Australian small cap universe.

Chart 2 - Australian small caps ranked by return on equity

Source: Bloomberg, VanEck, 30 September 2021. Australian small cap universe is S&P/ASX small ordinaries index. Dividend payer constituents in MVIS Australia Small Cap Dividend Payers Index.

Chart 3 - Australian small caps ranked by earnings stability

Source: Bloomberg, VanEck 31 December 2020. Australian small cap universe is S&P/ASX small ordinaries. Earnings stability is the standard deviation of yearly earnings growth over the past 5 years. Dividend payer constituents in MVIS Australia Small Cap Dividend Payers index.

Small cap stocks also provide the opportunity for significant upside growth potential compared to large caps.

|

COMPANY |

SECTOR |

DESCRIPTION |

DIVIDEND YIELD |

|

BEGA |

Consumer staples |

Bega Cheese Ltd (ASX ticker: BGA) offers a variety of cheese product including can, stringers, fingers, slice, whey powder, processed, natural and reduced fat cheddar cheeses. The company exports whey powder to Asian countries. |

2.63% |

|

BAPCOR |

Consumer discretionary |

Bapcor Limited (ASX ticker: BAP) retails vehicle parts, accessories, equipment service and solutions. |

3.84% |

|

NATIONAL STORAGE |

Real Estate |

National Storage (ASX ticker: NSR) is one of the leading self-storage providers in Australia and New Zealand, providing residential and commercial storage to customers at 200+ centres. |

3.56% |

Source: Bloomberg. As at 11 October 2021.

The VanEck Australian Small Companies Masters ETF (ASX code: MVS) tracks the MVIS Australia Small Cap Dividend Payers Index, which screens out companies that did not omit their latest dividend payment.

Published: 19 October 2021