Bitcoin investment picking up steam

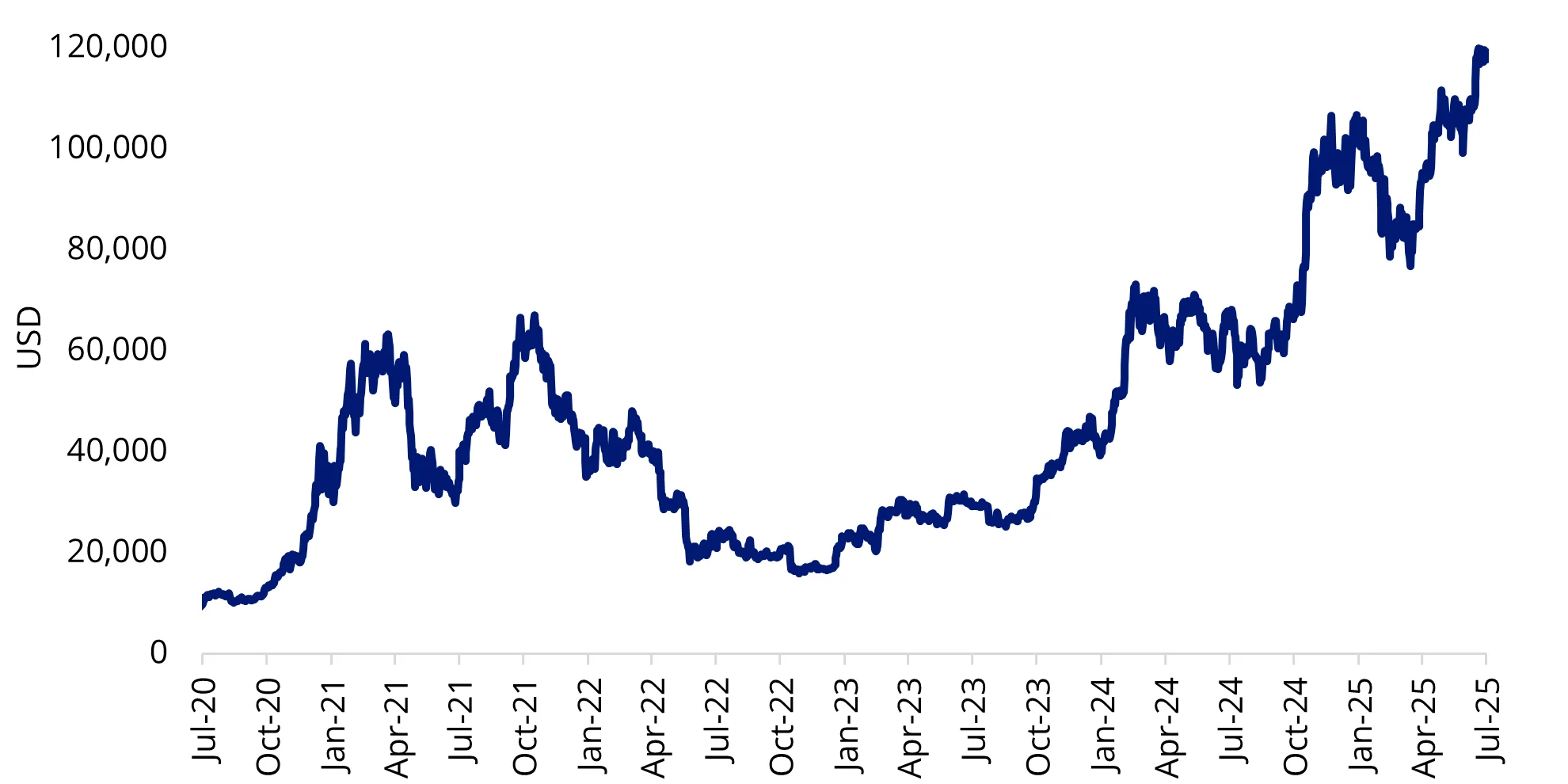

Last week, we saw the bitcoin price achieve a new all-time high of US$120K – a rally that may have been driven by the potential passing of three new crypto bills in the United States. While only one of these was passed – the “GENIUS” Act1, which creates a regulatory framework for stablecoins (digital assets that have value pegged to another asset, such as fiat currency) – the development marks the first major law governing the issuance and trading of cryptocurrency.

Chart 1: Bitcoin surpasses US$120,000

Source: VanEck. Bloomberg. Bitcoin price based on MarketVectorTMBitcoin Benchmark Rate in USD. Data from 30 June 2020 to 24 July 2025.

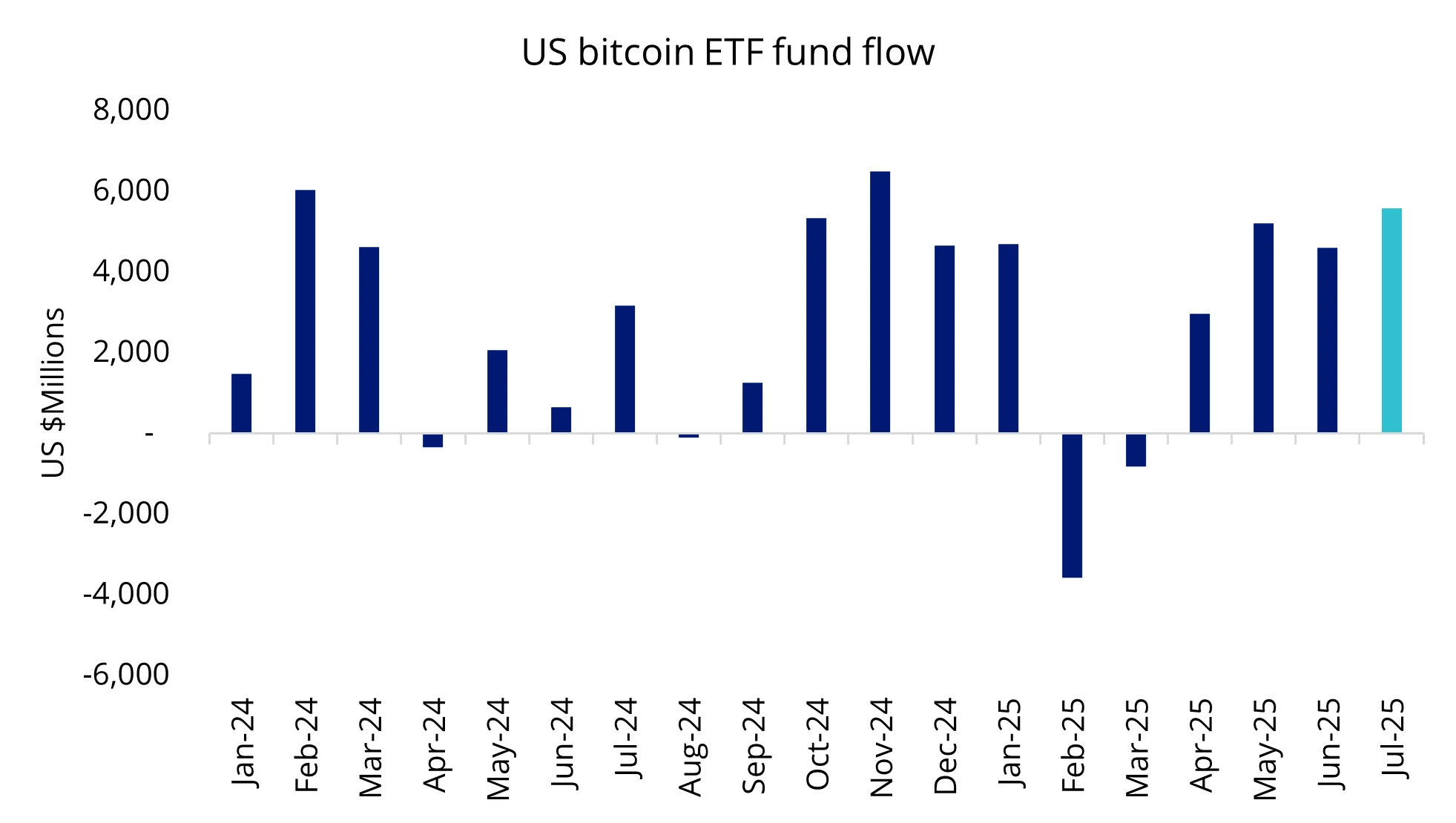

On Wall Street, investors have been piling into bitcoin ETFs, with month to date flows exceeding US$5.5 billion. While this has not yet beaten November 2024’s monthly record of US$6.5 billion (a surge driven by Trump’s win of the US presidential elections), there is still a little under a week’s worth of trading left to go.

Chart 2: July could see the highest inflow into bitcoin ETFs in history

Source: VanEck. Bloomberg. Flows in USD. Data from 1 January 2024 to 22 July 2025. Flows as represented by Bloomberg US Bitcoin ETF Flows Index (ticker: 12BTCETF G).

Net flows into Australian bitcoin ETFs in July have spiked in the back end of July, going from $18.7 million mid-month to a week later (as at 22 July). While this response has not reached the same scale as the US, we don’t think this represents a lack of interest so much as it does a more measured approach taken by Australian investors.

One of the differences we have noted about the Australian market is that investors appear to be more cautious about bitcoin exposure, but there are certainly signs that the local base is participating in the global groundswell. May 2025, which continues to be the strongest month for bitcoin ETFs in Australia, pulling in a total of $87.5 million, was when Moody’s downgraded the US government’s credit rating from AAA to AA1, and there was an improvement to risk sentiment due to US-China trade tensions easing.

Taking a global view, Australia ranks eighth in the top 10 of ‘“crypto countries“ based on investment in crypto exchange traded products (ETPs), with US$584.41 million (circa AU$890 million) – just behind Hong Kong’s US$668.48 million and well ahead of the Netherlands’ US$277.67 million.

Table 1: Global leaderboard of cryptocurrency ETF total AUM

|

Rank |

Country |

Amount (USD) |

|

1 |

US |

$175.18 billion |

|

2 |

Switzerland |

$9.65 billion |

|

3 |

Germany |

$5.34 billion |

|

4 |

China |

$5.16 billion |

|

5 |

Sweden |

$4.34 billion |

|

6 |

Brazil |

$1.47 billion |

|

7 |

Hong Kong |

$668.48 million |

|

8 |

Australia |

$584.41 million |

|

9 |

Netherlands |

$277.67 million |

|

10 |

France |

$229.18 million |

Source: Bloomberg, as at 16 July 2025.

Australia moves up the rankings to fifth when looking at year-to-date net flows, with a total US$177.66 million. Switching to the 1-month view, Australia’s position strengthens even further, leapfrogging over Switzerland to move up to fourth place, with net flows of US$44.12 million.

The VanEck Bitcoin ETF (VBTC), which recently passed 12 months of being the first bitcoin ETF on the ASX, tracks the spot price of bitcoin (using the MarketVector Bitcoin Benchmark Rate), and has returned 79.76% in the last year (as at 30 June 2025). We think the price of bitcoin still has further room to move in 2025, and think it could reach US$180,000 by the end of the year. Several tailwinds underpin this forecast, including the increased adoption of crypto strategic reserves by governments world-wide, growing institutional investment, and a broader shift towards tokenising real-world assets onto blockchains.

One local trend we have observed through a recent analysis of VanEck investors is that the mass affluent have been making meaningful allocations to bitcoin, with the average investment in VBTC approximately $40K. A review of ASX and CBOE data from 30 June 2024 to 31 May 2025 revealed VBTC consistently maintained the tightest trading spreads on average among its peers since inception. Tighter spreads directly translate to greater cost efficiency for investors – a critical yet often overlooked aspect when assessing costs. This difference can be significant on large trades, which could be a factor in the mass affluent groundswell we are seeing in VBTC’s investor base.

Key risks:

An investment in the fund involves extremely high risk and the potential for loss of all capital invested. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an investment in the fund include those associated with pricing risk, regulatory risk, custody risk, immutability risk, ASX trading time risk, concentration risk, environmental risk, currency risk, operational risk, underlying fund risk and forking risk. See the VanEck Bitcoin ETF PDS and TMD for more details.

Sources:

1https://www.congress.gov/bill/119th-congress/senate-bill/394/text

Published: 29 July 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.