Was it bitcoin or burritos

Last June was an exciting time on ASX. Two listings got a lot of media attention.

- VanEck’s Bitcoin ETF (VBTC), the first bitcoin ETF on ASX; and

- Guzman y Gomez

|

By coincidence, each started trading for the first time on ASX on the same day. There was cynicism about both, but each also had its defenders. Digital currencies and fast food… One was born from technology and created as a currency outside the fiat system, the other is a “clean is the new healthy” substitute for pizza, burgers and fried chicken in an otherwise saturated market. |

|

Last month, Guzman y Gomez (GYG) announced its results to the market. It was the first time ASX investors could assess GYG’s results during an August reporting season. Its share price fell after it announced its results. The reporting season was volatile.

At the same time, the price of bitcoin was falling.

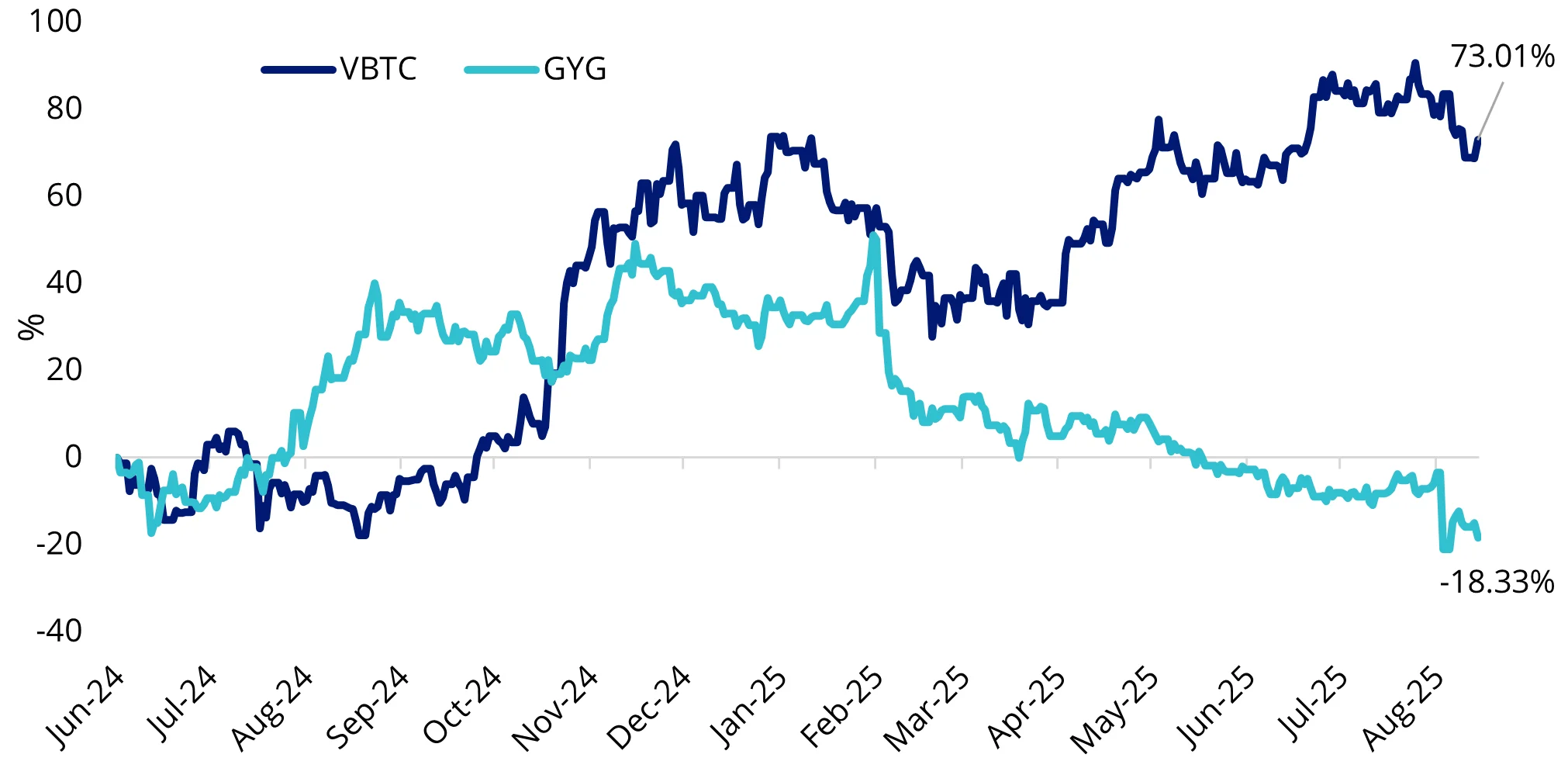

A little more than a year on, we pondered, was it bitcoin or burritos? Or both? Noting, of course, that past performance should not be relied upon for future performance and that in this instance, apart from the listing date, the investments should not be compared as each has different risks.

Chart 1: Bitcoin versus burritos

Source : VanEck, Morningstar, Bloomberg as at 2 September 2025. Past performance is not a reliable indicator of future performance.

VBTC inception date is 20 June 2024, and a copy of the factsheet is here.

GYG is shown for comparison purposes because each listed on ASX on the same day. There is no implication that the two assets have the same risk-return profile.

For those interested in bitcoin and VBTC, read on.

We are hosting our first Crypto Investor Symposium on 17 September 2025. This inaugural symposium will help decode the price drivers and outlook for bitcoin and other digital assets. You can register now – Click here for details

Why VanEck offered a bitcoin ETF

In the past, VanEck has made opportunities available to investors that they would otherwise not have had access. This goes back to our origin.

Founder, John C van Eck, understood that investors need a hedge in their portfolios if and when governments lose control over the money supply. When US spending was out of control in the 1960s, he launched the first gold miners share fund in the US, even though gold had been pegged against the US dollar for about 190 years. Investing in gold bullion was illegal at the time. Three years later, the peg broke.

That gold miners fund is still being managed today.

This philosophy and spirit of innovation underpins our approach to investing and many of the products we bring to market.

In this spirit, we are making this opportunity available to ASX investors.

Bitcoin ETFs

Recognising that investors may need professional help to navigate the complex world of cryptocurrencies, VanEck determined that ETFs could be an ideal vehicle for investors to access this asset class. Importantly, as they are managed funds, ETFs are subject to the same regulatory oversight as other ETFs.

ETFs are an efficient and low-cost way of investing in shares or other assets and have become one of the world's most popular ways to invest. They are known for their transparency and ease of trading. ETFs have also made available investment opportunities that were previously inaccessible to everyday investors.

We think bitcoin is one such opportunity.

VanEck was one of a handful of investment managers that launched a bitcoin ETF in the US in January 2024, and we were excited to bring this opportunity to ASX investors as the first bitcoin ETF to list on ASX.

VBTC key facts

The first bitcoin ETF on ASX

Enables simple and convenient access without the complexity of owning individually.

Institutional custody

A safekeeping arrangement offering institutional-grade protection of bitcoin.

Growth potential of a digital asset

Access to the world’s first and largest decentralised currency.

Investment with a digital leader

VanEck has been a pioneer for digital assets, since 2017 we have been investing across the spectrum of this emerging frontier.

Key risks: An investment in the fund involves extremely high risk and the potential for loss of all capital invested. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an invest in the fund include those associated with pricing risk, regulatory risk, custody risk, immutability risk, ASX trading time risk, concentration risk, environmental risk, currency risk, operational risk, underlying fund risk and forking risk. See the VanEck Bitcoin ETF PDS and TMD for details.

VBTC is likely to be appropriate for investors seeking capital growth as a satellite allocation within a portfolio, with no minimum investment timeframe, and who have an extremely high risk/return profile. Refer to the TMD at vaneck.com.au

Published: 04 September 2025