A golden year, with more leverage ahead

A banner year for gold

What a year for gold! The metal closed at an all-time high of US$4,533.21 on 26 December. Some profit-taking was not surprising, given gold’s spectacular performance in 2025, which pushed prices lower during the final week of the year to close at US$4,319.37 per ounce on 31 December. Gold finished the year up 64.58%.

The drivers behind this strength were twofold: central banks around the world continued to be net purchasers of gold as they advanced their de-dollarisation agenda, and investors more broadly increased their gold exposure to hedge against market uncertainty, volatility, and geopolitical risk. Gold also benefited from a growing need to diversify and protect portfolios globally, particularly as real rates declined and gold became a more attractive investment.

Gold stocks steal the spotlight

In 2025, the price of gold had its best annual gain since 1979. But gold stocks stole the spotlight, more than doubling bullion’s gains. The NYSE Arca Gold Miners Index was up 139.81% during the year.

After years of underperformance, gold mining stocks finally benefited from a gold rally that included Western investors as one of the main driving forces, unlike in recent years, when central bank demand was largely behind gold’s strength. As investors returned to gold, their appetite extended to gold stocks in search of a leveraged play. This flow of capital, while still modest relative to the broader equity markets, had a significant impact on the deeply oversold and comparatively tiny gold equity universe, which we estimate increased to just around US$1 trillion of combined market cap at the end of 2025.

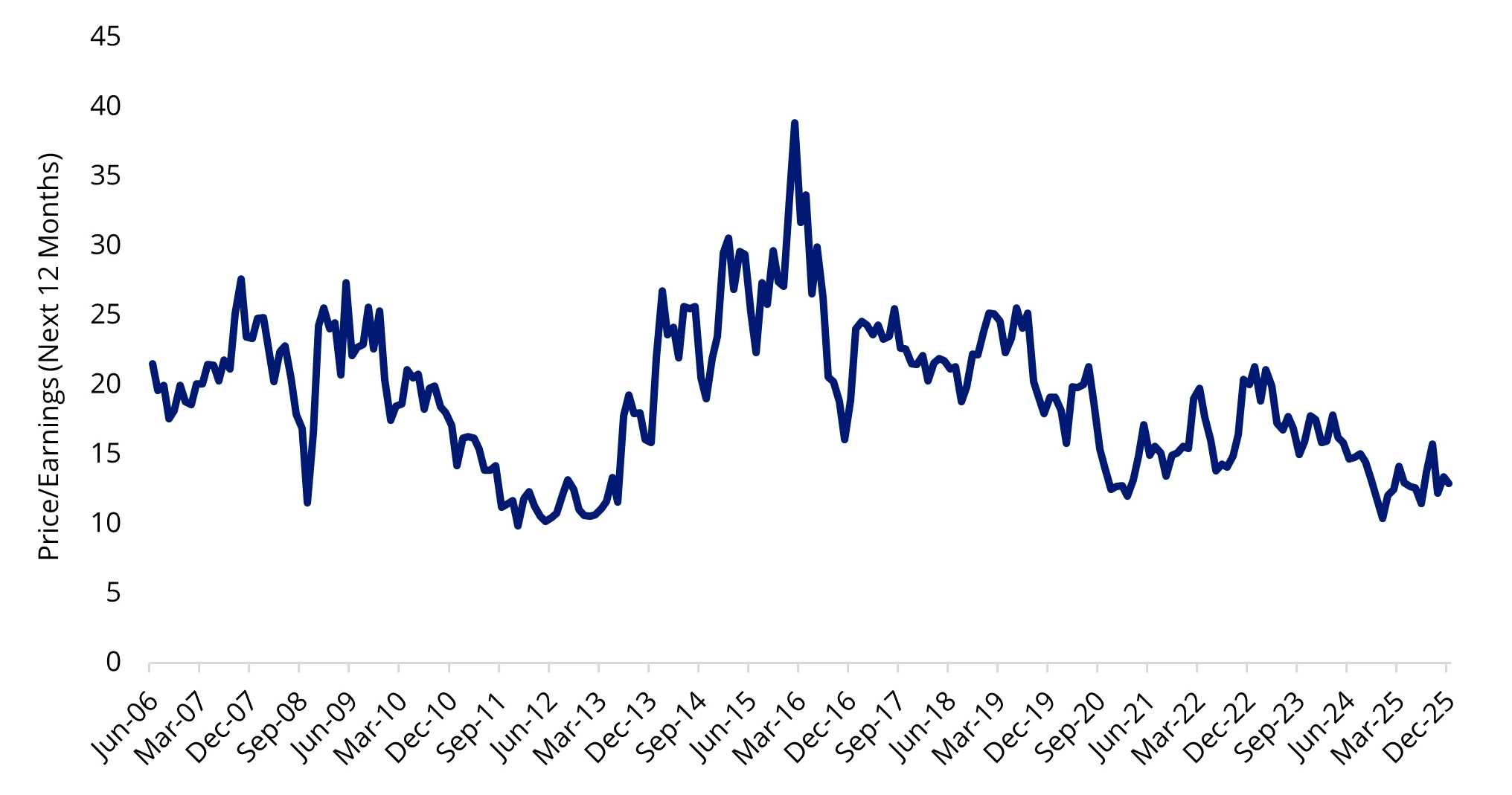

Valuations still compelling after the re-rating

Despite triple-digit gains in 2025, we believe gold stocks could continue to outperform gold in 2026. Gold companies remain at historically low valuations based on most metrics. While stocks experienced a re-rating in the second half of 2025, this came after almost two decades of persistent de-rating.

Gold stocks are rebounding from oversold levels, so even after last year’s rally, valuations remain attractive.

Chart 1: Gold miners’ price-to-earnings ratios remain below historical averages, even after the strong performance seen in 2025

Source: FactSet. Data as of December 2025. "Gold Miners" represented by the NYSE Arca Gold Miners Index.

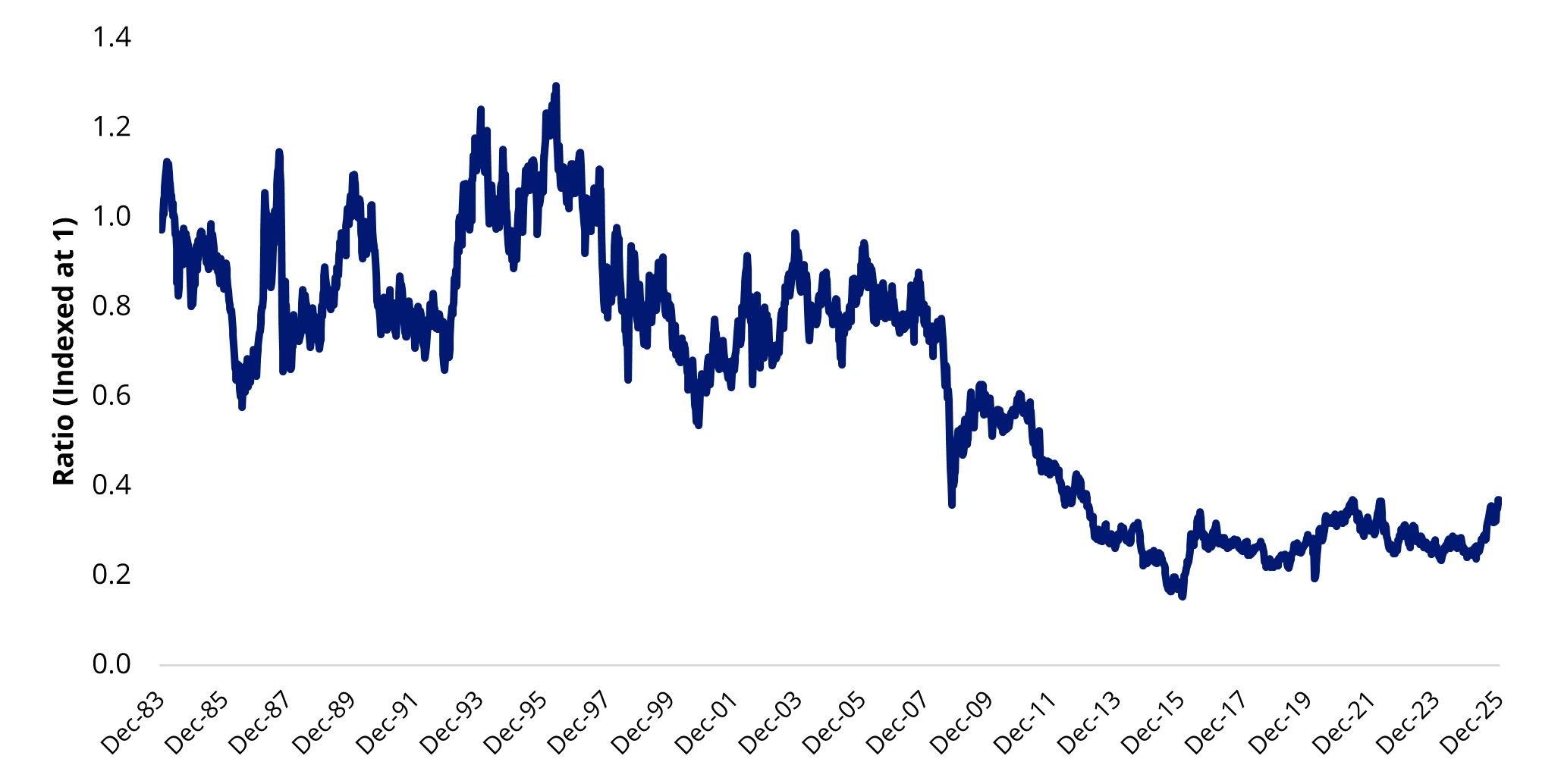

Chart 2: Gold and precious metals mining equities continue to trade at lower levels relative to gold

Source: Bloomberg. Data as of December 2025. “Gold & Precious Metals Miners” represented by the Philadelphia (PHLX) Gold/Silver Miners Index (TR)3. Past performance is not indicative of future results. It is not possible to directly invest in an index.

Room for capital rotation

Our outlook for higher gold prices in 2026 is supported by increasing investment demand for gold, which should also translate into investment demand for gold stocks.

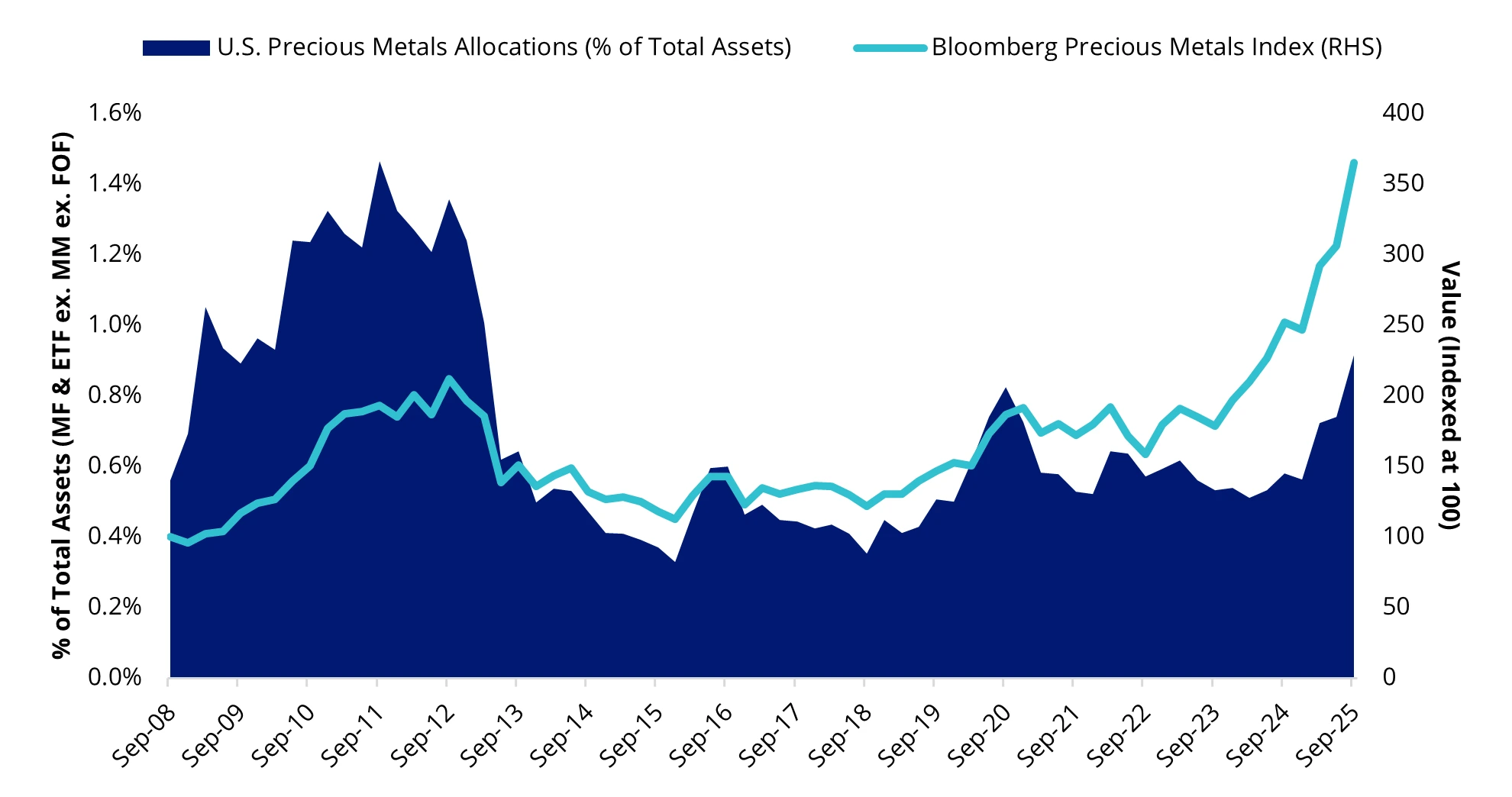

As shown in the chart below, gold and precious metals remain a relatively small allocation within global portfolios. With only an estimated 1–2% of assets globally currently allocated to gold and gold stocks, there is plenty of room for increased gold exposure across global portfolios.

Chart 3: Precious metals still under owned as portfolio allocations remain low despite rising prices

Source: Morningstar, VanEck. Data as of December 2025. Bloomberg Precious Metals Index (BCOMPR) tracks the performance of futures contracts for precious metals like gold and silver. Past performance is not indicative of future results. It is not possible to directly invest in an index.

While gold bullion may be the first stop for many investors, as they search for excess returns and look for alternatives to sectors with richer valuations, the gold stocks should emerge as a solid option. It won’t take much capital rotation to get gold stocks moving again in 2026. In addition, strong fundamentals should support further re-rating of the sector.

Leverage works both ways

In a rising gold price environment, the case for gold equities will be easy to make, especially after a firm demonstration of leverage in 2025. If gold goes up, gold stocks should go up even more, most market participants would agree. Historically, gold stocks have outperformed gold when the gold price increases and underperformed gold when the gold price decreases or is trading sideways/rangebound.

There is a case to be made, however, that even in an environment where gold prices are sustained, perhaps rangebound around or even slightly below these record levels, the gold stocks have the potential to continue to re-rate and outperform the metal.

Gold price assumptions remain conservative

We estimate that senior gold producers are trading at valuations that imply, on average, a gold price assumption of around US$3,400 per ounce. This leaves ample room for valuations to increase as markets grow more confident that gold prices will remain near current spot levels of around US$4,400 per ounce and as stocks progressively price in higher long-term gold price assumptions.

In this scenario, even if gold stays at current levels, the stocks could continue to post gains.

Record margins provide a strong cushion

Gold miners are enjoying record margins, by a long shot. For reference, at the peak of the last gold bull market in 2011, when the gold traded around US$1,800 per ounce, average all-in-sustaining costs (AISC) were about US$1,200 per ounce. In 2025, AISC for the sector was around US$1,600 per ounce, compared to an average gold price of US$3,440 per ounce.

Even the highest-cost producers are profitable at current spot prices, with more than 90% of all global gold production at AISC below US$2,500 per ounce. This provides considerable runway for miners to maintain record levels of cash flow generation, even if gold prices were to decline.

Costs are likely to rise, but discipline remains

We have a positive outlook on gold prices, which is why we expect margins won’t compress materially in 2026. That said, we do anticipate higher AISC for the industry. Miners continue to focus on cost control and operational optimisation to offset industry cost inflation. Another factor that can increase unit costs is that the processing of lower-grade ores leads to higher unit costs.

However, processing plants at major producers are operating at capacity, and as a group, the companies don’t appear to have plans to drop their cutoff grade. These cost control initiatives and production discipline give us comfort that costs won’t begin to spiral out of control. In addition, mine plans, reserve assumptions and project economics are being done at conservative gold price assumptions, significantly below spot prices.

The gold price itself is a cost driver

With that said, certain elements of the cost structure remain outside of the miners’ control, most significantly the gold price itself. Higher gold prices can contribute to higher demand for equipment, consumables, services, and labour, leading to industry-wide cost inflation. Higher gold prices can also strengthen foreign currencies in gold-producing countries, which in turn leads to higher US dollar-denominated costs.

Beyond that, some costs are directly linked to the gold price, such as royalties, production taxes, and profit-sharing agreements. The higher the gold price, the higher these costs will be. While the impact varies greatly from company to company, we estimate ballpark figures of about US$100/oz increase in costs for every US$1,000/oz increase in the gold price.

The gold price today is about US$1,000/oz higher than the average price in 2025; this alone suggests costs in 2026 to be about US$100/oz higher. Combined with industry-guided cost inflation of 3–5% annually, we expect total costs to rise approximately 10–12% versus 2025.

Outlook: still exceptionally attractive

Companies will be providing 2026 annual production and cost guidance when they report their fourth-quarter 2025 results, starting at the end of February. The production cost sensitivity to the gold price appears to us to be well telegraphed. In our view, the sector remains exceptionally attractive.

Even if the realised gold price doesn’t fully offset the cost increase this year, gold mining companies’ margins and free cash flow generation should be robust and remain significantly above historical levels, while their stocks still trade at historically low multiples.

Published: 16 January 2026

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable product disclosure statement (PDS) and target market determination (TMD) available at vaneck.com.au for more details. Investment returns and capital are not guaranteed.