RMBS ETF: An Australian first

In an Australian first, investors are now able to access a dedicated Australian residential mortgage-backed securities ETF.

A residential mortgage-backed security is a type of fixed-income bond secured by a pool of residential home loans, where payments of principal and interest on the bonds are funded by the payments made on the underlying mortgages.

Residential mortgage-backed securities are one of Australia’s fastest-growing fixed income asset classes, surpassing a landmark A$50 billion of issuance in 2024.

Chart 1: 2024 Australian Securitisation Issuance

Source: Bloomberg. RMBS is residential mortgage backed securities, CMBS is commercial martage backed securities, ABS is asset-backed security.

Australian residential mortgage backed securities have been used by fixed income investors as a diversifier within their bond portfolios. Traditionally, these have primarily been available to institutional or 'sophisticated' investors, with very high minimum investment amounts.

Historically, Australian RMBS exposure has primarily been accessed as a sleeve within diversified fixed income strategies, rather than as a standalone investment. This is due to the complexity, lower liquidity, and specialist expertise required to manage RMBS effectively. For most investors, exposure has typically come through multi-sector credit or income funds where RMBS plays a supporting role for yield and diversification.

That is changing. For the first time all types of Australian investors are able to access this asset class on the ASX via the VanEck Australian RMBS ETF (RMBS).

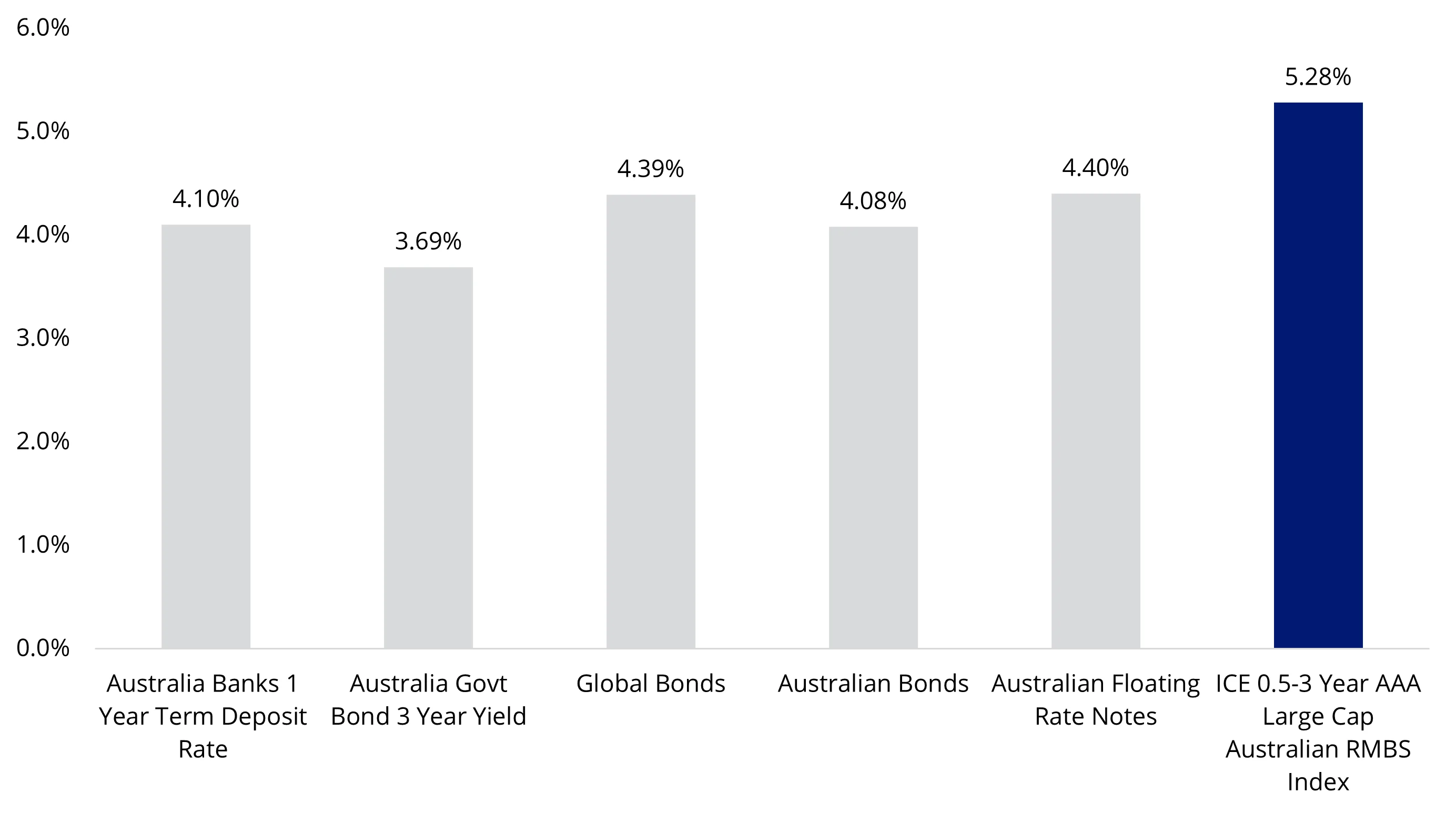

RMBS offers investors a transparent, liquid AAA credit rated investment opportunity with a potential yield uplift.

Chart 2: Yield to maturity comparison

Source: Bloomberg, RBA as at 31 March 2025. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Yield measures are not a guarantee of future dividend income from the funds. Australia Banks 1 Year Term Deposit Rate is AUIDTD1Y Index, Australia Govt Bond 3 Year Yield is GACGB3 Index, Australian Floating Rate Notes is Bloomberg AusBond Credit FRN 0+ Yr Index.

RMBS tracks the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index, which only includes bonds with a AAA credit rating. AAA rated RMBS benefits from a diversified underlying mortgage pool, liquidity and payment seniority compared to more junior tranches.

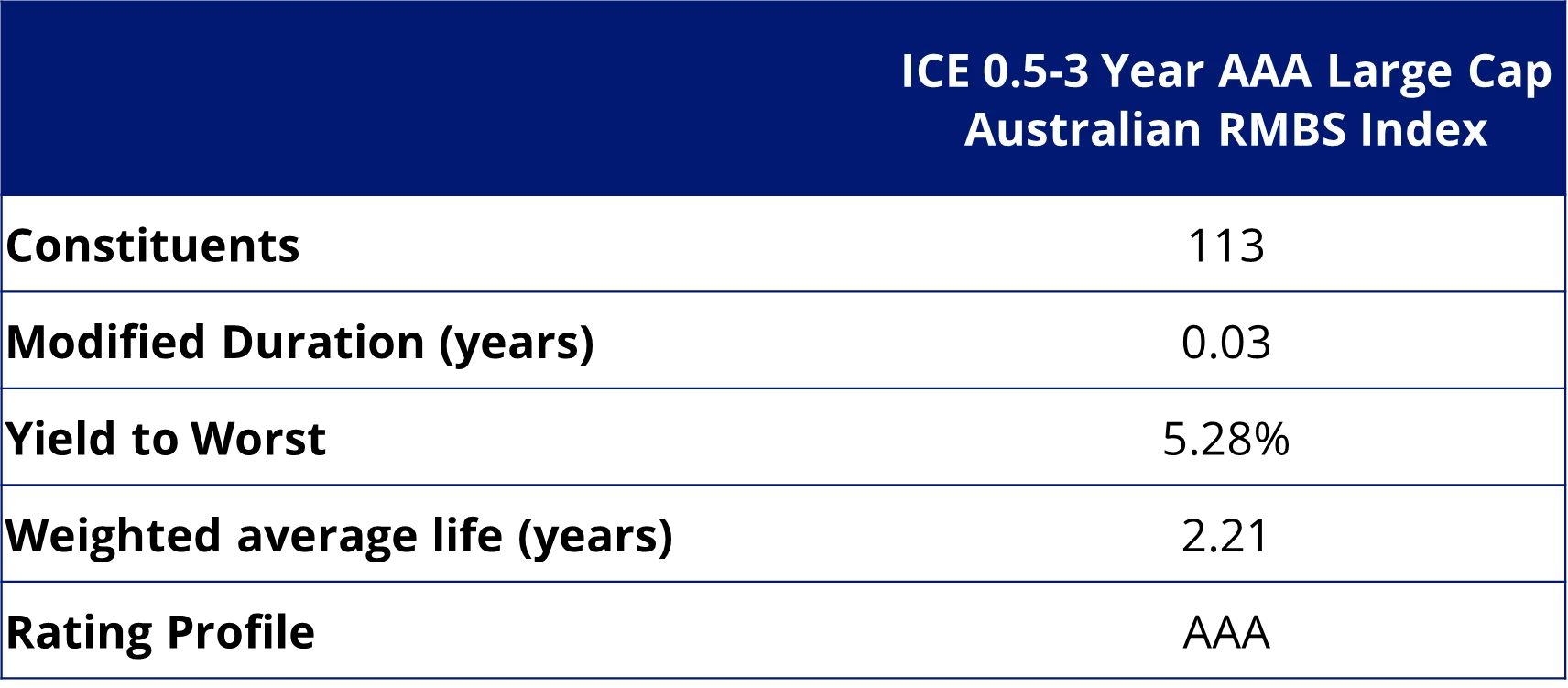

ICE 0.5-3 Year AAA Large Cap Australian RMBS Index

RMBS tracks the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index issued by Intercontinental Exchange Inc which only includes AUD denominated, residential mortgage-backed securities issued in Australia that hold a AAA rating based on an average of Moody’s, S&P and Fitch.

Table 1: Index characteristics - ICE 0.5-3 Year AAA Large Cap Australian RMBS Index

Source: ICE, as at 31 March 2025. You cannot invest in an index. Yield measures are not a guarantee of future dividend income from the funds.

The RMBS opportunity:

Dedicated Australian residential mortgage-backed securities exposure

- Access to a portfolio of Australian RMBS with AAA credit rating.

Access to floating rate exposure

- RMBS pay coupons that vary with short-term interest rates. Interest rates are reset periodically resulting in reduced duration (interest rate) risk.

Yield premium, paid monthly

- RMBSs typically offer higher yield, commensurate with risk.

Key risks: An investment in our residential mortgage backed securities ETF carries risks associated with: securitisation market, housing market, trustee management, concentration, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. Once available, see the PDS and TMD for more details.

Published: 14 April 2025

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.