What to consider when your hybrids are called

A major structural shift is coming to Australian banks. ASX bank hybrids will begin phasing out from January 2027, bringing significant implications for investors in this $42 billion market.

Since APRA called time on hybrids1, investors have been considering how to approach their existing allocation to bank capital. Tier 2 capital, which sits higher in the capital structure, could be a consideration for investors. And among Tier 2 funds, SUBD is the original.

The recently called $930m ANZ (ANZPH) and the $1.4b CBA (CBAPG) hybrids represent the first hybrids called since APRA’s December 2024 announcement that hybrids were to be phased out.

Due to APRA's changes, these ANZ and CBA hybrids were not immediately rolled into a new AT1 deal as had been the custom in the past. Instead, both banks turned to domestic and foreign markets before the call dates to pre-fund the expected increase in Tier 2 capital requirements.

Looking ahead, we anticipate that major banks will continue to transition hybrids into Tier 2 debt as they are called. As the Tier 2 market gets bigger, there will be more demand for these bonds. There is a way investors can access a portfolio of tier 2 bonds on ASX.

Why APRA called time on hybrids

It is useful to understand why Australia’s regulators had hybrids in their sights.

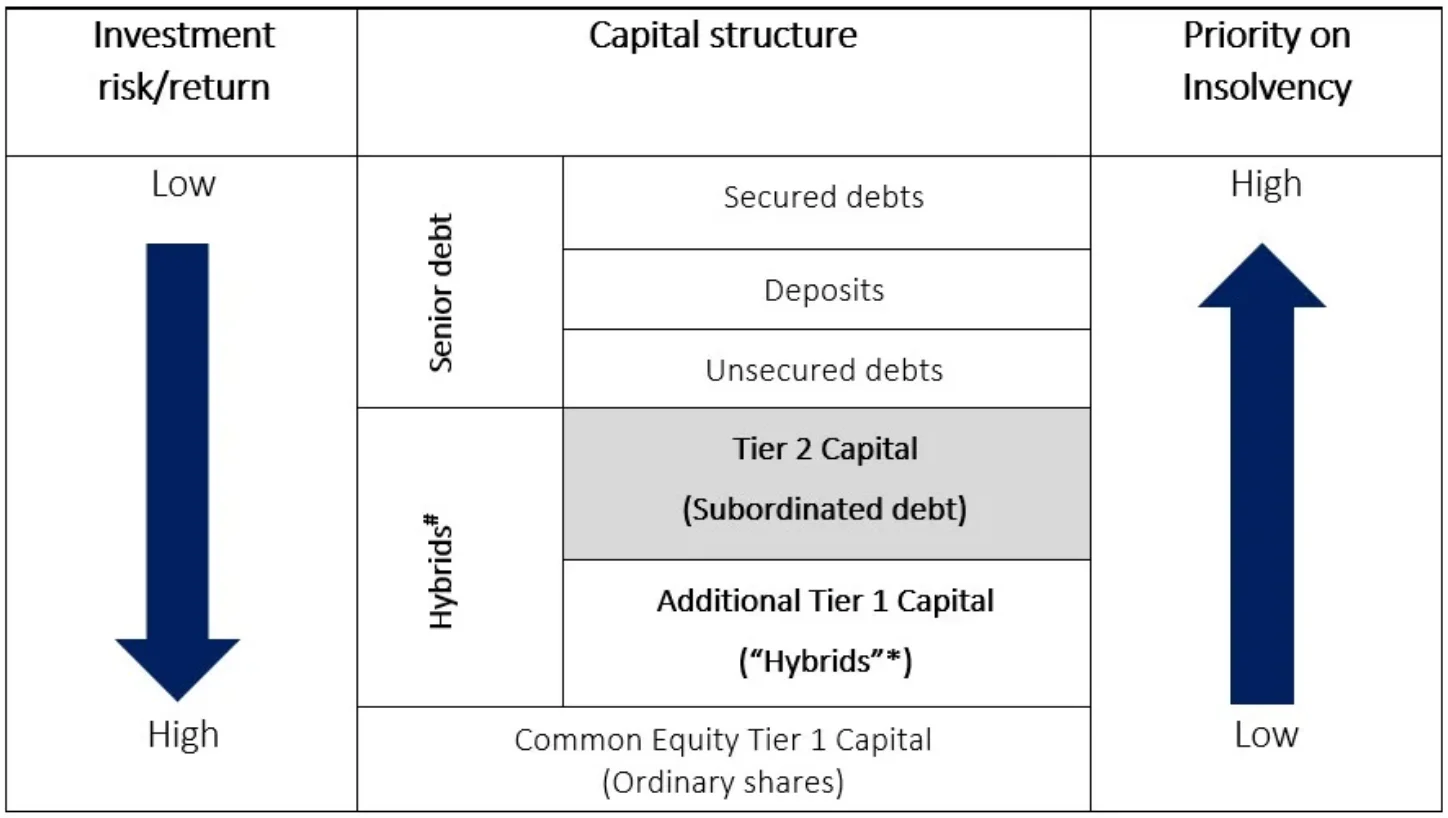

Hybrids2 were mainly issued by banks and insurers and sit at the bottom of a bank's debt capital structure, one tier above common equity (see figure 1 below). They are designed to have characteristics of both debt and equity. In other words, these were riskier than the bonds the bank issued.

Investors should be rewarded for these risks, but often these risks were not well understood. The result was that sometimes these risks were not being properly compensated. For this reason, hybrids have been in the eye of Australia’s regulators for some time. In 2012, ASIC warned of the risks of hybrids and that any additional restriction on their ownership imposed by regulators would be consistent with global peers, such as the UK, which banned hybrids for retail investors in 2014.

The collapse of Switzerland’s Credit Suisse in March 2023 highlighted the potential risks of hybrids. The Swiss banking regulator wiped out the holdings of Credit Suisse’s AT1 capital as part of its forced merger with UBS.

At the time, investors and regulators alike were on tenterhooks following the collapse of US regional banks Silicon Valley Bank and Signature Bank. There was a palpable fear of contagion throughout the entire global financial system, with the memories of the GFC still lingering. As a result, when Credit Suisse announced a weakness in its financial reporting controls and delayed the release of its annual report, the market and regulators moved with haste.

The Saudi National Bank (the largest shareholder of Credit Suisse) stated that it could not increase its shareholding, and as a result, Credit Suisse’s share price fell, and withdrawals increased. Stating that the bank was experiencing a crisis of confidence, Swiss regulators intervened. This resulted in a forced merger of Credit Suisse and UBS, with favourable terms for UBS. As a part of the merger, Credit Suisse shareholders received CHF3 billion, while all of Credit Suisse’s AT1s were written down to zero (about CHF16 billion), irrespective of creditor hierarchy or structural features.

Investors that held Credit Suisse’s AT1s at the time included many of the world’s largest sovereign wealth funds, some of the most experienced bond investors globally, and, of course, some Swiss retail investors.

APRA considered its local market and observed that, unlike in Switzerland, Australian hybrids are predominantly held by retail investors.

Tier 2 capital and the buffer it provides

Throughout all this, one of the responses to 2008’s global financial crisis was the mandated requirement for banks, depending on their size, to have a buffer to absorb potential losses in the event of financial distress. This ‘buffer’ was to be in the form of Tier 2 capital, also known as ‘subordinated debt’ and would be an additional protection beyond existing Tier 1.

Tier 1 and Tier 2 capital are used to protect depositors and policyholders so that they can feel confident their money is safe. The new mandate also had the goal of protecting taxpayers from costly bailouts.

Subordinated debt has similar characteristics to traditional bonds, however in times of financial stress, it can be converted to shares or may be written off completely. It is called ‘subordinated’ because it sits below ‘senior debt’ or traditional bonds in the capital structure, but it also sits above and takes priority over ordinary shares and hybrids, in the event of insolvency. See the shaded area in the chart below.

The following chart provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by financial institutions rank in priority of payment in the event of collapse.

Figure 1. Simplified capital structure of a financial institution

AT1 is being phased out

APRA is phasing out AT1 capital from January 2027, and this brings significant implications for investors.

It is anticipated that there will be increased demand for Tier 2 subordinated bonds due to the changes APRA announced on 9 December last year.

How to access the Australian subordinated debt market

VanEck Australian Subordinated Debt ETF (ASX: SUBD) launched in 2019 on ASX, giving investors access to a portfolio of investment-grade subordinated bonds via a single trade on ASX. Since its launch, SUBD has grown to over $2.4 billion, establishing itself as the go-to subordinated debt strategy.

SUBD tracks iBoxx AUD Investment Grade Subordinated Debt Mid Price Index (SUBD Index), which is designed to reflect the performance of investment grade subordinated bonds denominated in AUD. The index only includes AUD-denominated floating rate bonds issued by financial institutions that qualify as Tier 2 Capital under APRA's2 Rules (or equivalent foreign rules) and which hold an iBoxx credit rating of investment grade.

For more than a decade, VanEck has been recognised for delivering innovative investment solutions that extend beyond the conventional, offering exposure to asset classes and strategies that enhance portfolio construction. Our foundation is built on innovation, deep client relationships, and a steadfast commitment to delivering superior investment outcomes.

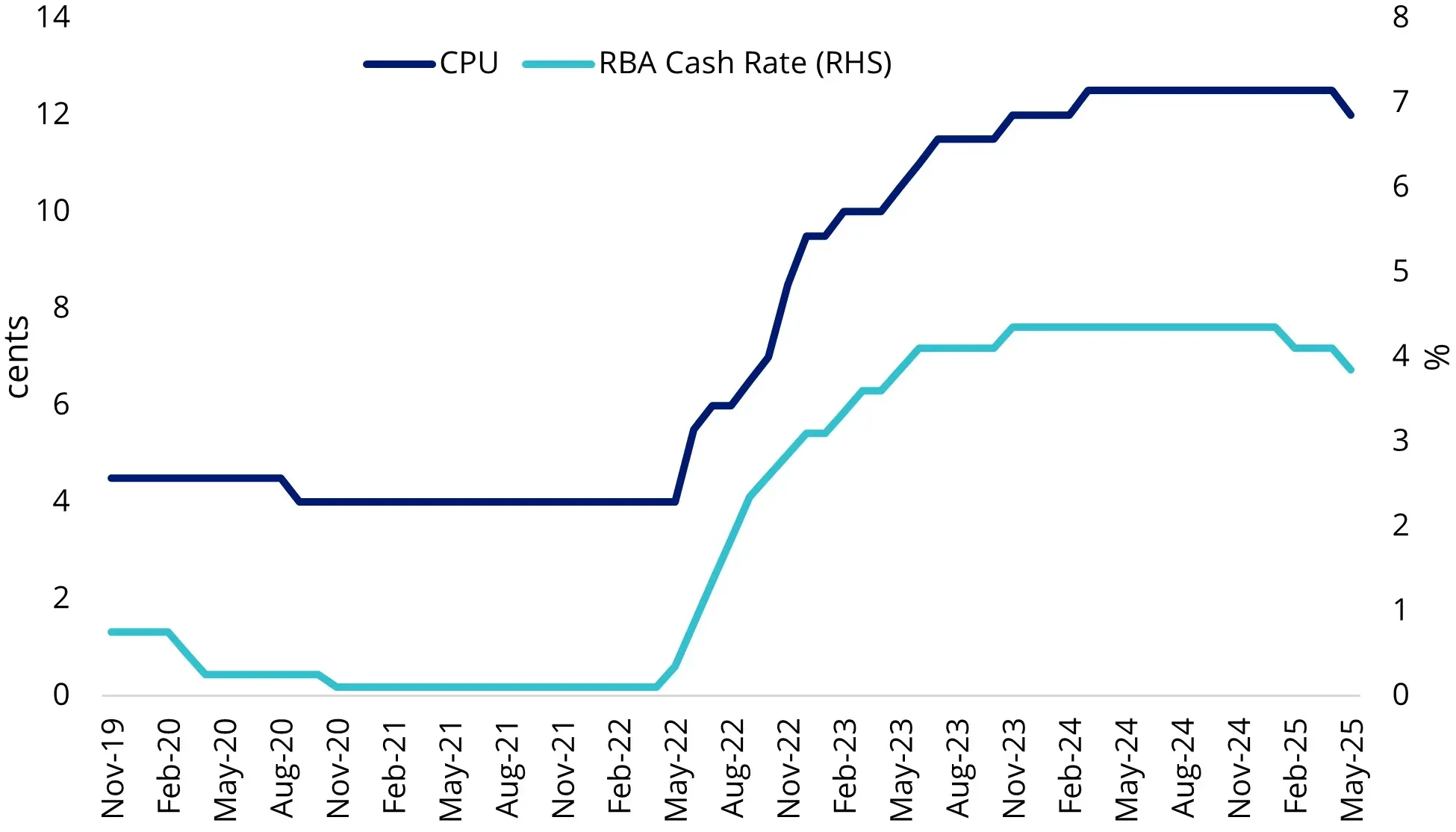

ETFs are all we do. SUBD is a prime example of this. The fund, since its inception, has maintained its monthly distribution, providing steady and reliable income, in line with market expectations and the underlying securities.

Figure 2: SUBD CPU since inception

Source: VanEck. Past performance is not a reliable indicator of future performance.

For investors, subordinated bonds can serve two important roles in a portfolio:

- Increase return for a commensurate increase in risk – for investors with large holdings of traditional senior bonds, who are willing to take more credit risk, subordinated bonds issued by financial institutions can enhance income;

- Decrease risk – for investors with large holdings in hybrids or bank shares who are seeking to reduce their overall risk, subordinated bonds may perform a useful role.

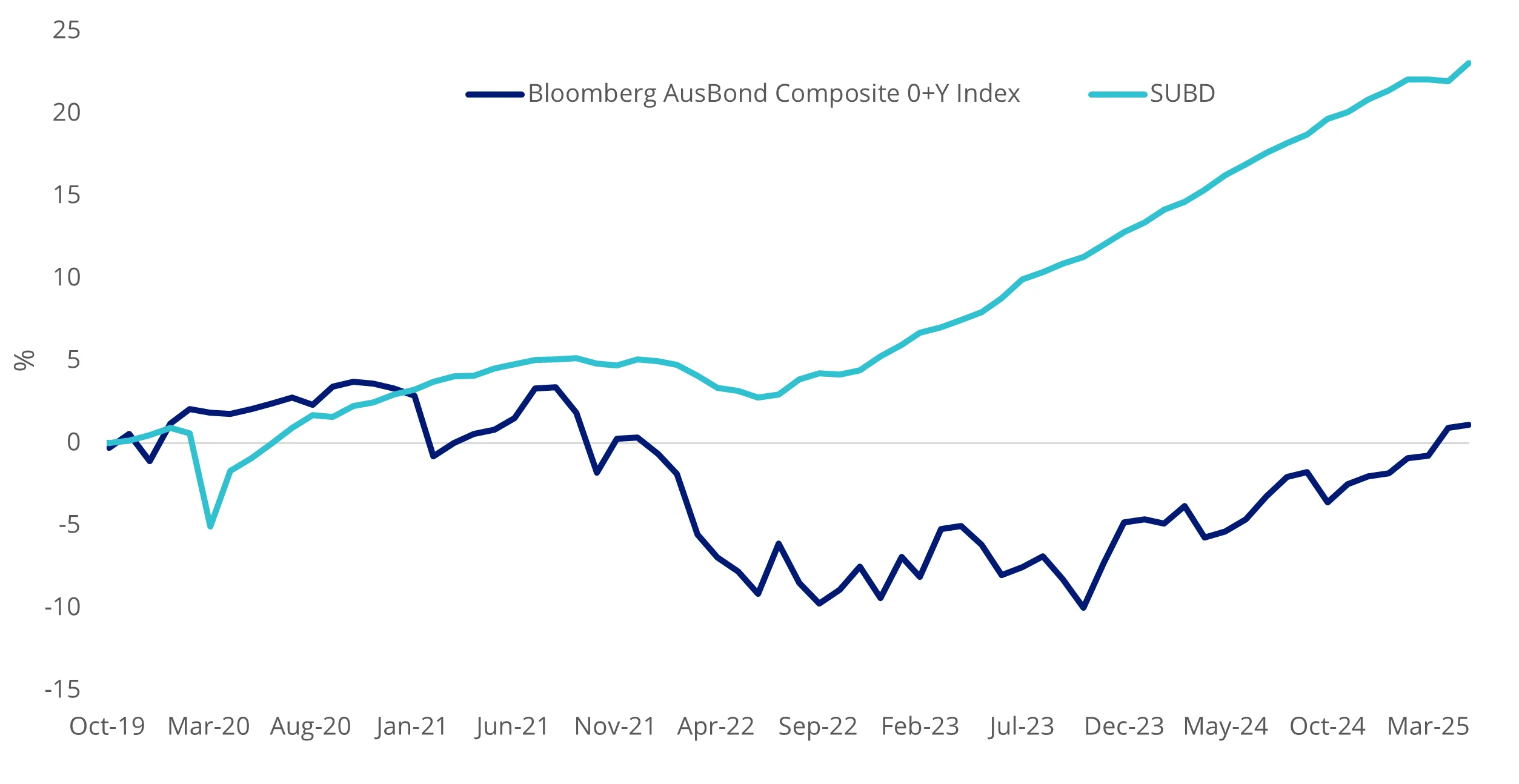

Figure 3: Cumulative performance since SUBD inception

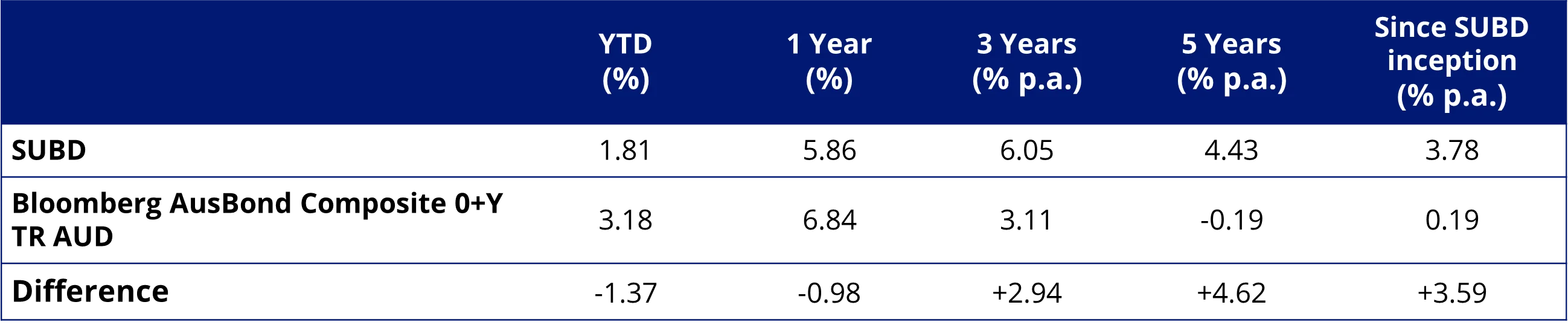

Table 1: Trailing performance as at 31 May 2025

* SUBD Inception date is 28 October 2019 a copy of the factsheet is here.Figure 3 and Table 1 source: Morningstar Direct, VanEck as at 30 April 2025. The chart and table above show past performance of SUBD and the Bloomberg AusBond Composite 0+ Yr Index. You cannot invest directly in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. SUBD results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance. The Bloomberg AusBond Composite 0+ Yr Index (“BACI”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the broad Australian bond market, weighted by market value. SUBD’s Index is designed to reflect the performance of the investment grade AUD denominated subordinated bond market. The index SUBD tracks has fewer bonds, fewer issuers, a different rating profile, different industry allocations, different sensitivity to interest rates and a different maturity profile than BACI. Click here for more details.

We recently held a webinar for hybrid investors, Australian hybrids: Navigating the next phase – you can watch a replay here.

Key risks: An investment in the ETF carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS and TMD for details.

Source

1APRA winds down $43b bank hybrid market, angering investors

2Please note: Although the term “hybrid” is used by ASIC to refer to both Tier 2 Capital and Additional Tier 1 Capital, this term tends to be used in the market (by advisers and the media) to describe only Additional Tier 1 Capital securities or ‘capital notes’. In this document, the word “hybrid” refers to Additional Tier 1 Capital securities or capital notes and “subordinated bonds” or “bonds” refers to Tier 2 Capital or subordinated debt.

Published: 13 June 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

S&P Dow Jones Indices LLC or its affiliates (“SPDJI”). SPDJI is not a related body corporate of VanEck.

The iBoxx AUD Investment Grade Subordinated Debt Mid Price Index (“the Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and licensed for use by VanEck. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed by VanEck. The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of them makes any representation regarding the advisability of investing in the Fund. Such parties do not accept liability for any errors, omissions, or interruptions of the Index and do not give any assurance that the Fund will accurately track the performance of the index or provide positive investment returns. Inclusion of a security within the Index or Fund is not a recommendation by any party to buy, sell, or hold such security.