Duration dilemma

Bond yields and inflation have been in the news. The inverse relationship between yields and bond prices means that rising yields is putting pressure on the returns of bonds. This is a problem for investors who rely on bonds as the defensive allocation of their portfolios. There are ETFs that can help investors manage these risks.

Bond yields and inflation have been in the news. The inverse relationship between yields and bond prices means that rising yields is putting pressure on the returns of bonds. This is a problem for investors who rely on bonds as the defensive allocation of their portfolios. There are ETFs that can help investors manage these risks.

Inflation concerns

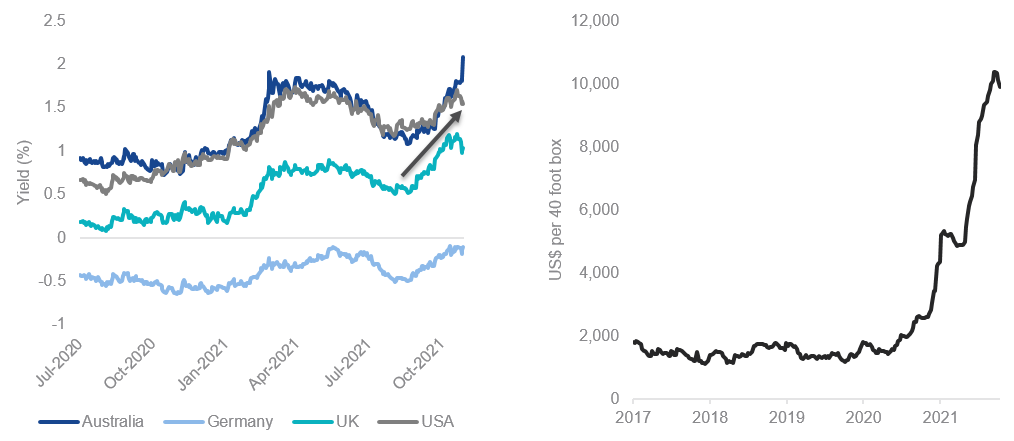

Government bond yields jumped in September and October over renewed inflation concerns particularly in Europe. 10Yr UK Gilts government bond yields have doubled over two months with markets expecting Bank of England rate rise shifting to early 2022. Challenges combating COVID-19 have disrupted supply chains. Companies are reporting significant input price pressures notably higher wages, raw material prices and transportation costs. World shipping container costs have jumped 90% year to date.

Chart 1 – 10 year government bond yields Chart 2 – WCI World shipping costs

Source: Bloomberg Source: Bloomberg, WCI Composite Container Freight Benchmark Rate per 40 Foot Box.

Impact on fixed income investments

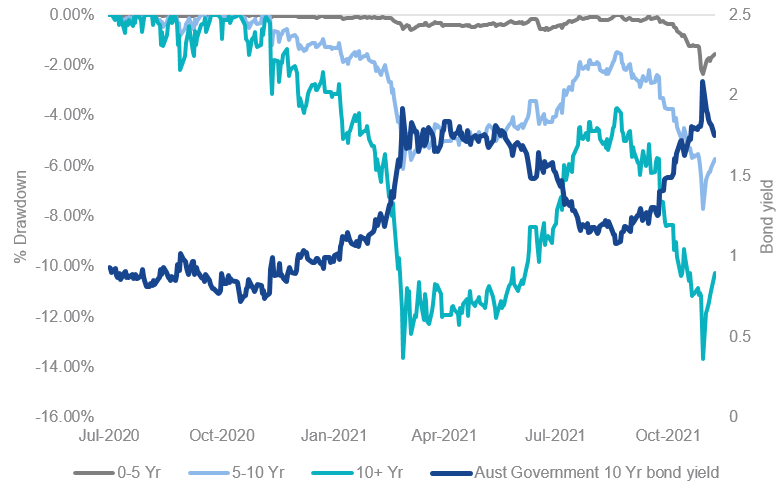

Rising bond yields have adversely impacted fixed income investments due to the negative relationship between changing yields and bond prices. The impact of changing yields on bond prices increases as time to maturity increases. Bloomberg Ausbond Government 0-5Yr and 10+Yr index returned -0.39% and -11.99% respectively between November 2020 and February 2021 when Australian government bond 10yr yield increased by 1.17%.

Chart 3 - Australia Government Bond Indices at different maturity terms drawdown versus 10 year bond yield

Source: Bloomberg, Bloomberg Ausbond Government 0-5Yr, 5-10Yr and 10+Yr indices.

Alternative to mitigate duration

Modified duration quantifies the impact of a change in yield on bond prices. Floating rate debt instruments mitigate duration risk as coupon payments are variable as opposed to fixed which offsets the effect of changing interest rates on valuations.

|

Instrument |

Average time to maturity (yrs) |

Modified Duration (yrs) |

1% govt bond yield increase bond price impact (%) |

|

Australian government bonds 10+ yr |

14.69 |

11.90 |

11.90% |

|

Australian government bonds 5-10 yr |

7.49 |

6.78 |

6.78% |

|

Australian government bonds 0-5 yr |

2.74 |

2.62 |

2.62% |

|

Australian corporate floating rate notes |

1.92 |

0.13 |

0.13% |

|

Australian subordinated debt |

3.58~ |

0.08 |

0.08% |

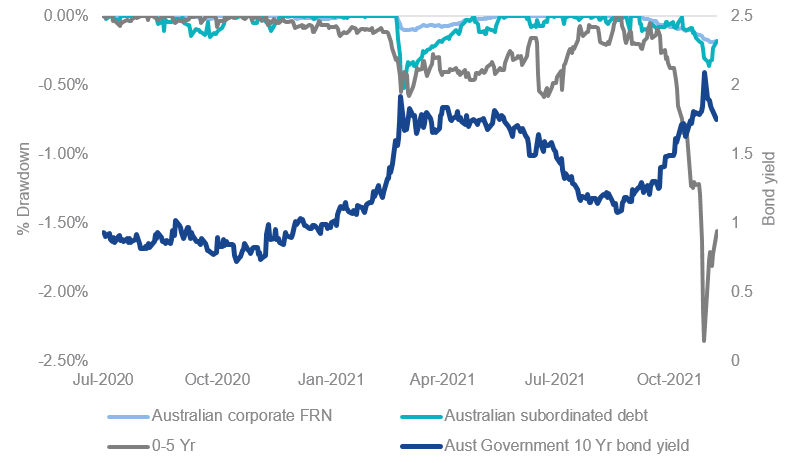

Chart 4 – Drawdown comparison versus 10 year bond yield

Source: Bloomberg, Bloomberg Ausbond Government 0-5Yr index. Australian corporate FRN as Bloomberg Ausbond Credit FRN 0+ Yr Index, Australian subordinated debt as iBoxx AUD Investment Grade Subordinated Debt index.

Access

VanEck offers two floating rate income ETFs listed on the ASX across different investment risk/return profiles;

- VanEck Australian Floating Rate ETF (ASX ticker: FLOT)

- VanEck Australian Subordinated Debt ETF (ASX Ticker: SUBD)

We always recommend speaking with your financial advisor or broker to determine which investment risk/return profile is appropriate for your circumstances.

Published: 15 November 2021