The home truth about rate cuts

More rate cuts isn’t always good news, especially for income investors. The good news is that hunting for higher yield doesn’t necessarily mean higher-risk investments.

Last week’s below-expectation GDP numbers mean that the RBA may be forced to cut rates again1to ignite economic growth. Low rates are bad for investors who rely on income2from their investments. To maintain income, investors often stray too far up the risk curve.

We think residential mortgage-backed securities can be used to enhance yield for investors, without having to incur extreme risks. In a December 2024 speech at the Australian Securitisation Conference, David Jacobs, Head of Domestic Markets Department at the RBA said, “investors in rated Australian RMBS have never suffered credit losses from these investments. This is largely because losses on the underlying loans have been extremely low, and are typically covered by available income remaining in the mortgage pool after required payments have been made.”

At the time of his speech, investors in residential mortgage-backed securities had primarily been institutional or “sophisticated” investors, with very high minimum investment amounts.

Now, all types of investors can access this asset class via the VanEck Australian RMBS ETF (RMBS), which we launched in April. RMBS is an Australian first, the only ETF giving investors direct access to a portfolio of Australian residential mortgage-backed securities.

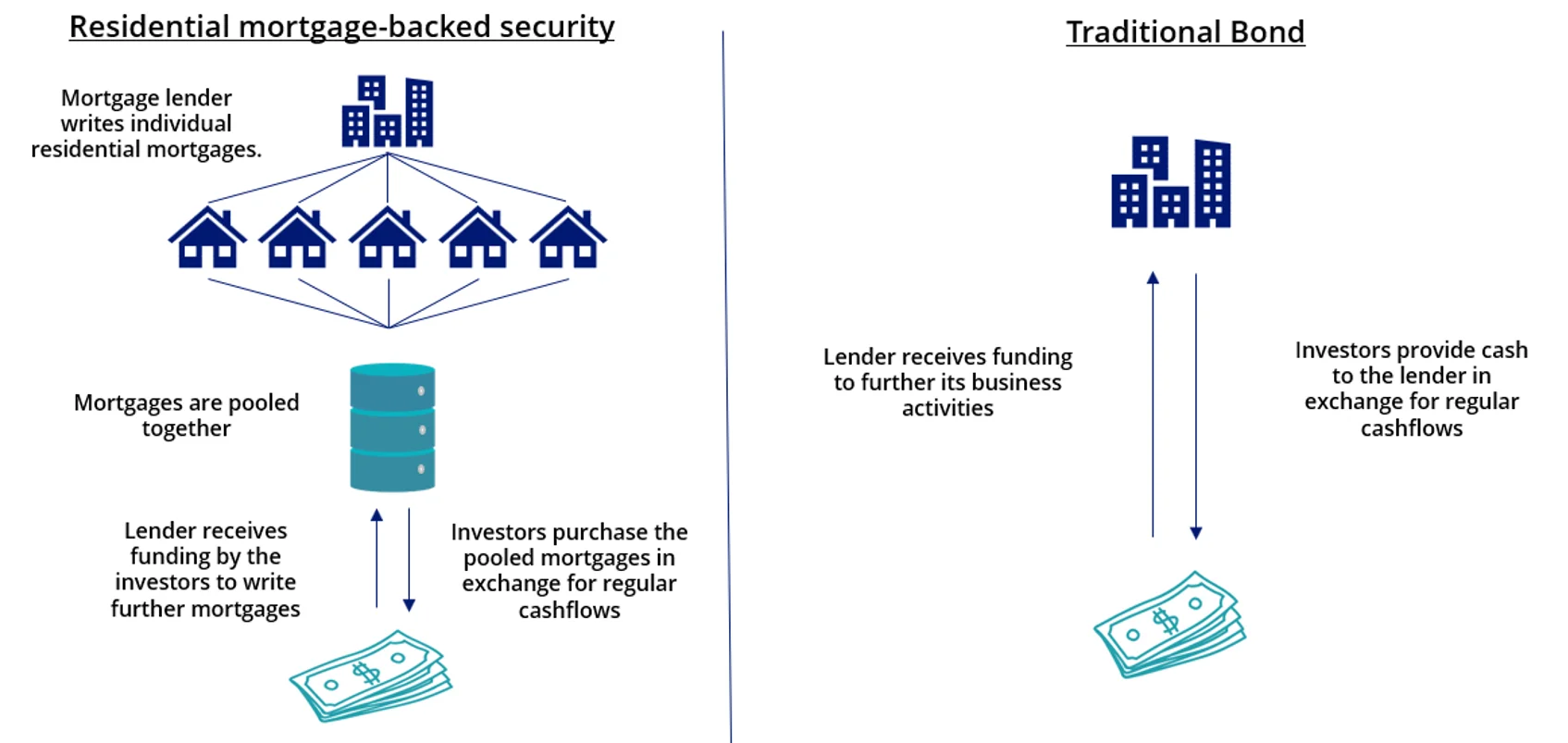

RMBS provides investors with regular cash flows backed by a pool of residential mortgages. This differs from a traditional bond, which is backed by the lender's assets or revenue.

Exhibit 1 – Differences between residential mortgage-backed securities and traditional fixed income

Source: VanEck. For illustrative purposes.

RMBS invests in a portfolio of residential mortgage-backed securities with a AAA credit rating.

Exhibit 2: Features of AAA-rated residential mortgage-backed securities and AAA rated government bonds

Source: VanEck.

Since the first residential mortgage-backed securities issuance in 1986, the industry has ballooned, with the broader Australian securitisation market reaching a landmark ~$75b in issuance in 2024.

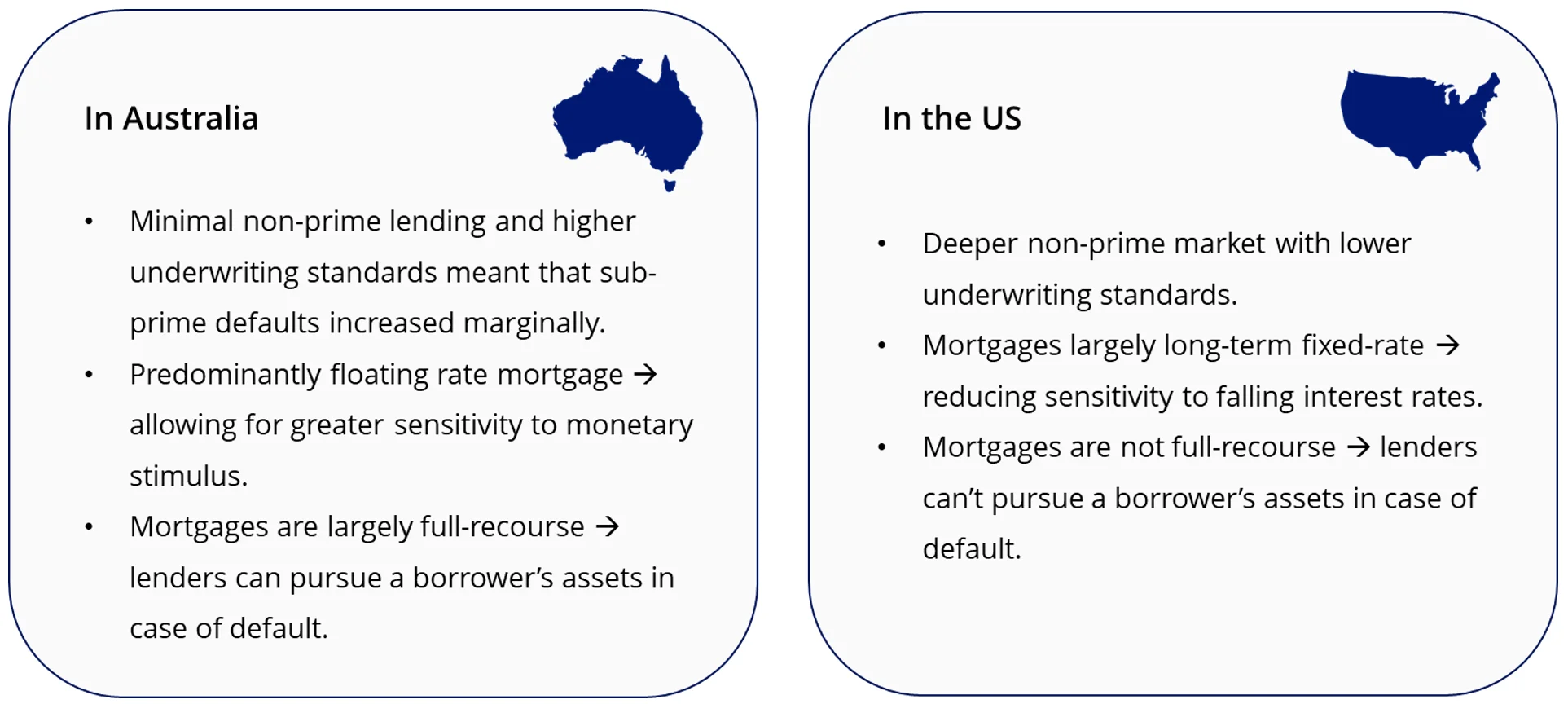

It’s important to note that the mortgage-backed securities market in Australia is different from the US, which gained notoriety during the fallout from the GFC.

Exhibit 3: The United States and Australian markets are not the same

Source: VanEck. For illustrative purposes.

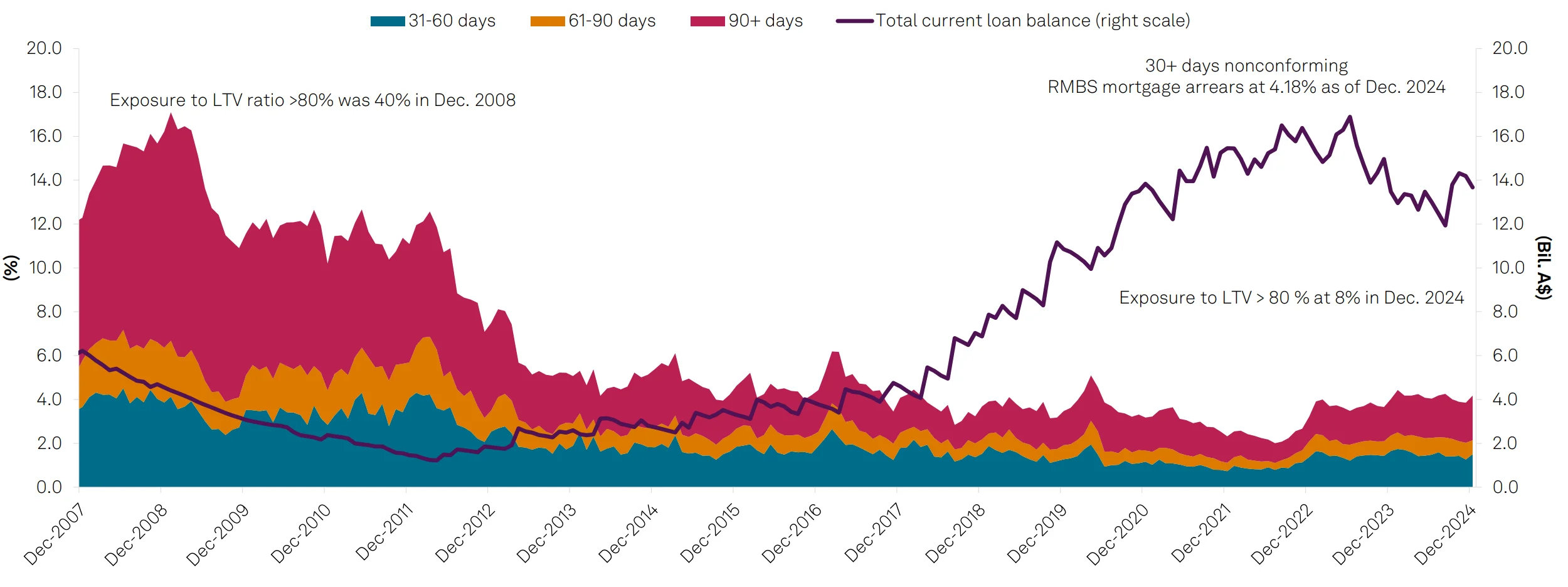

Australian loan arrears remained subdued during both the GFC and COVID-19

Exhibit 4: Prime RMBS loans more than 30 days in arrears (%)

Source: Reserve Bank of Australia, S&P Global Ratings, access here.

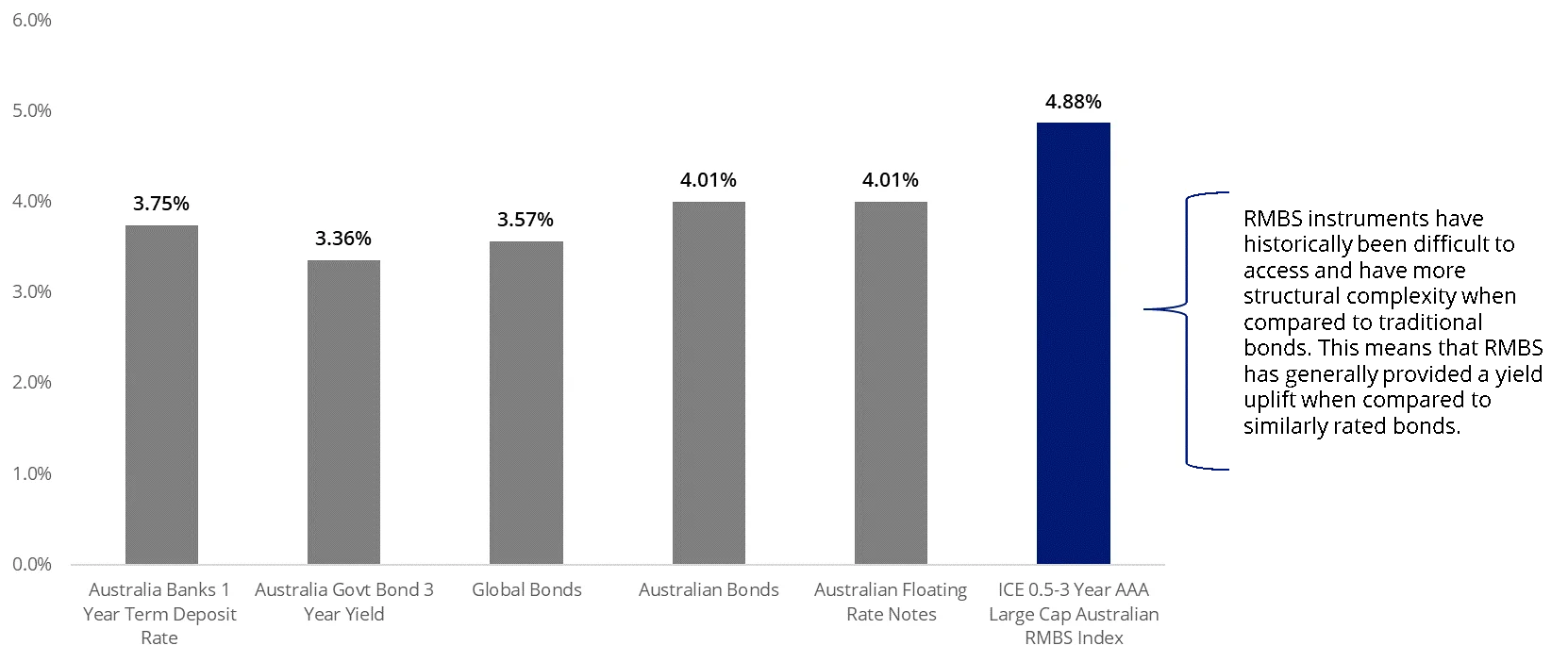

RMBS offers investors a transparent, liquid, AAA credit-rated investment opportunity with a potential yield uplift.

Exhibit 5: Yield to maturity vs cash, Gov Bonds and Senior Debt

Source: Bloomberg, RBA as at 31 May 2025. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Yield measures of RMBS index are not a guarantee of future dividend income from RMBS. Australia Banks 1 Year Term Deposit Rate is AUIDTD1Y Index, Australia Govt Bond 3 Year Yield is GACGB3 Index, Australian Floating Rate Notes is Bloomberg AusBond Credit FRN 0+ Yr Index. Australian bonds is Bloomberg AusBond Composite 0+Y Index, Global bonds AUD hedged is Bloomberg Global Aggregate Hedged to AUD Index.

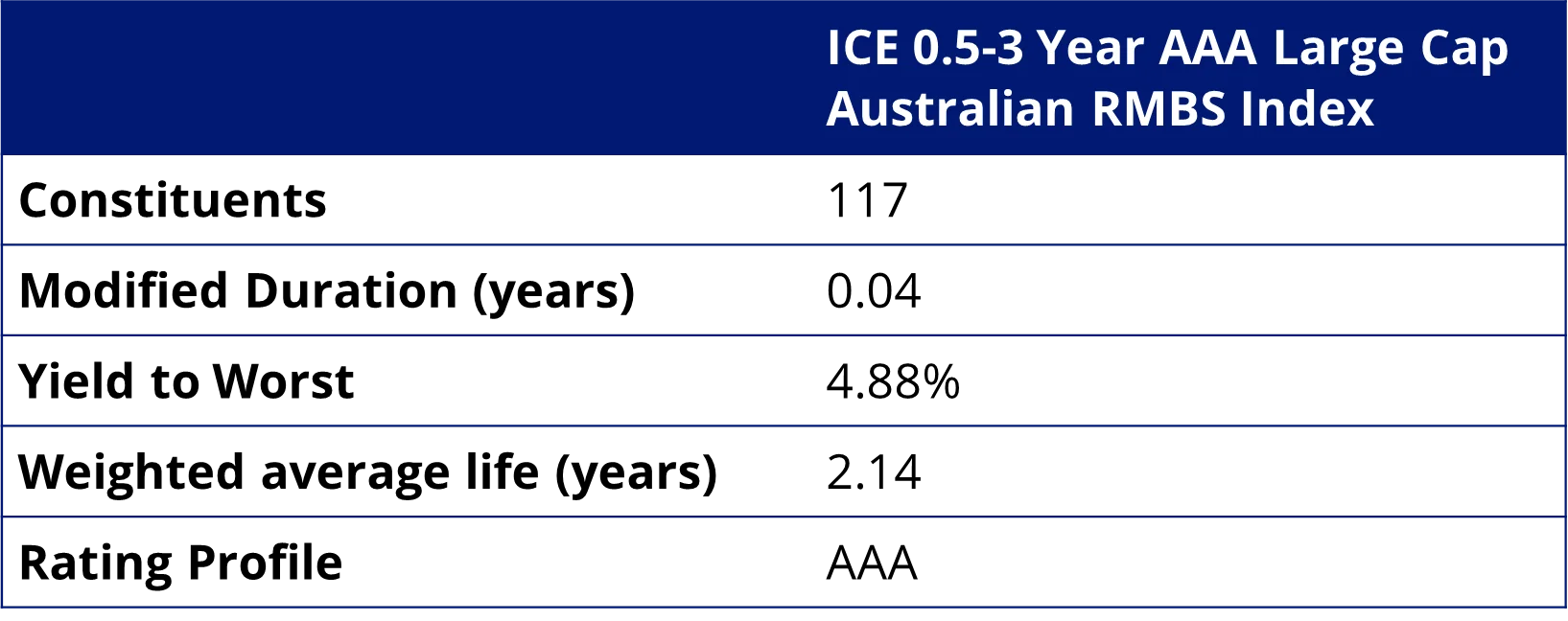

RMBS tracks the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index, which only includes AUD-denominated, residential mortgage-backed securities issued in Australia that hold a AAA rating based on an average of Moody’s, S&P and Fitch. AAA-rated residential mortgage-backed securities benefit from a diversified underlying mortgage pool and high payment seniority.

Exhibit 6: ICE 0.5-3 Year AAA Large Cap Australian RMBS Index

Source: ICE, as at 31 May 2025. You cannot invest in an index. Yield measures are not a guarantee of future dividend income from RMBS.

The RMBS opportunity

Dedicated Australian residential mortgage-backed securities exposure

Access to a portfolio of Australian RMBS with AAA credit rating.

Access to floating rate exposure

RMBS pay coupons that vary with short-term interest rates. Interest rates are reset periodically resulting in reduced duration (interest rate) risk.

Yield premium, paid monthly

RMBSs typically offer higher yield, commensurate with risk.

Key risks: An investment in our residential mortgage backed securities ETF carries risks associated with: securitisation market, housing market, trustee management, concentration, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. Once available, see the PDS and TMD for more details.

Source

Published: 12 June 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

ICE is a registered trademark of ICE Data Indices, LLC or its affiliates. This trademark has been licensed, along with the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index (“Index”) for use by VanEck in connection with RMBS (the “Product”). Neither VanEck nor the Product(s), as applicable, is sponsored, endorsed, sold or promoted by ICE Data Indices, LLC, its affiliates or its third party suppliers (“ICE Data and its Suppliers”). ICE DATA AND ITS SUPPLIERS MAKE NO REPRESENTATIONS OR WARRANTIES REGARDING THE ADVISABILITY OF INVESTING IN SECURITIES GENERALLY, IN THE PRODUCT(S) PARTICULARLY, OR THE ABILITY OF THE INDEX TO TRACK GENERAL MARKET PERFORMANCE. ICE DATA AND ITS THIRD PARTY SUPPLIERS ACCEPT NO LIABILITY IN CONNECTION WITH THE USE OF THE INDEX, INDEX DATA OR MARKS. See PDS for a full copy of the disclaimer.