Mortgage-backed securities offering the home advantage

Domestic credit spreads have tightened markedly since US Liberation Day on 2 April, buoyed by US trade deal announcements between a range of key trading partners and expectations of future RBA rate cuts. A strong August earnings season built on this momentum, providing a further tailwind for credit spreads to compress further.

In this environment of tightening spreads, we think AAA-rated Residential Mortgage-Backed Securities (RMBS) stands out as an attractive investment opportunity, offering enhanced yield potential from both an absolute and relative return perspective.

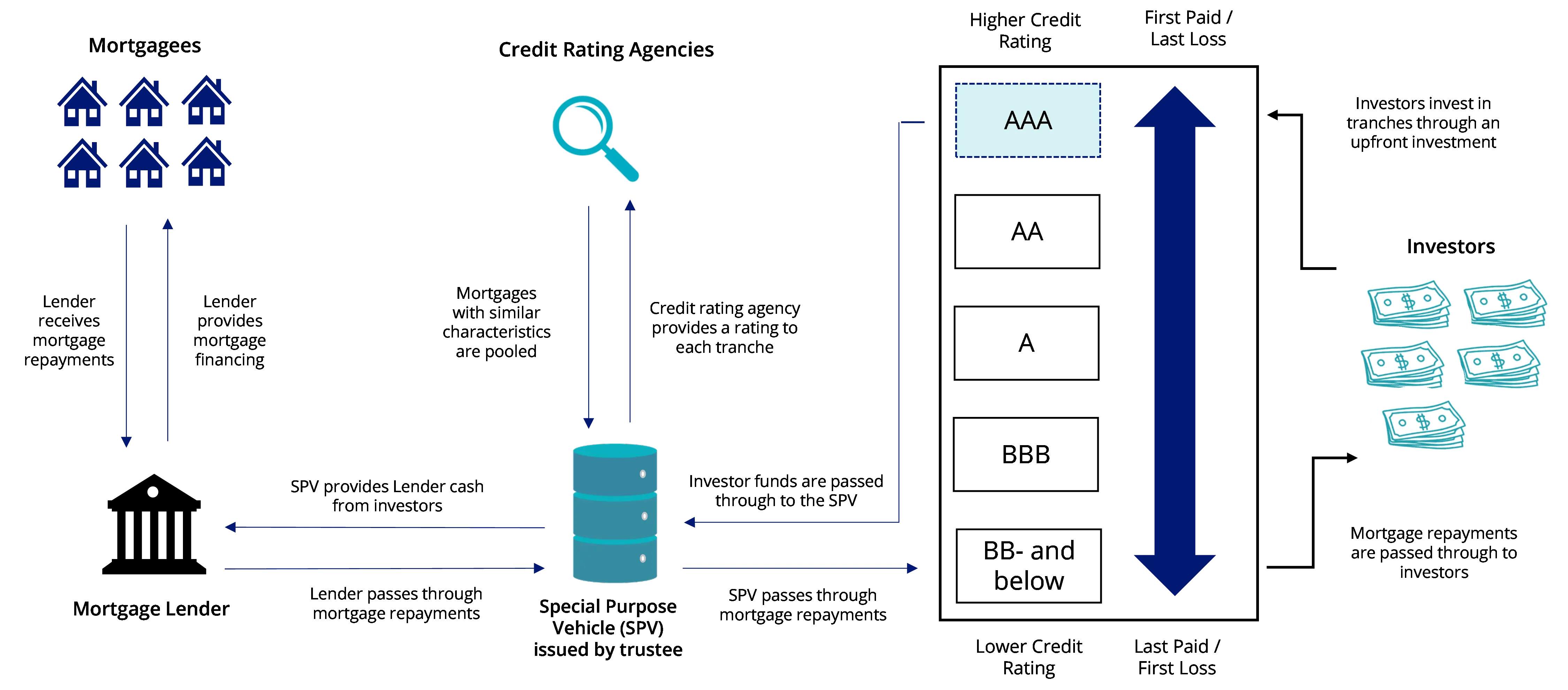

Defining RMBS

RMBS provide investors with regular cashflows backed by a pool of residential mortgages. This differs from a traditional bond, which is backed by the issuer’s own assets or revenue.

The RMBS is divided into different tranches which have varying risk profiles. The more senior notes within the tranche structure offer more downside protection than lower ranking tranches, with the lower tranches absorbing losses first.

Chart 1: RMBS deal structure

Source: VanEck. For illustrative purposes only.

RMBS instruments have historically been difficult to access and have more structural complexity when compared to traditional bonds. This has meant that RMBS has generally provided a yield uplift when compared to similarly rated bonds.

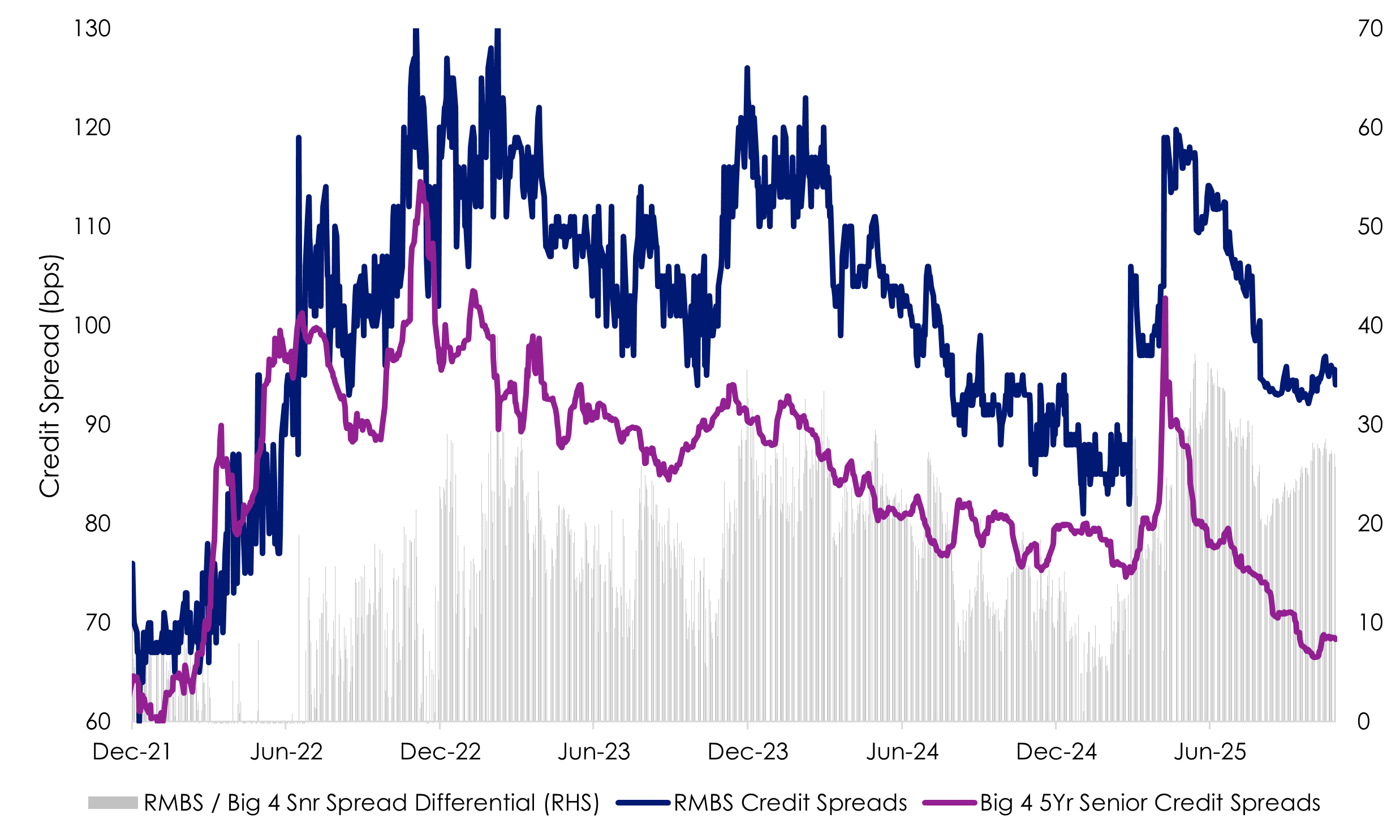

RMBS relative value

While RMBS credit spreads have tightened recently, this move has been more modest relative to other segments of the market. Compared to Big 4 senior debt with a similar maturity, the margin between RMBS and senior debt is currently ~25bps, which is above historical averages. This differential suggests there is scope for further spread compression for RMBS, indicating outperformance potential on a relative basis.

Chart 2: AAA Rated RMBS vs. 5yr Big 4 (AA-) senior spread comparison

Source: Bloomberg. Big 4 spreads are weighted average based on bonds with 4-5 years to maturity.

Loan arrears may improve

With three rate cuts already implemented in 2025 and market pricing suggesting the potential for another in 2026, a more accommodative monetary policy stance is expected to support improvements in loan arrears and compress credit spreads. The chart below illustrates how both owner-occupied and investment property loan arrears declined through late 2020 and 2021 amid the low-rate environment, before rising again in late 2022 as the RBA’s tightening cycle began. The rate cuts delivered thus far in 2025 have already started to exert downward pressure on arrears.

Chart 3: Australian RMBS loan arrears

Source: Bloomberg. As at 29 October 2025.

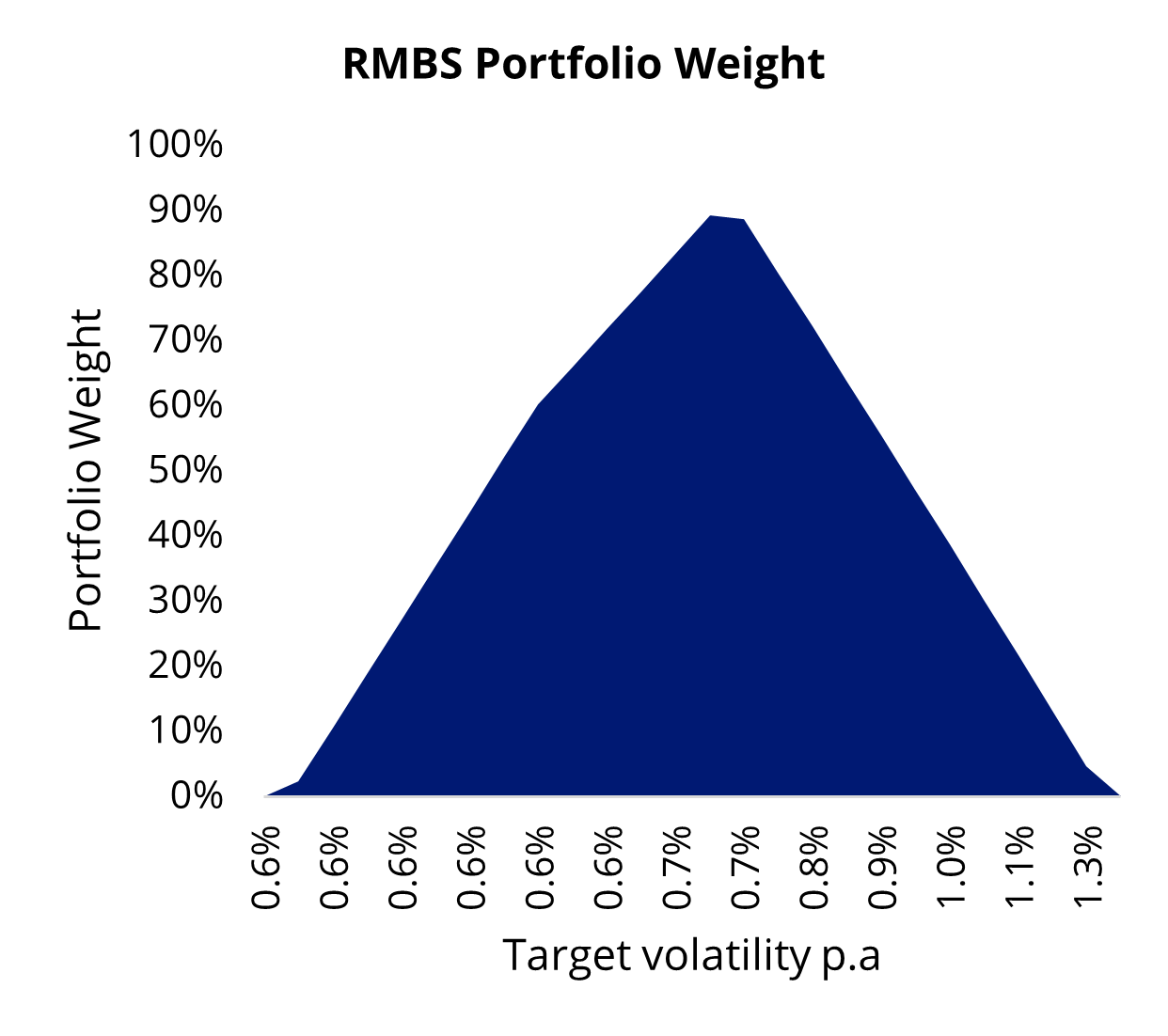

RMBS position in a low duration credit portfolio

RMBS offers a low correlation to traditional fixed income asset classes, offering diversification benefits.

Using efficient frontier analysis to determine the maximum return for a given level of target risk, the optimal allocation to AAA-rated RMBS peaked at 90%, alongside a mix of Australian bank bills, floating rate senior debt and floating rate subordinated debt. This analysis is based on performance data from 1 July 2020 to 29 October 2025.

Chart 4: Efficient frontier: return vs risk

Chart 5: RMBS portfolio weight

Source: Bloomberg, 1 July 2020 to 29 October 2025. Bank Bill as Ausbond Bank Bill Index, AAA RMBS FRN as ICE 0.5-3 Year AAA Large Cap Australian RMBS Index, Corporate FRN as Bloomberg AusBond Credit FRN 0+ Yr Index, Subordinated Debt FRN as iBoxx AUD Investment Grade Subordinated Debt Mid Price Index. You cannot invest in an index.

As of 30 September 2025, AAA-rated RMBS as represented by ICE’s 0.5-3 Year AAA Large Cap Australian RMBS Index offered an all-in yield of 4.55%, marginally below that of floating rate subordinated debt (4.75%, A-) and above floating rate senior debt (4.19%, AA-). This yield advantage, despite RMBS carrying a higher AAA credit rating, highlights its compelling value in the current market environment, noting that past performance is not an indicator of future yield.

Chart 6: Yield uplift compared to other fixed income instruments

Source: Bloomberg. Senior Debt as Bloomberg AusBond Credit FNR 0Yr+ Index, Subordinated Debt as iBoxx AUD Investment Grade Subordinated Debt Mid Price Index, RMBS as ICE 0.5-3 Year AAA Large Cap Australian RMBS Index, As at 30 September 2025. All-in yield comparison is not an indication of future yield. All-in yield is the discount margin above the reference benchmark rate. Yields may vary and are subject to market and credit risks.

Access the opportunity

Investors can access a dedicated portfolio of AAA-rated Australian residential mortgage-backed securities via a single trade for the first time through the VanEck Australian RMBS ETF (ASX: RMBS). RMBS offers investors a liquid investment opportunity with a yield uplift, commensurate with risks.

Below outlines the latest underlying metrics for the RMBS portfolio:

Table 1: RMBS metrics

| As at 30 September 2025 | VanEck Australian RMBS ETF (RMBS) |

| Number of RMBS securities | 70 |

| Number of underlying loans | 122,828 |

| Weighted Average Loan Size | $532,758.38 |

| Weighted Average LVR | 66.11% |

| Weighted Average Life (WAL) | 2.21 |

| Weighted Average Interest Rate | 6.18% |

| Owner Occupied | 57.29% |

| Interest Only | 11.21% |

| 90+ Days in Arrears | 0.58% |

| Credit rating | AAA |

| Yield to maturity | 4.63% |

| Modified duration | 0.04 |

| Credit Support | 18% |

RMBS tracks the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index which only includes Australian dollar-denominated, residential mortgage-backed securities publicly issued in Australia that hold a AAA rating based on an average of Moody’s, S&P and Fitch.

Key risks: An investment in the ETF carries risks associated with: securitisation market, housing market, trustee management, bond markets generally, interest rate movements, concentration, credit ratings, fund operations, liquidity and tracking an index. See the PDS and TMD for more details.

Published: 09 November 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

ICE is a registered trademark of ICE Data Indices, LLC or its affiliates. This trademark has been licensed, along with the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index (“Index”) for use by VanEck in connection with RMBS (the “Product”). Neither VanEck nor the Product(s), as applicable, is sponsored, endorsed, sold or promoted by ICE Data Indices, LLC, its affiliates or its third party suppliers (“ICE Data and its Suppliers”). ICE DATA AND ITS SUPPLIERS MAKE NO REPRESENTATIONS OR WARRANTIES REGARDING THE ADVISABILITY OF INVESTING IN SECURITIES GENERALLY, IN THE PRODUCT(S) PARTICULARLY, OR THE ABILITY OF THE INDEX TO TRACK GENERAL MARKET PERFORMANCE. ICE DATA AND ITS THIRD PARTY SUPPLIERS ACCEPT NO LIABILITY IN CONNECTION WITH THE USE OF THE INDEX, INDEX DATA OR MARKS. See PDS for a full copy of the disclaimer.