Fortune favours the (pro)active

Investors searching for alternative income assets with the phasing out of ASX hybrids would be wise to move beyond the domestic hybrid habit by allocating smarter and globally.

Investors are searching for alternative income assets as ASX Hybrids are phased out1, and they want to maintain exposure to high quality banks.

Major banks have been calling outstanding Tier 1 hybrids and reissuing them in the Tier 2 space, which has reduced supply and compressed risk premiums in the local hybrid universe.

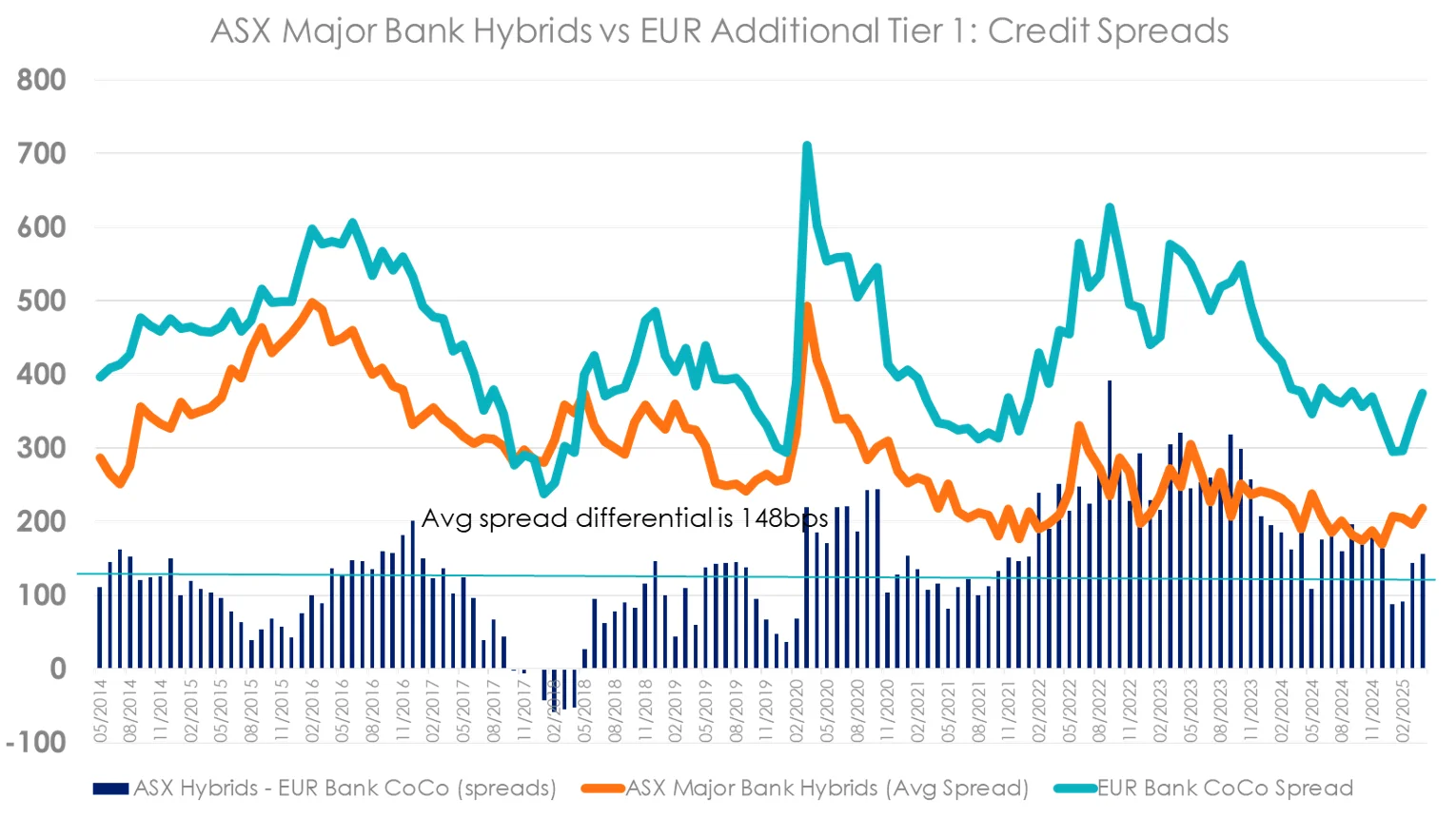

Australian AT1 hybrids are now trading expensively, relative to global counterparts. As of April 2025, EUR bank CoCos offer 155 bps more yield than ASX-listed major bank hybrids.

Chart 1 - ASX Major Bank Hybrids vs EUR Additional Tier 1: Credit Spreads

Source: Bentham, ASX, 1 May 2014 to 30 April 2025

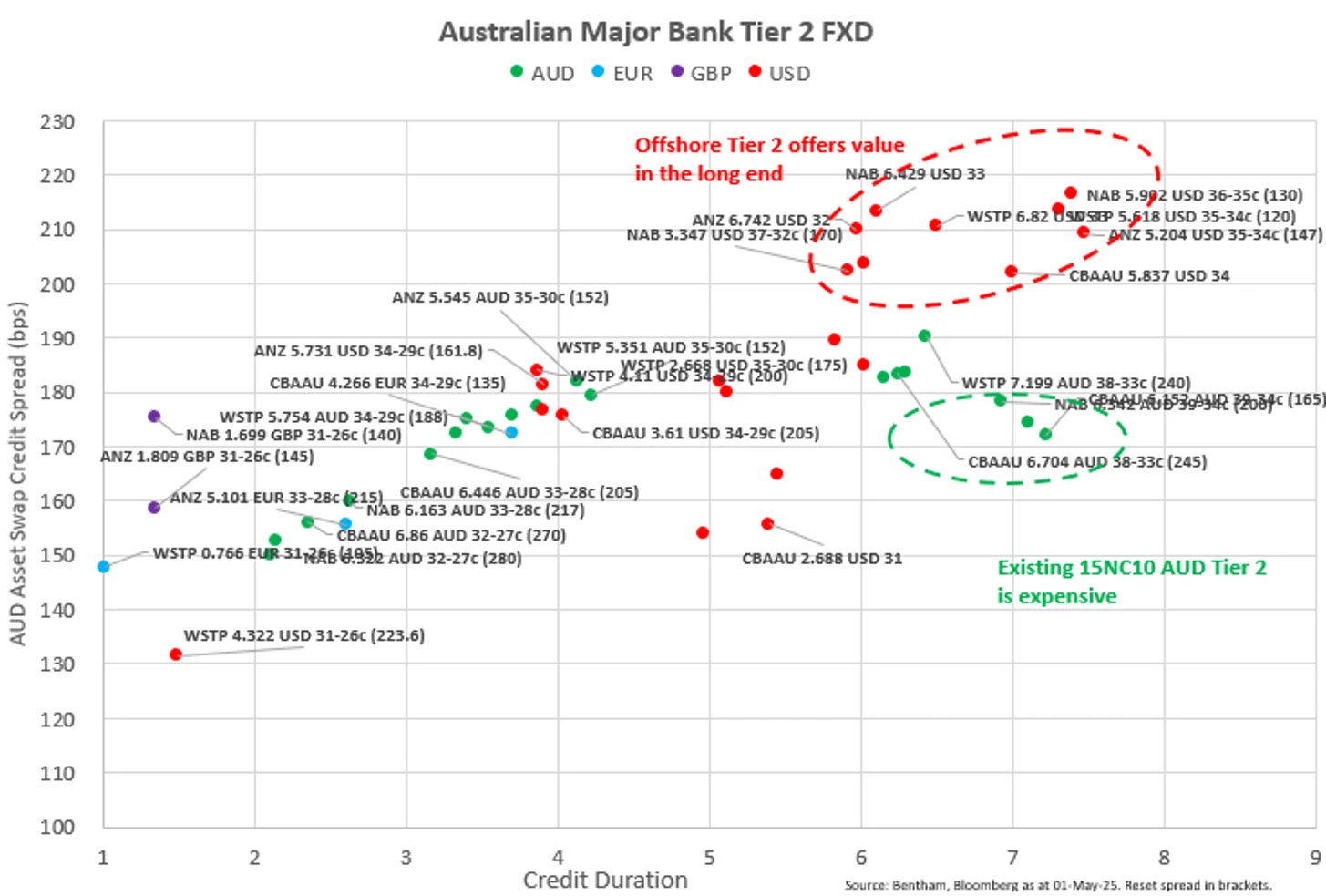

Long dated USD Major Bank Tier 2 is cheap to comparable AUD Tier 2, offering 40 basis points (bps) pick-up by switching into US dollar bonds with a more investor-friendly structure.

Chart 2 – Australian Bank Global Tier 2 Relative Value (AUD, USD, EUR and GBP)

15NC10 AUD Tier 2 is expensive to USD Tier 2 in the long end of the curve.

Source: Bentham, Bloomberg May 2025

It’s time to think global, and when thinking global for capital securities, think active. The VanEck Bentham Global Capital Securities Active ETF (GCAP) is an actively managed, global portfolio of capital securities, powered by Bentham Asset Management’s global credit expertise.

GCAP offers a compelling income investment strategy for clients seeking enhanced yield, diversification, and resilience.

We think there are three compelling considerations why GCAP warrants consideration by Australian investors assessing their capital securities going forward:

- The same Australian banks that issue AUD capital securities also issue comparable bonds in offshore institutional markets (e.g. USD, EUR & GBP).

- The traded credit spread between the AUD market and the offshore market can vary through the cycle, even though it is essentially the same credit risk.

- GCAP is set up to take advantage of these differentials and hedge the currency risk.

- Diversification, beyond the five banks that dominate Australian portfolios by considering securities issued by high-quality systemically important European and US banks.

- GCAP offers diversification across geographies and issuers.

- Exposure to over 60 global banks and insurance issuers spanning Europe, Asia and North America, reducing concentration risk beyond five Australian banks.

- Blend allocations between different parts of a bank’s capital structure to optimise income for the risk outlook. For example, because the fund is actively managed, in periods where it pays to be defensive, it can increase allocations to senior bank bonds or to take additional risk when riskier CoCos/AT1s present a compelling yield.

Now is the time to move beyond the domestic hybrid habit by allocating smarter and globally.

The benefits of active management

As an actively managed ETF, GCAP provides exposure to Tier 1 and Tier 2 capital, and can allocate where risk premium is often mispriced relative to equity.

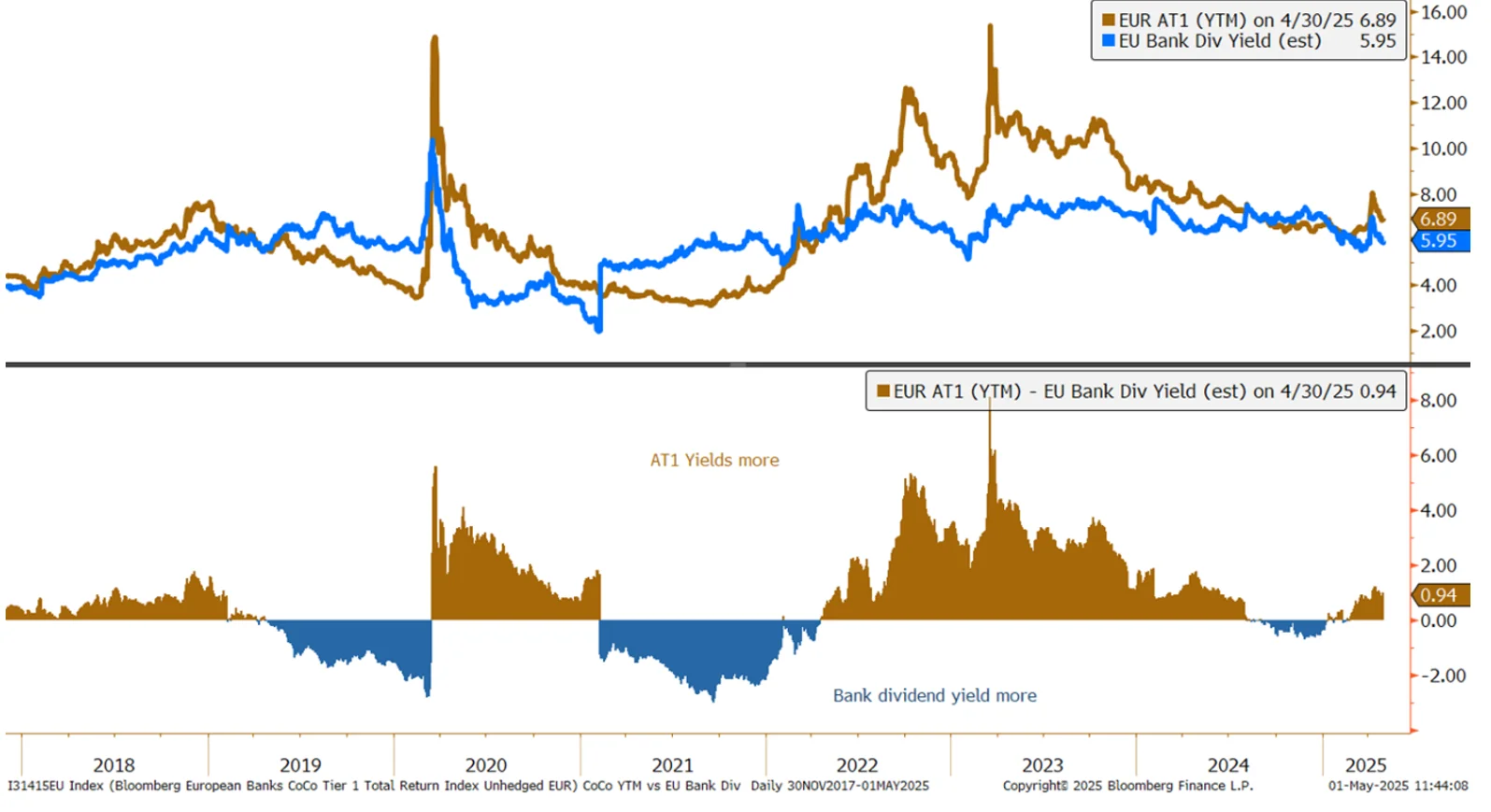

European bank CoCos currently yield more than the ordinary dividends of the same issuers, highlighting mispricing of equity vs subordinated debt capital.

Chart 3: EU Bank Dividend Yield versus CoCo YTM

Source: Bentham, as at 30 April 2025. Past performance is not indicative of future performance.

Attractive yield per unit of risk

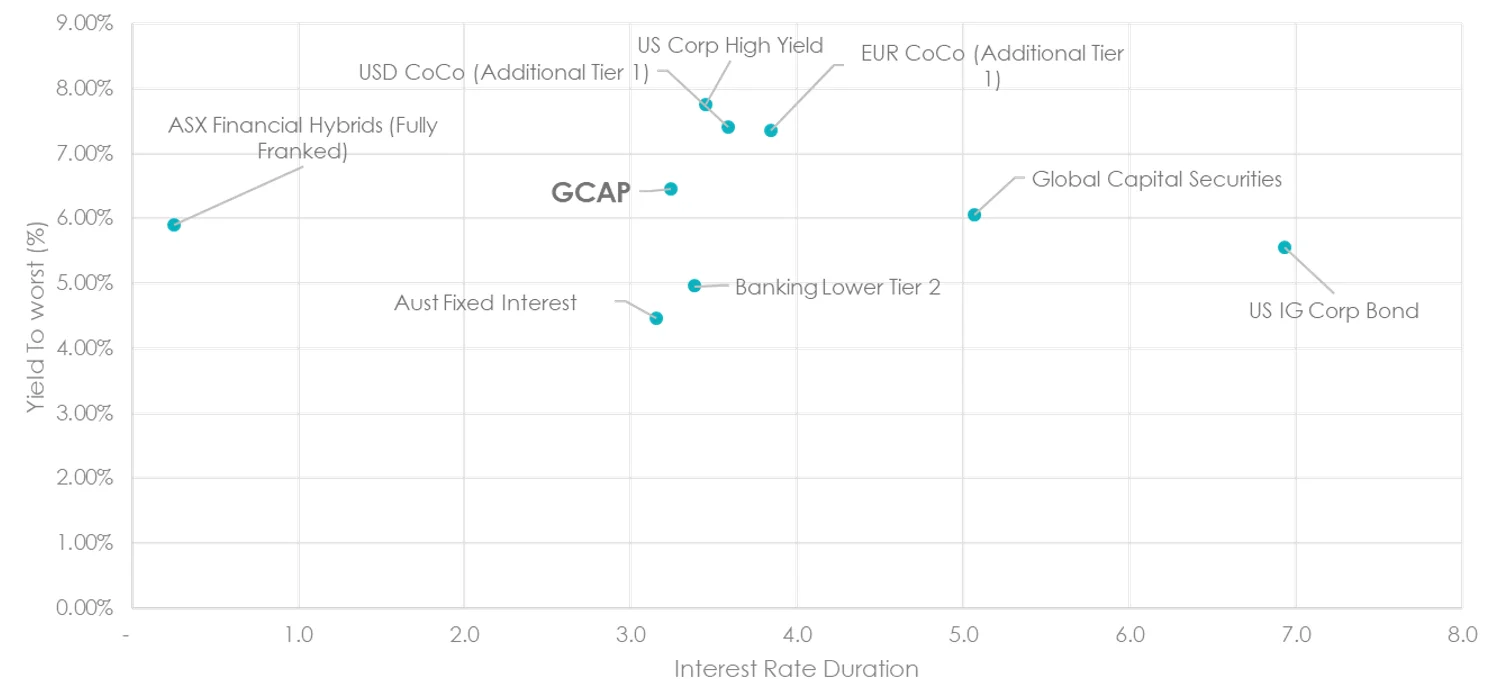

The YTW on GCAP’s capital securities portfolio remains above investment-grade fixed income, while duration is modest and well-managed. The current running yield of 6.65% with income paid monthly.

Compared to equities, CoCos have delivered higher yields without dividend volatility; EU bank CoCos are currently yielding more than the dividends of the same banks' equities.

Chart 4: Yield to Worst vs Interest Rate Duration relative to other exposures

^The yield of global indices are hedged into AUD. Index definitions: Aust Fixed Interest is Bloomberg AusBond Credit 0+ Index, US IG Corp Bond is Bloomberg Barclays US Corporate Bond Index, Global Lower Tier 2 is Bloomberg Barclays Banking Lower Tier 2, Global Capital Securities is the Bloomberg Barclays Global Capital Securities Index, EUR CoCo (Additional Tier 1) is Bloomberg Barclays Contingent Capital EUR Index, USD CoCo (Additional Tier 1) is the Bloomberg Barclays European Banks CoCo Tier 1 USD, US Corporate High Yield is the Bloomberg Barclays US Corporate High Yield Index, Australian Major Bank ASX Hybrids (Yield to Call)

This yield chart does not consider the differing risk profiles of the fixed income and credit sectors shown. Yield measures are not a guarantee of future dividend income from the fund

Source: Bentham, Bloomberg. As at 30 April 2025.

GCAP: the smarter hybrid allocation

With a narrowing window to reposition portfolios for better credit income, we see an immediate opportunity for advisers and brokers to consider:

GCAP offers a more scalable, liquid and diversified access point to global Tier 1 capital securities, an asset class under-utilised by Australian investors. With a mispriced opportunity across geographies and capital structures, GCAP enables institutions to retain income yield while upgrading credit discipline.

Key risks: An investment in the Fund carries risks associated with: subordination in the capital structure, derivatives, bond markets generally, interest rate movements, currency hedging, below Investment Grade securities, country and issuer concentration, liquidity, and issuer default. See the VanEck Bentham Global Capital Securities Active ETF PDS and TMD for more details.

Source

1Did markets misread APRA’s proposed phase-out of ASX hybrids?

Published: 22 May 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.