Duration could be the new darling

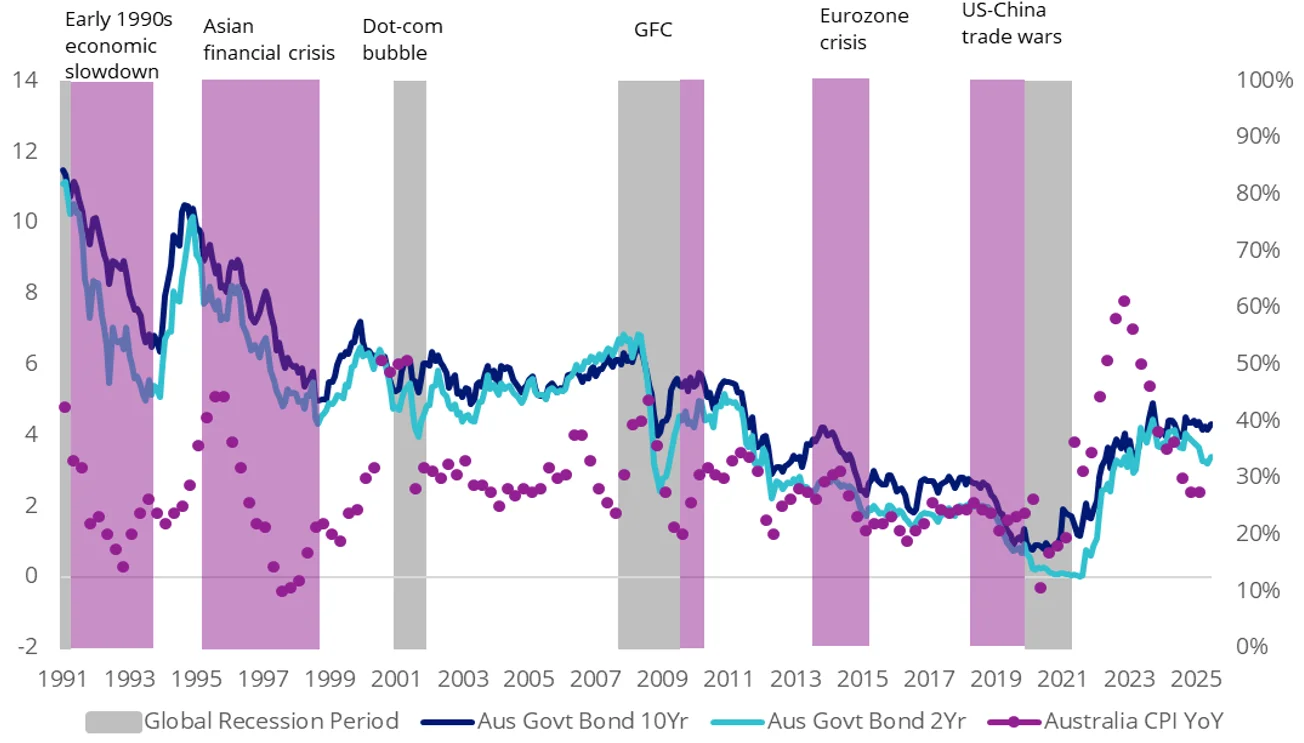

Around the world, yield curves are steepening, with the longer end rising, as bond investors aim to predict long term inflation expectations.

The Australian government bond 10-year yield has surged back above 4.40%.

These moves suggest bond investors are anticipating higher inflation in the future. In the US, long-end yields rose as the 90 day ‘Liberation day’ extensions expired and President Trump started to advise trade partners that they would be sanctioned, and these would have an inflationary impact, there are also concerns about Fed Independence.

Meanwhile, in Japan, long-term bonds have been hitting 30-year level highs. Last week, the 20-year Bond yield rose to 2.65%, its highest level since 1999. The 30-year yield hit a record 3.20%, reflecting the market's concerns over Japan’s fiscal outlook and the upper house elections (on 20 July). Intensifying investor apprehension is heightened inflationary pressures and public discontent due to rising living costs and any subsequent post-election fiscal policies, that could have a flow-on effect on rates.

Australia has not been immune

Since the start of the new financial year, the Australian government bond 10-year yield surged back above 4.40%. Australia’s sluggish GDP numbers and slowing inflation had many in the market expecting a July rate cut. As we noted in our recent monthly webinar, the Fix, in a vacuum, the May inflation print was lower than expected (headline CPI at 2.1% YoY and trimmed mean at 2.4%). While this didn’t eventuate, the market is still anticipating two more rate cuts this year.

Chart 1: Australian 10-year bond yield

Source: Bloomberg.

Persistent labour market tightness (unemployment rose slightly to 4.3% in June), elevated services inflation and strong wage growth, and the RBA’s preference for analysing quarterly inflation prints gave the Board room to hold off. This reinforces our forecast of a shallow easing cycle.

When you also consider turmoil elsewhere, Australian duration could be a potential ‘darling’ for global bond investors in the second half of 2025 as a way of avoiding US woes, soaring Japanese Government Bond yields and sell-off in UK gilts.

Positioning for economic weakness

While we believe Australia can navigate the current macro environment, it is important to acknowledge that there will be bumps along the way. Should economic conditions unexpectedly weaken, long-dated government yields could fall. A way to capitalise on this potential movement is to increase portfolio duration by investing in long-dated bonds.

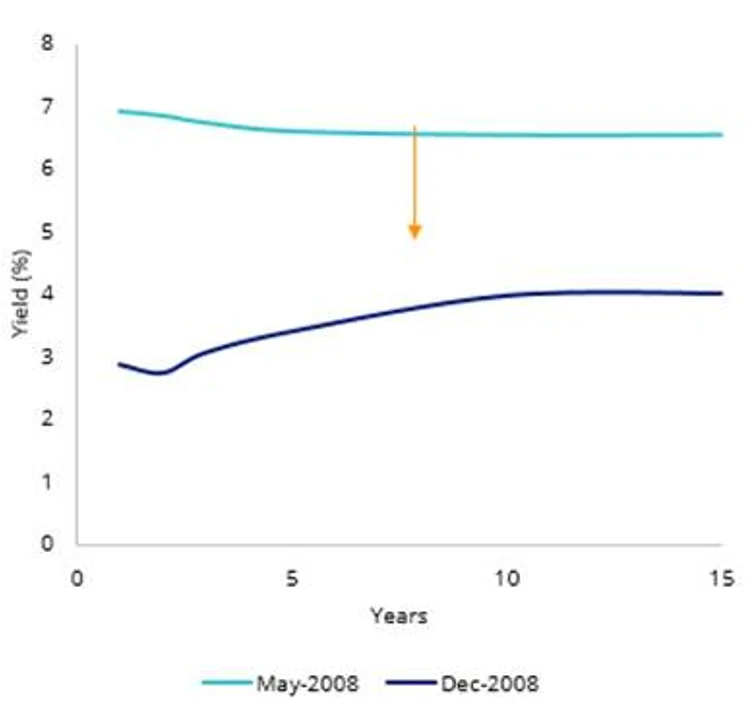

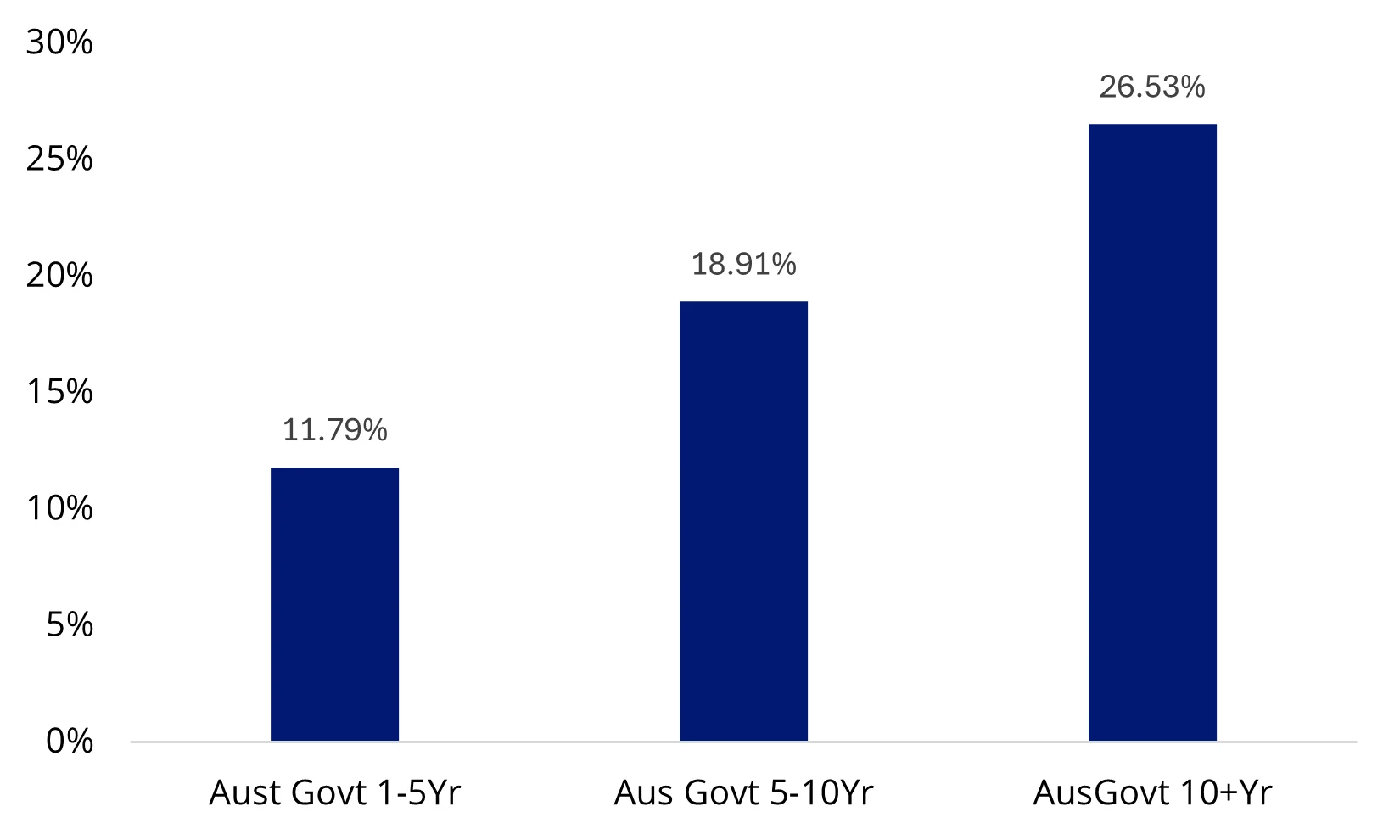

Additionally, should an unforeseen market event unfold, increasing portfolio duration can also serve as an important tail risk hedge. During the dot-com bubble, global financial crisis, and COVID-19 period, a ‘bull flattening’ scenario unfolded, where short- and long-term Australian government bond yields declined. The charts below illustrate the changes in the Australian government bond yield curve leading up to the global financial crisis, along with the respective returns by maturity bands and historical bull-flattening periods.

Chart 2: Australian Government Bond Yield Curve: GFC

Chart 3: Return comparison during GFC: May ’08 to Dec ‘08

Charts 2 and 3 source: Bloomberg, Past performance is not indicative of future performance. Aus Govt 1-5Yr as S&P/ASX iBoxx Australian & State Governments 1-5 Index, Aus Govt 5-10Yr as S&P/ASX iBoxx Australian & State Governments 5-10 Index, Aus Govt 10+Yr as S&P/ASX iBoxx Australian & State Governments 10-20 Index.

Chart 4: Australian government bond yields and CPI

Source: Bloomberg, to 30 June 2025. Past performance is not indicative of future performance.

One way to increase duration is the VanEck 10+ Year Australian Government Bond ETF (XGOV), a portfolio of Australian government bonds with maturity dates between 10 and 20 years. XGOV could be used as a way to express your interest rate view. The longer duration of XGOV means that it is more sensitive to changes in interest rates and as at 17 July 2025, its modified duration was 9.22. This means that for every 1% fall in interest rates, XGOV’s value is expected to increase 9.22% and vice versa.

XGOV is one of three VanEck Australian Government Bond ETFs, each targeting three distinct maturity buckets within different parts of the yield curve so investors can express their view on the direction of rates and potentially add value to their portfolio.

Key risks: An investment in the ETFs carry risks associated with: interest rate movements, bond markets generally, issuer default, credit ratings, country and issuer concentration, liquidity, tracking an index and fund operations. See the PDS and TMD for more details.

Published: 25 July 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.