Infrastructure assets keep on truckin

The long-term risk-return profile has made infrastructure a staple of institutional portfolios, but this asset class also offers broader appeal for investors.

Metropolitan car drivers who use toll roads may have noticed that tolls have increased (again), in line with inflation. Most recently, those roads that have quarterly escalation rates have passed on their October increase.It’s likely too that these price increases have not resulted in drivers taking alternate routes, because demand is inelastic, i.e. there is almost no change in demand, despite a price rise.

This is one of the reasons infrastructure, as an asset class, has become sought after by investors.

Infrastructure is critical for a functioning society, consisting of a diverse range of assets, including transport networks such as roads, railways, airports, canals and ports, and it also includes other networks and facilities necessary for sustaining society, such as utilities, towers and water.

Investors have come to recognise that infrastructure assets tend to be linked to steady and reliable income, supported by real assets that tend to be long-lived and that generally retain their value. Local toll road operator Transurban is a good example.

Generally, road tolls increase in line with changes in the Consumer Price Index. Government regulation determines the amount, and the frequency of toll price increases each year. And despite these rises, these roads still have traffic jams.

This highlights one of the key drivers of the long-term performance of global infrastructure securities: they exhibit inelastic demand for the services they offer.

These are basic services in people’s lives. The consumption patterns, and therefore the cash flow, vary little in response to price or the economic cycle.

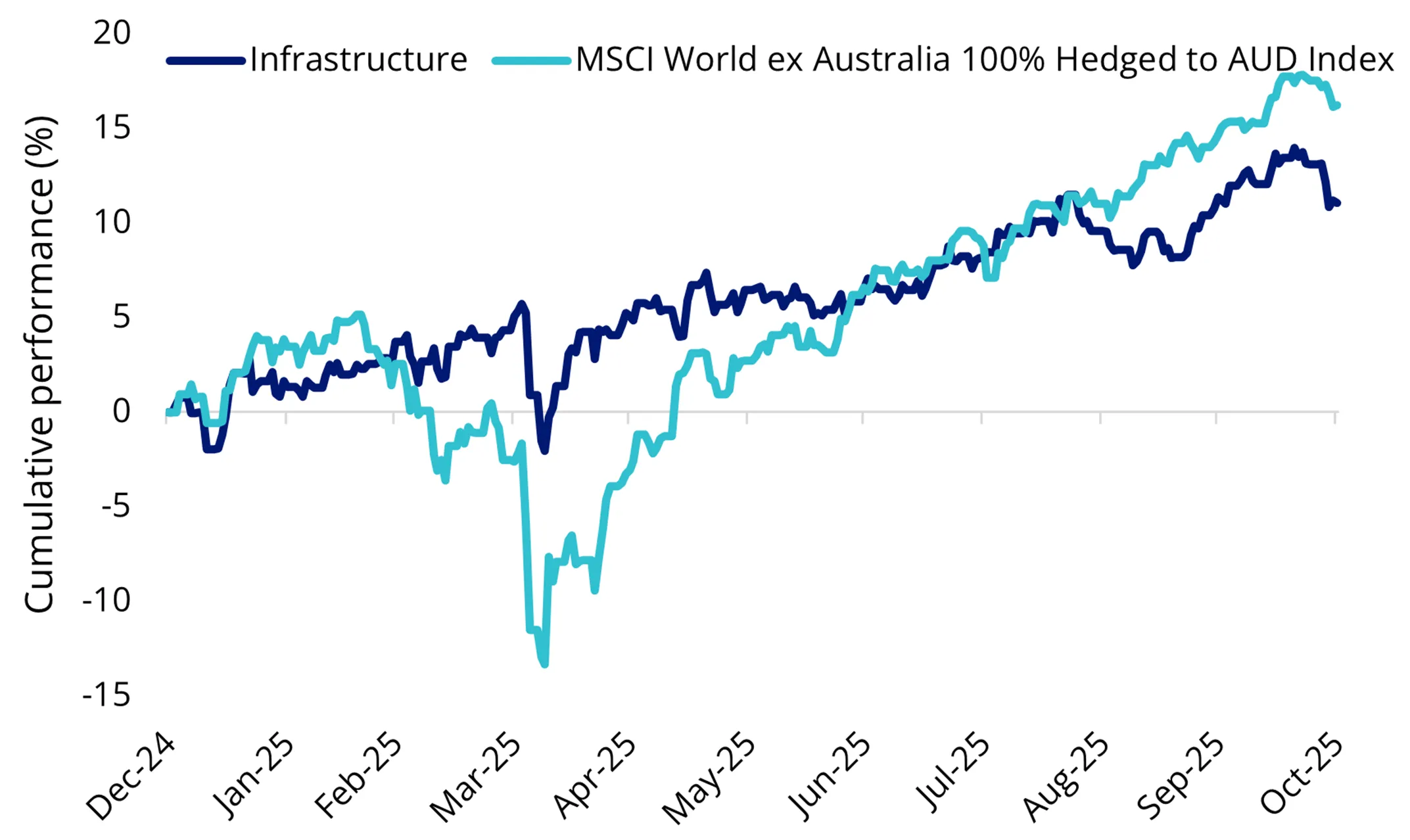

As a result of these characteristics, infrastructure is considered by investors to be a relatively stable investment that provides smooth income. If we consider the first metric, relative stability, a review of the 2025 returns of global listed infrastructure, relative to the broader global equities market, reinforces the asset class’s reputation. The performance of global equities could be described as a roller coaster in 2025, whereas the returns of global infrastructure have been a relatively smoother rise. For investors considering the second metric, smooth income, we cover that further below.

Chart 1: Year-to-date performance

Source: Morningstar Direct, 1 Jan 2025 to 31 October 2025. Infrastructure is the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

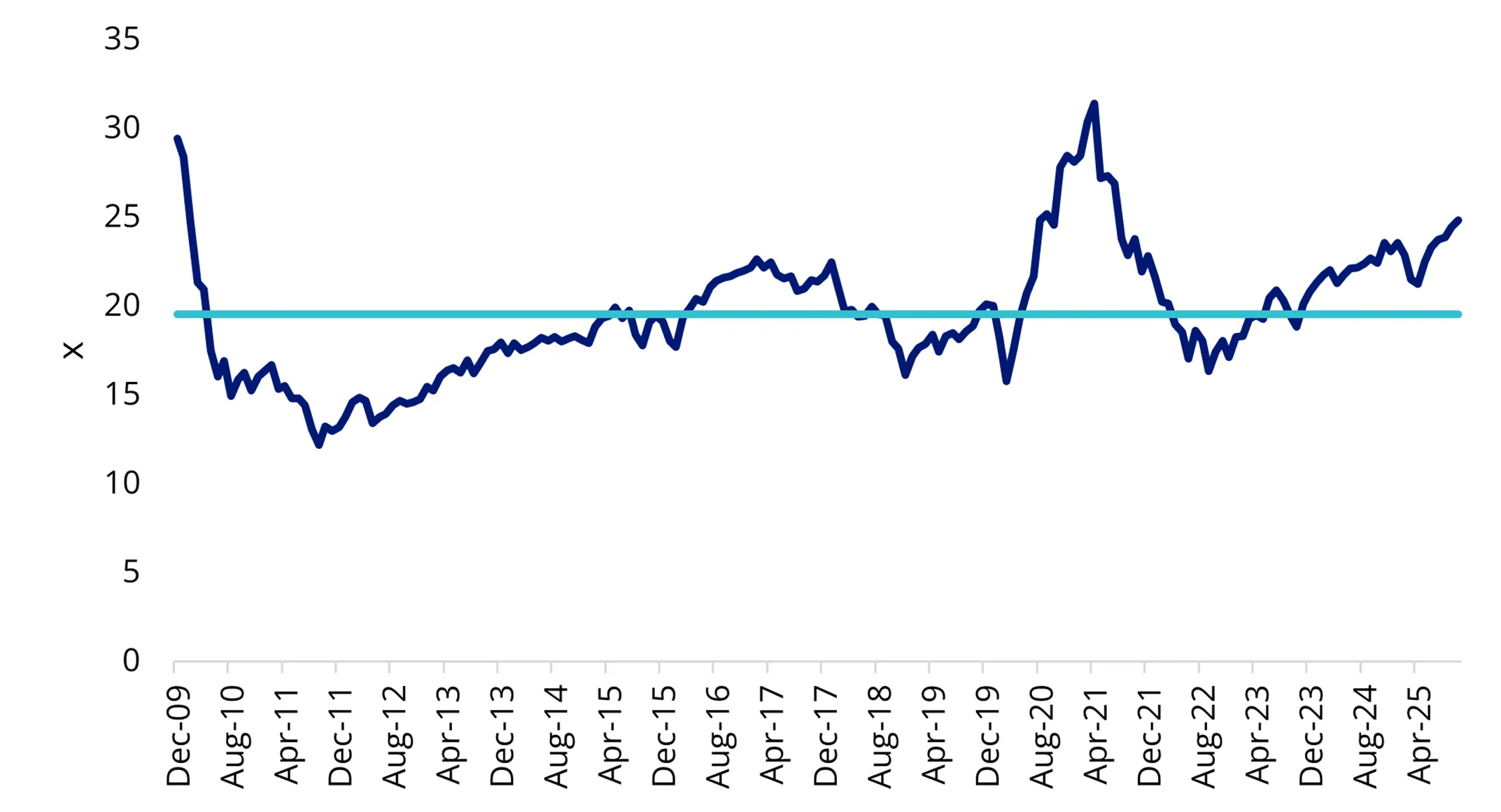

While equities have run hard since Liberation Day, investors are starting to worry about valuations. On a price-to-equity valuation, the MSCI World ex Australia Index has only been this expensive four times in the past 15 years, as the valuation has risen well above its long-term average.

Chart 2: Price to equity valuation of MSCI World ex Australia Index

Source: MSCI, December 2009 to 31 October 2025.

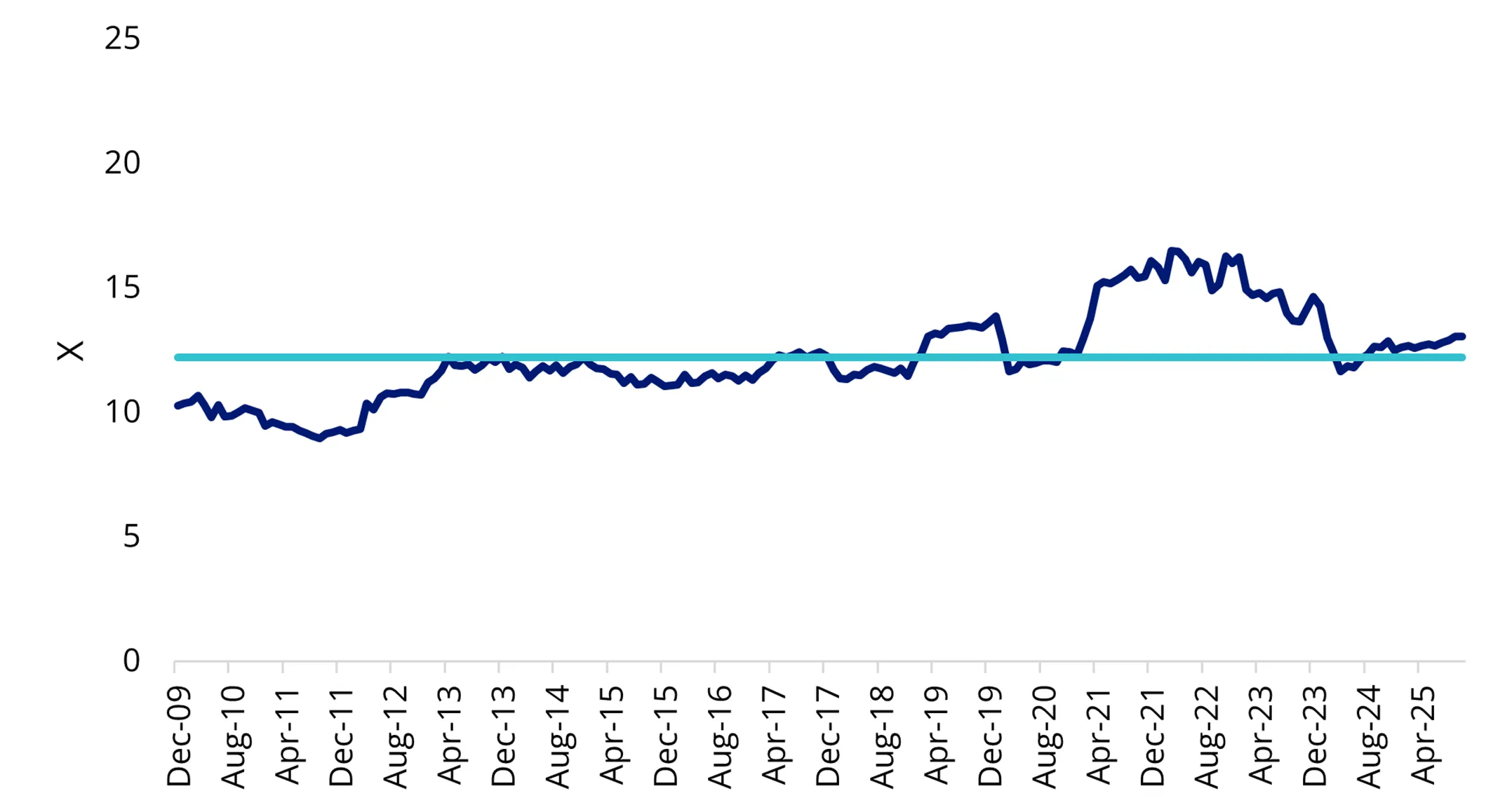

For investors seeking value, the relative value of the global infrastructure index, on an enterprise value (EV) to EBITDA valuation, does not look as stretched relative to its historical average.

Chart 3: EV to EBITDA of FTSE Developed Core Infrastructure 50/50 Index

Source: FTSE, December 2009 (Index base date) to 31 October 2025.

This means that should global equity valuations start to move back in line with historical averages, global infrastructure has the potential to maintain its resilience.

Now could be the time to consider the asset class that keeps on truckin’ as a portfolio construction tool.

Long-term tailwinds

Long term, the dire need for infrastructure spending underpins the policies for growth for the next decade and beyond for many governments around the world. According to the World Bank, over US$90 trillion of new investment will be needed to meet infrastructure needs over the next two decades. Shifting demographics, such as the growing global population, require not only more investment in infrastructure but also doing more with less.

In developed markets, the aging population that requires a stable income to fund retirement will put a premium on income-generating assets, driving demand for assets such as global listed infrastructure.

Diversification is key

While we believe that long-run return expectations for infrastructure are attractive, this environment still has significant risks for individual assets. As such, being diversified across a range of underlying sectors and stocks is key.

The VanEck FTSE Global Infrastructure (AUD Hedged) ETF (IFRA) gives investors exposure to a diversified portfolio of 135 global listed infrastructure securities. IFRA tracks the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index, which has sector and stock capping that improves diversification and reduces concentration risk at a sector and stock level. It is also used as the global infrastructure benchmark by industry participants, including consultants and fund managers.

IFRA tracks the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index (IFRA Index), the widely regarded market benchmark for the sector. The index includes companies that own and operate the networks and foundations for modern society to function, including transport, energy, water, communications and social services.

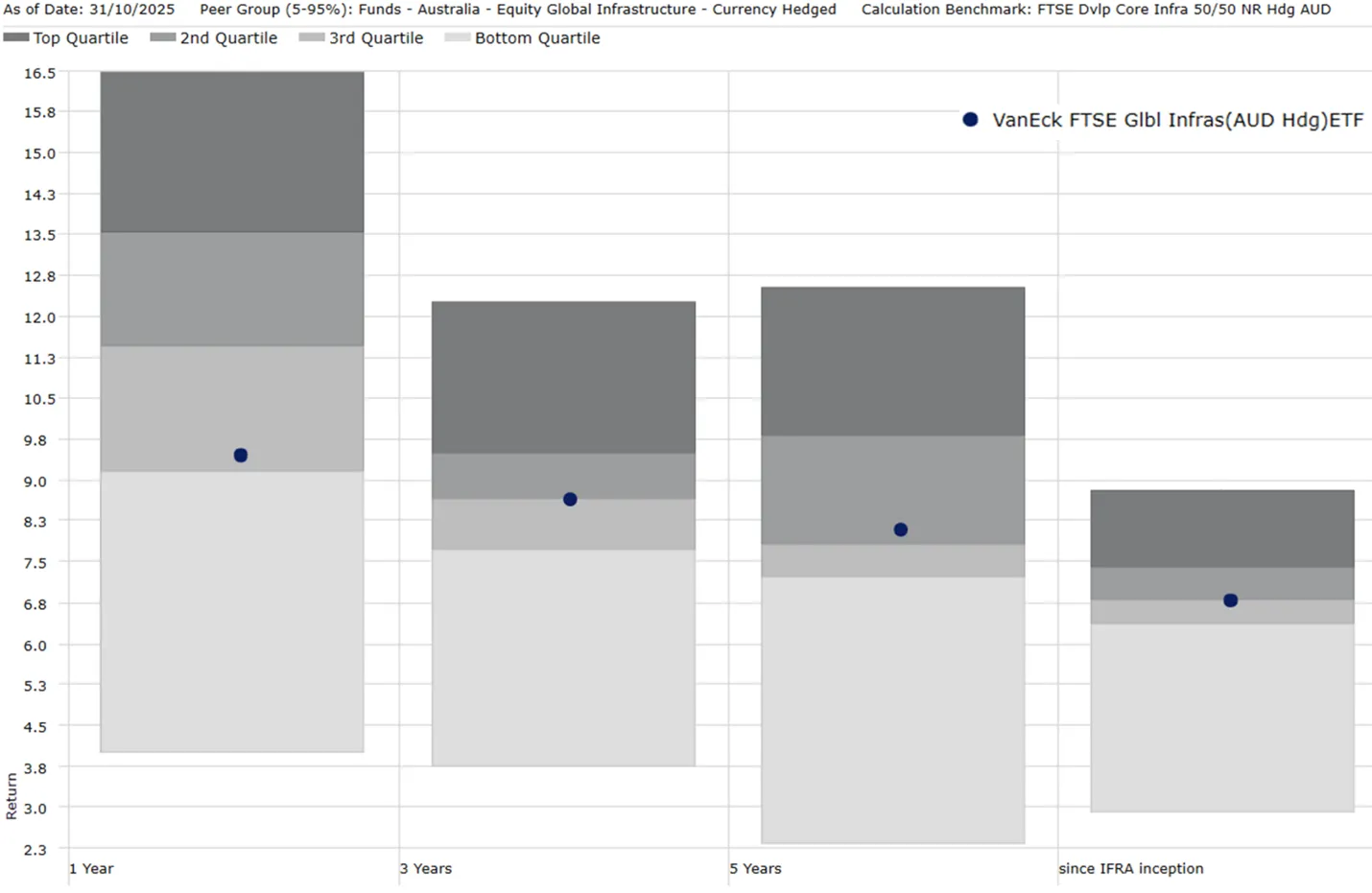

We think a passive approach to the sector is warranted due to the wide dispersion of returns among active managers. Consider the spread of returns below, the returns over three and five years are more incredible when you consider that those are annualised. Additionally, over the long term, manager-pick risk is a potential issue. In trailing time periods greater than three years, IFRA’s low-cost passive approach outperforms at least 50% of other funds.

Chart 4: Performance relative to peer group

Source: Morningstar Direct. Past performance is not a reliable indicator of future performance. Results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads. Returns for periods longer than one year are annualised. The peer group, Global Infrastructure – Currency Hedged funds invest in listed or unlisted infrastructure securities issued by global entities that have as their primary focus (in terms of income and/or assets) the management, ownership and/or operation of infrastructure and utilities assets. These funds seek to protect against the impact of foreign currency movements by being predominately hedged for foreign exchange risk as a neutral position.

Stable income and the VanEck advantage

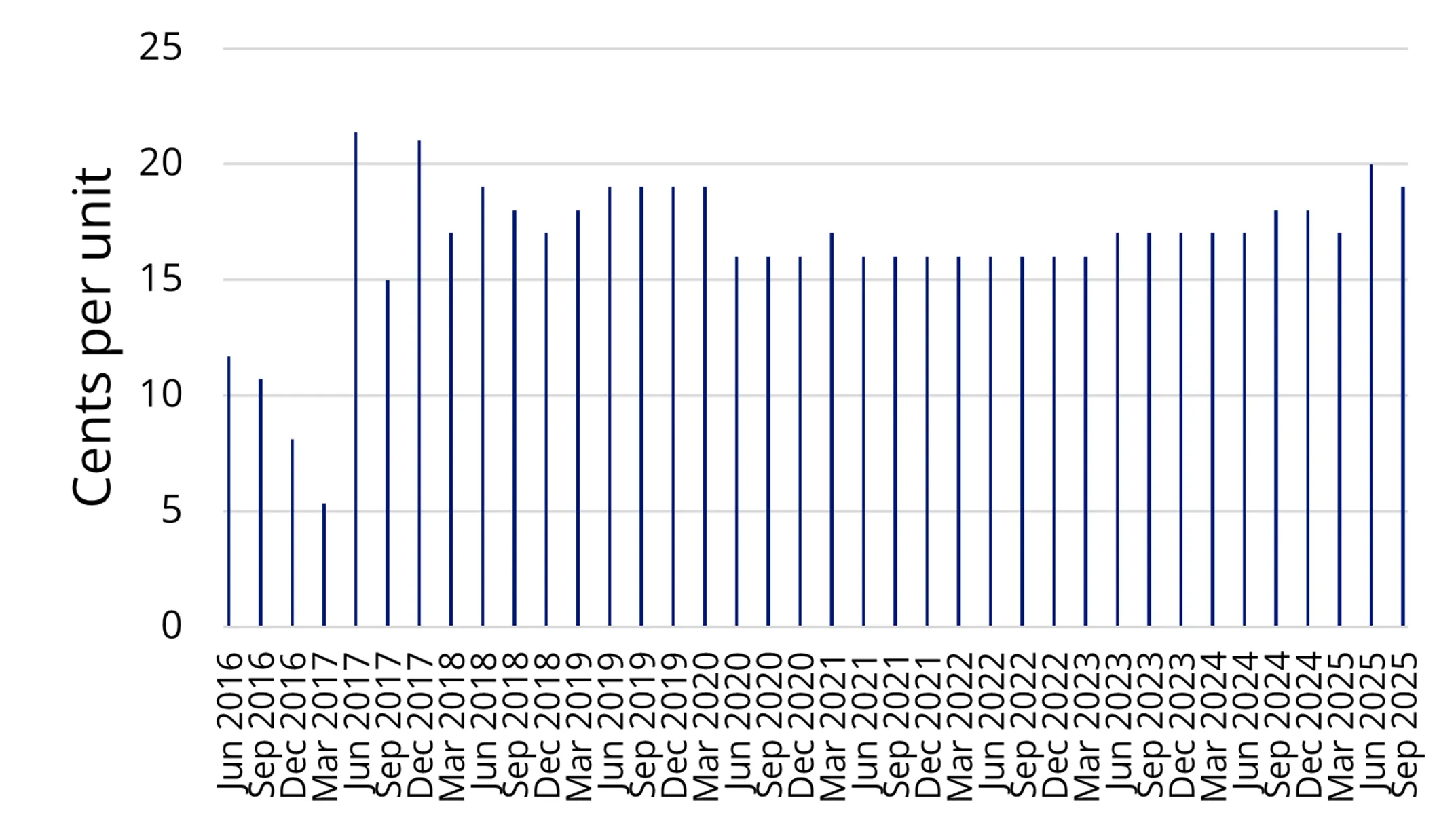

As noted above, infrastructure, as an asset class, is considered for its stable income. IFRA’s stable income is one of its competitive advantages, we think. Dividends are paid four times a year – furthermore, VanEck’s tax strategy aims to ensure income is smooth and not impacted by currency fluctuations.

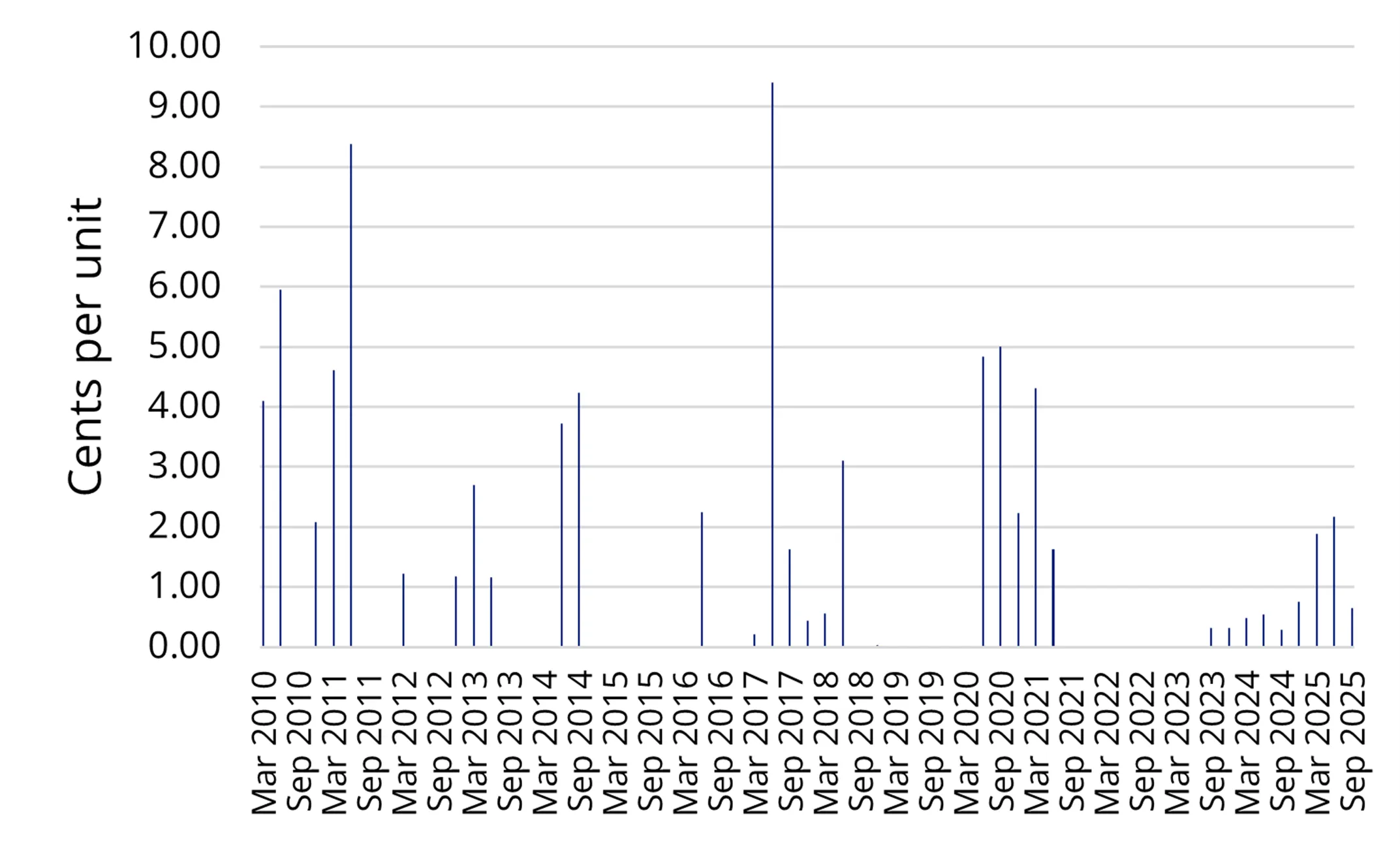

IFRA is hedged into Australian dollars to limit the impact that currency movements could have on income. IFRA, unlike many other global listed infrastructure funds, also makes beneficial choices under the tax rules, including adopting the ‘Taxation of Financial Arrangements’ (ToFA) currency hedging rules. These tax choices enable smooth income payments to be maintained over time.Not all fund managers utilise this strategy. Below on the top is a hedged infrastructure example from a widely regarded fund manager, on the bottom is IFRA. Note that the example Australian dollar hedged unlisted managed fund made no distributions in 2019, nor did they distribute between September 2021 and March 2023. IFRA, on the other hand, has maintained a steady income.

Chart 5: Unlisted Managed Fund: Dividend Payment History (CPU)

Source: Fund Manager website accessed 20 November 2025.

Chart 6: IFRA: Dividend Payment History (CPU)

Source: VanEck. IFRA inception date is 29 April 2016. Past performance is not a reliable indicator of future performance. IFRA dividend payment history (CPU) is not a guarantee of future dividends payable from IFRA.

One trade access to 135 Global Listed Infrastructure securities

With one trade on ASX, IFRA gives investors access to:

- a portfolio of 135 of the world’s largest infrastructure securities providing international diversification that replicates the well-regarded market benchmark for global listed infrastructure, the FTSE Developed Core Infrastructure 50/50 Hedged into Australian Dollars Index;

- stable income paid quarterly; IFRA’s 12-month trailing dividend yield is 3.19% (as at 31 October 2025), as always dividend yield is not a guarantee of future dividends by IFRA;

- a cost-effective strategy with a management fee of 0.20% p.a.

Key risks: An investment in our global infrastructure ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck FTSE Global Infrastructure (AUD Hedged) ETF PDS and TMD for more details.

IFRA is likely to be appropriate for a consumer who is seeking capital growth and a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and has a high risk/return profile.

Published: 24 November 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.