GWTH: New international growth ETF

We are pleased to announce that we are launching an international equity ETF that will target companies poised for rapid revenue and earnings expansion, or ‘growth’.

REGISTER YOUR INTEREST BELOW

In an Australian first, VanEck is offering investors a way to access a portfolio of international companies selected as being among the top companies based on five growth descriptors as measured by MSCI.

Growth is about selectivity

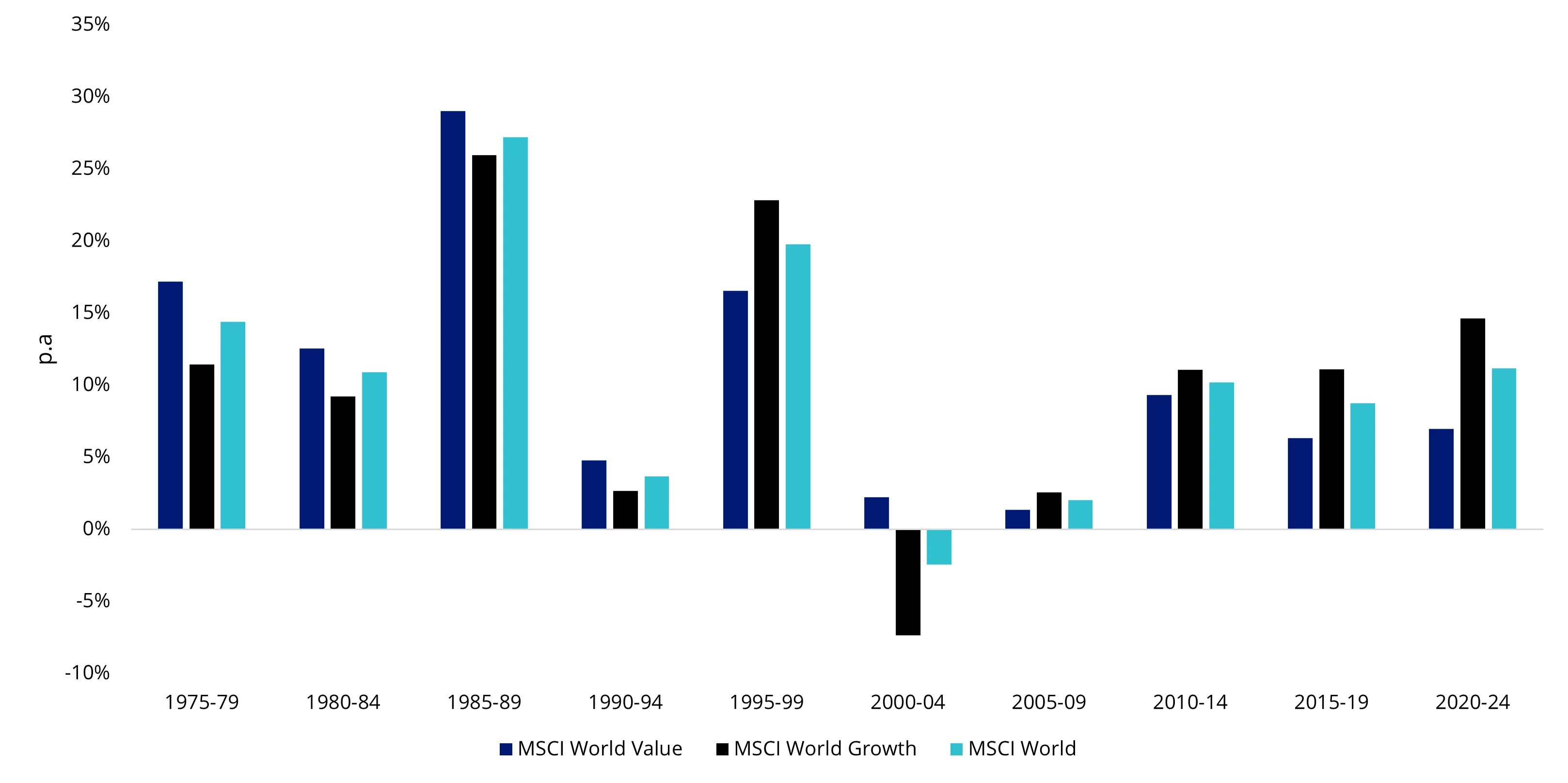

Growth has been a hot topic among international equity investors since the GFC, as ‘growth’ companies outperformed ‘value’ companies after many decades of underperformance.

Since the GFC, growth has outperformed value

Source: Bloomberg. You cannot invest in an index. Past performance is not indicative of future performance. show less

Traditionally, ‘growth’ has been the domain of active managers.

Investing with a skilful ‘growth’ active manager, who is selective and curates their portfolio, has been rewarding for investors, irrespective of the era. Growth investing focuses on identifying companies poised for rapid revenue and earnings expansion, often driven by innovation, market disruption or evolving consumer preferences.

Successful growth investors emphasise:

- Strong historical and future earnings growth

- Competitive advantage through innovation or market leadership

- Sustainable long-term growth trends rather than short-term valuations.

For a fraction of the costs of the typical active management fee, we think that it is possible to access the growth factor utilising a systematic, rules-based approach that targets outperformance.

Active management provides the key: selectivity.

VanEck has a distinguished history of harnessing technological advancement and advanced analysis to identify and unlock opportunities for Australian investors. For over a decade, we have pioneered smart beta ETF strategies in Australia, with a vast number of our smart beta ETFs being the first of their kind on the ASX, offering investors the ability to construct portfolios with a targeted outcome in mind.

It is with this mindset that we contemplated the growth factor and a selective, systematic approach.

The result is the VanEck MSCI International Growth ETF, which will soon list on ASX under the ticker ‘GWTH’.

The new ETF will track the MSCI World ex Australia Growth Select Index.

GWTH will invest in around 100 international companies that have been selected, according to MSCI, as being among the top companies based on:

- Long-term forward earnings-per-share (EPS) growth rate

- Short-term forward EPS growth rate

- Current internal growth rate

- Long-term historical EPS growth trend

- Long-term historical sales-per-share growth trend

GWTH is an ETF that will allow investors to add a growth tilt to their portfolio, for passive fees. Importantly, it is a diversifier to the growth factor away from the over-held companies, with NVIDIA being the only ‘Magnificent-7’ company currently included in the portfolio.

The GWTH opportunity

International companies exhibiting growth characteristics

Access a portfolio of international companies that are selected based on (i) Long-term forward EPS growth rate, (ii) Short-term forward EPS growth rate, (iii) Current internal growth rate, (iv) Long-term historical EPS growth trend and (v) Long-term historical sales-per-share growth trend.

Outperformance potential

The index is designed to select those companies poised for rapid revenue and earnings expansion with the potential to outperform the global equity benchmark over the long term.

Diversified across countries, sectors and companies

Offering investors a portfolio of approximately 100 companies across a range of geographies, sectors and economies

Published: 15 August 2025

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity of VanEck MSCI International Growth ETF (‘GWTH’). Units in GWTH are not currently available. GWTH has been registered by ASIC and VanEck has lodged an application with ASX for units in the fund to be admitted to trading status on ASX. The PDS has been lodged with ASIC and it will be available at the end of the exposure period at www.vaneck.com.au. This is general advice only, not personal financial advice, and does not take into account any person’s individual objectives, financial situation or needs. GWTH is subject to investment risk, including possible loss of capital invested. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the fund. GWTH will invest in international markets which have specific risks that are in addition to the typical risks associated with investing in the Australian market. These include foreign currency, ASX trading time differences, country or sector concentration, political, regulatory and tax risks. The PDS and TMD details the key risks. This information is believed to be accurate at the time of compilation but is subject to change. VanEck does not represent or warrant the quality, accuracy, reliability, timeliness or completeness of the information. To the extent permitted by law, VanEck does not accept any liability (whether arising in contract, tort, negligence or otherwise) for any error or omission in the information or for any loss or damage (whether direct, indirect, consequential or otherwise) suffered by any recipient of the information, acting in reliance on it.

GWTH is indexed to a MSCI index. GWTH is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to GWTH or the MSCI World ex Australia Growth Select Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and GWTH.