Powering the new data age: URAN

Pre-register your interest via the form below.

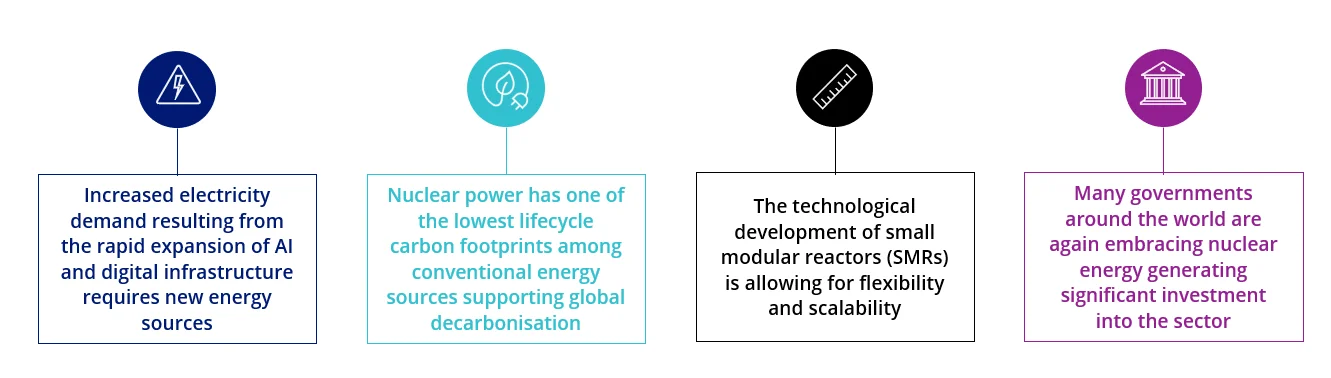

Nuclear energy is considered a reliable and low-carbon source of electricity. Unlike fossil fuel energy generation, nuclear power plants do not emit greenhouse gases when operating. Additionally, nuclear energy has a much smaller land footprint compared to renewable sources of electricity, such as solar and wind power, and is much less resource-intensive.

Uranium-powered nuclear energy is helping satisfy increasing electricity demand.

Source: Goldman Sachs (via Masanet et. al, 2020, IEA, Cisco and Goldman Sachs Global Investment Research). For illustrative purposes only.

The uranium-powered nuclear energy sector offers investors the opportunity to access the current leaders in uranium mining as well as technological development associated with nuclear energy:

The URAN opportunity:

Supporting rapid technological advancement

A sector positioned to meet the accelerating electricity demands from the rapid expansion of AI, computational power and digital infrastructure.

Targeted exposure

Exposure to the largest global companies involved in the uranium mining and nuclear energy sectors, which are typically under-represented in benchmarks.

Emerging growth opportunity

An investment in a revived and alternative global energy supply that supports decarbonisation and the transition to clean energy.

Key risks: An investment in our uranium and energy innovation ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. Once available, see the PDS and TMD for more details.

Published: 16 October 2025

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETFs traded on the ASX. VanEck Uranium and Energy Innovation ETF (URAN) are not currently available. URAN has been registered by ASIC and is subject to ASX and final regulatory approval. The PDS will be available at vaneck.com.au. The Target Market Determination will be available at vaneck.com.au. You should consider whether or not any VanEck fund is appropriate for you. Investing in ETFs has risks, including possible loss of capital invested. See the PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.