Building block for portfolios

Asset allocation can determine around 90% of your portfolio’s returns. Explore how investors can optimise their ETF strategy.

Many investors aim to develop a resilient investment portfolio that stands the test of time. And more investors are using ETFs to achieve this.

The rise of ETFs in Australia has coincided with greater choice within superannuation options and the growing popularity of self-managed superannuation funds (SMSFs).

The ETF industry reached a record $280 billion in funds under management as at 30 June 2025, up from $65 billion five years ago. And we think this momentum is likely to continue as the industry heads toward $300 billion by year end.

The breadth of ETFs now available allows investors to gain exposure to previously untapped or difficult to access asset classes such as subordinated debt and gold bullion.

With many online brokers promoting ETFs and regular savings plans, it is little wonder ETFs have become the investment fund of choice for many investors.

ETFs are being used by investors to create their own diversified portfolios. This asset allocation is, perhaps the most important investing decision they will make.

In the 1986 article “Determinants of Portfolio Performance”, Brinson et al, demonstrated that the asset allocation decision was responsible for 93.6% of a diversified portfolio's return pattern over time. Subsequent studies have confirmed this (Donaldson et al, 2013).

As the asset allocation decision is responsible for around 90% of portfolio movements, the remaining 10% comes from security selection and market timing.

Asset allocation is a critical element of any investment strategy. It forms the basis of a prudent investment policy and drives the bulk of an investor’s risk and return outcome.

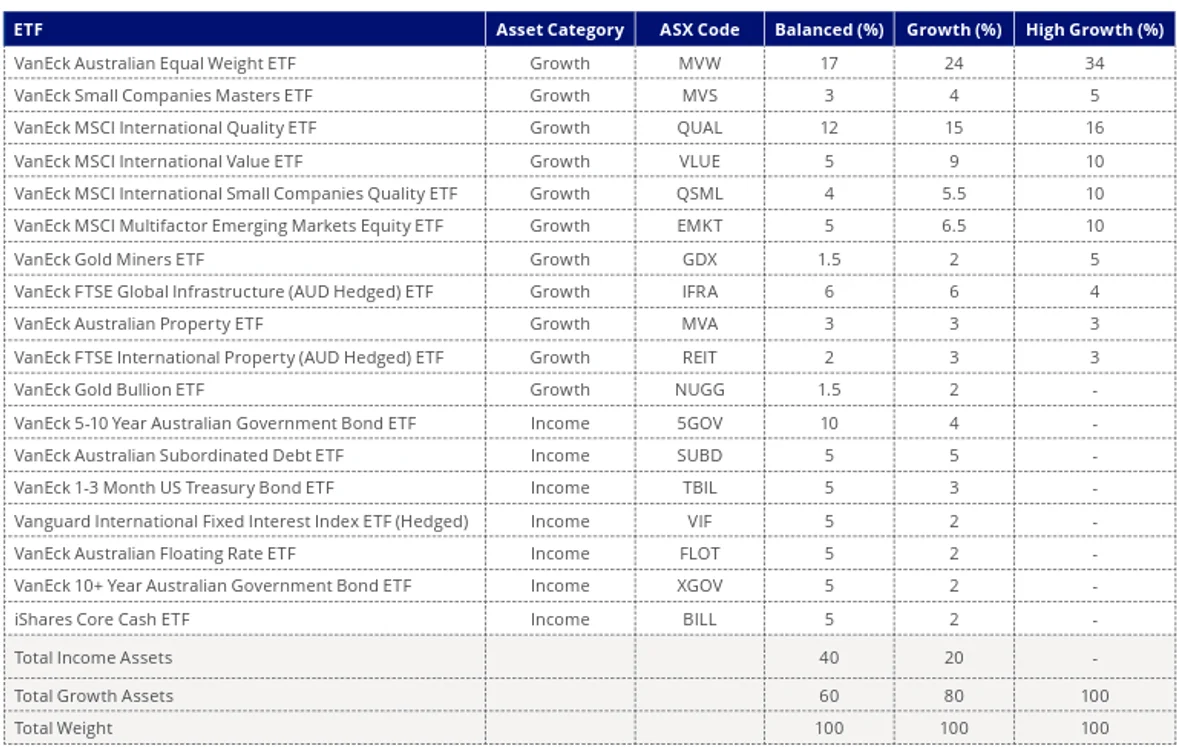

We believe a diversified approach to portfolio construction is critical to achieving investment objectives. VanEck has a series of notional paper-based model portfolios that are split between growth and defensive assets across a range of ETFs that give exposure to many asset classes.

These hypothetical portfolios utilise well-established research and portfolio construction expertise, considering risk and return.

An informed understanding of risk and return of the various asset classes is important to the portfolio construction process.

The Australian Government (moneysmart.gov.au) has provided investors with a practical guide to investing called “Investing between the flags”. This guide highlights typical investment portfolios including ‘balanced’ and ‘growth’ mixes based on desired return outcomes, having regard to investors’ different timeframes and levels of risk.

The Australian Securities & Investments Commission (ASIC) defines defensive assets as cash or government bonds, so for the purposes of the below defensive assets are Australian bonds, international bonds and cash. This means the growth assets below are: Australian equities, international equities, Australian property, international property and global infrastructure.

A balanced portfolio will include a mix of defensive and growth assets while a portfolio targeting high growth will have 100% allocated to growth assets

Growth assets are considered riskier than defensive assets, so a high-growth portfolio is riskier than a balanced portfolio.

Below is an example of typical asset allocation in balanced, growth and high-growth portfolios.

Each notional model portfolio provides broad market exposure across asset classes including Australian equities, global equities, property, infrastructure, Australian fixed income and international fixed income. You will note it includes VanEck’s ETFs, as well as funds from our ETF peers, where we do not have an equivalent capability. The portfolios include a mix of ‘beta’ and ‘smart beta’ strategies, utilising simple low-cost ETF strategies to deliver diversified exposure for considerably less cost than the average cost of Australian managed funds.

Important: This is general advice only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making any asset allocation or investment decision, you should seek personal financial advice from a licensed financial adviser to determine your risk profile and financial products that are appropriate for your personal circumstances. You should read the relevant product disclosure statements and target market determinations to help determine if a product is appropriate for you.

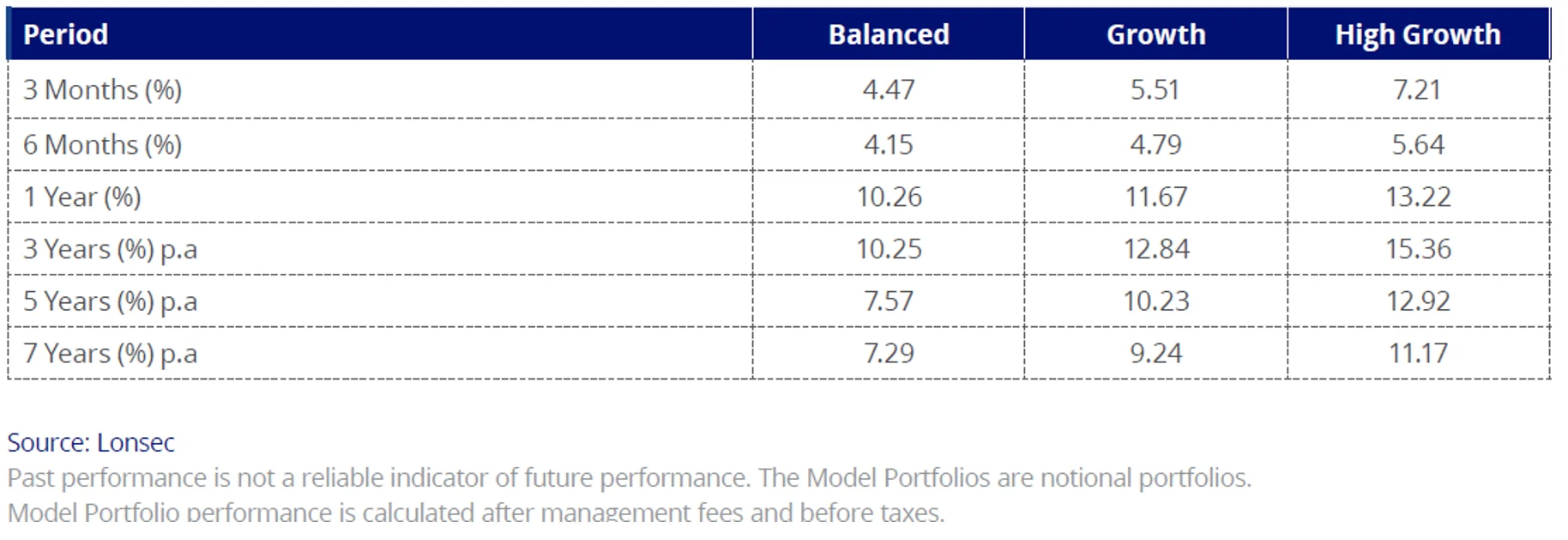

We have been calculating the modelled returns of these notional models for over seven years. The table below show the returns of hypothetical portfolios based on the notional models.

As you can see from the above table a hypothetical one-year investment in our model high growth portfolio for the period ending 30 June 2025 would have returned 13.22%. It’s important to remember that equities have soared this year despite ‘Liberation Day’ tariffs, but even over the past five and seven years, these returns compare favourably to the returns of balanced and growth funds being reported by some large superannuation funds.

The hypothetical returns are demonstrative of the benefits diversification can have for investors as a long-term portfolio strategy and how investors are using ETFs to achieve their investing goals.

An investment in any fund involves risk. As always, we would recommend you speak to a financial adviser or broker to determine which investment is right for you. The moneysmart.gov.au website also includes a factsheet for getting financial advice.

Published: 25 July 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all VanEck Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.