Starbucks, not a quality bean

Australia has a thriving coffee culture and we are serious coffee connoisseurs, just look at the plethora of Instagram, blogs and apps dedicated to Australian coffee (for the record our favourite bean is Campos) – we are really spoilt for choice!

Australia has a thriving coffee culture and we are serious coffee connoisseurs, just look at the plethora of Instagram, blogs and apps dedicated to Australian coffee (for the record our favourite bean is Campos) – we are really spoilt for choice!

But what happened to Starbucks?

The Seattle-based coffee chain with over 27,000 stores worldwide opened its doors in Australia in 2000 but after incurring US$105m in losses it ultimately shut down the vast majority of its stores here. Its expansion to our continent was not met with open arms mainly because most people in Australia don’t rate the quality of its coffee very highly, and we are not the only ones – just ask the Italians…

But as an investment, does Starbuck’s represent quality?

There are a lot of reasons to like Starbucks including its global coffee alliance with Nestle and aggressive China expansion. Since the beginning of the year Starbuck’s share price has increased from US$64.32 to just over US$90, its return on equity (ROE) is a healthy ~114% and it has strong earnings and revenue growth.

But what about its debt?

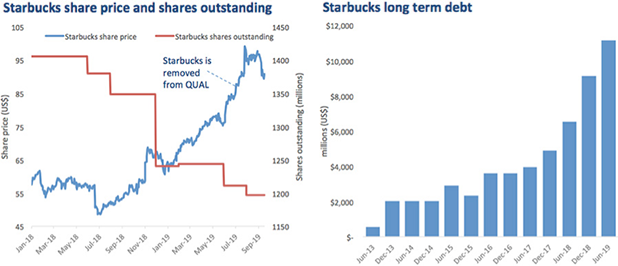

In May 2019 Starbucks was removed from the VanEck Vectors MSCI World ex Australia Quality ETF (QUAL) for one simple reason, financial leverage. After buying back its shares at an extraordinary rate it now holds over ~$US11bn of long term debt notwithstanding it declared it was using the proceeds from the Nestle deal to increase planned stock buybacks.

Starbucks loses its quality aroma

Starbuck’s has been undertaking a program to return ~US$25 billion to shareholders via buybacks and dividends. For a company with a market cap of ~US$100 billion, the size of the buyback is extremely high. Since the buyback program began in 2018, Starbuck’s share price has been on a tear as investors, encouraged by the returns to shareholders through these buybacks and dividends, drove the price up.

However the buyback has come at a price. According to a recent Forbes article, “the company incurred a lot of debt to fuel all these buybacks.

- Three years ago, Starbucks had about $3 billion in debt and a debt/equity ratio of 59%.

- The company now carries $9.2 billion in debt and the debt/equity ratio exceeds 800%.”

Please note figures in the Forbes article are expressed in US dollars.

As a result of this debt, Starbucks was removed from the QUAL Index, and therefore was also removed from QUAL, at the last rebalance. It had been in the index and the fund since QUAL launched in 2014.

Source: Bloomberg, January 2018 to 17 September 2019. Past performance is not a reliable indicator of future performance.

Quality companies may outperform

The low interest rate environment has encouraged companies like Starbucks to take on more risk by increasing their borrowing, however growth among developed companies is anaemic. Inflation remains low so investors need to exercise caution. Starbucks announced earlier this month that it expects its earnings growth to slow in 2020.

In a low growth, low inflation environment, companies that traditionally do well have the following characteristics:

- Value creating return on equity (ROE) – a ROE above 15%;

- Attractive growth profile – above average earning per share (EPS) growth;

- Sustainable earnings – demonstrated across multiple business cycles; and

- Strong balance sheets – gearing ratios ~50% with strong net cash positions.

QUAL tracks an index that only includes the 300 highest quality scoring stocks determined by MSCI based on three easily identifiable financial characteristics:

- High ROE;

- Stable year-on-year earnings growth; and

- Low financial leverage.

With a single trade on ASX you can use QUAL to invest in 300 quality international companies and since its inception it has consistently outperformed the broad market MSCI World ex Australia Index, after fees.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors MSCI World ex Australia Quality ETF and VanEck Vectors MSCI World ex Australia Quality (Hedged) ETF. This is general information about financial products only and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to an ETF, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The funds are subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from any ETF.

QUAL and QHAL invest in international markets. An investment in QUAL or QHAL has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.

QUAL and QHAL are indexed to a MSCI index. The ETFs are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or QHAL or the MSCI Index. The PDSs contain a more detailed description of the limited relationship MSCI has with VanEck and the ETFs.

Published: 02 October 2019