Gaming stocks outplay the Magnificent 7

The technology sector has traditionally been among the highest growth industries, however, it has also typically been US-centric. The video gaming and esports sector offers an alternative, diversified route to high-growth opportunities.

Before the US hit the world with the most extreme tariff aggression in almost a century, one of the main buzzword for investors was “artificial intelligence”1. We don’t think AI will go anywhere soon, with many of the world’s biggest companies heavily investing in AI software development and infrastructure, particularly US tech giants such as Meta, Amazon, and Alphabet.

However, recent events demonstrate why the old playbook of holding just the richly valued Magnificent 7, which has declined 7.39% YTD (to 30 April 2025), can be a risky and costly strategy. In this environment, smart investors should consider harvesting the AI tailwind via diversified tech names in the video gaming and esports industry.

The scale of global games market has grown rapidly in recent years, with forecasted revenue reaching US$522.46 billion this year and US$691.33 billion by 2029, according to Statista. To put that into perspective, this is double the size of the global computing market, which is expected to reach US$222.2 billion this year.

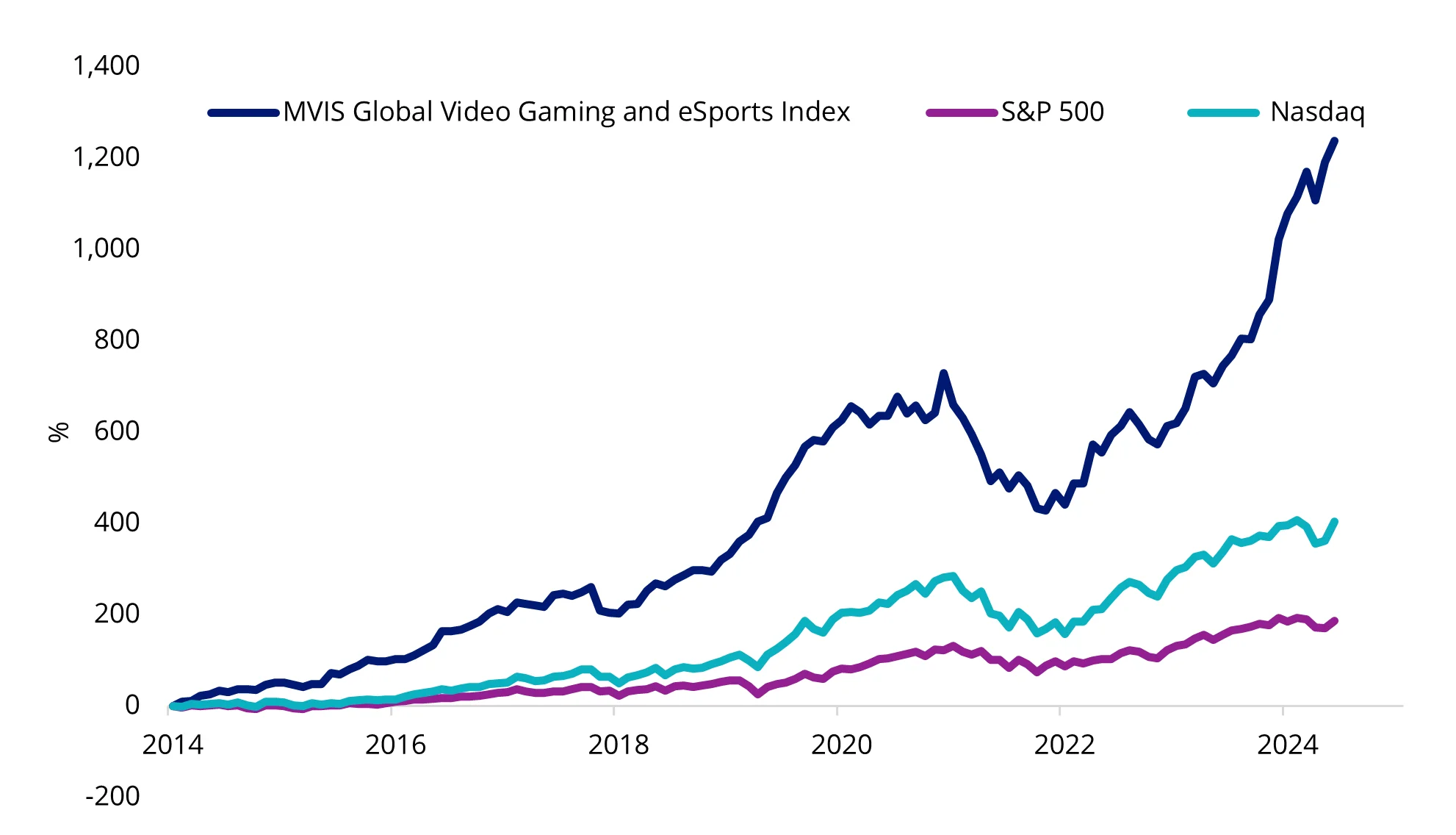

The long-term growth potential of the gaming industry piqued investors’ interest five years ago, when gaming stocks rallied during the COVID lockdown. We believe that this was a part of a long-term structural trend. In September 2020, we launched the VanEck Video Gaming and Esports ETF (ESPO), which tracks the MVIS Global Video Gaming & eSports Index (ESPO Index). The sector, as represented by the ESPO Index, has consistently outperformed the broad-based S&P 500 and tech-heavy NASDAQ 100 since its base date in 2014. As always, past performance is not indicative of future performance.

Chart 1: Hypothetical long-term performance of ESPO Index, S&P500 and Nasdaq

Source: Bloomberg as at 15 May 2025. Performance shown of the ESPO Index prior to its launch date of 14 August 2020 is simulated based on the current index methodology. Results assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF and taxes. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance of the ESPO Index or ESPO.

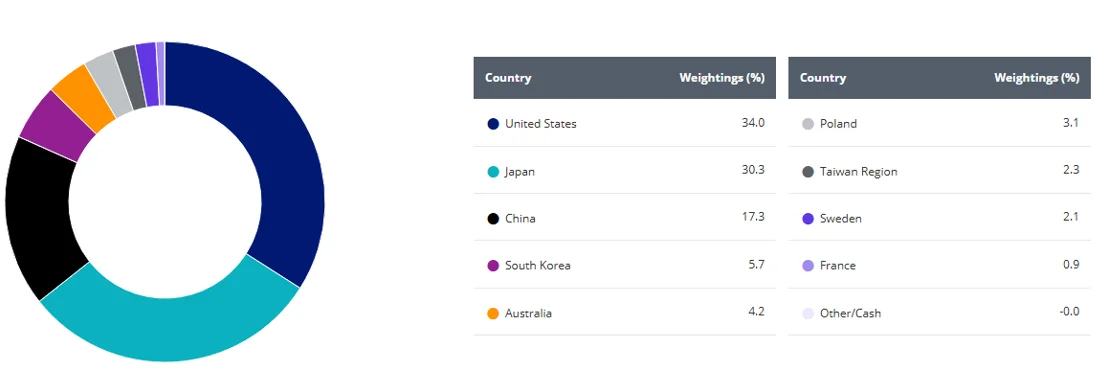

More recently, ESPO has outperformed the S&P 500 and NASDAQ 100 Index. While it was not immune to the cross-asset sell-off following the US Tariff Liberation Day, ESPO has bounced back rapidly as the Trump administration rolled back tariff policies as part of negotiations. This could be considered evidence of robust investor confidence in the future of the technology and the gaming sector as well as resilient corporate fundamentals and diversification outside of the US tech sector (US companies make up only a third of the portfolio).

Chart 2: ESPO’s geographic diversity

Source: VanEck Australia. As at 30 April 2025.

In April, 2025, ESPO delivered a gain of 6.86% over the month (YTD: +9.42%). Holdings in Japan, Konami group (9766 JP), Nintendo (7974 JP) and BANDAI (7832 JP), were among the key contributors. This is a short time period and should not be relied on as an indication of future performance.

Chart 3: Japan was the top contributor to ESPO’s recent outperformance

Source: VanEck, Bloomberg, From 31 March 2025 to 30 April 2025. Past performance is not a reliable indicator of future performance. Performance in AUD. Not a recommendation to act.

Several structural growth trends indicate ESPO’s growth could be long-lasting, underpinned by the rapid advancements in AI Revolution 2.0:

- AI-powered game development – Accelerated content creation, intelligent Non-Player Characters (NPCs), and cost-efficient production enhance profitability for Tencent and Roblox.

- Cloud gaming & AI infrastructure – AI driven latency reduction, real time upscaling, and enhanced server efficiency fuel demand for AMD and Microsoft-powered gaming ecosystems.

- AI-driven monetisation – Personalised in-game purchases, dynamic ad targeting, and AI-driven engagement tools maximise revenue for AppLovin, NetEase, and Tencent.

- eSports & competitive gaming growth – AI powered analytics refine player performance, optimise game strategies, and elevate viewer engagement, benefiting Bandai Namco, Konami, and Krafton.

Table 1: Key contributors of ESPO performance

|

|

Portfolio weight |

YTD performance % |

AI catalysts |

|

NINTENDO CO LTD |

7.30 |

19.48 |

Nintendo's stock rallied in April, driven by several positive factors including the official announcement of the Nintendo Switch 2, hands-on events in major cities worldwide, and a strong earnings report that exceeded market expectations. |

|

GAMESTOP CORP-CLASS A |

5.21 |

21.58 |

A meme rally followed CEO Ryan Cohen’s 3rd April purchase of 500k shares (around USD $10.8 m), plus a wave of retail trader enthusiasm that drove the stock double digits higher that week. |

|

KONAMI GROUP CORP |

4.97 |

18.20 |

The stock rallied driven by strong casino systems momentum in Japan and optimism ahead of earnings season. |

|

ROBLOX CORP |

6.27 |

12.04 |

The stock rallied in April driven by strategic partnerships, innovative AI driven game creation tools, and a strong earnings report that exceeded market expectations. |

|

CAPCOM CO LTD |

5.07 |

15.34 |

Upward earnings revision (net income guidance +5 %) cited strong early demand for Monster Hunter Wilds and other catalogue titles, sparking a sharp share price move. |

|

SQUARE ENIX HOLDINGS CO LTD |

2.96 |

21.56 |

The stock set a new 52 week high after reports that Final Fantasy VII Remake (and sequels) will come to Nintendo Switch 2, underscoring the publisher’s broader multi-platform push. |

Source: VanEck, Bloomberg, From 1 January 2025 to 30 April 2025. Past performance is not a reliable indicator of future performance. Performance in AUD. Not a recommendation to act.

Key risks

An investment in our video gaming and esports ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Video Gaming and Esports ETF PDS and TMD for more details.

Source

1The next AI shake-up could unlock even bigger opportunities

Published: 16 May 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.