Gaming and esports set up for growth in 2023

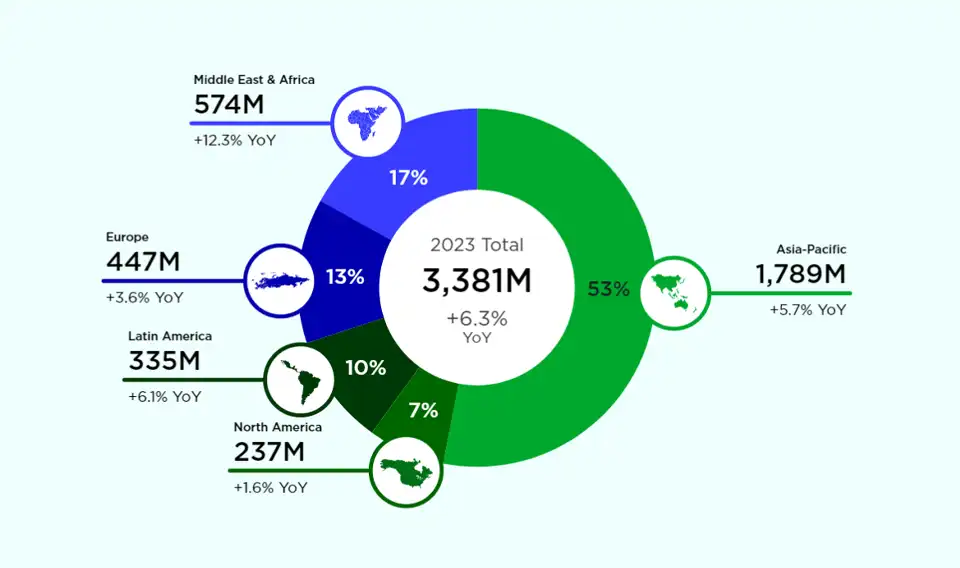

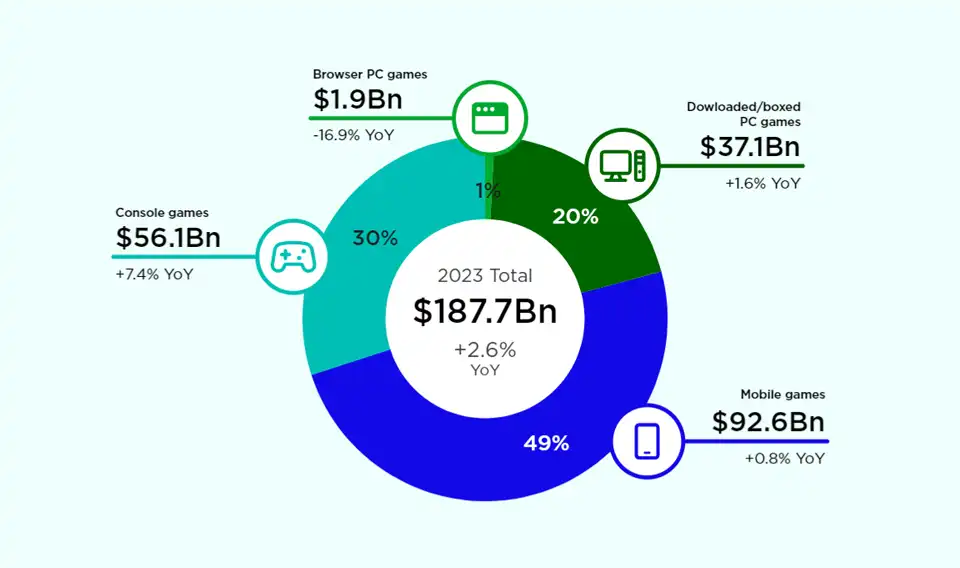

The growth of global games market is continuing in 2023 overall, despite macroeconomic headwinds. According to the latest NewZoo report1, gaming revenue will reach US$187.7 billion representing a 2.6% year-on-year (yoy) growth. Also more players will be attracted into the ecosystem worldwide, reaching 3.38 billion (6.3% yoy) by the end of the year thanks to the wider accessibility of mobile games.

Video gaming and esports forecast growth by region in 2023

Source: NewZoo, figures in US dollars.

Video gaming and esports forecast growth by segment in 2023

Source: NewZoo, figures in US dollars.

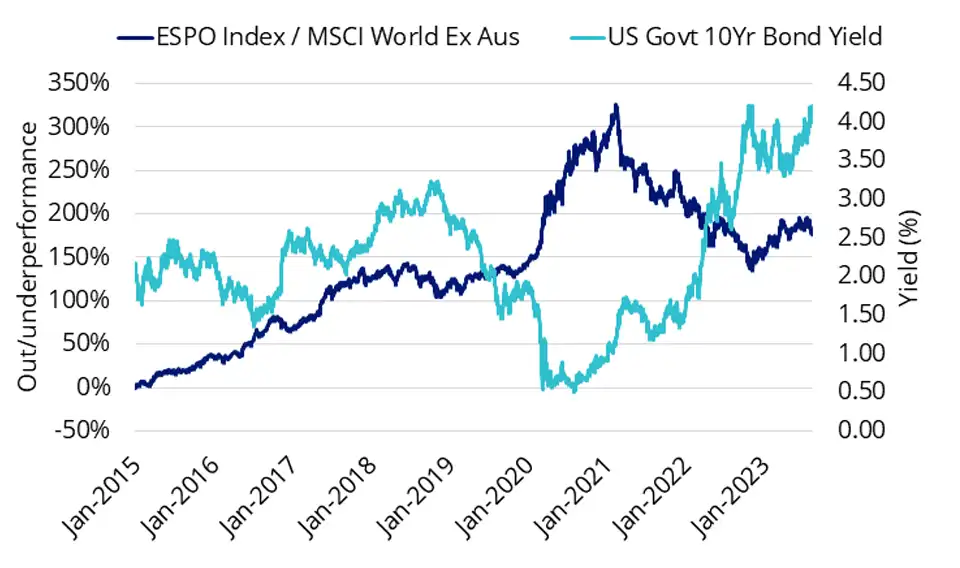

The tech sector has already seen a resurgence this year, driven by AI fever. With the US 10-year bond yield close to a peak this economic cycle, gaming companies may find further strength. The MVIS Global Video Gaming and eSports Index (ESPO Index) tracks the largest and most liquid companies involved in video game development, esports and related hardware and software globally. Below we see the performance of the ESPO Index against the MSCI World ex Australia Net Total Return AUD Index (MSCI World Ex Aus), alongside US 10-Year Gov Bond Yields. Generally the US treasury 10-year bond yield is negatively correlated with the performance of tech companies (which are considered ‘growth’ stocks), as it is often used as the discount rate for estimating the present value of stock prices.

Source: Bloomberg as at 23 August 2023. Past performance is not indicative of future results. You cannot invest directly in an index. ESPO’s Index base date is 31 December 2014. ESPO Index performance prior to its launch on 14 August 2020 is simulated based on the current index methodology.

More importantly, players are willing to spend more as gaming becomes mainstream. It is expected that player numbers will grow by +7.3% globally to 1.47 billion in 2023 and grow 4.7% p.a. from 2021 to 20261, driving up earnings for gaming publishers.

Indeed, August saw Nintendo hit a new high for first-quarter profit after the successful launch of its latest Legend of Zelda game – Tears of the Kingdom which sold 18.51 million units in the quarter. The Japanese interactive entertainment company commented that the latest instalment sold over 10 million copies in its first three days and is already the ninth-best-selling title in Switch history, which led to increased sales of its Switch console. The Super Mario Bros Movie which rocked the box office earlier this year also helped nearly triple Nintendo’s licensing royalties.

On a more granular level, Nintendo recorded a 25% increase in weekly in-app purchases (IAP), the biggest jump among the gaming companies.

|

Developer |

Ticker |

Weekly IAP in $ Millions |

% Change |

Monthly IAP in $ Millions |

% Change YoY |

|

Nintendo Co Ltd |

TYO:7974 |

2.4 |

25% |

9.5 |

-17% |

|

Ubisoft |

UBI FP |

0.5 |

5.6% |

2.1 |

-13% |

|

Sea Limited |

SE US |

6.6 |

5.3% |

27 |

-19% |

|

Activision Blizzard |

ATVI US |

21 |

2.1% |

98 |

-19% |

|

Take Two Interactive |

TTWO US |

18 |

-0.6% |

79 |

-23% |

|

Rovio Entertainment Oyj |

HEL: ROVIO |

1.7 |

-1.2% |

7.4 |

-2.8% |

|

Electronic Arts |

EA US |

8.5 |

-2.1% |

40 |

9.7% |

|

NetEase |

NTES US |

33 |

-11% |

156 |

4.5% |

Source: Bloomberg, Apptopia as at 13 August 2023.

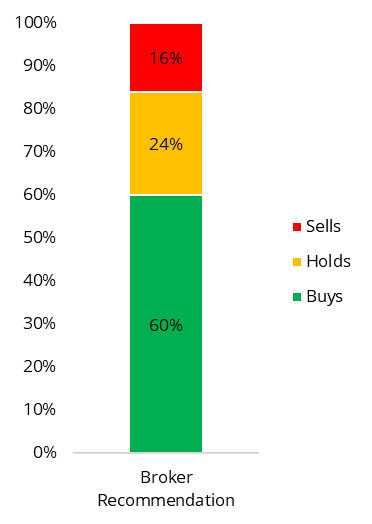

Broker split for Nintendo (25 analysts)

Source: Bloomberg, As at 14 August 2023.

An investment in the ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

1. NewZoo Global Games Market Report July 2023

https://newzoo.com/resources/blog/games-market-estimates-and-forecasts-2023

Published: 28 August 2023