New leagues, new legends, new rules

Global gamers are set to exceed the three most populous countries, providing gaming stocks with significant growth opportunities.

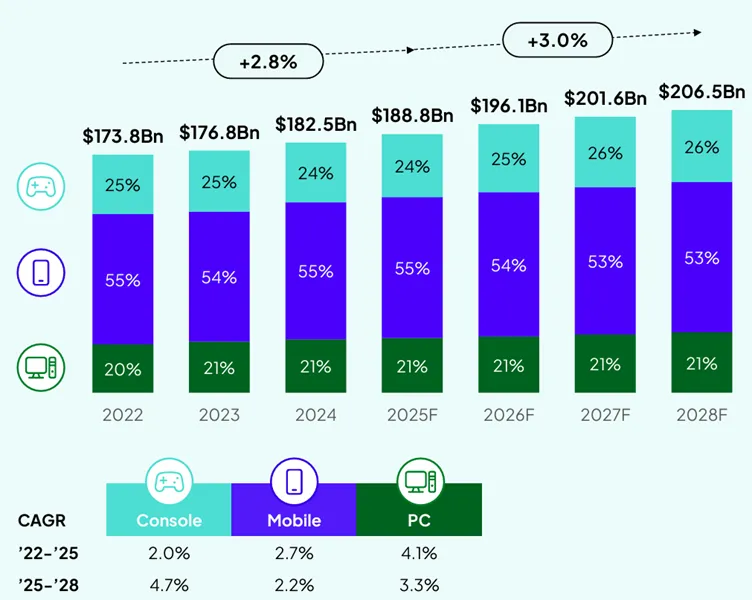

Whether you value gaming as a pastime or not, the value of digital gameplay as a global cultural phenomenon is undeniable. In the latest report published by Newzoo, a gaming analytics company, the global player base is projected to increase by 4.4% to 3.6 billion people in 2025. To put that into perspective, this is more than the top three most-populated countries combined (India: 1.46 billion; China: 1.41 billion; USA: 347.3 million, according to Statista, as at 5 August 2025). Paying gamers are expected to grow at a faster rate (4.9%) than the broader player base (4.4%) this year, with revenue expected to reach US$188.8 billion in 2025.

Chart 1: Forecast of global gaming revenue by platform

Source: Newzoo. September 2025. All currency shown is in US dollars. Forecast revenue should not be relied upon and is not guaranteed to be met.

While mobile (83% of all players) and PC (26% of all players) are the preferred mediums for gameplay, console revenue might get an extra boost this year with the launch of the Nintendo Switch 2, higher software prices, and a stronger release calendar.

Esports World Cup 2025

The continued global popularity of gaming has helped establish it as a legitimate sport category, known as “esports”. Esports is well on its way to going mainstream, with an ever-growing viewership and rising sponsorship revenue. At the end of August, the second Esports World Cup concluded in Riyadh, Saudi Arabia, surpassing last year’s event with 2,500 players from 89 countries competing for a total prize pool worth US$70 million.

The 2025 Esports World Cup drew more than three million visitors, roughly equal to Las Vegas’s monthly visitors. The event also secured a combined nine figure sponsorship total from household names such as Sony, Amazon, and Pepsi, and coverage expanded across more than 800 broadcast channels.

Two global stocks in particular are riding the global gaming wave: Nintendo, listed on the Tokyo Stock Exchange; and Tencent Holdings, listed on the Hong Kong Stock Exchange.

Nintendo

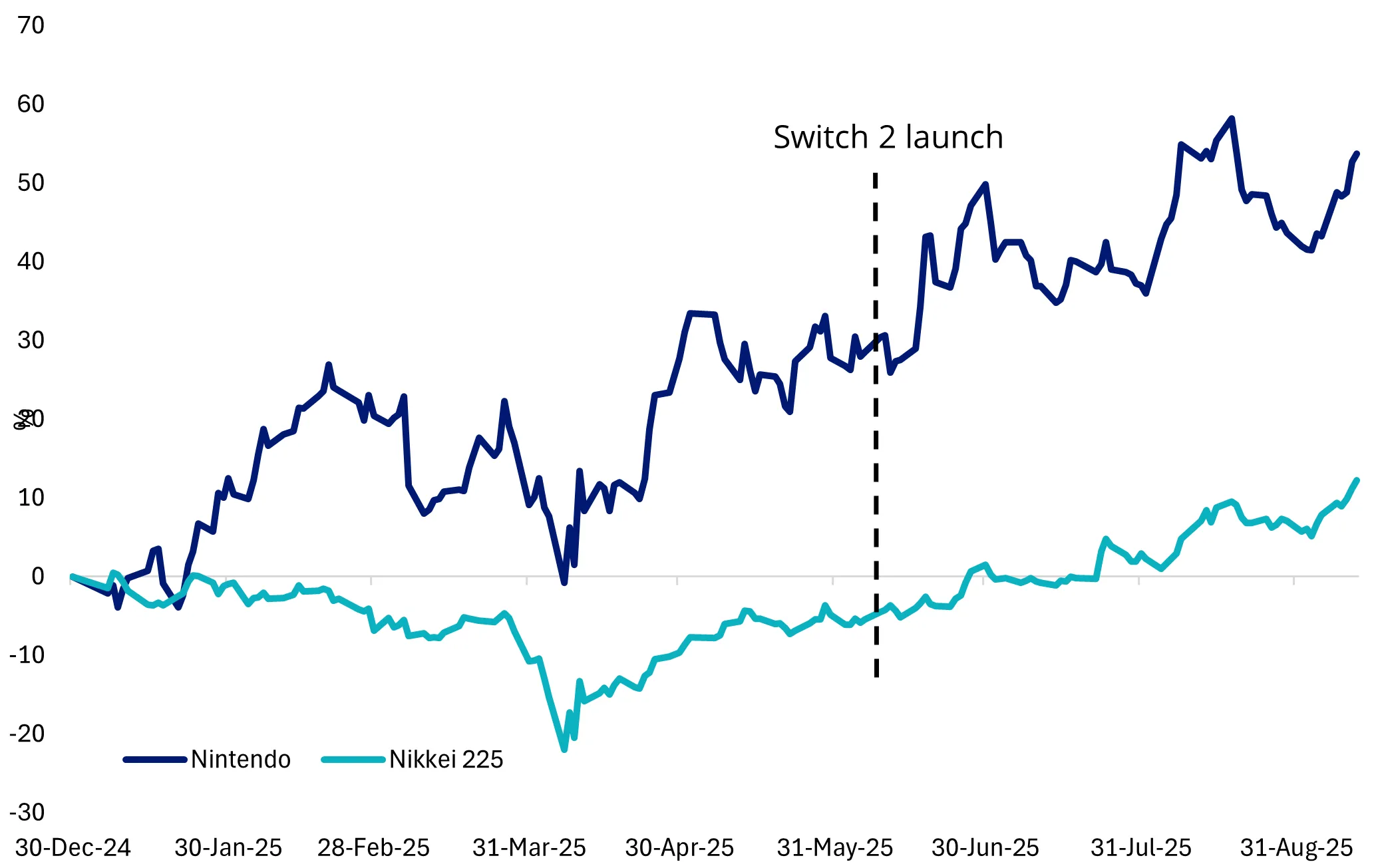

Nintendo released its much-anticipated Switch 2 console in June this year, eight years after the original Switch came out. Since the launch on 5 June 2025, Nintendo’s share price has risen by over 14.5% in AUD terms, outpacing Sony (7.7% in AUD). Market enthusiasm pushed the share price to an all time high in August, and the stock has outperformed the Nikkei 225 by a meaningful margin this year, highlighting the strength of its ecosystem.

Beyond recent console success, Nintendo has a strong record of timeless franchises such as Super Mario Bros and The Legend of Zelda. The company has also extended its IP to The Super Mario Bros. Movie and three Super Nintendo World theme park areas at Universal Studios, with more to come.

Chart 2: Nintendo’s YTD performance

Source: Bloomberg, as at 12 September 2025. Past performance is not indicative of future performance.

Tencent Holdings

We covered the game plan of this Chinese tech giant previously. In August, Tencent wrapped up its 2Q earnings with another all-round beat. By segment, its online games had the biggest YoY increase, with domestic games up 16.8% and international games up 35.3%, mainly driven by the longevity of games such as Honour of Kings and Valorant.

Tencent’s latest mobile game, Valorant Mobile, is generating a strong player base in China. Since its launch in August, the game has been ranked #1 in strategy game downloads in the Apple App Store. With new game launches both domestically and overseas, Tencent could hit 19% YoY growth in terms of online games revenue for 2025, according to Morgan Stanley estimates.

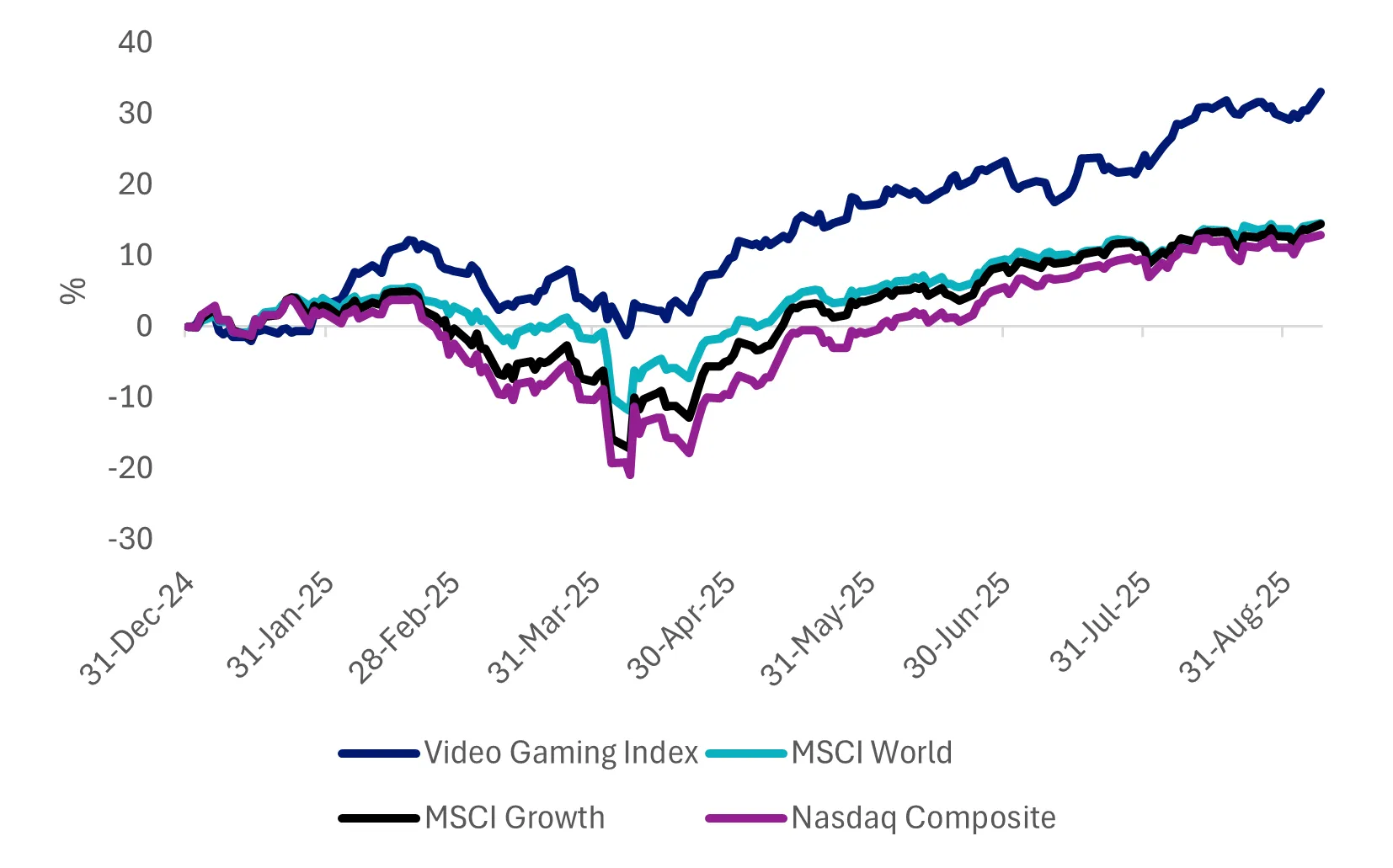

Video gaming and esports companies, as represented by the MVIS Global Video Gaming & eSports Index ("Video Gaming Index"), have outperformed MSCI World, MSCI Growth and the Nasdaq Composite by over 20% this year.

Chart 3: Video gaming and esports sector performance

Source: VanEck, Bloomberg, as at 8 September 2025. Video gaming index is MVIS Global Video Gaming & eSports index. You cannot invest in an index. The past performance of the ESPO index is not a guide to the future performance of VanEck Video Gaming and Esports ETF (ESPO).

The growing demand and use cases for generative AI have created new opportunities for investors, and we think video gaming and esports companies could be an alternative AI play, diversifying away from the tech giants such as the Mag 7. Some companies in the sector are the leaders or early adopters of chips/semiconductor technology, whereas game developers could benefit from faster content generation and bug detection. For the field of esports, AI coaching and post-match analysis tools could enhance player performance.

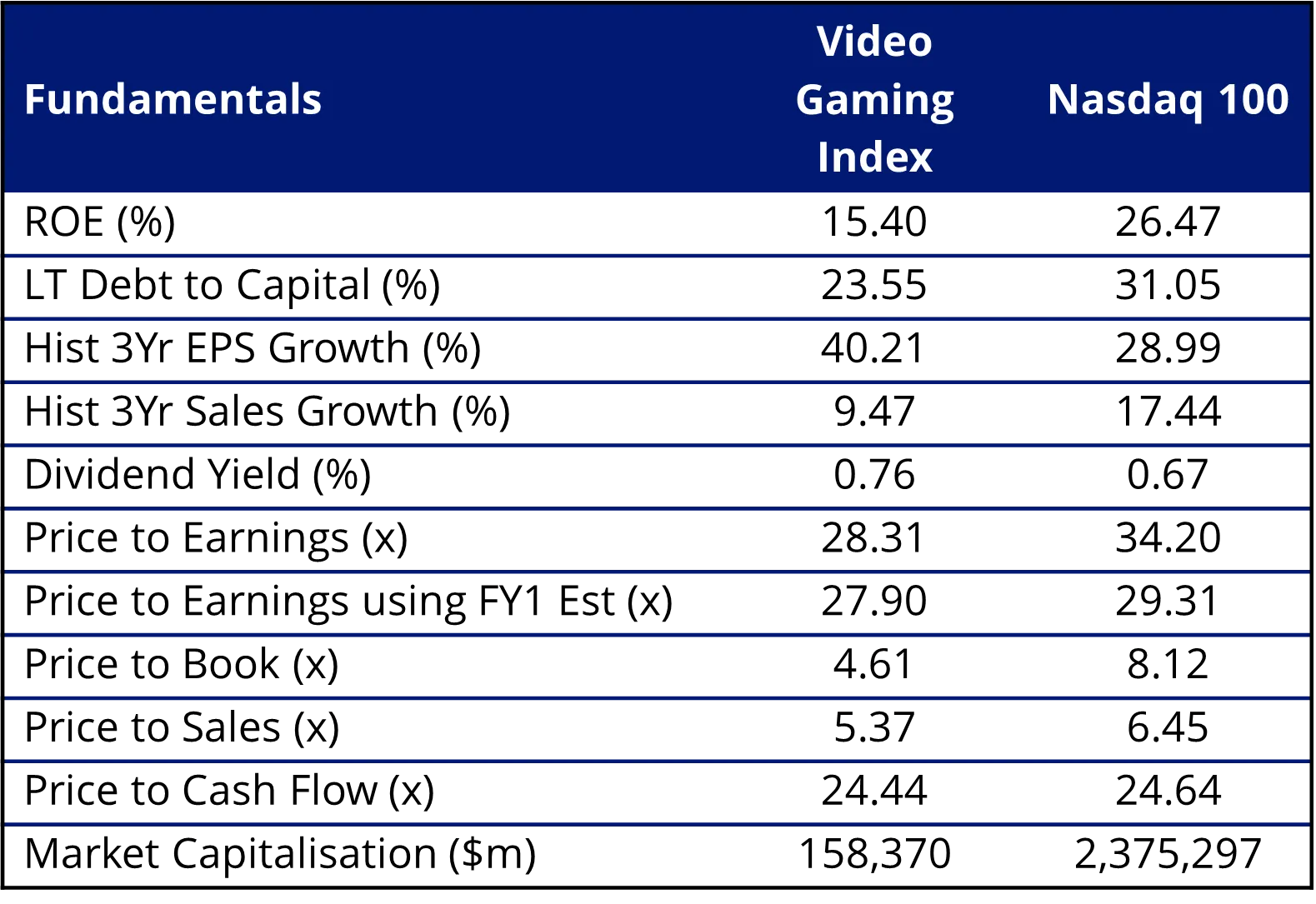

The fundamentals of the video gaming and esports sector look compelling relative to the Nasdaq 100. Despite stronger historical EPS growth, the sector trades at a lower valuation than the Nasdaq 100 and carries a lower debt to capital ratio.

Table 1: Video gaming index vs Nasdaq 100 fundamentals

Source: FactSet, as at 31 August 2025. Data is annualised. Video Gaming Index is MVIS Global Video Gaming & eSports index. Past performance is not a guide to future performance. You cannot invest in an index.

Accessing the global video gaming and esports sector

Investors who want to benefit from the growth of this thriving industry can consider the VanEck Video Gaming and Esports ETF (ESPO), which tracks the MVIS Global Video Gaming & eSports index. ESPO gives investors exposure to a diversified portfolio of the largest and most liquid companies involved in video game development, esports and related hardware and software globally.

Key risks

An investment in our video gaming and esports ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Video Gaming and Esports ETF PDS and TMD for more details.

ESPO is likely to be appropriate for a consumer who is seeking capital growth, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and a very high risk/return profile.

Published: 18 September 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

Any references to individual securities are provided for informational purposes only and do not constitute an offer, solicitation, or recommendation to buy or sell any security.