Hidden value stocks riding the AI growth wave

Frothy tech valuations at year-end bring us back to where we started in 2025. Here’s where to find value opportunities with AI exposure.

The global tech sector seems to be having a Groundhog Day moment. For those unfamiliar, Groundhog Day was a movie released in 1993. Actor Bill Murray played a self-centred meteorologist that inexplicably found himself reliving the same day over and over. This time loop repeated until he did everything the right way, ultimately becoming a better person in the process. After a turbulent year of shifting geopolitical dynamics and tariff-driven macro shake-ups, international equities at the tail end of 2025 are once again priced to perfection, just like they were at the beginning of the year.

One of the key drivers of equity market strength this year has been investors chasing the AI thematic, leading to valuations becoming more expensive. For some investors, the Magnificent 7 (Mag 7) tends to be the default AI exposure, however some tech stocks with more reasonable valuations have quietly outperformed the megacaps.

We have identified some of the ‘hidden gems’ in the richly priced rubble of international equities that are beneficiaries of the AI boom. These companies are not Johnny-come-latelies, having been in business longer than most of the Mag 7 (~50 years). This depth of experience is important when it comes to specialised hardware manufacturing, as it typically involves steep barriers to entry on account of the capex, R&D, supply chain and engineering complexity required. This hurdle is epitomised by market leader Nvidia. Prior to becoming the global AI superpower, it had been manufacturing gaming graphics cards for more than two decades – expertise that it leveraged when designing AI-optimised chipsets.

The companies below are also based in the US, which is an advantage given the close proximity to most of the world’s biggest hyperscalers and cloud service providers.

Micron Technology

Micron Technology is one of the hidden gems of the AI ecosystem. As one of the world’s largest long-time suppliers of high-bandwidth memory (HBM) products, it has recently emerged as one of the newest AI infrastructure power players.

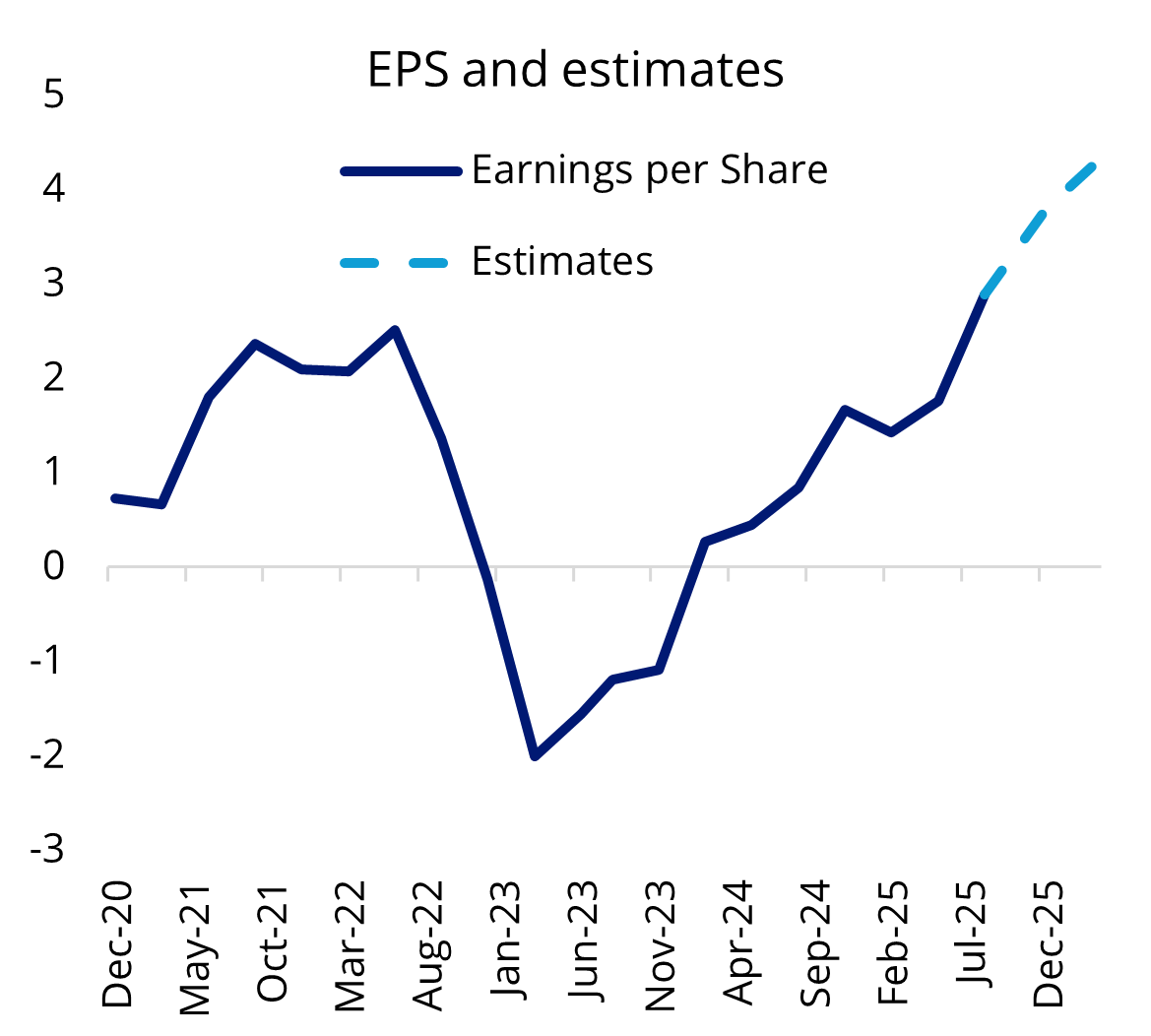

Micron announced record revenues at its latest earnings, with 46% year-over-year revenue growth to US$11.32 billion off the back of strong demand for its AI infrastructure products. Its Q1 26 guidance also indicated record revenue in the near-term due to multi-year AI demand and long-term high bandwidth memory agreements. On a 12-month forward price-to-earnings basis, it’s valued at ~13x, which represents a deep earnings gap relative to US tech peers.

Chart 1 & 2: Micron Technology performance & EPS (earnings per share) forecast

Source: Bloomberg. Data as at 18 November 2025. Performance in AUD. Past performance is not a reasonable indicator of future performance. Forecasts cannot be guaranteed. This is not a recommendation to act.

Western Digital

Another storage manufacturer benefiting from the AI boom is Western Digital. The US-based data storage manufacturer is one of the main suppliers of high-capacity hard disk drives to hyperscalers and cloud service providers, who need to store vast amounts of data generated and processed by AI and high-performance computing systems.

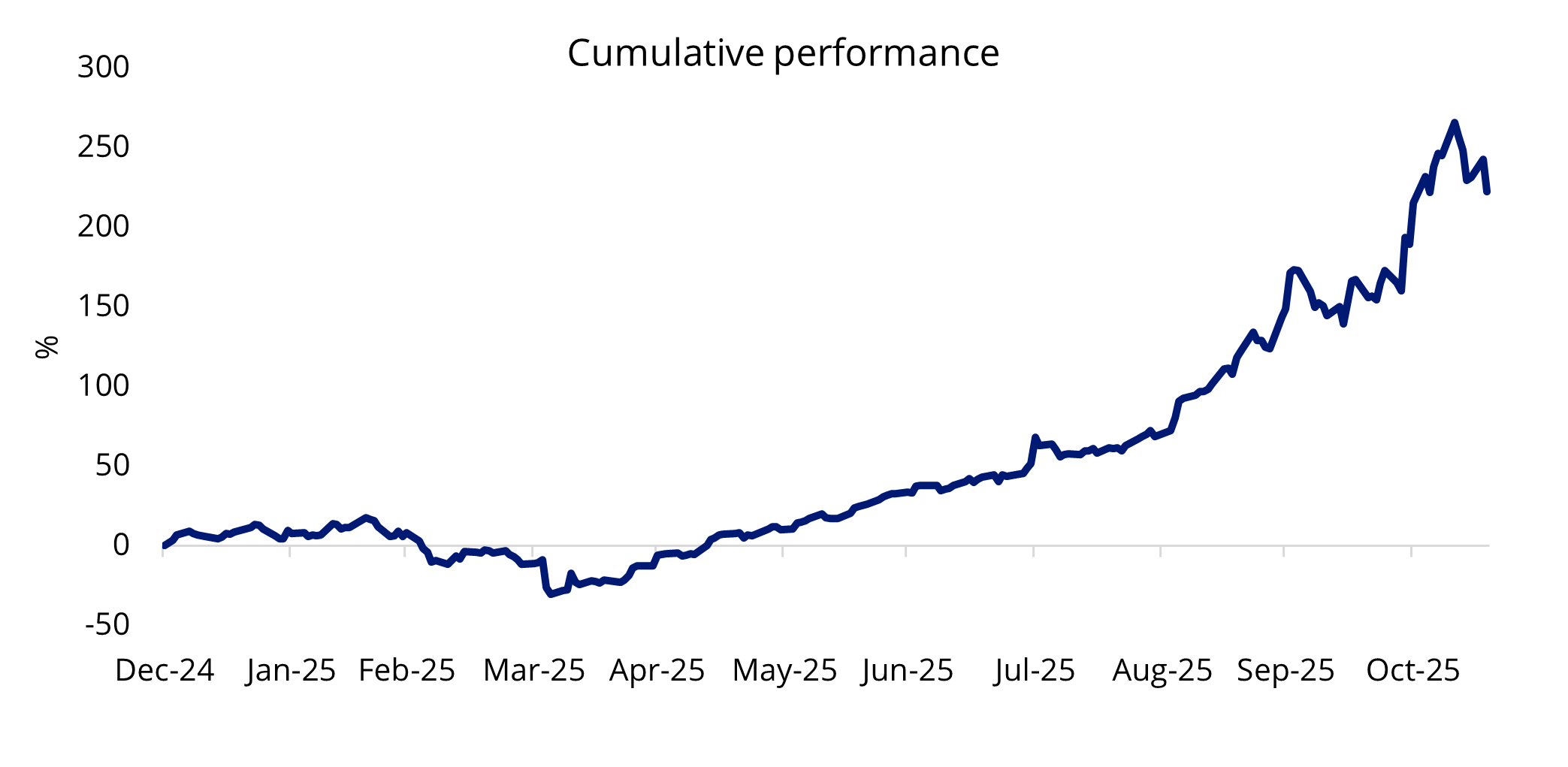

A major appetite for high-performance, scalable storage solutions has sent WDC’s price skyrocketing more than 200% in the year to date (as at 18 November 2025). Despite the strong demand, WDC’s valuations remain attractive relative to its earnings growth trajectory, and is currently priced at a 20.58x P/E ratio. Some analysts predict WDC’s earnings per share will increase by 48.3% in fiscal 2026 and a further 50.3% in 2027.

Chart 3: Western Digital cumulative performance

Source: Bloomberg. Data as at 18 November 2025. Performance in AUD. Past performance is not a reliable indicator of future performance. This is not a recommendation to act.

Cisco

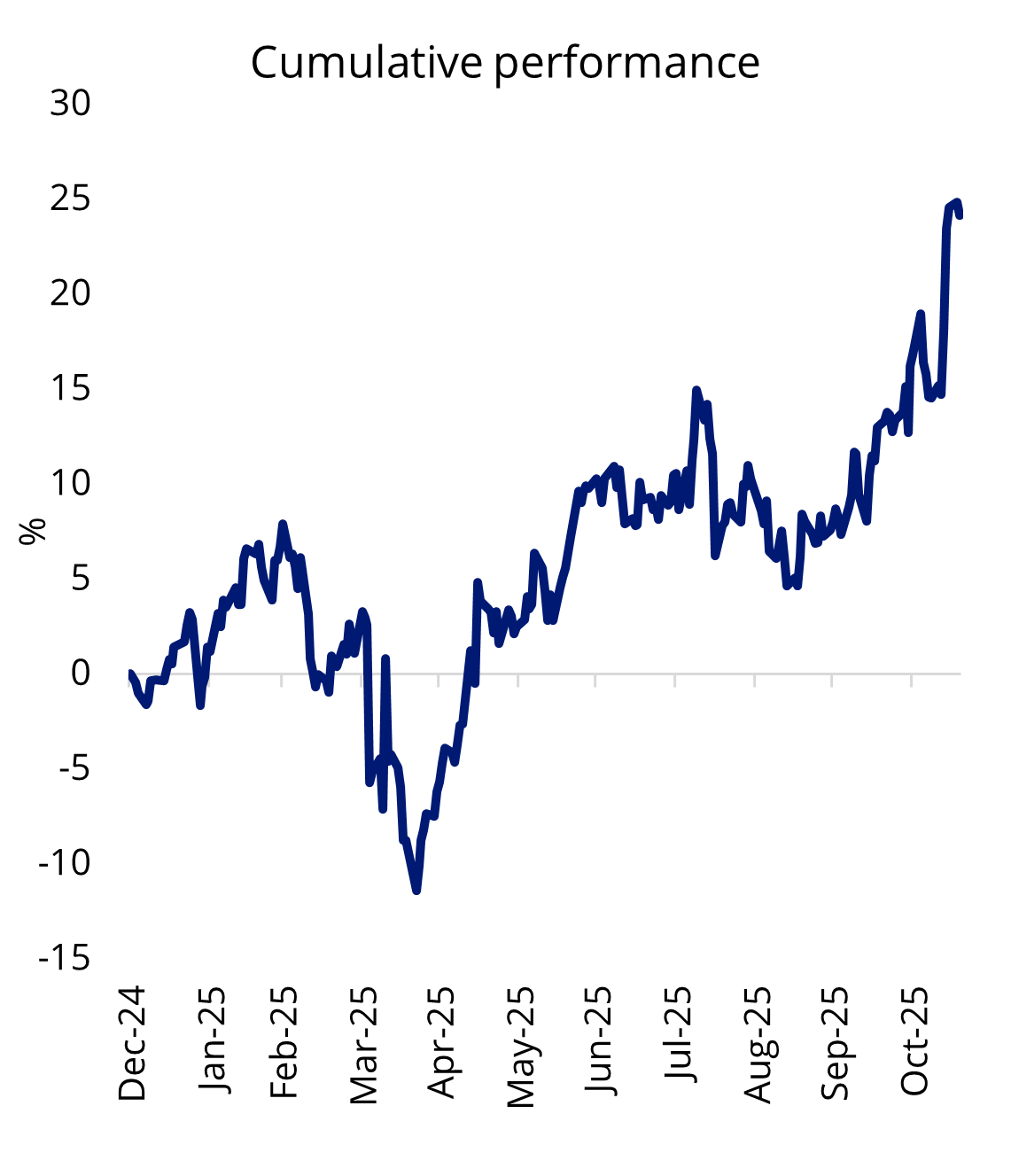

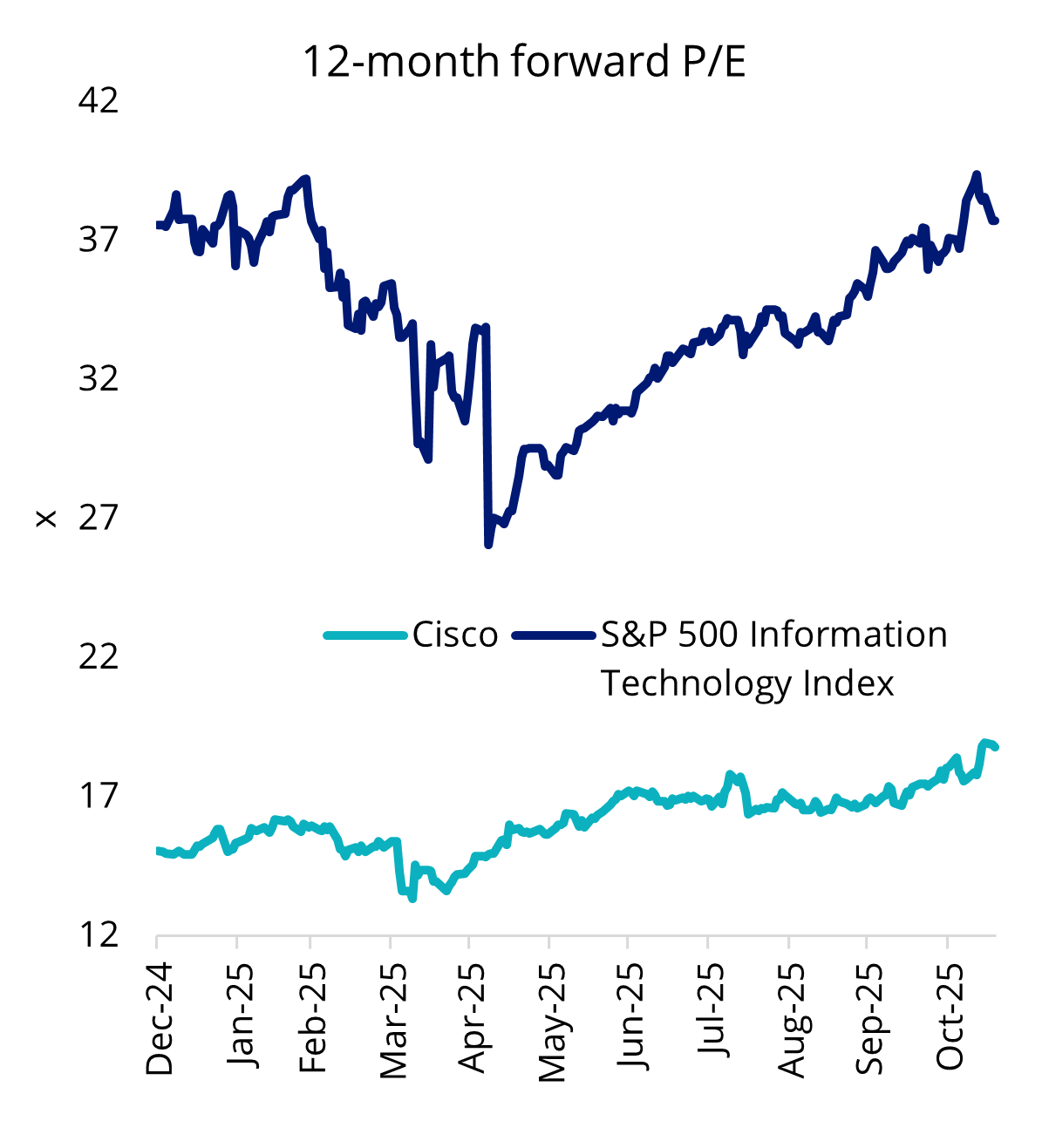

Last, but certainly not least, is Cisco, a brand some may recognise from wireless routers, modems, and other networking equipment. Over the last year, the US-based networking veteran has quietly reinvented itself as a strategic AI infrastructure provider, attracting billions of dollars from hyperscalers like Nvidia, Microsoft and Alibaba. During its last quarterly earnings update, Cisco announced it had secured US$1.3 billion worth of AI infrastructure orders, a healthy 62.5% increase from the previous quarter. As with the other two AI hardware suppliers, Cisco’s valuations are still relatively low, with a P/E ratio of 17x.

Chart 4 & 5: Cisco performance and 12-month forward P/E

Source: Bloomberg. Data as at 18 November 2025. Performance in AUD. Past performance is not a reliable indicator of future performance. This is not a recommendation to act.

Looking ahead

The risk for the Mag 7 lies in their AI monetisation timelines. Microsoft, Amazon, Google and Meta have spent hundreds of billions of dollars on of AI capex in a short period of time, and investors are fast losing patience – a sentiment felt by Meta during the most recent Q3 earnings season, costing it 9% off its share price. If investors don’t see evidence of this AI spending spree turning into revenue, we may see a valuation compression similar to the dot-com bubble. When the dot-com bubble burst in early 2000, overpriced stocks were hit the hardest, while value companies fared better.

Assuming this really was a ‘Groundhog Day’ event and we had to use a different playbook to the historical default strategy (i.e. doubling down on Mag 7 exposure), we think the key to breaking out of the valuations time loop is focusing on stocks that demonstrate ‘operational intelligence’, defined by strong operations and market penetration, healthy fundamentals with positive free cash flow, and reasonable valuations.

Value factor investing

Value opportunities aren’t confined to the tech sector. Investors who want broader exposure to international equities that exhibit ‘value’ characteristics (high value score relative to sector peers based on price to book value, price to forward earnings and enterprise value to cash flow from operations) may wish to consider the VanEck MSCI International Value ETF (VLUE). This value factor strategy gives investors a diversified portfolio of 250 international developed market large- and mid-cap companies, with high value scores as calculated by MSCI at each rebalance.

VLUE’s rules-based enhanced value approach offers an antidote to frothy, speculatively-valued AI stocks, delivering performance that’s far from artificial. VLUE represents a disciplined, data-driven, and targeted way to diversify away from concentrated U.S. tech risk and target the value factor.

VLUE has outperformed the MSCI World ex Australia Index by 6.76% for the 12 months ending 31 October 2025. Additionally, VLUE’s technology sector exposure is 29.4%, similar to MSCI World ex Australia Index, but it’s overweight Micron Technologies (+4%), Western Digital (+0.9%) and Cisco (+3.65%). VLUE’s exposure to Micron Technologies, Western Digital and Cisco constitutes 9.35% of the portfolio, compared to 0.72% of the MSCI World ex Australia Index.

HVLU is an Australian dollar hedged version of VLUE, enabling investors to manage their desired currency exposure.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging (HVLU), country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the relevant funds’ PDS and TMD for more details.

VLUE and HVLU are likely to be appropriate for a consumer who is seeking capital growth, is intending to use the product as a major, core, minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and has a high risk/return profile.

Published: 25 November 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.