An overlooked benefit

One of the most overlooked advantages of an exchange traded fund (ETF) is something we cannot avoid, taxes.

The old joke is that there are two things we cannot avoid, death and taxes. As humans, we do our best to avoid both. The rise of exchange traded funds (ETFs) has been well documented, but most people do not realise that ETFs have tax benefits.

Before the rise of ETFs, investors would complete forms, and buy and sell units in unlisted managed funds. Apart from the paperwork, non-transparency and daily pricing, one of the other disadvantages of unlisted managed funds is tax. In unlisted managed funds, your tax liability goes up when other investors desert the fund. ETFs, being listed on ASX, have a mechanism to mitigate this risk.

In unlisted managed funds, if an investor redeems from the fund, they leave behind their share of the tax liabilities on any capital gains that are realised. In an unlisted managed fund these tax liabilities will be attributed to the remaining investors. This does not happen in an ETF. Investors sell their units on the exchange to other investors, or the market maker. A market maker is someone whose job is to ensure there are units available for investors to buy or sell. The market maker may redeem their units in the ETF but the good news is that when they do, they take the CGT attached to that redemption with them. The ETF therefore protects investors from the impact of redemptions by other investors.

Those who have had a bad tax experience with an unlisted managed fund will understand.

This tax efficiency is often an overlooked benefit of investing ETFs. However, it is not the only tax consideration when investing in ETFs. An investor should also assess how their ETF issuer implements tax rules. It is important to avoid tax dinosaurs. I wrote about this recently here – Avoid tax time dinosaurs.

In summary, what you are looking to avoid are ETF issuers that are not using new tax rules to smooth the flow of income. A simple way to determine this is to go to the webpage of the ETF you are considering and locate the dividend history.

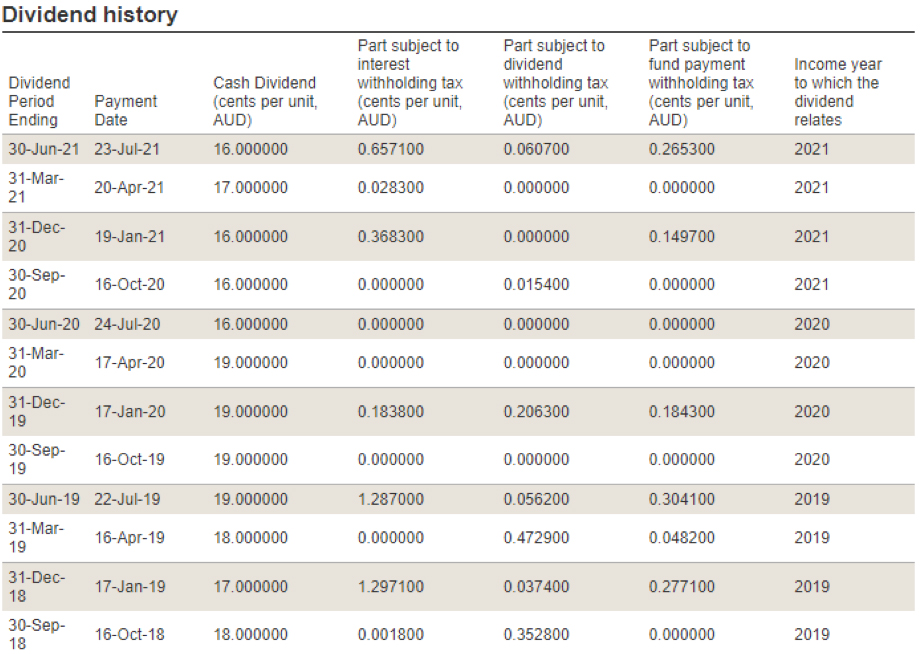

For illustrative purposes, below is the dividend history of the VanEck FTSE Global Infrastructure (Hedged) ETF over the past three years, which you can also find here - https://www.vaneck.com.au/etf/equity/ifra/dividends/

Source: vaneck.com.au, accessed here on 24 September 2021.

Infrastructure is an asset investors see as generating income. Investors investing in an infrastructure fund would like to see regular, stable income.

You can see from the above that there is not much variance between the regular, quarterly dividends. This is despite the last three years being volatile due to COVID.

If there are large, unexpected variances, or distribution periods without dividends, chances are that ETF issuer is a tax dinosaur.

So for those investors joining the ETF revolution, there are tax reasons to further rationalise your investment. ETFs are generally a tax efficient investment vehicle because they minimise exposure to CGT when other investors redeem. However, be aware there are differences between ETF issuers and how they implement tax laws. Always look out for dinosaurs.

Published: 24 September 2021

IMPORTANT NOTICE: Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs Before making an investment decision in relation to IFRA or any VanEck funds, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37.

No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance.

VanEck is the responsible entity and issuer of units in the VanEck ETFs traded on ASX. All investments carry some level of risk. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations.