Bank capital: The director’s cut

Up until now, ETF investors have only known short-duration, floating-rate subordinated bond ETFs. Now there is a new cut.

Although it has been more than 15 years, the fallout from the GFC and the subsequent learnings loom large over Australian banks and how they raise capital.

More recently, APRA changes to regulations and a new interest rate environment have created new considerations for banks. These have implications for investors. They are important to understand, as is the story behind them.

Sometimes in Hollywood, a film’s director will release a new version. It’s often called the Director’s Cut. These tend to include additional scenes left out of the original release. They have a longer duration.

Up until now, ETF investors have only known short-duration, floating-rate subordinated bond ETFs.

Now there is a new cut. It has a longer duration, but like some of Hollywood’s Director’s Cut, there could be additional rewards. But, like all epics, there is a bit of history.

Act 1 - the GFC

Way back in 2008, global markets experienced the failures and bailouts of many large financial institutions, which were previously considered “too big to fail”. Lehman Brothers filed for bankruptcy on 15 September 2008. Merrill Lynch, AIG, HBOS, and Royal Bank of Scotland were among the financial institutions that teetered on the brink of failure until the US Fed and other central banks around the world bailed them out. Governments also had to step in to rescue financial institutions and prevent a potential “breakdown in law and order”[1].

In response to the fallout from the GFC, the Bank of International Settlements’ Basel Committee sought to redraft its universal standards. The new standards would ensure banks around the world could withstand unforeseen losses, unexpected withdrawals and reduce the likelihood that taxpayers would be forced to bail out large institutions again. Basel III, as it was known, was published in 2009, with an implementation deadline of 2019.

Basel III led to the concept of Total Loss Absorbing Capital (TLAC). TLAC is an additional layer of bonds that convert into equity capital once an institution’s debt capital reserves are depleted.

While each country drafted their own rules relating to Basel III and TLAC, Australia’s regulators carefully considered the specifics that would be applied here.

With the implementation deadline approaching, following a period of consultation, APRA decided that the major banks would need to significantly increase the minimum loss-absorbing capital they hold in July 2019. The intention was to boost their TLAC and minimise the risk of a systemically important bank failing and requiring Australian taxpayer money to support a bailout.

Act 2 - a new rising fixed income asset class

Up until 2019, Australia’s financial institutions had issued only modest amounts of what is called ‘Tier 2 Capital’, also known as ‘subordinated debt’. This is a particular category of debt securities that financial institutions can issue to raise total loss-absorbing capital.

APRA’s 2019 regulations required the major banks to more than double the amount of Tier 2 Capital they held.

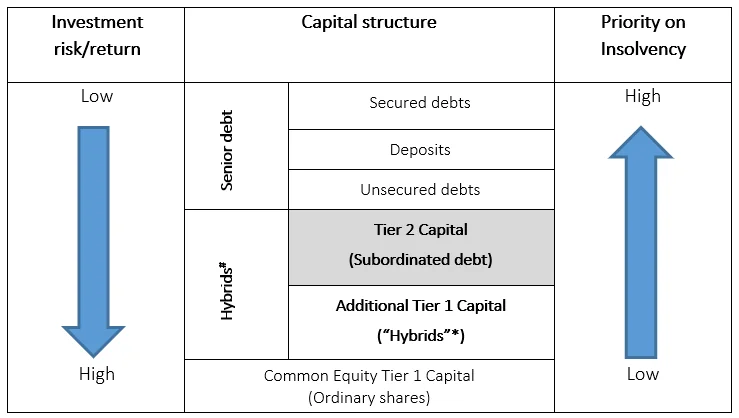

The following chart provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by financial institutions rank in priority of payment in the event of insolvency.

Chart 1. Simplified capital structure of a financial institution

#Per ASIC Report 365. *Per market convention.

Subordinated debt has many similar characteristics with traditional bonds, however, to facilitate loss absorption, in times of financial stress, it can be converted into shares or written off completely. It is called ‘subordinated’ because it sits below ‘senior debt’ or traditional bonds in the capital structure, but it also sits above and takes priority over ordinary shares, in the event of insolvency. See the shaded area in the chart above.

Like traditional bonds, while the issuing financial institution is operating efficiently without financial stress, interest payments are made throughout the term of a subordinated bond and capital is repaid at maturity. Subordinated bonds are typically issued for 10 to 15 years. Also, to date in Australia, they have always been called early, 5 years from maturity, as the bonds start losing regulatory value at the 5-year mark.

The chart also shows that the highest priority, in the event of insolvency, is given to deposits and other senior debt. Shareholders get paid last, if at all.

For this reason, subordinated bonds carry more risk than deposits and traditional bonds but are considered less risky than shares and other hybrids2. As a result, financial institutions typically offer subordinated bonds with a higher interest rate than traditional bonds, but a lower interest rate than hybrids.

Act 3 - Two recent major adjustments

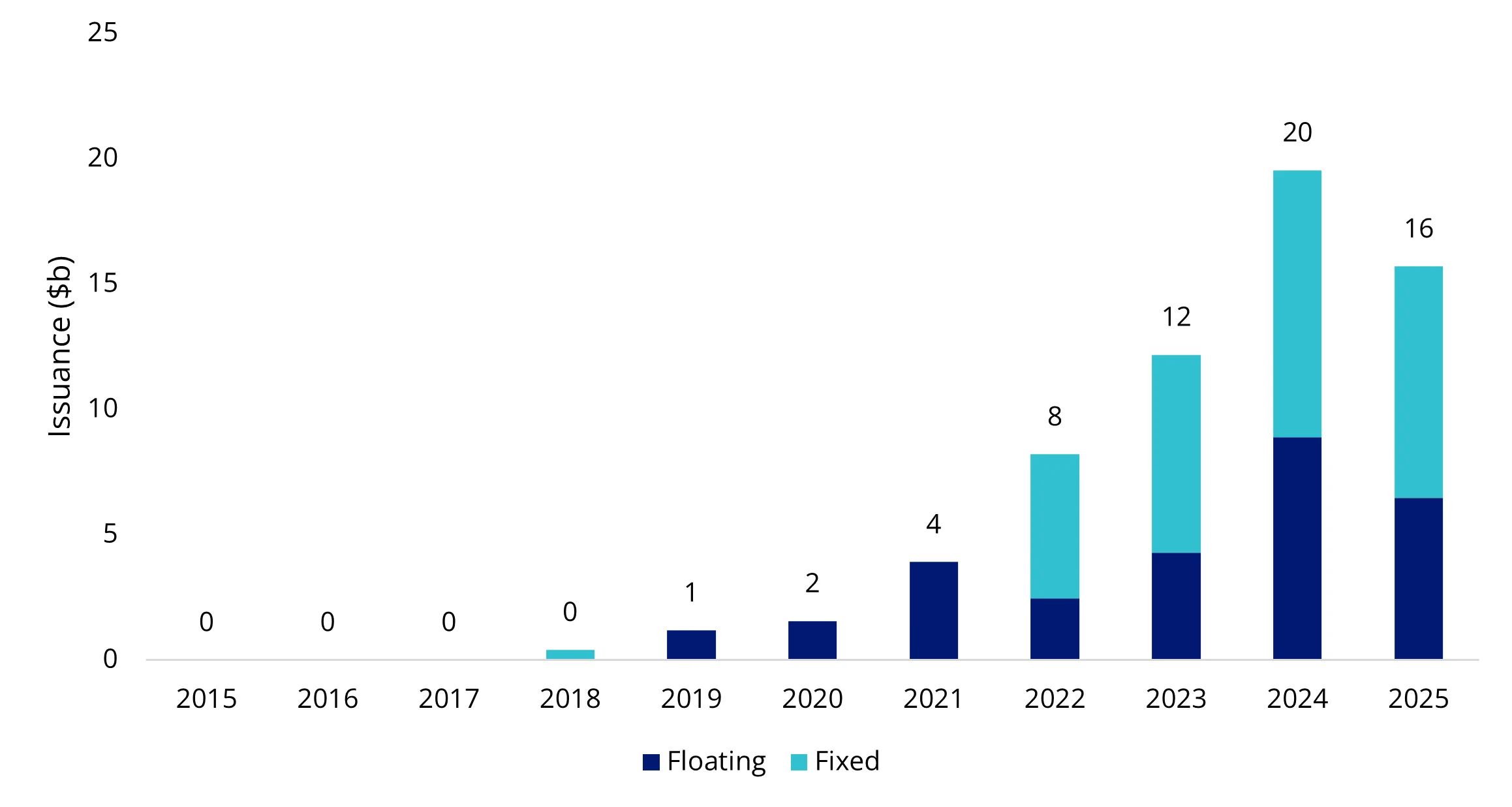

In the interest rate environment of 2019, most subordinated debt issuance was floating. As a result, the market index, the iBoxx AUD Investment Grade Subordinated Debt Mid Price Index (SUBD Index), only included floating-rate notes. However, as the interest rate environment changed and rates rose, investors started to demand higher rates. This prompted Australia’s big four banks to begin issuing fixed-rate subordinated debt in 2022. Since then, it has become common for banks to issue both fixed and floating-rate instruments, as shown in the chart below.

Figure 2: AUD Subordinated Debt Issuance by Calendar Year

Source: Bloomberg. As at 21 November 2025.

While the Australian market was dealing with this adjustment, another plot was brewing.

In 2012, ASIC warned of the risks of hybrids (Tier 1 capital in figure 1). They noted that any additional restriction on their ownership imposed by regulators would be consistent with global peers, such as the UK, which banned hybrids for retail investors in 2014.

The collapse of Switzerland’s Credit Suisse in March 2023 highlighted the potential risks of hybrids. At the time, investors and regulators alike were on tenterhooks following the collapse of US regional banks Silicon Valley Bank and Signature Bank. There was a palpable fear of contagion throughout the entire global financial system, with the memories of the GFC still lingering. As a result, when Credit Suisse announced a weakness in its financial reporting controls and delayed the release of its annual report, the market and regulators moved with haste.

The Swiss banking regulator, in response to a falling share price, increasing withdrawals and a loss of confidence, forced the merger of Credit Suisse and UBS, with favourable terms for UBS. As a part of the merger all of Credit Suisse’s additional Tier 1 (AT1) capital was written down to zero (about CHF16 billion).

APRA considered its local market and observed that, unlike in Switzerland, Australian hybrids are predominantly held by retail investors.

After a period of consultation, APRA proposed to phase out AT1 (hybrids) as a component of bank capital. For large banks, the existing 1.5% AT1 requirement would be replaced by 1.25% Tier 2 capital and 0.25% Common Equity Tier 1 (CET1) capital. Smaller banks would replace AT1 entirely with Tier 2 capital.

The implementation of this change would begin in January 2027 and continue until 2032. During this period, upcoming AT1 calls would be refinanced with Tier 2 capital as they mature. At the time, given the current Tier 2 requirement of 6.5%, the additional 1.25% would represent approximately a 20% increase in the size of the Tier 2 market by the end of the phase-out period.

These two adjustments, a growing Tier 2 market because of regulatory changes, and a changing composition of subordinated debt issuance, we think, create an opportunity for investors.

Act 4 - The opportunity

In 2019, VanEck launched the VanEck Australian Subordinated Debt ETF (ASX: SUBD). SUBD tracks the SUBD Index, and it has become the largest subordinated debt ETF in the country. As noted above, the index SUBD tracks includes only floating-rate subordinated bonds.

This week, we will launch the VanEck Australian Fixed Rate Subordinated Debt ETF (FSUB). FSUB will track the iBoxx AUD Fixed Investment Grade Subordinated Debt Mid Price Index (FSUB Index), which includes only fixed-rate subordinated bonds.

Both funds allow investors access to this growing market.

Act 5 - closure

In Hollywood stories that follow the five-act structure, Act 5 is when everything gets resolved.

Soon investors will have the ability to invest in both floating-rate and fixed-rate subordinated bonds to achieve their portfolio goals. One of the key differences between floating and fixed-rate bonds is their sensitivity to changes in interest rates (modified duration). We have written about this in the past here and here.

Or perhaps we could write a sequel. That would be very Hollywood.

An investment in our Australian Subordinated Debt ETFs carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS and TMD for more details.

FSUB is likely to be appropriate for a consumer who is seeking a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 3 years, and has a medium risk/return profile.

SUBD is likely to be appropriate for a consumer who is seeking capital preservation and a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 3 years, and has a medium risk/return profile.

Sources:

1In 2018, Alistair Darling, who was the U.K.'s Chancellor of the Exchequer at the time, spoke out and stated that Britain came within hours of "a breakdown of law and order" the day that RBS was bailed-out.

2Please note: Although the term “hybrid” is used by ASIC to refer to both Tier 2 Capital and Additional Tier 1 Capital, this term tends to be used in the market (by advisers and the media) to describe only Additional Tier 1 Capital securities or ‘capital notes’. In this document, the word “hybrid” refers to Additional Tier 1 Capital securities or capital notes and “subordinated bonds” or “bonds” refers to Tier 2 Capital or subordinated debt.

3A reference to APRA in this context includes any equivalent foreign prudential regulatory body.

Published: 05 December 2025

IMPORTANT NOTICE:

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable product disclosure statement (PDS) and target market determination (TMD) available at vaneck.com.au for more details. Investment returns and capital are not guaranteed.

The iBoxx AUD Investment Grade Subordinated Debt Mid Price Index (“SUBD Index”) and iBoxx AUD Fixed Investment Grade Subordinated Debt Mid Price Index (“FSUB Index”) are products of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and licensed for use by VanEck. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); ASX® is a trademark of ASX Operations Pty Limited and these trademarks have been licensed for use by SPDJI and sublicensed by VanEck. SUBD and FSUB are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, ASX or their respective affiliates and none of them makes any representation regarding the advisability of investing in the Fund. Such parties do not accept liability for any errors, omissions, or interruptions of the Index and do not give any assurance that the Fund will accurately track the performance of the index or provide positive investment returns. Inclusion of a security within the index or Fund is not a recommendation by any party to buy, sell, or hold such security. Read the PDS for the full index disclaimer.