Central Banks, rates and elections

During George Washington’s first term, a battle of words captivated the public as a series of back-and-forth essays (longer than today’s social media posts) appeared in the press about executive power, debt and the central bank. The ‘trolling’ included personal barbs between Hamilton and future President Thomas Jefferson. When in power, Jefferson didn’t force the closure of Hamilton’s First Bank of America; that was President Madison.

The current incarnation of the US Federal Reserve System emerged before World War One after the ‘Panic of 1907’. Since then, it has been a key player during periods of economic and political turbulence. And could be a focus in this US election year. The last election followed the 2020 COVID crisis and lockdowns that had investors and central bankers on edge. In response to that crisis, central banks loosened monetary policy. This time slowing growth may force central banks to loosen again. Central bankers have played different playbooks throughout history – but the lesson for investors confronting any economic or election cycle is simple.

In our recent ViewPoints, we said in 2024, “for investors, rates and inflation will remain where they generally belong, front and centre.”

No one knows what is going to happen in this US Presidential election year. Will inflation return or have the US Federal Reserve and Australia’s RBA successfully navigated a soft landing?

The market seems to indicate a soft landing (a soft landing is when no recession follows a cycle of rate hikes and they are rare, and a hard landing is when a recession follows a rate hiking cycle) is likely.

Throughout history, share markets have been good at pricing in demand trends, earnings expectations, technology innovations and many other things. However, one thing markets have great difficulty putting a price on is uncertainty.

It was US stock market barons, primarily from the banking sector, who warned of a looming crisis in the early 1900s as the US operated without a central bank. Notably, future Federal Reserve Board member, Paul Warburg wrote the prescient “A Plan for a Modified Central Bank” published in the New York Times in early 1907.

In October the “Panic of 1907” hit. The fallout and proposed initiatives became an issue of the 1908 US election, won by Republican William Taft over Democrat William Bryan. Eventually, however, it was up to, Woodrow Wilson’s government, which won in 1912, to finalise and pass The Federal Reserve Act with bipartisan support. The enactment of the Act established the US Federal Reserve (The Fed).

Before the most recent US election, in 2020, The Fed was in action as the threat of COVID-19 and subsequent lockdowns hit. Stock market falls were extreme and fast. Central banks reacted. So did many investors.

2020 is a good recent lesson for investors, as we think was 2023.

It is understandable that investors get spooked and flee the market when markets fall. However, this can result in losses and prevent investors from reaping the rewards when the market rebounds. 2020 provided a textbook lesson. Investors who remained fully invested were rewarded.

Likewise, at the end of 2022, many pundits predicted that economies would grind to a halt in the face of the fastest and highest interest rate rises in over four decades. Understandably, many investors altered their approach, but again, trying to time the market prevented investors from reaping the rewards of the unanticipated AI boom in 2023.

We think most investors understand the importance of remaining invested during the down times and, most importantly, through the rebounds. No chart of a share market’s return is a straight line, the slope may be up, but it often has many peaks and troughs, resembling rocky cliffs. The difficulty for investors is finding those strategies that outperform ‘through the cycle’.

We think this is why ‘factor’ investing is becoming popular. MSCI has illustrated how its factors such as Quality and Enhanced Value outperformed the market capitalisation benchmarks through the cycle. ETFs allow investors to invest in strategies that target these factors and savvy investors have been using them to invest for the long term, with the intent of achieving long-term outperformance with lower costs.

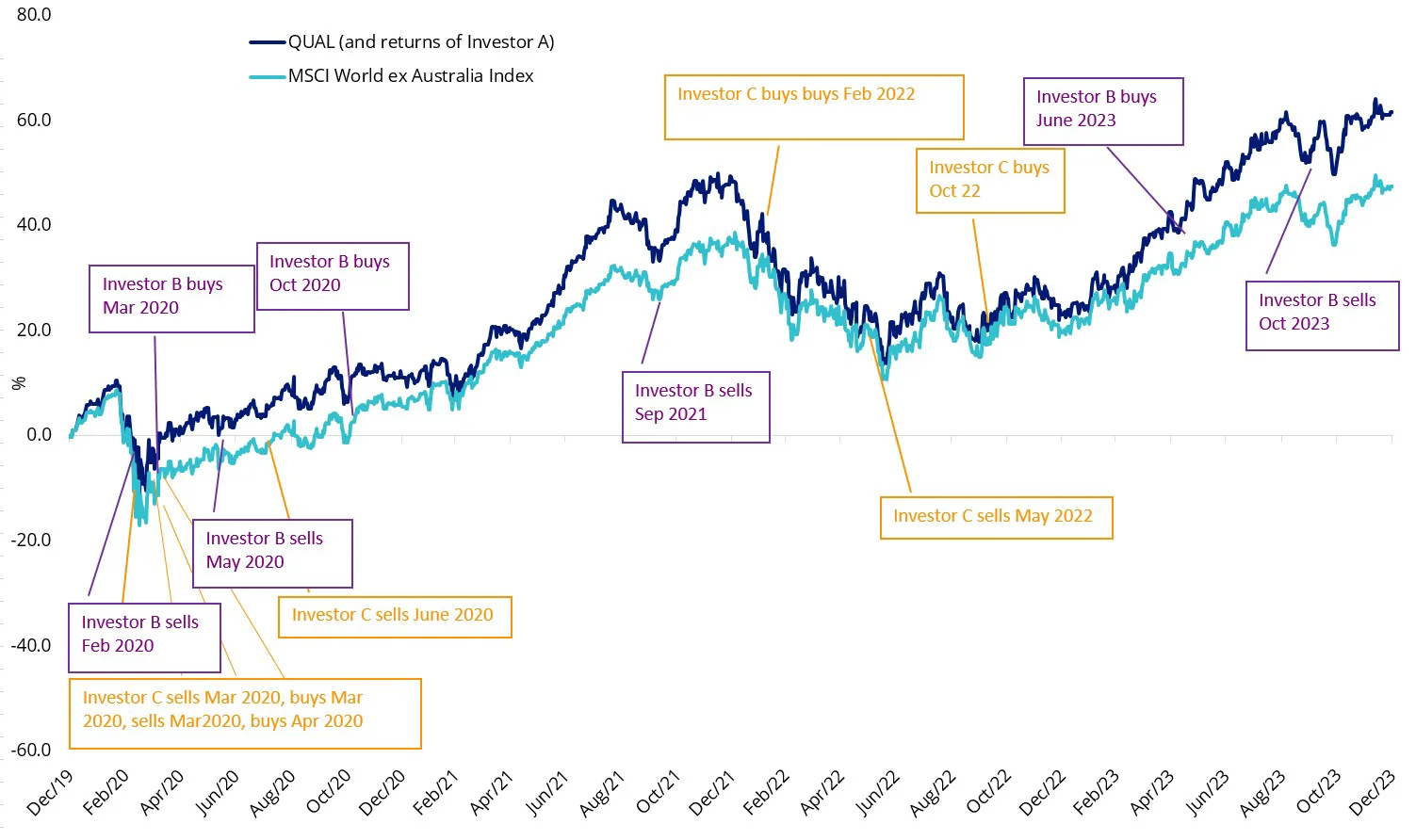

2020/21 and 2022/23 provide extreme examples of the importance of remaining invested. Let’s look at a range of hypothetical scenarios where three different investors have $1,000 at the start of 2020 in the VanEck MSCI International Quality ETF (QUAL). The chart below shows the returns of QUAL through these four years with the trading activity of three types of investors.

This is for illustrative purposes only. This is not indicative of future performance.

Chart 1: Comparative performance: QUAL and MSCI World ex Australia Index: 1 Jan 2020 to 31 Dec 2023

Source: Morningstar Direct, VanEck. The chart above shows past performance of QUAL and of the MSCI World ex Australia Index over the period 1 Jan 2020 to 31 December 2023 to reflect a recent relevant volatile period: QUAL's full performance history can be found here. You cannot invest directly in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. QUAL results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Past performance is not a reliable indicator of future performance. The MSCI World ex Australia Index (“MSCI World ex Aus”) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market large- and mid-cap companies, weighted by market capitalisation. QUAL’s index measures the performance of 300 companies selected from MSCI World ex Aus based on MSCI quality scores, weighted by market cap x quality score at rebalance. Consequently, QUAL’s index has fewer companies and different country and industry allocations than MSCI World ex Aus.

In January 2020 COVID-19 had barely spread beyond Wuhan. Markets were rising. Then markets panicked.

- Investor A had the discipline to stay in QUAL throughout the volatility of 2020 and then throughout the interest rate-rising cycle that started in 2022 and she stayed invested all through 2023 despite the doomsayers’ warnings about potential substandard returns. At the end of 2023, she had $1,615, a return of 12.80% p.a.

- Investor B is easily spooked. He sold immediately after the share market fall in February 2020. He then re-entered the market one month later, but true to form he sold at the next sign of volatility in May. The rises and falls in June through to November spooked him, but he captured November and December’s positive months, buying during a dip in October 2020. Riding those returns through 2021 he sold out in September 2021 as fears about inflation and rate rises started to surface. He stayed out of the market right through the choppy 2022 and was happy to stay out of the market at the start of 2023 because many financial industry professionals were saying that 2023 would be a poor year for share markets. By June 2023 he was ready to go back in again before selling out in October with gains. He’s still out of the market but was happy because he did capture much of the second half of 2023’s share market rise. In all, Investor B executed seven trades over three years. Investor B had $1,400 at the end of 2023, a return of 8.77% p.a. excluding the costs of trading.

- Investor C tried to time the market. She sold out in February. She vowed to enter again following a daily market rise greater than 3%, and exited based on falls of the same size, a rule she has had in place over the past four years. She finished 2023 with $1,250, a 5.74% p.a. return, excluding the costs of trading.

It is worthwhile noting both investors B and C avoided the depths of the falls in 2020 and 2022 but this did not help them over the four years had they remained invested.

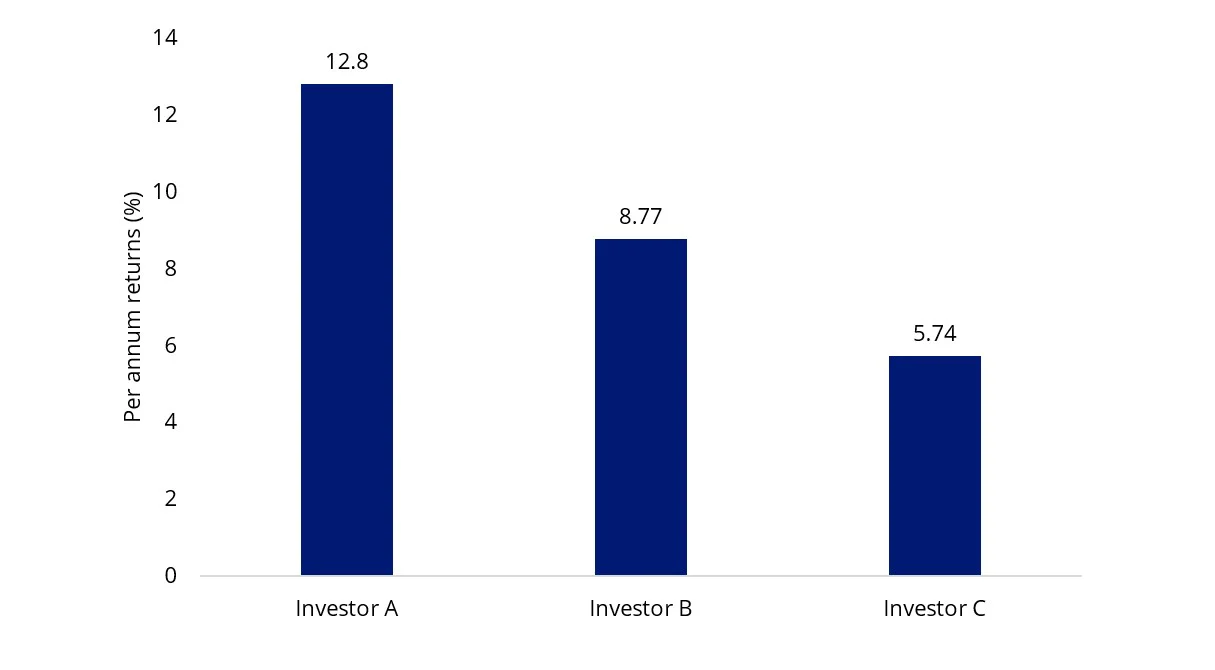

Chart 2: The importance of remaining invested throughout volatility during 2020 to 2023

Source: Morningstar Direct, VanEck. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. QUAL results are net of management fees but do not include brokerage costs of investing in QUAL. Past performance is not a reliable indicator of future performance.

This shows that if you try to time the market and get it wrong you would be significantly worse off than if you stayed invested for the duration. The probability of correctly timing the market is low.

With so many unknowns in politics and the economy as we enter 2024, we think, investing is about “time in the market, not timing the market.”

In our recent ViewPoints we suggest, “The investment playbook is to approach risk assets selectively. A good start is to focus on leverage i.e., balance sheets and cash flow… Navigating equities smarter through factor strategies such as ‘quality’ and ‘low-size’ becomes more meaningful.”

We wish we had a crystal ball, but the only thing investors can rely on is uncertainty and we think 2024 will be no different.

As always, we recommend you speak to a financial adviser or stock broker about any of the strategies mentioned above.

Key risks: An investment in the ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 15 January 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.