This cloud has a golden lining

For many years countries tied their currency to the amount of gold they physically held. This was called the gold standard. While gold is no longer used this way it continues to be among the most traded asset classes in the world. Recently the gold price has shot up.

The rise in the price of gold has been in response to the unprecedented intervention by central banks during the COVID-19 crisis and concerns over the impact of these interventions. While most asset classes have struggled in 2020, the shiny metal has been one of the few winners. One of the beneficiaries of a rising gold price is its miners. We believe that gold’s 2020 winning streak will continue, and its miners will flourish.

In addition to its rarity, gold has always been revered. It is easy to identify because of its colour and density. Unlike other metals it does not tarnish. Gold also gave rise to the concept of currency and it fits the three generally accepted conditions of money:

- Medium of exchange

- Unit of account

- Store of value.

Gold has a history of holding its value in times of financial or political uncertainty when the values of other assets fall. Gold mining companies hold vast resources of gold locked in the ground that only they have the technology and skills to extract and bring to market.

For investors who don’t already have gold bullion or gold miners in their portfolio, there are reasons to consider adding it now. The world’s most renowned investors are buying these assets. On Monday, the Financial Times stated, “some of the world’s largest hedge funds are raising their bets on gold, forecasting that central banks’ unprecedented responses to the coronavirus crisis will lead to devaluations of major currencies.”

Since the beginning of the year the gold price has risen 22.47%, while the VanEck Vectors Gold Miners ETF, representing the largest and most liquid gold miners around the world, has risen 25.87% (to 13 May 2020).

The economic environment

The reason this gold bull market is likely to continue is the economic environment, including:

- Deflation and looming systemic financial risks

- Government debt levels

- Negative ‘real rates’.

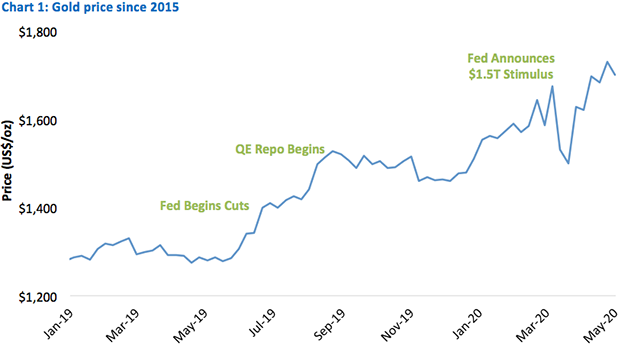

The price of gold had been steadily increasing in 2019 fuelled by the change in US central bank policy and declining interest rates. Since the beginning of March 2020, after an initial decline, gold rallied due to the unprecedented government and central bank intervention and concerns about the aftermath of the COVID-19 crisis.

Source: Bloomberg, VanEck. Data as of April 2020.

Looming risk - deflation

Debt is a problem in a deflationary environment and the COVID-19 pandemic is a deflationary shock of the highest order. Demand for almost everything collapsed overnight as most of the world went into lock-down. We are headed for a global recession and its likely deflationary pressures will last for some time.

While lock-downs are slowly lifted investment and consumption patterns will continue to be cautious, so long as the threat of new virus outbreaks remains. The record depression-level unemployment figures also suggest a long recession.

Government debt

Policy makers have scrambled to stimulate the economy as best they can and protect jobs by pushing debt to historic levels. In the US, Goldman Sachs forecasts the US budget deficit will reach US$3.6 trillion this fiscal year and US$2.4 trillion in 2021. This is on top of US$17.9 trillion worth of existing debt, which now exceeds 100% of GDP. Based on these figures, it appears unlikely that the US government will ever pay back the money it owes. At zero interest rates, money is free and debt keeps piling up.

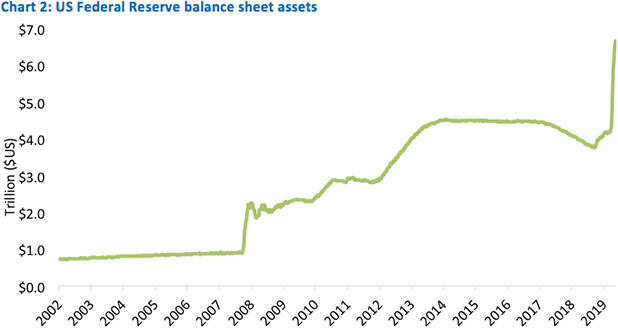

Central banks must help fund this debt increase. Since the end of February, the Fed’s balance sheet has already grown by 60% and is on track to more than double by the end of the year. Even our own Reserve Bank of Australia, which avoided unorthodox quantitative easing measures in the aftermath of the GFC has allowed its balance sheet to increase by 43%.

Source: Federal Reserve of St. Louis, VanEck. Data as of April 2020.

The question of whether or not this is sustainable over the long run is yet to be determined. Hopefully US government debt eventually gets pared down in a cycle of inflation. But inflation seems a far-off goal, especially as central banks did all they could after the GFC to push wage growth higher and it barely moved.

Real rates are negative

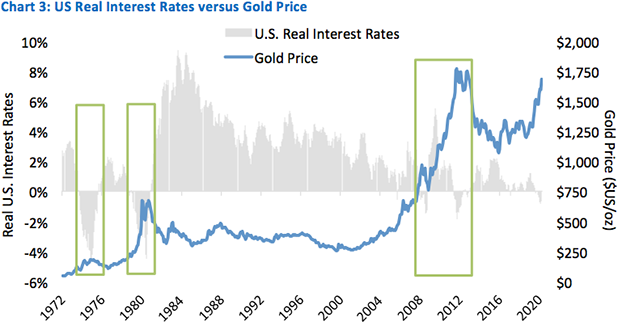

The possibility, then, for a potentially longer-than-anticipated recovery means gold is an attractive investment option. In the past, gold prices have reacted strongly to negative real interest rates in the US. In the chart below the grey area represents US real interest rates. You can see in the past when real interest rates have been negative that the gold price, the blue line, has increased.

Source: CIBC, Federal Reserve of St. Louis, VanEck. Data as of April 2020

Gold equities rather than bullion

Investing in the shares of gold mining companies exposes investors to the fluctuations of the gold price as it directly affects the profitability of those companies. As a shareholder in the gold mining business the investor also shares in the profit made when gold is extracted from the ground for less than its market price.

As gold shares can pay dividends, gold equities provide income whereas an investment in bullion incurs storage and insurance costs. Already we have seen gold miners buck the trend of firms cutting or reducing dividends. Yamana Gold increased its dividend by 25%, Newmont by 79%, and Kirkland Lake by 100%.* All three companies have temporarily suspended production at some of their mines due to the lockdowns. These companies exemplify the financial strength and earnings power of the gold industry.

Like many companies in the resources sector, management in gold mining companies have been focused on cost reductions and operational efficiency. Improvements in operations will lead miners to outperform bullion. The operating costs per ounce of gold produced are falling and management’s overall focus on cost discipline is paying off as cash flow generation increases. Further, gold miners should get a boost from lower energy prices and weaker local currencies.

For investors, maybe this cloud has a golden lining

*Source: Company Reports. As of April 30, 2020, these positions represented approximately 1.80%, 15.73% and 4.29% of GDX’s net assets, respectively. This is not a recommendation to buy or sell any security.

All performance is sourced from Morningstar Direct and in Australian dollars unless otherwise noted.

IMPORTANT NOTICE:

Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of units in the VanEck Vectors ETFs traded on ASX. This is general information only about financial products and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevant PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. PDSs are available at www.vaneck.com.au or by calling 1300 68 38 37. All investments carry some level of risk. Investing in international markets has specific risks that are in addition to the typical risks associated with investing in the Australian market. These include currency/foreign exchange fluctuations, ASX trading time differences and changes in foreign regulatory and tax regulations. See the PDS for details.

No member of VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return of any VanEck funds. Past performance is not a reliable indicator of future performance.

© 2020 Van Eck Associates Corporation. All rights reserved.

Related Insights

Published: 15 May 2020