Factor investing for international equities

Over the last decade factor-based investing has increased in popularity, especially in international equities where there is academic and practical evidence to support particular strategies. Understanding factors can help investors achieve their long term goals. For international investing over the long term, there is a clear winner.

According to index provider MSCI, there are six main equity style factors: quality, size, value, momentum, dividend yield and volatility. We introduced you to these in the last Vector Insights - Factors that can boost investment outcomes.

Over the past decade factor investing has increased in popularity, especially in international equities. There are two catalysts for this trend.

- There has been a trend for investors to diversify beyond Australian equities, which make up less than 3% of global markets, seeking increased opportunities overseas.

- Recognition that factor-based strategies can complement or replace active strategies.

Factors are identifiable, persistent drivers of risk and return. Contrary to the standard adage ‘past performance is not a reliable indicator of future performance’, understanding how factors have behaved historically over the long term can assist investors consider how such factors may influence the behaviour of an investment in the future. Due to availability of data, to demonstrate the performance of MSCI’s factors we assessed performance over the last 10 years. VanEck maintains the view however that it would be prudent to consider the performance of factors over a range of economic cycles through a 30 to 40 year period. MSCI undertook this most recently in 2014 and this can be viewed here. The performance exhibited below is hypothetical only.

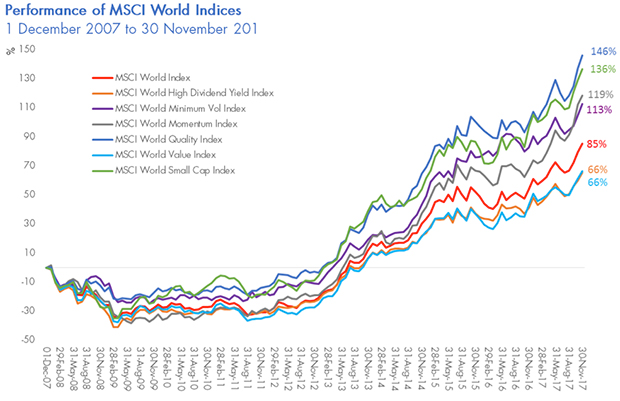

The chart below illustrates that over the past ten years, the MSCI World Quality Index has outperformed all other MSCI factor indices, having returned 146 per cent, followed by the MSCI World Small Cap Index, capturing the size factor, at just over 136 per cent.

Source: Morningstar Direct, VanEck as at 30 November 2017. The chart above show past performance of MSCI World Index and MSCI World Factor Indices. Results are calculated monthly in US dollars and converted to Australian dollars and assume immediate reinvestment of distributions. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

The chart also reveals another important point. Four of MSCI’s six factor indices outperformed the broader international share market as measured by the MSCI World Index during the ten year period, with value and dividend yield underperforming. It is worth noting however that during the past ten years these factors too have had periods of outperformance, notably in the past two years.

Risk and return of different factors

Generally, the higher risk you take with your investment, the higher return you will reap over time.

International investing involves risks that are in addition to those risks associated with Australian share investing. These include but are not limited to currency, geopolitical and tax risks. One way investors assess risk is to measure the standard deviation of returns. Standard deviation of returns measures how much the periodic returns differ from the average. The higher the standard deviation, the ‘riskier’ the investment. Unsurprisingly, momentum and small companies (size) has the highest volatility and investors have been rewarded for this risk. However quality has better rewarded investors with much lower risk. Only minimum volatility, as you would expect, is less volatile than quality as the chart below reveals.

Source: Morningstar Direct, VanEck as at 30 November 2017. The chart above show past performance of MSCI World Index and MSCI World Factor Indices. Results are calculated monthly in US dollars and converted to Australian dollars and assume immediate reinvestment of distributions. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

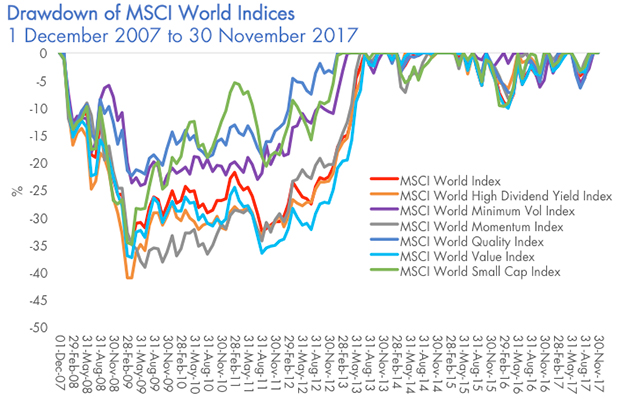

Quality a drawdown defence

For any investments, the risk of negative outcomes or the potential for losses should also be considered. Drawdown is a useful measure of the depth of a fall from a previous peak. The pace of the recovery to a new peak is also important. Investments with a lower drawdown and faster recovery are often considered more desirable.

The chart below reveals that the MSCI World Quality Index was the most resilient from December 2007 to November 2017, a period of time which included the Global Financial Crisis (GFC). The MSCI World Quality Index had the lowest maximum drawdown, or fall, compared to all other MSCI factor indices.

- The maximum drawdown of the MSCI World Quality Index was 22.4% versus the MSCI World Index at 34.4 per cent; and

- The MSCI World Quality Index had the quickest recovery period of 15 months compared to 16 months for the MSCI World index and 23 months for the MSCI World Minimum Volatility Index.

Source: Morningstar Direct, VanEck as at 30 November 2017. The chart above show past performance of MSCI World Index and MSCI World Factor Indices. Results are calculated monthly in US dollars and converted to Australian dollars and assume immediate reinvestment of distributions. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Using ETFs for quality investing

Australian investors can now access entire portfolios of international securities selected on the basis of individual or multiple factors via a range of ETFs on ASX including the VanEck Vectors MSCI World ex Australia Quality ETF (ASX code: QUAL) which tracks the performance of the MSCI World ex Australia Quality Index.i

Factor-based ETFs, such as QUAL, are ideal building blocks for an investment portfolio due to their:

- lower costs;

- ease of trading;

- explicit rules based methodology;

- transparency of holdings; and

- reduction of risks, including liquidity, key man risk and investment process risk.

For more information about QUAL, click here.

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the VanEck Vectors MSCI World ex Australia Quality ETF (‘Fund’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 38 37. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

QUAL invests in international markets. An investment in QUAL has specific and heightened risks that are in addition to the typical risks associated with investing in the Australian market. These include currency risks from foreign exchange fluctuations, ASX trading time differences and changes in foreign laws and regulations including taxation.

QUAL is indexed to a MSCI index. QUAL is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck and QUAL.

i The MSCI World ex Australia Quality Index is not the same index as the MSCI World Quality Index used in the examples above. The holdings and the performance will be different. See www.vaneck.com.au/qual or contact us for more information.

Published: 09 August 2018