Understanding floating rate notes

For investors seeking stable and increased income above bank deposit rates, it is important to understand the nature of the underlying investment to properly assess the risks and potential opportunities of fixed income products. Here, we present a primer on floating rate notes compared to Australian Government bonds.

A floating rate note (FRN) is a type of bond. A borrower, typically a government or company, issues bonds to raise capital. In return, they promise to pay bond holders back in full on the bond’s maturity date. Until that date, the borrower pays regular interest payments or ‘coupons’.

Bonds are commonly called ‘fixed-income investments’. But the term ‘fixed income’ should not be mistaken for a guarantee that income derived from a bond is ‘fixed’ or that bonds pay a fixed yield. The term instead is derived from the fact that bonds make interest coupon payments more regularly, typically monthly or quarterly, as opposed to equities, which may pay dividends only annually or semi-annually.

Therefore, when a lot of bonds are included in a portfolio, there is potential to create a regular relatively stable, colloquially referred to as ‘fixed’ income stream for investors. There are a number of factors that can impact the level and stability of income from a bond.

The difference between fixed and floating rate bonds

The key differentiator between FRNs and other types of bonds is whether or not the interest coupon payment is fixed or variable. Most bonds carry a fixed coupon interest rate. This means the coupon interest rate, from the time the bond is issued through to its maturity, does not change.

An example is government bonds, which are debt securities issued by the Australian Government. For example, a government bond with a 5% coupon interest rate will pay investors $5 a year per $100 face value amount in coupon interest payments.

With FRNs, the coupon interest rate is variable, or ‘floating’ which means it tracks short-term interest rates.

This has the effect of preserving the capital value of the bond in a rising interest rate environment. FRN coupon interest rates are most commonly set by reference to the 90-day bank bill swap rate (BBSW). For example, a FRN may be issued with a face value of $100 for 3 years with a coupon of ‘3-month BBSW + 1%’.

This means coupon payments will increase if the benchmark 3-month BBSW interest rate rises or decrease as the 3-month BBSW interest rate falls. The coupon interest rate of a FRN is usually reset each quarter to capture any changes in the benchmark BBSW.

The frequency of payments between FRNs and government bonds also varies. Coupon interest payments on FRNs are typically quarterly. Coupon payments on government bonds are made every six months.

The coupon interest rate is different to the ‘yield to maturity,’ which is the rate of return expected on a bond (expressed as an annual rate) if purchased at the current market price and held until the maturity date. The yield to maturity will vary with the price of the bond which is subject to a variety of factors.

Factors affecting a bond’s market price

The market price of a bond will vary over time depending on what's happening in the economy and with interest rates, as well as any changes in the credit worthiness of the borrower. If a borrower’s credit rating falls, then the prices of its bonds will also fall.

Demand for government bonds often rises when equity markets are falling as they are deemed safer investments than stocks and corporate bonds.

Example of how FRNs work

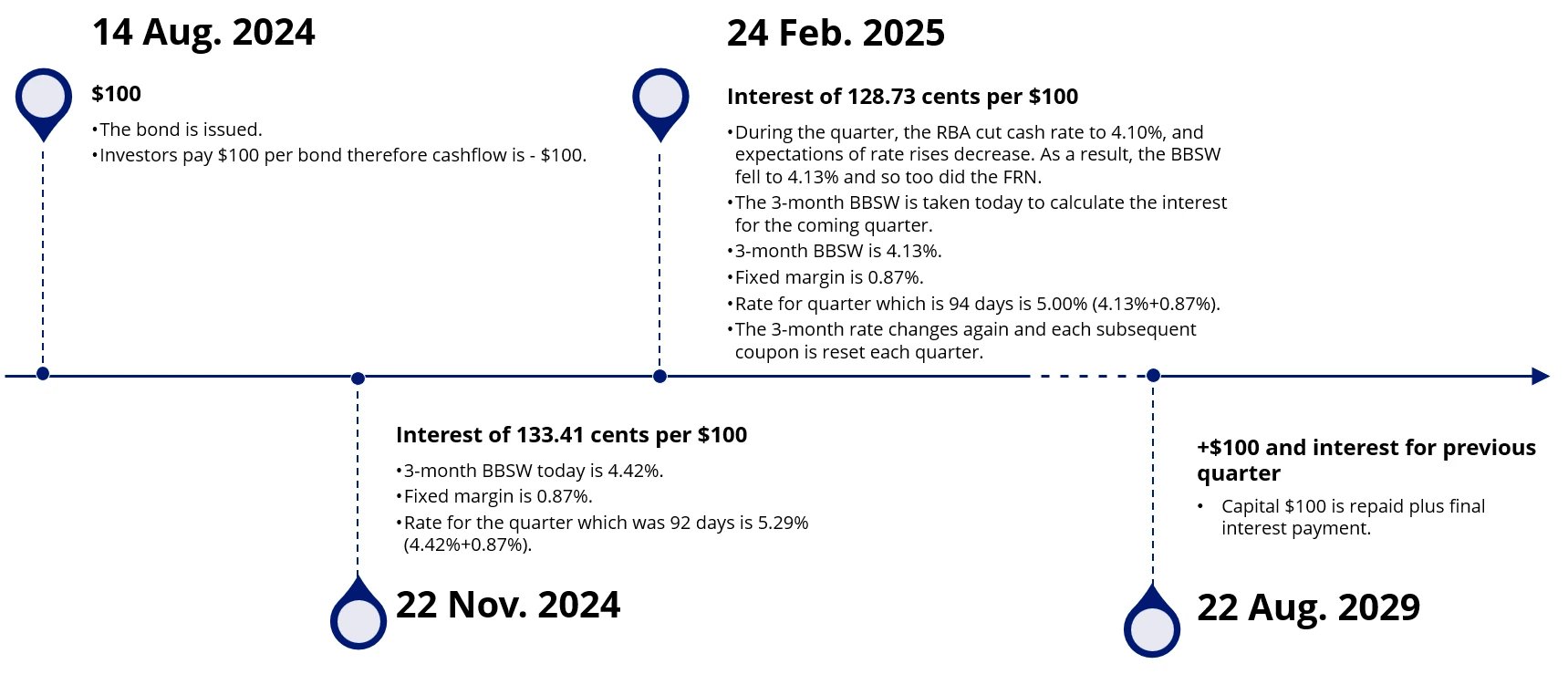

The example below indicates how income from a FRN is derived. FRNs are commonly issued by financial institutions in Australia, including the one described below.

- Commonwealth Bank issued a floating rate bond on 14 August 2024 with a maturity date of 22 August 2029.

- The interest rate is set at 3-month BBSW plus a fixed margin of 0.87%.

- The bond was issued for five years and pays quarterly interest.

- On the very first day of issue, investors outlaid $100 per bond. The 3-month BBSW rate is taken that day and added to the fixed margin of 0.87% to determine the interest rate applicable for the coming quarter.

- The coupon rate for a quarter is calculated at the time the interest is paid for the previous quarter.

- The last payment to investors on 22 August 2029 will be the $100 face value of the bonds plus interest for the final quarter.

FRNs offer investors several key benefits:

- Potential Protection against rising rates – You can see in the above example when the RBA cut the interest rate in February 2025, the coupon for the coming quarter fell to 5.00%. The opposite happens when rates rise. When interest rates go up, FRN coupons rise. Additionally, due to the coupon resetting regularly, the price of a FRN will remain relatively steady or could rise given the coupon will reset at a higher interest rate.

- Potentially attractive yield compared to bank bills and cash funds – Coupons are typically reset on a quarterly basis and go up with short-term interest rates. Hence, FRNs are good potential alternative investments to term deposits, bank bill funds and cash investments which are yield returns, particularly after inflation.

Investing directly in FRNs is difficult. Usually, FRNs are only offered to institutional investors, they are traded off-market and often require a large minimum investment size. One way to invest in a diversified portfolio of FRNs is via an ETF.

VanEck offers three types of floating rate credit securities ETFs.

|

Floating rate credit securities |

||

Key risks: An investment in the ETFs carry risks associated with: bond markets generally, interest rate movements, issuer default, subordinated debt (SUBD), securitisation market (RMBS), credit ratings, country and issuer concentration, fund operations, liquidity and tracking an index.

Please read the target market determination for each fund available at vaneck.com.au to help determine if the fund is appropriate for you.

Related Insights

Published: 27 January 2026

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable product disclosure statement (PDS) and target market determination (TMD) available at vaneck.com.au for more details. Investment returns and capital are not guaranteed.