MVW – Primed for 2017

Last year VanEck’s Australian Equal Weight ETF (ASX code: MVW) outperformed the S&P/ASX 200 Index and well positioned to continue its impressive performance because it is:

- overweight stocks that are leveraged to a strengthening US dollar

- overweight commodity equities recovering from one of the most severe downturns in history

- underweight top 10 stocks, which have a negative outlook

2016 delivered the equal weight advantage

MVW significantly outperformed the S&P/ASX 200 Index in 2016.

Source: Morningstar Direct, as at 31 December 2016. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. MVW results are net of management costs but do not include brokerage costs of investing in MVW. Performance on is not a reliable indicator of future performance.

This was affirmed by the Mercer survey published in the Australian Financial Review (19 January 2017) in which VanEck’s Equal Weight strategy was placed 8th of all Australian equity long only managers. This result is remarkable for a passive strategy.

Primed for 2017

MVW is well positioned for 2017 compared to the S&P/ASX 200 Index as it:

- has a more diversified exposure to all sectors of the Australian economy

- has larger allocation to some of the key US dollar earners (QBE, BXB, CPU, RMD, WFD) and

- reduces top 10 exposure by over 35%

Source: VanEck as at 31 December 2016

Higher allocation to sectors with a positive outlook

MVW is overweight materials and energy which benefited the strategy in 2016 and looks set to contribute further in 2017. The stocks which contributed most to MVW’s relative outperformance were its overweight exposure to materials companies Fortescue Metals, BlueScope and South 32. These smaller sized companies, which have greater upside potential, benefited as cyclical commodities emerged from one of the worst bear markets ever. Cuts in capital spending by producers began to choke off supplies as global demand crept higher and this theme is predicted to continue into 2017. This supply and demand compression is also playing out in the energy sector. Late last year OPEC agreed to curtail supply even though consumption remained resilient. As supply diminishes prices will rise.

Larger allocation to US dollar earners

It didn’t matter who won the US presidential election, both candidates were going to embark on a fiscal stimulus plan. Ultimately, after Trump swept to power his more aggressive rhetoric pushed the US dollar higher. Despite complaining now that it’s too high, it’s likely Trump’s policies and US rate rises will continue to apply pressure to the US dollar. For Australian companies that earn their income in US dollars, a strengthening US dollar is positive. MVW is overweight many of these (QBE, BXB, CPU, RMD, WFD) which have all done well since Trump’s victory.

Source: Factset, Bloomberg. The DXY Currency index is the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of US trade partners' currencies.

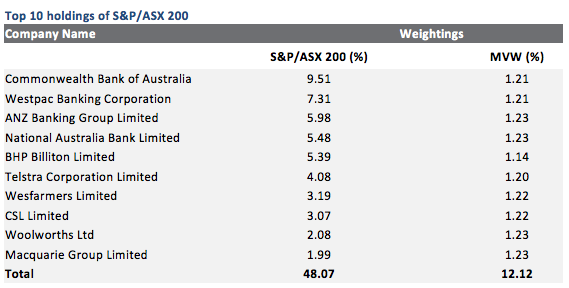

Underweight the Top 10

The top 10 is dominated by banks. Last week, rating agencies Fitch and S&P revised their outlook of the Australian banking sector to negative. Among the headwinds banks face, both agencies highlighted that profit growth of Australian banks will slow in 2017 reflecting low interest rates, slow asset

growth for assets and deposits, higher funding costs and a rise in loan-impairment charges.

MVW reduces exposure to banks by 20%.

Source: VanEck as at 31 December 2016

Access the equal weight advantage

MVW is the only equal weight ETF on ASX. Since its launch in March 2014 it has outperformed the S&P/ASX 200 Index by 4.30% p.a.

Inception

date is March 4, 2014.

Source: Morningstar Direct, as at 31 December 2016. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. MVW results are net of management costs but do not include brokerage costs of investing in MVW. Performance on is

not a reliable indicator of future performance.

The index MVW tracks has now outperformed in 11 of the past 14 calendar years including the last five.

Source: VanEck, FactSet, as at 31 December 2016. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in MVW. You can’t invest directly in an index. Past performance of MVW’s Index is not a reliable indicator of future performance of MVW.

MVW distributes generally twice a year and passes through all dividends and associated franking credits to investors.

For more information on MVW click here

IMPORTANT NOTICE:

If you no

longer wish to receive this email, reply with ‘unsubscribe’ in the subject

line.

This

information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL

416755 (‘VanEck’) as responsible entity of the VanEck Vectors Australian Equal

Weight ETF (MVW) (‘Fund’). This is general information only and not financial

advice. It is intended for use by financial services professionals only. It

does not take into account any person’s individual objectives, financial

situation nor needs. Before making an investment decision in relation to the

Fund, you should read the PDS and with the assistance of a financial adviser

and consider if it is appropriate for your circumstances. The PDS is available

at www.vaneck.com.au or by calling 1300 68 3837. The Fund is subject to

investment risk, including possible loss of capital invested. Past performance

is not a reliable indicator of future performance. No member of the VanEck

group of companies gives any guarantee or assurance as to the repayment of

capital, the payment of income, the performance or any particular rate of

return from the Fund.

Published: 09 August 2018