Carbon pricing could be set to surge with new global carbon trading scheme

The United Nations’ COP29 concluded in Baku, Azerbaijan recently, and one of the main highlights was significant progress towards the creation of a global carbon trading system.

After nearly a decade of deliberation, the rules for trading carbon between countries under Article 6.2 of the Paris Agreement were finalised, enabling the new Paris Agreement Crediting Mechanism (PACM) under Article 6.4 to become fully operational. This agreement included a framework on how nations could create, trade and register emission reductions and removals.

The new system is expected to provide countries with more opportunities to meet Paris Agreement targets in the race to reduce greenhouse emissions, as well as funnelling billions of dollars into sustainability projects around the world, including forestry schemes, solar and wind farms, and other renewable energy investments.

For carbon market investors, a greater demand for carbon credits globally – driven by the huge emission reduction gap experienced by many nations – could see the price of credits surge significantly. Standardised methodologies and verification processes under the new global scheme are expected to drive a more liquid and efficient carbon market, while enhancing the credibility of carbon credits to encourage greater participation and investment.

BloombergNEF expects the Europe’s EU ETS (EUA) carbon price to average €65 per metric ton (US$71/Mt) this year, before more than doubling to €145/Mt by 2030. Carbon could even surpass €175/Mt by 2035 if policy parameters remain unchanged.

To date, there are 36 compliance carbon trading schemes around the world1, which are regulated by a central government body and mandatory for companies covered by the scheme to participate. A few of these are linked regionally, however most schemes are standalone. Some other schemes are voluntary, as is the case with the Australian Carbon Credit Unit (ACCU) scheme, which have been criticised by the lack of transparency in the past.

Pedro Martins Barata of the Environmental Defense Fund commented “For the first time since 2013, we may see the emergence of a viable, UN-backed mechanism to broaden and link carbon markets across the world.”

The COP29 deal also included measures for transparency in carbon credit trading, creating a dual-layer registry system and setting guidelines to prevent changes to credits once transferred.

However, some observers have argued that the rules are incomplete, with insufficient consequences for inconsistencies in carbon tracking and offsetting. The broader concern is that governments around the world need to be held accountable for how carbon credits transfers are counted towards their respective emission targets.

According to BloombergNEF, 14 of the G20 countries have carbon pricing systems in place, and these regions cover roughly a quarter of all carbon emissions globally.

In our view, such systems are best implemented as compliance or mandatory mechanisms regulated by governing bodies, rather than voluntary schemes, as this provides a transparent and enforceable method for countries to achieve their Paris-aligned carbon neutrality goal.

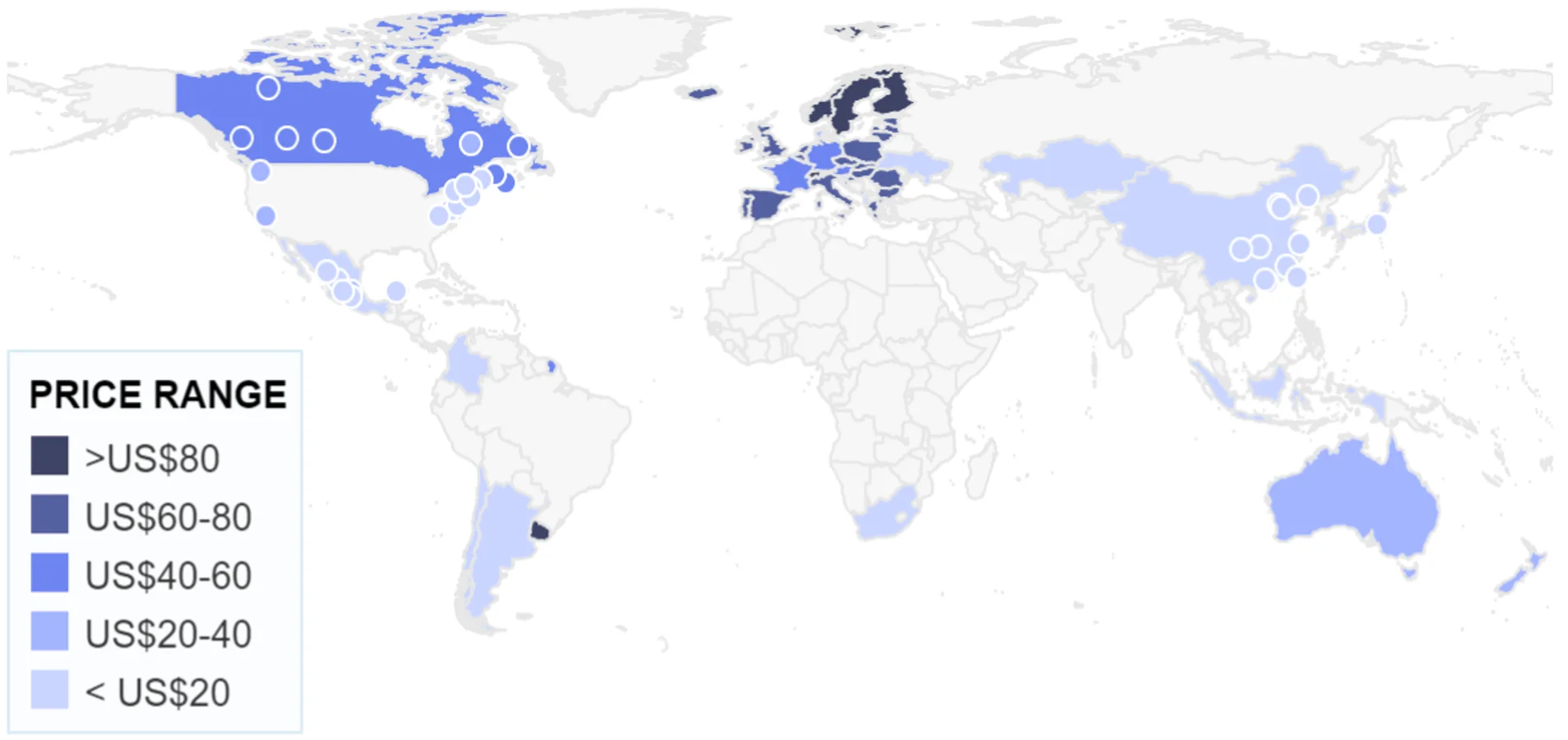

Heat map shows the level of the main price set by emissions trading systems or Carbon taxes in each jurisdiction (US$/tCO2e), subject to any filters applied. The year can be adjusted using the slider below the map.

Chart 1: A wide disparity in the price of carbon credits around the world

Source: World Bank

It will be interesting to see how interoperability is achieved between nations moving forward, as there is currently a wide disparity in the price of carbon credits between trading schemes. World Bank data indicates that even within the compliance carbon markets, the ‘cost to pollute’ ranges widely from US$0.46 to US$167 per ton of CO2 emission, with only 1% of global emissions priced above the recommended level.

For now, most schemes are currently underpricing carbon credits relative to the lag in meeting carbon emission reduction goals. An analysis done by BloombergNEF suggests that EUA pricing – while reduced over the last year – is currently the only one that is aligned with World Bank’s projected pathway to 2°C by 2030. Some jurisdictions could have the potential to achieve likewise, including Canada, UK, California and China.

With Article 6.4 in place, parties to the Paris Agreement can now begin taking steps towards trading credits with other countries. However, significant headway is unlikely before next year’s COP in Belém, where the scheme’s supervisory body has been tasked with elaborating on the scheme’s standards.

ASX investors can access global carbon markets via the VanEck Global Carbon Credits ETF (Synthetic) (ASX:XCO2).

Source:

Published: 01 December 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.