A Green Planet

The global equity falls have highlighted the risk in ESG investing with the market disproportionally punishing shares in high growth companies, particularly IT. Many sustainable international equity funds and ETFs that are hyper-concentrated to ‘growth’ sectors such as IT have fallen hard, but not all.

The global equity falls have highlighted the risk in ESG investing with the market disproportionally punishing shares in high growth companies, particularly IT. Many sustainable international equity funds and ETFs that are hyper-concentrated to ‘growth’ sectors such as IT have fallen hard, but not all.

Many ESG approaches take a ‘blunt instrument’ approach to companies, neglecting to consider the different ESG considerations each industry faces. The result is often a portfolio that is concentrated to industries that have relatively few ESG concerns and that emit low carbon, such as IT. The potential risks of such an approach has come to the fore recently.

We think it is possible for a portfolio to achieve diversification while also achieving low carbon and high ESG-ratings.

There is no doubt that ESG had become an important consideration for investors prior to the COVID-19 pandemic and in the current geopolitical environment, it is likely to be a subject of renewed focus. This is why it is important that investors target ESG leaders because those companies are best prepared to mitigate risks, have the best employee practices, and are best positioned to ensure the world is a better place for future generations. Diversification is also important for your ESG fund, it should not be concentrated to a particular sector.

Low carbon footprint is key

Climate change is a global problem and minimising its impact on the environment requires coordinated international action by all countries to reduce greenhouse gas emissions, including CO2. In the financial community, investors of all sizes are directing investments to companies with a low carbon footprint.

The Investor Group on Climate Change, for example, which includes the nation’s largest institutional investors like superannuation funds AustralianSuper and Unisuper, is promoting investor action on climate change “to avoid dangerous global warming, responsibly manage long term risks and drive sustainable returns for investors and the beneficiaries they represent.”1

Advisers too can put their client’s money to work towards reducing global carbon emissions by investing in companies with low emissions.

Not all funds are equal

The VanEck MSCI International Sustainable Equity ETF (ESGI) is one of the few sustainable ESG funds that maintains a sector risk profile similar to that global benchmark index and thus avoids unintended concentration risks. Recently, ESGI investors have benefited from this prudent approach.

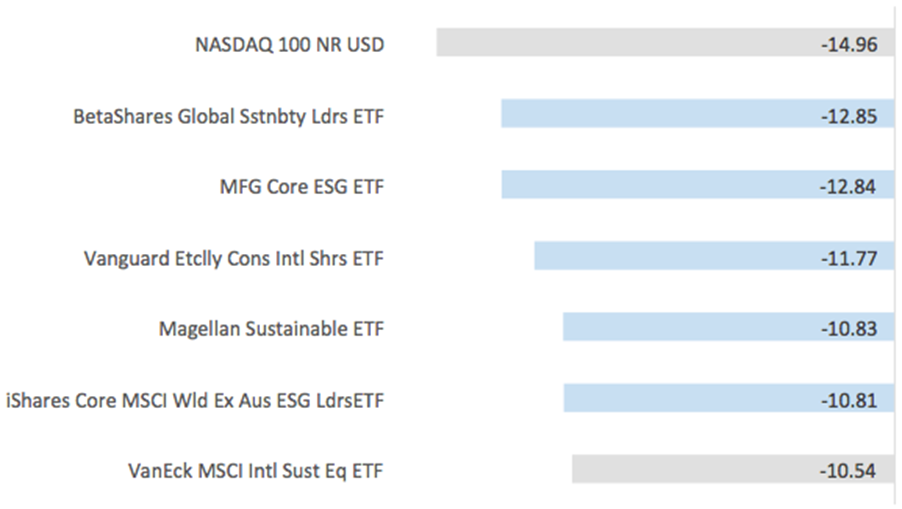

Earlier this year, a Morningstar.com.au article highlighted the returns of sustainable global equity ETFs since the NASDAQ 100 hit its peak on 19 November 2021. The article included a chart that highlighted the performance of various ESG funds in the current market environment. At the time, Morningstar only identified one ESG fund as having outperformed the market benchmark, ESGI.

Subsequent to that article, Russia invaded Ukraine, which has continued to further declines in markets.

We have extended the timeframe to the time of writing (data available to COB 19 April 2022) to provide a more up-to-date snapshot, and the result is ESGI remaining the best performing ESG fund out of the group since the NASDAQ 100’s 19 November peak.

Chart 1: Sustainable global equity ETF performance: Cumulative returns from 19 November 2021 to 19 April 2022

Source: Morningstar, VanEck, 19 November 2021 to 19 April 2022. Updated chart from “Sharemarket decline highlights risks in sustainable ETFs: Editor's Note.” Past performance is not a reliable indicator of future performance. You can view the performance history of ESGI – here.

Sector diversification

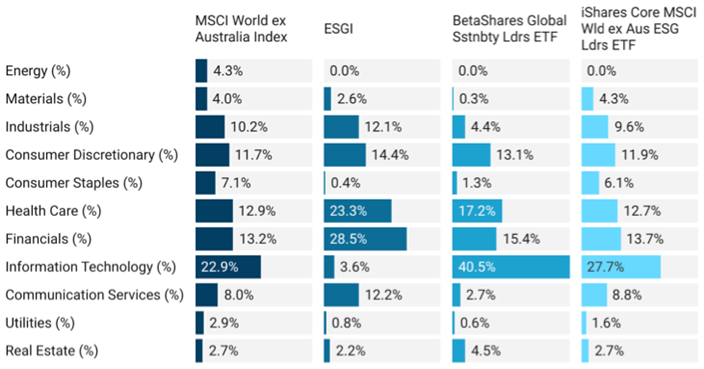

Morningstar’s article also highlighted the relative sector positions of ESGI and its peers compared to the MSCI World ex Australia Index. Again, we have updated this. ESGI’s largest overweight positions are in healthcare and financials. It is underweight IT.

Chart 2: Asset allocation: Sustainable global equity ETFs v Benchmark

Source: VanEck, MSCI, Fund manager’s websites. 31 March 2022. Based on Morningstar.com, “Sharemarket decline highlights risks in sustainable ETFs: Editor's Note.”

ESGI tracks the state-of-the-art MSCI World ex Australia ex Fossil Fuel Select SRI and Low Carbon Capped Index (ESGI Index). An important part of the index design is the utilisation of MSCI’s best-of-breed ESG analysis, which is conducted by a team of over 200 analysts worldwide.

MSCI ESG Research assesses all of the stocks in its global universe on a 'AAA' to 'CCC' scale according to their exposure to industry specific ESG risks and their ability to manage those risks relative to peers. In addition to negative screens for fossil fuels, socially irresponsible business activities and carbon emissions, the ESGI Index includes only those companies that rank in the top 15% by market-cap for ESG performance from each GICS sector.

The result is a true-to-label, well diversified ESG ETF encompassing both values-based and environmental, social and governance (ESG) investing. In addition to rating companies, MSCI also aggregates its data to assess funds.

ESGI excludes companies based on their carbon emissions, and exclude investments in companies that have any ownership of fossil fuel reserves, or derive revenue from the mining or sale of thermal coal, or from oil and gas related activities resulting in the most comprehensive, in depth, dark green index in MSCI’s ESG family.

This is important because The Investor Group on Climate Change, for example, which includes the nation’s largest institutional investors like superannuation funds AustralianSuper and Unisuper, is promoting investor action on climate change.

You can view this information here: https://www.msci.com/esg-fund-ratings

(Hint: type the full fund name).

Key risks:

An investment in ESGI carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations and tracking an index. See the PDS for details.

Published: 28 April 2022