A pillar of Australia’s economy

Australian investors have an affinity for banks. Australian banks represent a pillar of the Australian economy.

Investing in a bank can be as simple as taking out a deposit at the local branch. It can also be as complex as investing in a debt instrument that the bank can potentially write off to zero if it gets into financial stress.

It’s worth understanding common ways to invest in a bank, and what drives the performance and the risks of these.

A bank’s capital structure

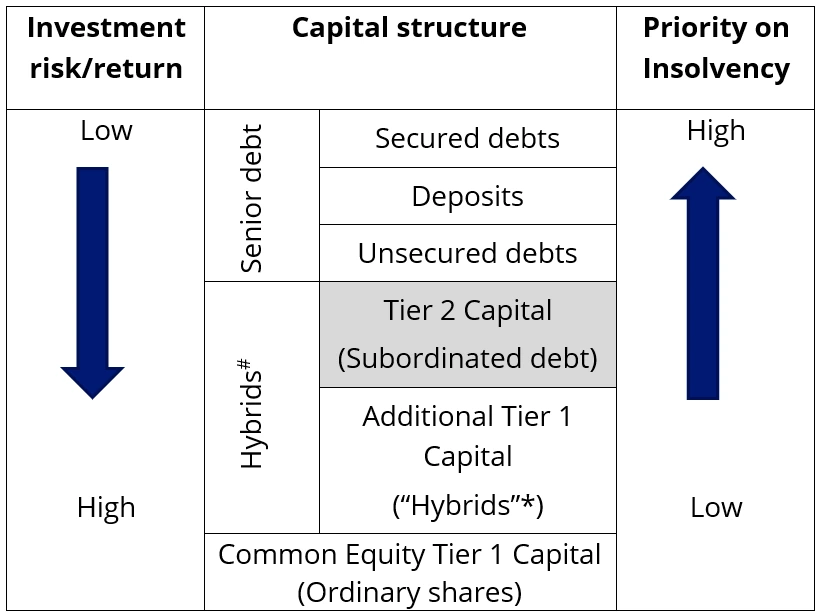

Chart 1 is a simplified capital structure of an Australian bank. Those items, under the capital structure heading, represent securities that investors may consider when investing in banks. Please note that this list is not exhaustive; it is used for illustrative purposes.

The most common ways to invest in banks include bank deposits, bank debt (or bonds), hybrids and shares. It’s worth understanding how each of these works, because they have varying degrees of risk. Chart 1 shows that secured bonds and deposits are the lowest risk/lowest return. Shares, according to the chart, have the highest risk/highest return potential.

If a bank were to become insolvent, Chart 1 also illustrates the order of priority of repayment of the different securities issued by financial institutions. Starting at the top is senior debt. In the event of a bank’s collapse, holders of these investments get paid back first. These include investors who have deposited funds at the bank and investors who have loaned the bank money via bonds or similar debt instruments.

If there is any money left over, hybrid investors are next in line. Because they are riskier, hybrids typically pay higher yields than senior debt. Finally, the bank's shareholders are last in line in the event of insolvency. Bank shares are considered the riskiest way to invest in a bank.

Chart 1. Simplified capital structure of a financial institution

#Per ASIC Report 365. *Per market convention.

Below is an explanation of each of these securities and the factors that may impact their return.

Investing in a bank’s bonds

A bond is essentially a loan by the investor to the entity issuing the bond. The entity issuing the bond could be the Commonwealth Government of Australia, the State Government of New South Wales or a corporation such as National Australia Bank or ANZ.

In return for the loan, the entity makes a promise, that is, it “gives its bond”, that it will repay the loan on a specified date (the maturity date) and will make interest payments at regular intervals during the term of the loan.

Several factors impact the risk/return profile of a bond.

At issue, the entity determines the principal amount per bond, known as the face value of the bond, and a specified interest rate, called the coupon. Like a loan, a bond is issued for a specific term or maturity. This generally ranges from 12 months to 30 years. Most bonds have a fixed coupon, which is paid periodically from the time the bond is issued through to its maturity.

For example, a bond might be issued with a face value of $100, a 5% fixed coupon and a term to maturity of 2 years. This means the bond will pay investors a $5 coupon per annum over the life of the bond. At the maturity date in two years, the issuer has an obligation to repay the $100 principal plus the final $5 coupon to the bondholder.

A bond’s coupon reflects:

- The bond’s term to maturity.

- The prevailing market interest rates at the time the bond is issued; and

- The issuer’s creditworthiness.

Generally, the higher risk you take with your capital, the higher expected return you will reap over time. It’s important to be aware that a bond’s price, or capital value, may go up or down from the face value because of external market risk factors as well as its creditworthiness, whereas with a bank deposit, your principal is held by a bank and generally isolated from these types of risks.

The most important factors impacting a bond investment are interest rates and the creditworthiness of its issuer. We’ll discuss each of these in more detail below.

How a bond’s value changes with interest rates

In financial markets, interest rates go up and down. Bonds issued when interest rates are higher will pay higher coupons than bonds issued when interest rates are lower, and changes in rates impact the market value of the bond. This is because existing bondholders will consider the ‘opportunity cost’ of their existing bond compared to new bonds issued at higher interest rates. Opportunity cost is the loss incurred by an investor when one alternative is chosen over another, and it’s important when you consider bond prices and interest rates. Put simply, when rates are rising, investors don’t want to hold bonds with the old lower rate; they would prefer to be rewarded for risk with the new higher rate. Conversely, when rates are falling, existing bonds with higher rates are more appealing.

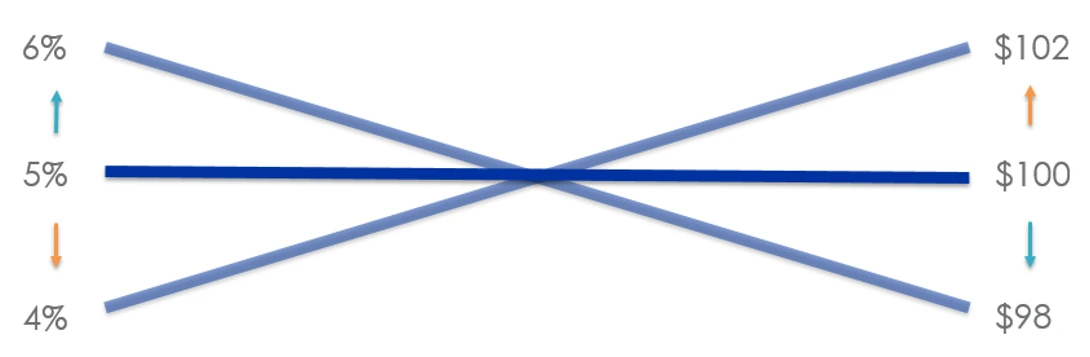

Chart 2: Interest rates and bond prices have an inverse relationship. When interest rates rise, the value of a bond falls, and when interest rates fall, bond prices rise.1For illustrative purposes only.

Going back to our example above. A bank has issued a 2-year $100 bond carrying a 5% coupon. Let’s assume you liked this deal and bought the bond. What it means is that you receive $5 in year one and $5 in year two. At the end of year two, you also receive the return of your $100 principal.

Let’s suppose that immediately after you bought that bond, interest rates rose. New bonds are being offered with a 6% coupon. This means new $100 bonds now pay $6 per year. The immediate impact in the market is that buyers of bonds will not pay $100 for your bond paying 5%. The opportunity cost is too high; they would prefer the new bond paying 6%. If you need to sell your bond, you’d have to offer it at a lower price (a discount), which would enable it to generate about 6% to the new owner. In this case, that would mean a price of around $98. In other words, the 1% rise in interest rate has meant the market value of the bond has fallen by 2%.

Similarly, if rates dropped to below your original coupon rate of 5%, your bond would be worth more to buyers in the market than $100. It would be priced at a premium, since it would be carrying a higher interest rate than what was currently available on new bond issues.

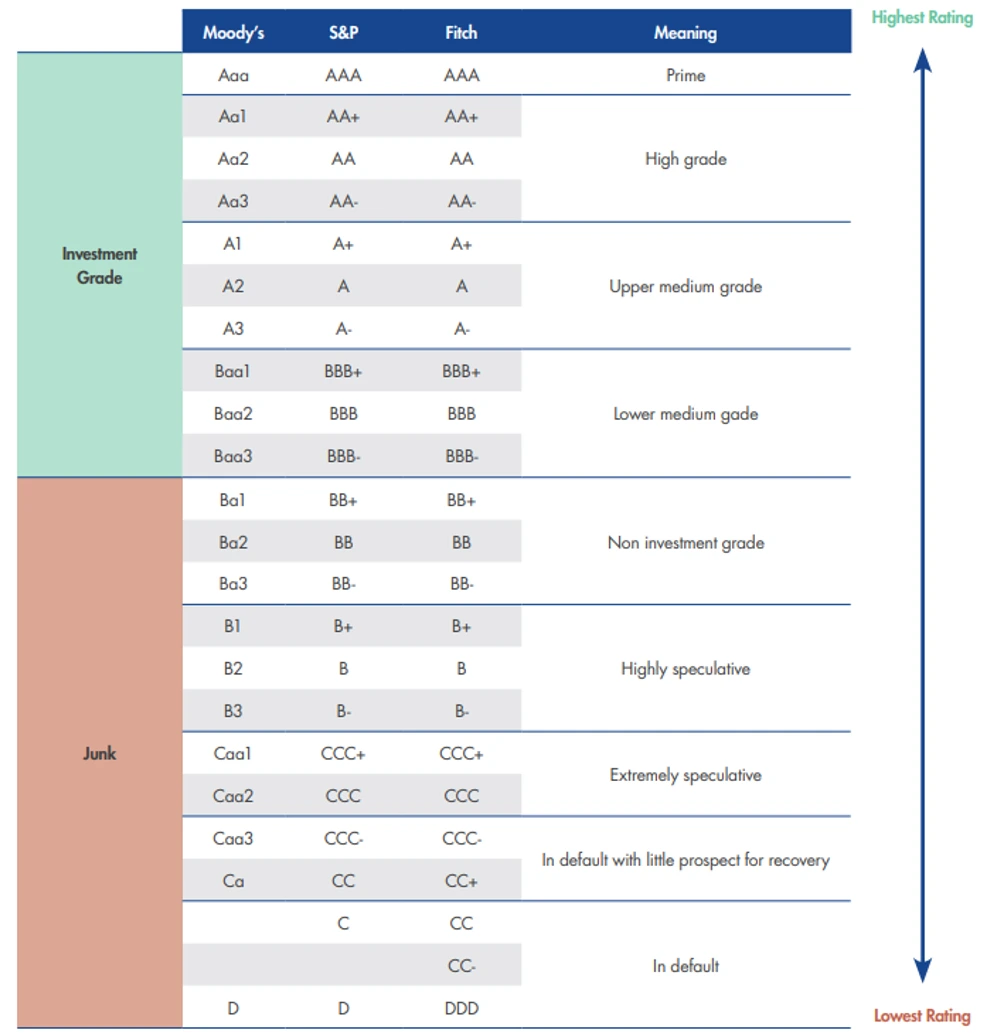

How a bond’s value changes with credit ratings

Bond issuers such as banks usually have a credit rating that has been determined by independent rating agencies. These ratings guide investors about the riskiness of the issuer and, therefore, its bond. If a bond has a low rating, the company or government issuing it is considered to have a high risk of default; it is riskier than a bond with a high rating. Therefore, when a bond is issued by a low-rated issuer, to compensate the investor for the extra risk they are taking, it will have to offer a higher coupon compared to what a higher-rated issuer would need to offer.

If a bond issuer’s credit rating goes down, or there is a perceived deterioration in its creditworthiness, then the price of its bonds will also fall. The table below lists the different credit ratings of Australian Bonds. All of Australia’s major banks are investment grade.

Source: VanEck

ETFs have made it much easier to access corporate bonds.

Not all corporate bond ETFs will pay the same level of income, because each has different underlying holdings, so they will have differing risks. Details of the different types of income ETFs are summarised here at our income investing microsite.

Investing in a bank’s hybrids

This has been in the news over the past few years as APRA called time on Additional Tier 1 Capital. Therefore, it is unlikely that there will be much new issuance of Additional Tier 1 Capital by Australian banks. Rather, they will issue Tier 2 debt, or as it is commonly called, “subordinated debt”.

Subordinated bonds are like other bonds that banks issue, but with a key difference: in times of financial stress, they can be converted to shares, or they may be written off completely.

Therefore, they are riskier than traditional bank bonds. As a result, financial institutions typically offer subordinated bonds with a higher interest rate than traditional bonds.

Investing in subordinated debt has primarily been accessible to large institutions, as these securities are traded over-the-counter (OTC). ETFs have made it possible for investors of all sizes to access a subordinated debt portfolio.

And among Tier 2 funds, the VanEck Australian Subordinated Debt ETF (ASX: SUBD) is the original. Last month, its sister fund, the VanEck Australian Fixed Rate Subordinated Debt ETF (ASX: FSUB) debuted on ASX. The differences between the two are outlined in this blog: The bonds getting interest – pun intended.

Investing in a bank’s shares

Bank share ownership is popular among Australian investors. Owning shares means buying a portion of a company, making you a part-owner (or shareholder) who potentially benefits from its growth, from share price increases and from profits which may be paid to shareholders as dividends. Shares in companies such as banks appeal to investors because they may deliver two potential sources of return: income from the dividends, as well as the capital appreciation of the bank’s share price should it rise. The share price could also fall. There are many reasons the share price of a bank moves around, such as the quality of its management, overall investor sentiment, the economic environment, its profitability and use of capital and changes to the regulatory landscape.

Investing in share markets can be more volatile than bonds, but it can often yield bigger rewards for the increased risk. As noted above, in the event of a bank’s insolvency, a bank’s shareholders are the lowest, in order of priority, so they may not get paid back at all.

Investing in banks with ETFs

VanEck offers investors a way to access a bank’s securities throughout the capital structure.

How to access Australian Bank Bonds

VanEck Australian Floating Rate ETF (ASX: FLOT) - a portfolio of investment-grade Australian corporate floating rate notes (FRNs – a type of short-term bond) via a single trade on ASX. As at 31 December 2025, FLOT had 98.8% exposure to FRNs issued by companies in the banking services and investment banks and investment services sectors.

VanEck Australian Corporate Bond Plus ETF (ASX: PLUS) – a portfolio of Australian dollar corporate bonds that offer the highest yield relative to government bonds of similar maturities. As at 31 December 2025, PLUS had 36.8% exposure to bonds issued by companies in the banking services and investment banks and investment services sectors.

How to access the Australian subordinated debt market

VanEck Australian Subordinated Debt ETF (ASX: SUBD) - a portfolio of floating rate investment-grade subordinated bonds via a single trade on ASX. Since its launch, SUBD has grown to over $3.3 billion, establishing itself as the go-to subordinated debt strategy.

VanEck Australian Fixed Rate Subordinated Debt ETF (ASX: FSUB) – our newest ETF, FSUB, launched last month on ASX, giving investors access to a portfolio of fixed rate investment-grade subordinated bonds via a single trade on ASX.

How to access Australian Bank shares

VanEck Australian Banks ETF (ASX: MVB) – The only pure Australian banks ETF on ASX, a portfolio of Australia’s largest and most liquid banks in a single trade. MVB delivers the growth and yield of Australia’s banks by passing on all dividends and franking credits to investors

Key risks: An investment in the FLOT, PLUS, SUBD and FSUB carries risks associated with: subordinated debt (SUBD and FLOT), bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the relevant PDS and TMD for details.

An investment in our Australian Banks ETF carries risks associated with: financial markets generally, individual company management, industry sectors, stock and sector concentration, fund operations and tracking an index. See the VanEck Australian Banks PDS and TMD for more details.

FLOT and SUBD are likely to be appropriate for a consumer who is seeking capital preservation and a regular income distribution, has an investment timeframe of at least 3 years, and has a medium risk/return profile. FLOT may be used as a core, minor or satellite allocation, while SUBD is intended for use as a minor or satellite allocation within a portfolio.

PLUS and FSUB are likely to be appropriate for a consumer who is seeking regular income distribution, has an investment timeframe of at least 3 years, and has a medium risk/return profile. PLUS may be used as a core, minor or satellite allocation, while FSUB is intended for use as a minor or satellite allocation within a portfolio.

MVB is likely to be appropriate for a consumer who is seeking capital growth and a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and has a high risk/return profile.

1Please note: Although the term “hybrid” is used by ASIC to refer to both Tier 2 Capital and Additional Tier 1 Capital, this term tends to be used in the market (by advisers and the media) to describe only Additional Tier 1 Capital securities or ‘capital notes’. In this document, the word “hybrid” refers to Additional Tier 1 Capital securities or capital notes and “subordinated bonds” or “bonds” refers to Tier 2 Capital or subordinated debt.

Published: 23 January 2026

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.