Duration Fixation

Australian duration as a potential ‘darling’ for global bond investors in 2026.

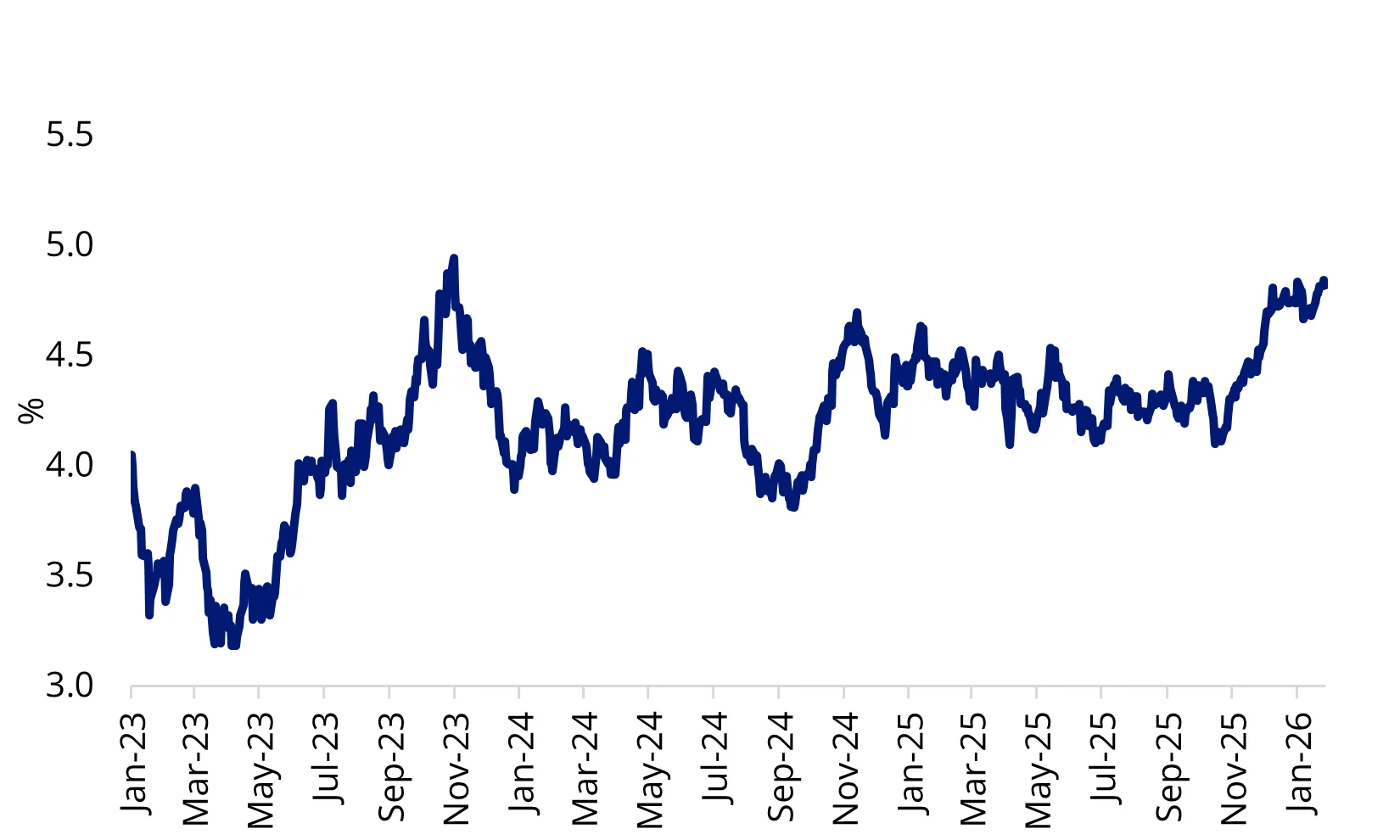

The Australian government bond 10-year yield has recently reached a multi-year high of over 4.80%. Yield rises of this nature negatively impact bond investments, especially those with longer duration, and they are reflective of a resilient Australian economy.

The labour market is strong, with the unemployment rate falling recently to 4.1%.Consumer conditions are also solid, household spending, property prices and economic growth are accelerating.

Year-on-year inflation is at 3.8%, and the trimmed mean has increased to 3.3%, which is above the RBA’s target band of 2-3%. Rate hikes are increasingly plausible with two priced by year-end, reflecting the rise in government bond yields.

However, this could swiftly change if a global macro shock unfolds, or an Australian economic print surprises to the downside. In this scenario, investing in longer-dated fixed income assets is a way to benefit from falling yields.

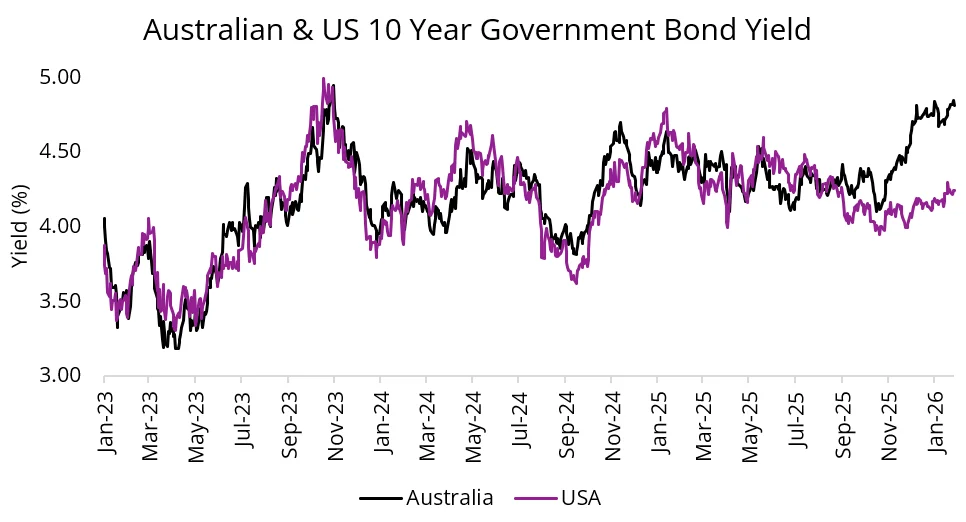

We think Australian duration could be a potential ‘darling’ for global bond investors in 2026 as a way of avoiding US debt and dollar woes and soaring Japanese Government Bond yields.

Australia’s economy is running hot

There is no doubt that the Australian economy is running hot. GDP growth, from a sluggish 2024 has started to reawaken, rising from 1.1% to be expected to be 2.2% in 2026. Inflation is higher than the RBA’s target band, and the labour market is as tight as a drum, surprising the market by falling to 4.1% in December.

Charts 1 & 2 & 3: Australian economy running hot

Source: VanEck. Bloomberg. Data as at 31 December 2025.

In response, markets are anticipating that rates will have to rise. The 10-year yield has risen to almost 4.9%, a level not reached since the end of 2023.

Chart 4: Australian 10-year at a multi-year high

When yields rise, bond prices fall, especially those with longer duration. However, many investors are wondering, how high can yields go?

Australia is vulnerable to macro shocks

We hold the view that a rate hike is increasingly plausible this year, and the market has priced this in too. However, long-dated bond yields could fall as Australia is vulnerable to macro shocks. We witnessed this following US liberation day in April 2025, and the Yen carry trade fallout in August 2024. In both of these instances, market volatility increased, and long-dated government bond yields fell.

In the current macro and geopolitical environment, Australian duration could also be a potential ‘darling’ for global bond investors in 2026 as a way of avoiding US dollar and debt woes and soaring Japanese Government Bond yields.

Chart 5: Australian bonds look relatively attractive for international investors

Source: Bloomberg, 28 January 2026.

A tail risk hedge

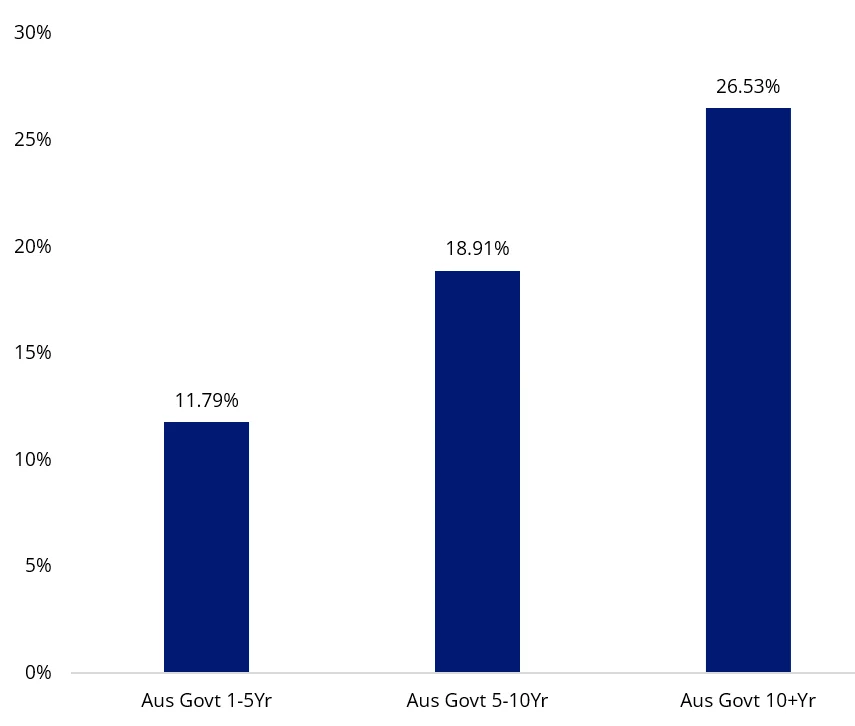

Additionally, should an unforeseen market event unfold, increasing portfolio duration can serve as an important tail risk hedge. During the dot-com bubble, global financial crisis, and COVID-19 period, a ‘bull flattening’ scenario unfolded, where short- and long-term Australian government bond yields declined. The charts below illustrate the changes in the Australian government bond yield curve leading up to the global financial crisis, along with the respective returns by maturity bands and historical bull-flattening periods.

Chart 6: Australian government bond yield curve & Chart 7: Return comparison during GFC: May '08 to Dec '08.

Charts 6 and 7 source: Bloomberg. Past performance is not indicative of future performance. Aus Gov 1-5Yr is S&P/ASX iBoxx Australian & State Governments 1-5 Index, Aus Gov 5-10 Yr is S&P/ASX iBoxx Australian & State Governments 5-10 Index, Aus Gov 10+Yr is S&P/ASX iBoxx Australian & State Governments 10-20 Index.

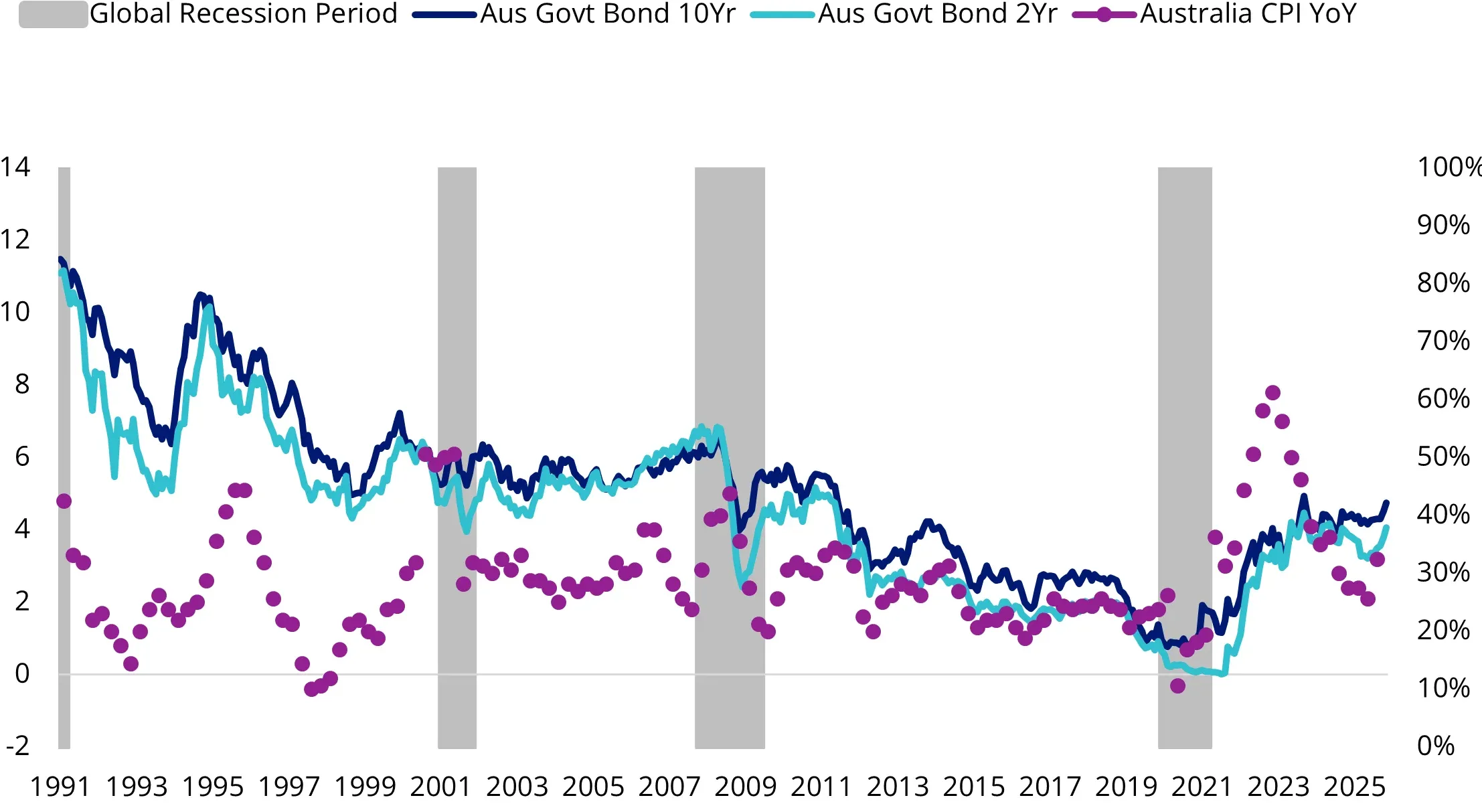

Chart 8: Positioning for lower long dated yields: Australian government bond yields and CPI

One way to increase duration is the VanEck 10+ Year Australian Government Bond ETF (XGOV), a portfolio of Australian government bonds with maturity dates between 10 and 20 years. XGOV could be used as a way to express your interest rate view. The longer duration of XGOV means that it is more sensitive to changes in interest rates and as at 27 January 2026 its modified duration was 8.97 years. This means that for every 1% fall in interest rates, XGOV’s value is expected to increase 8.97% and vice versa.

XGOV is one of three VanEck Australian Government Bond ETFs, each targeting three distinct maturity buckets within different parts of the yield curve so investors can express their view on the direction of rates and potentially add value to their portfolio. VanEck 1-5 Year Australian Government Bond ETF (1GOV) and VanEck 5-10 Year Australian Government Bond ETF (5GOV) are the other two ETFs in the series.

Credit considerations

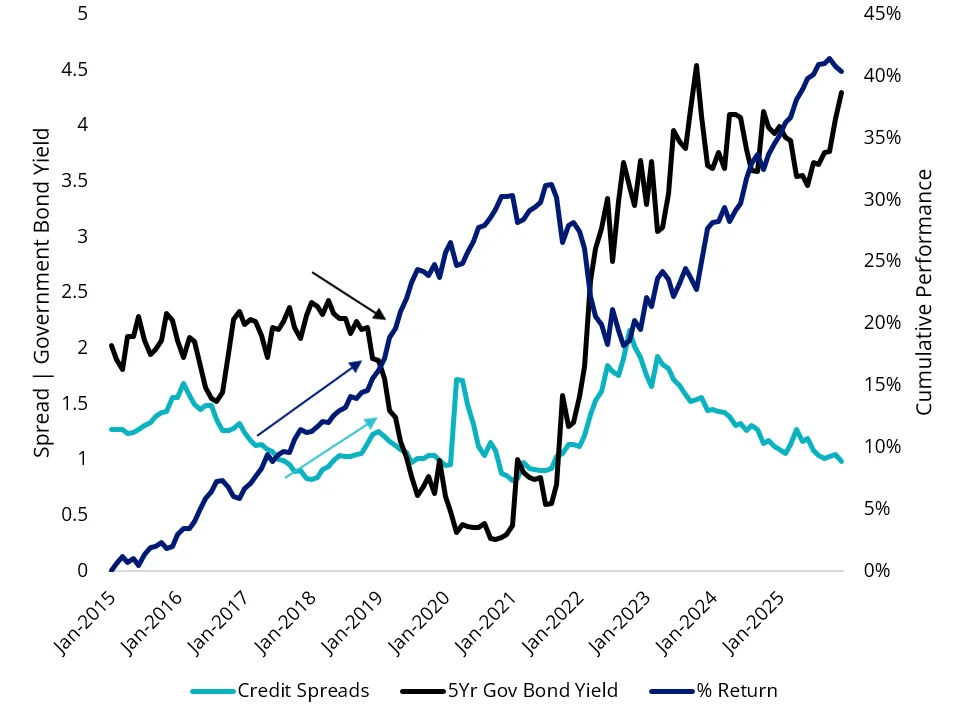

In addition to the long end of the yield curve, we think investors’ focus should also be on fixed rate investment-grade corporate bonds. While Australian corporate fundamentals are solid, any potential macro shocks could see credit spreads grind wider. This relationship was underscored in 2018 during the US-China Trade Wars, credit spreads widened from their cycle low, but government bond yields fell, boosting fixed rate Australian corporate bond returns. Within investment grade corporates, VanEck is a leader:

- We recently launched a fixed-rate version of our popular subordinated debt ETF (SUBD). As at 29 January 2026, the VanEck Australian Fixed Rate Subordinated Debt ETF’s (FSUB) modified duration was 4.38 years. This means that for every 1% fall in interest rates, FSUB’s value is expected to increase 4.38%, and vice versa.

- This modified duration is similar to our popular VanEck Australian Corporate Bond Plus ETF (PLUS), which as at 29 January 2026 was 4.30 years.

Source: Bloomberg, Australian corporate bonds is represented by Bloomberg Ausbond Credit Index. 5Yr Gov Bond Yield is Australia Bond 5 Year Yield (GTAUD5Y). You cannot invest in an index. Past performance is not indicative of future performance.

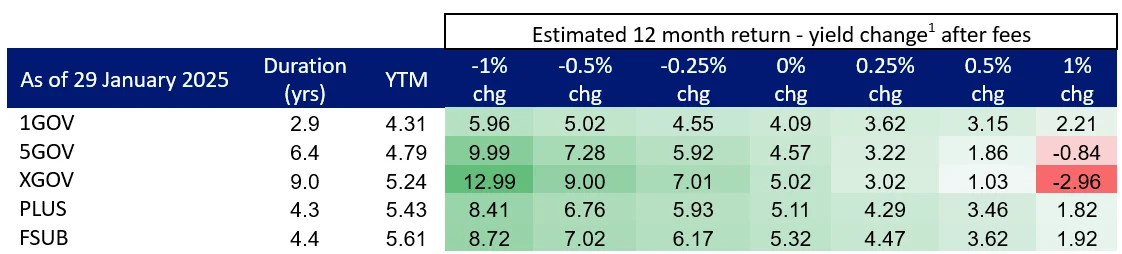

Positioning for rate changes

The table below sets out the hypothetical 12-month returns based on various yield change scenarios for some of VanEck’s suite of fixed income ETFs.

Table 1: Estimated 12-month return based on various yield change scenarios

1Estimated 12 month return = current YTM + yield change – duration * yield change – annual management fee. These are estimations only based on available data. Not a recommendation to act. Estimated returns are based on various assumptions about the future and are not a reliable indicator of fund or yield performance and cannot be guaranteed. Aus Gov 1-5yrs is VanEck 1-5 Year Australian Government Bond ETF, Aus Gov 5-10yrs is VanEck 5-10 Year Australian Government Bond ETF, Aus Gov 10-20yrs is VanEck 10+ Year Australian Government Bond ETF, PLUS is VanEck Australian Corporate Bond Plus ETF, FSUB is VanEck Australian Fixed Rate Subordinated Debt ETF.

Key risks: An investment in the ETFs carry risks associated with: interest rate movements, bond markets generally, subordinated debt (FSUB) ,issuer default, credit ratings, country and issuer concentration, liquidity, tracking an index and fund operations. See the PDS for more details.

Please read the target market determination for each fund available at vaneck.com.au to help determine if a fund is appropriate for you.

Published: 02 February 2026

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable product disclosure statement (PDS) and target market determination (TMD) available at vaneck.com.au for more details. Investment returns and capital are not guaranteed.