Have government bond yields peaked in Australia?

San Fransico Fed President Mary Daly said last week that the increase in treasury yields since the Fed’s last official meeting is roughly equivalent to a quarter-percentage point rate increase in the Fed’s short-term rate.

Atlanta Fed President Raphael Bostic reiterated Tuesday; “I actually don’t think we need to increase rates anymore… I think that our policy rate is at a sufficiently restrictive position to get inflation down to 2%.”

Taken together, their ‘dovish’ comments indicate the Fed could be contemplating keeping rates on hold at their meeting later this month.

At home, we are seeing a similar sentiment. Market participants’ pricing reintroduced the possibility of a rate cut, ascribing a 31% chance by December 2024. That was from zero chance last week.

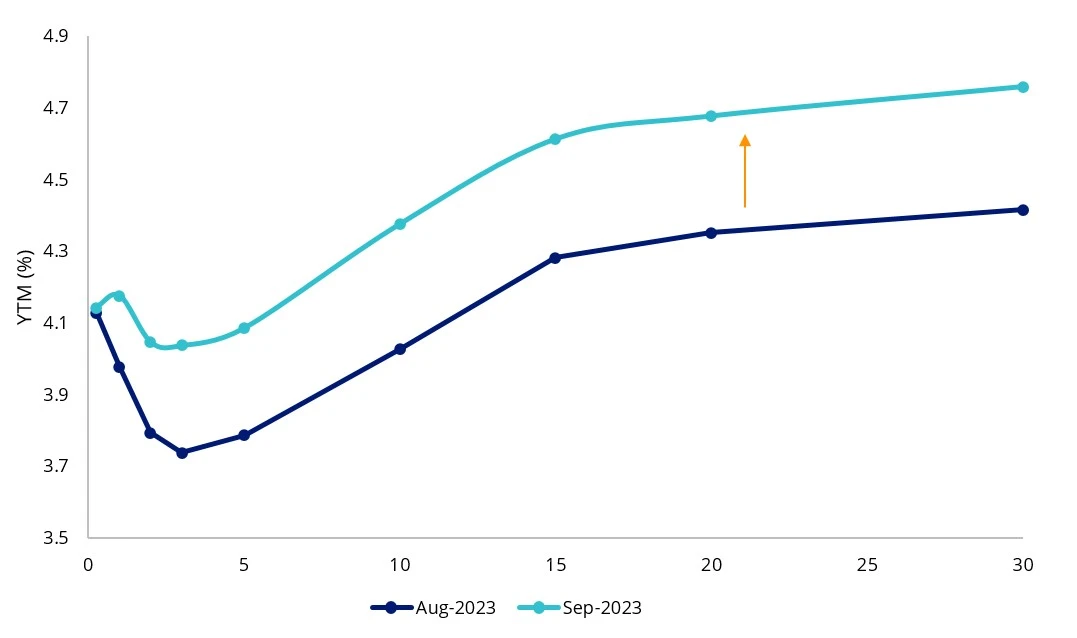

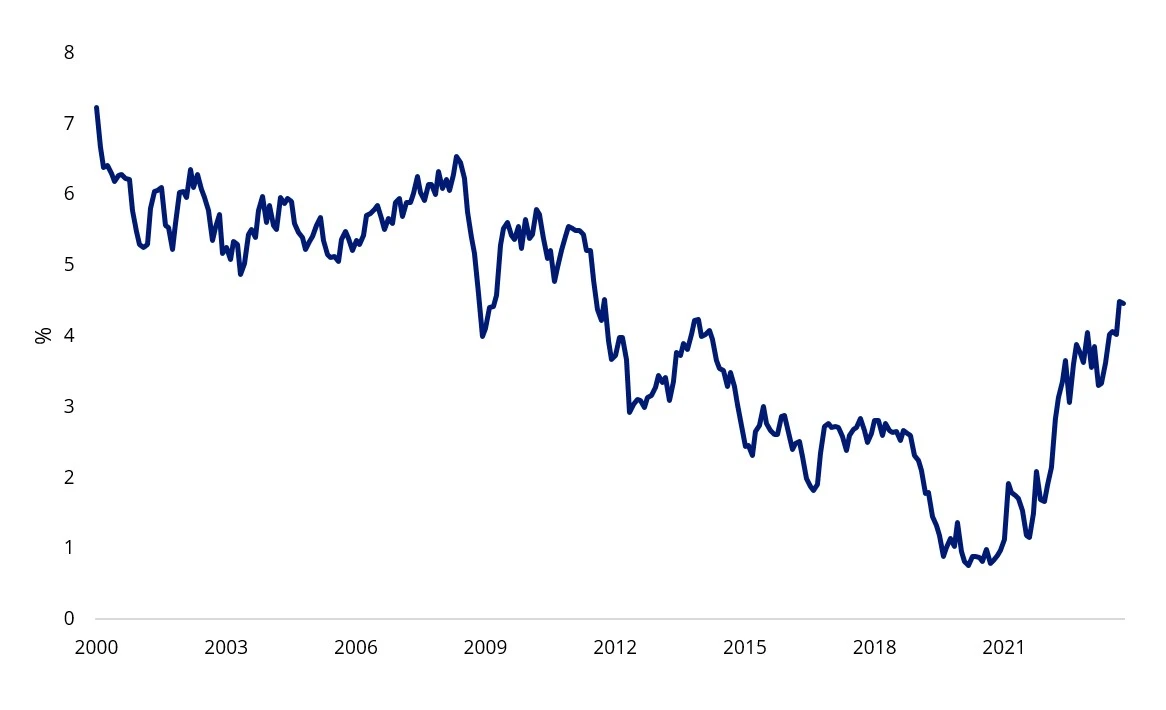

It comes after Australian and US long dated government bond yields surged in September with bond markets pricing in a ‘rates higher for longer’ environment. Despite the rapid increase in the RBA cash rate, the Australian economy has so far proved resilient. The unemployment rate remains near a record low, and wages growth is strong, keeping services and trimmed mean inflation elevated. Many Australian retailers also reported record sales growth for the financial year 2023. Economic strength resulted in the Australian government bond yield curve ‘bear’ steepening. The Australian Government 10-year bond yield has reached its highest point since 2011.

Australian Government yield curve change: Bear steepening – long dated yields have surged

Source: Bloomberg. Yield measures are not a guarantee of future dividend income from the funds.

Australian Government 10-Year Yield: Highest since 2011

So, what does this all mean for bond investors? Could long dated yields fall?

While it is very difficult to time the peak in bond yields, the change in tone from the Fed and market pricing locally creates a compelling opportunity for investors to consider adding longer-duration assets such as Australian government bonds.

And Australian investors have been piling into bonds and fixed income in the last quarter at the highest rate since 2021 according to research house Calastone. Australian bond and fixed income managed funds pulled in about $2 billion in net fund inflows over the quarter. According to the AFR, The bond fund inflows “started in the same month that Australian government bond yields matched the nominal yield from the S&P/ASX200 dividends for the first time in more than a decade.”

“Bond investors are juggling the attraction of locking into high yields now with the apparently receding prospect of capital gains in the short term,” Calastone director Marsha Lee said, commenting on the quarterly report.

The reality is that a sustained period of high rates could have profound implications on Australian economic growth as we head into 2024.

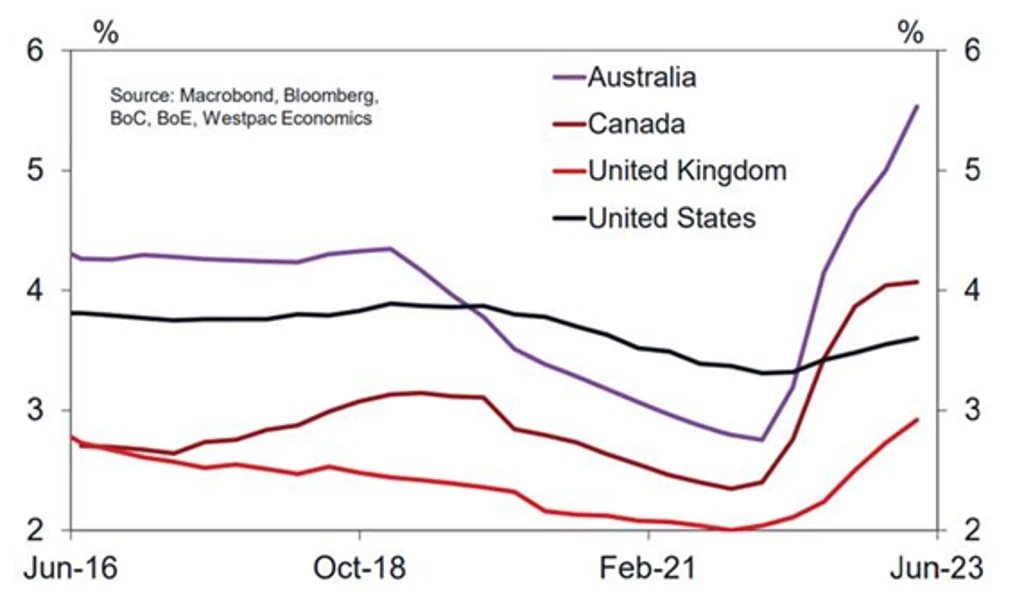

The RBA cash rate increases of 4% over the past 18 months will squeeze Australian household budgets more than global counterparts. RBA Assistant Governor Kent said in a speech on Wednesday, “Required mortgage payments are at a record share of household disposable income and will rise further as more fixed-rate loans expire.” While recent research from the International Monetary Fund (IMF) has found Australians’ mortgage payments by the end of last year consumed the largest share of household income of any country in the developed world. Since then interest rates have gone much higher.

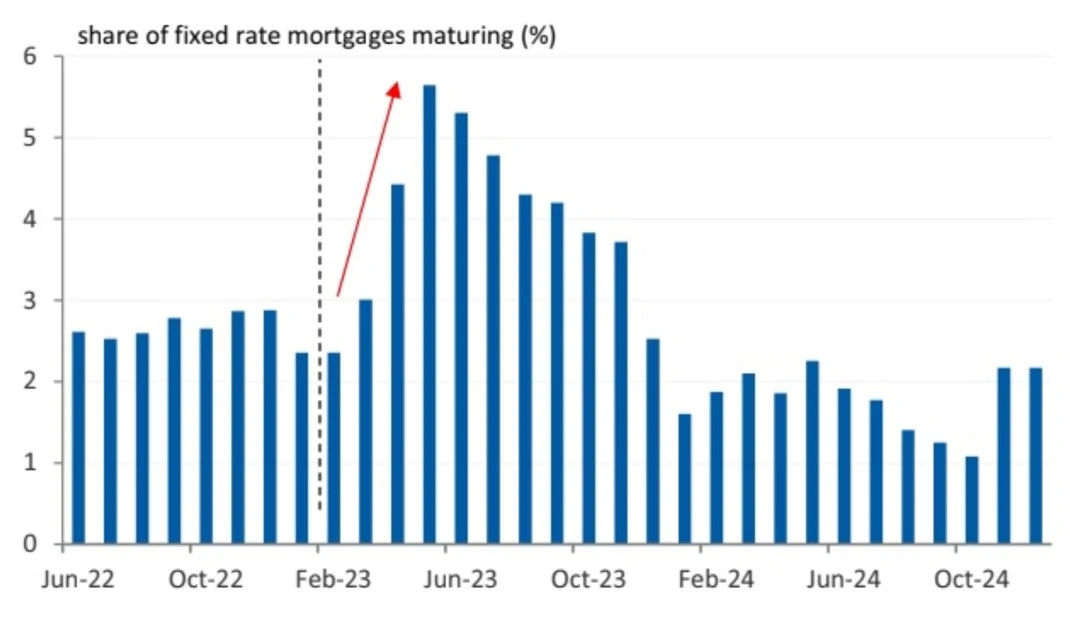

In Australia, the effective mortgage rate is roughly 50% higher than Canada, UK and USA given most of Australian households are on variable as opposed to fixed globally. Plus, the effective rate will increase further with the large proportion of fixed-rate mortgages now ending with the remainder to roll off over the next 12 months.

According to RBA Deputy Governor Christopher Kent, “the effect of slower demand growth on inflation is now building. For example, we are hearing in liaison that a range of retailers are discounting prices in the face of weak consumer spending.”

Effective mortgage rates: Australian 50% higher than global

Source: Westpac

Share of fixed rate mortgages maturing (%): Just passed the peak

Source: Morgan Stanley

The relative difference in mortgage rates suggests the RBA may have gone too hard on rate rises, increasing the chance of long dated Australian government bond yields falling (and prices rising) when economic conditions weaken.

Access to long dated Australian government bonds

One way to benefit is exposure to long dated Australian government bonds. VanEck recently launched three Australian government bond ETFs providing exposure to maturities between 1 to 5 years, 5 to 10 years and 10+ years. The tickers are 1GOV, 5GOV and XGOV respectively.

Key risks

An investment in the ETF carries risks associated with: interest rate movements, bond markets generally, issuer default, credit ratings, country and issuer concentration, liquidity, tracking an index and fund operations. See the PDS for more details.

Published: 18 October 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.