Positioning fixed income portfolios when rates are rising

High inflation and rising rates are scenarios that Australian investors need to brace for in 2026.

In 2026, high inflation and rising rates are scenarios investors need to brace for.

Last week, the RBA raised rates and predicted high inflation could be around for a little while, For fixed-rate bond investors, this is problematic, as a rising rate environment is generally unfavourable for bond returns.

However, cash-like and short-term instruments, including floating rate notes (FRNs) have near-zero interest rate risk, significantly lowering interest rate sensitivity in an investor’s portfolio.

High inflation and rising rates—is it really doom and gloom for bond investors?

High inflation and rising rates are scenarios that Australian investors need to brace for in 2026. Following the RBA’s board decision last week to increase the cash rate by 25bps to 3.85%, Governor Michele Bullock stated that inflation may not return to the target band until 2028 and could surpass 4% this year. Inflation has spiked to 3.8% (Chart 1), while 10-year bond yields have started to rise again (Chart 2). Investors are now grappling with the prospect of a tightening cycle, with markets pricing in another rate rise before the end of the year (Chart 3).

For fixed-rate bond investors, this is problematic, as a rising rate environment is generally unfavourable for bond returns. Bonds are exposed to interest rate or duration risk, which is the potential for investment losses that result from a change in interest rates. If bond yields rise, the value of a bond will decline.

Chart 1: Inflation shot up to 3.8%

Source: ABS, to December 2025; Annual movements before April 2025 are calculated by comparing each quarter to the same quarter in the previous year. From April 2025, these movements are calculated by comparing each month to the same month in the previous year.

Chart 2: Rising Australian Government Bond 10 year yield

Source: Bloomberg, VanEck, as of 31 Jan 2026.

Chart 3: Likely interest rate hikes priced in for 2026

Source: Bloomberg, as of 03 February 2026, after RBA announced its February rate cut.

While the market has priced these rate rises in, investors need to be wary.

Cash and cash-like securities can be a bright spot in a rising-rate environment

In an environment of rising bond yields, short-term money market instruments and floating rate notes (FRNs) can be an effective investment-grade alternative to other fixed-income instruments.

Money market instruments like Australian Government Treasury Notes, Negotiable Certificates of Deposits (NCDs) and Commercial Paper tend to be less susceptible to rate rises, retaining their value. Because they are often issued for short periods, new issues reflect the new, higher interest rate environment.

A new active cash and money markets solution

Last week, VanEck listed its Cash Plus Active ETF (MONY) on ASX. MONY is a portfolio that has been designed to identify yield opportunities across different cash, cash-like instruments and short-duration credit, issuers and individual securities to maximise risk-adjusted returns.

A unique aspect of MONY is its ability to invest in different types of floating rate securities, including subordinated debt, asset-backed securities and residential mortgage-backed securities.

Floating rate notes

Unlike other bonds, which typically pay a fixed coupon, FRNs pay a coupon that adjusts periodically with prevailing interest rates. Because FRN coupons reflect current interest rates, the price of the bonds is not sensitive to changes in rates (much like the short-term money market securities mentioned earlier). As a result, FRN prices have near-zero sensitivity to interest rates, and coupons will increase as rates go up, making them potentially attractive in rising-rate environments. In other aspects, such as credit risk, they are similar to other bonds from the same issuer.

Since FRNs have near-zero interest rate risk due to the periodic coupon reset feature, they can significantly lower interest rate sensitivity in an investor’s portfolio. Naturally, when interest rates fall, FRNs tend to underperform fixed rate.

VanEck offers three types of floating-rate credit securities ETFs.

|

Floating rate credit securities |

||

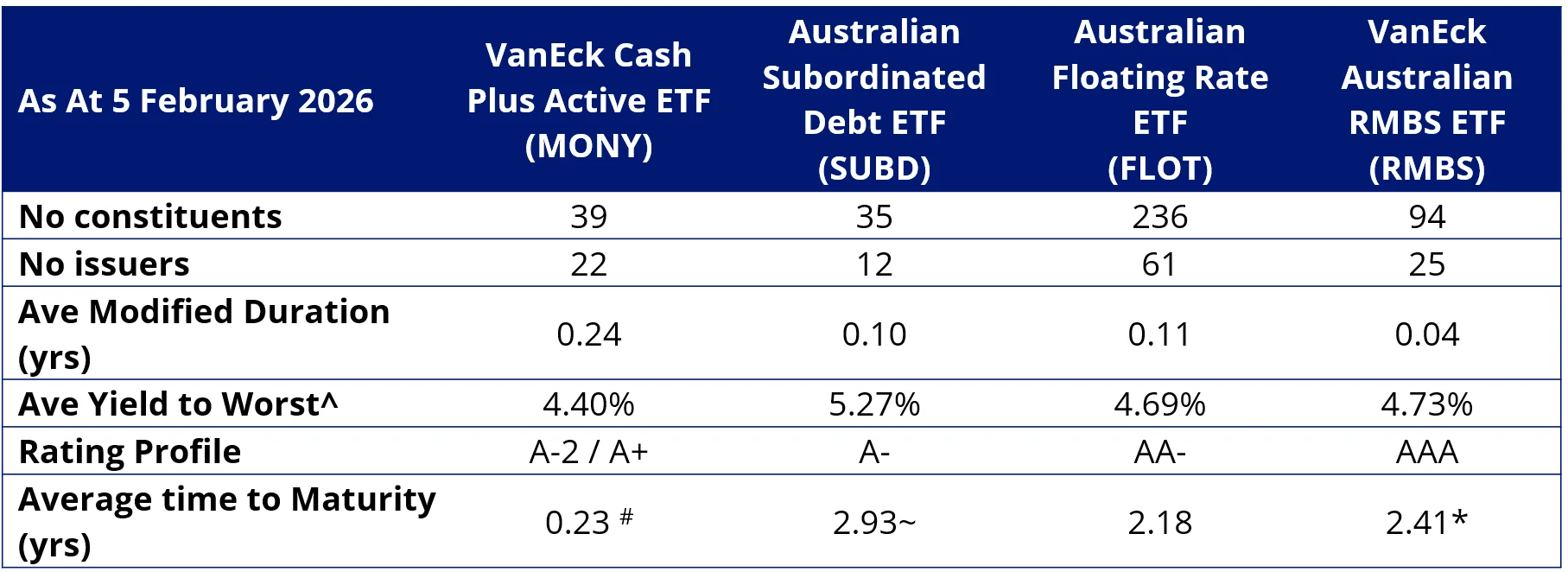

VanEck short-term money market and FRN solutions

Source: VanEck. #Calculated by reference to the maturity date for non-credit securities. For credit securities, it is calculated by reference to the next FRN reset date. ~time to next call; ^yield measures are not a reliable indicator of future dividend income from the funds; *weighted average life (WAL).

Key risks: An investment in the ETFs carry risks associated with: bond markets generally, interest rate movements, issuer default, subordinated debt (SUBD), securitisation market (RMBS), credit ratings, country and issuer concentration, fund operations, liquidity and tracking an index. Your investment in MONY is not protected by any government guarantee.

Please read the PDS and TMD for each fund available at vaneck.com.au to help determine if the fund is appropriate for you.

Related Insights

Published: 10 February 2026

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable product disclosure statement (PDS) and target market determination (TMD) available at vaneck.com.au for more details. Investment returns and capital are not guaranteed.