The case for investing in subordinated debt

Australian subordinated debt has thrived in both tightening and easing rate environments, making a strong case for consideration in fixed income portfolios.

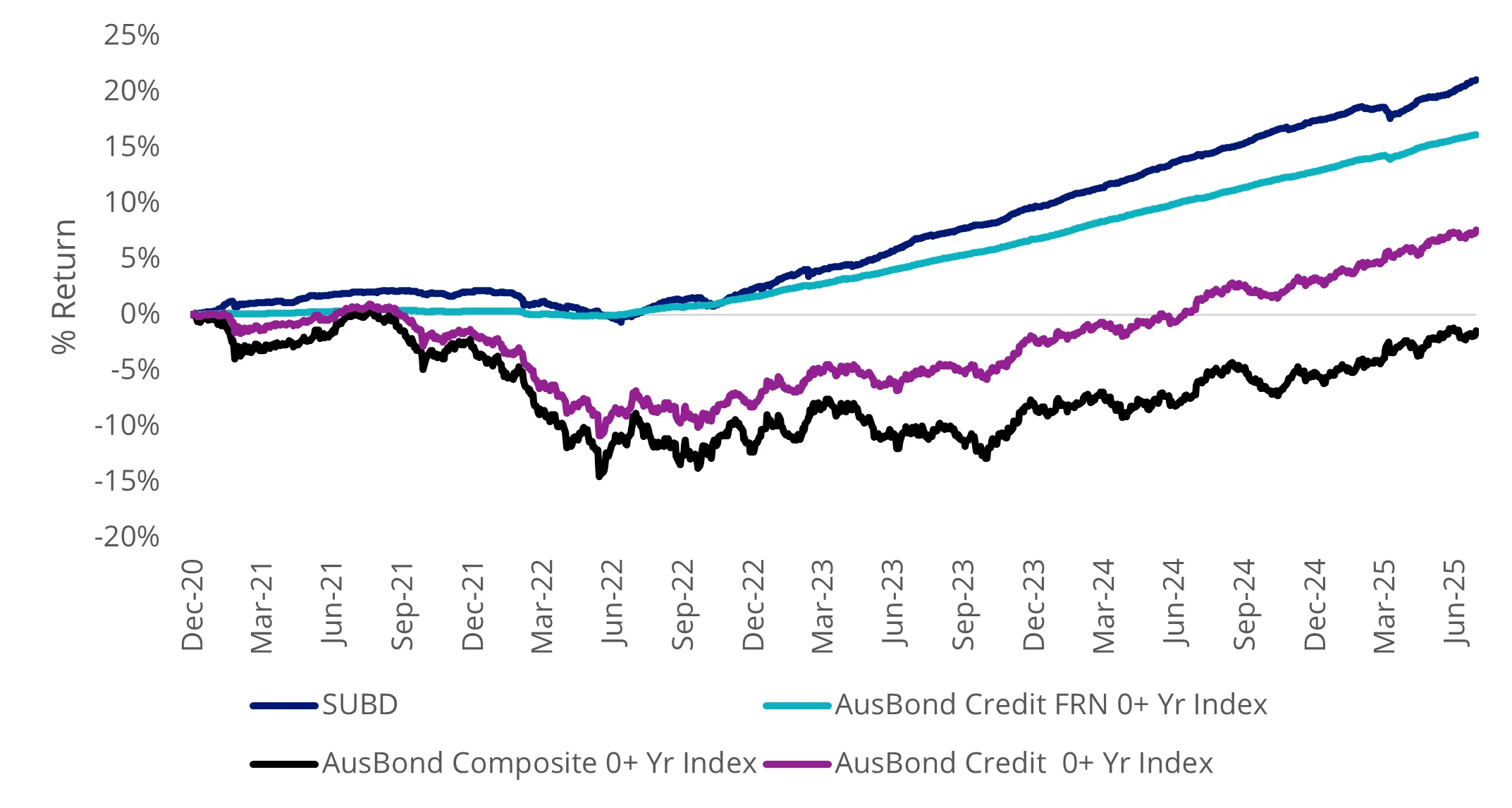

Many fixed income investors will remember the pain of 2022. This was when central banks, including the RBA, increased interest rates to tackle inflation. While supportive for the broader economy, the move led to fixed rate bonds underperforming. Floating rate bonds were the standout performers in this environment, including Australian subordinated debt, with coupons keeping up with rising central bank rates. Since 2021, buoyed by tightening credit spreads and higher yields, subordinated debt as represented by VanEck’s Australian Subordinated Debt ETF (SUBD) has outperformed the fixed rate AusBond composite benchmark by more than 4.5% per annum (as at 30 June 2025).

This point of reflection is important in today’s environment. With US tariffs posing a risk of inflation rising locally, combined with a tight labour market and the RBA’s decision not to cut rates in July, the prospect of longer-dated yields falling is not a foregone conclusion. Given this backdrop, higher-yielding, low-duration asset classes such as floating rate subordinated debt could continue to outperform.

Chart 1: Tier 2 bond performance

Source: Bloomberg, 31-Dec-20 to 30-Jul-25. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. ETF results are net of management fees and costs, but before brokerage fees or bid/ask spreads incurred when investors buy/sell on the ASX. Past performance is not a reliable indicator of future performance.

What is subordinated debt?

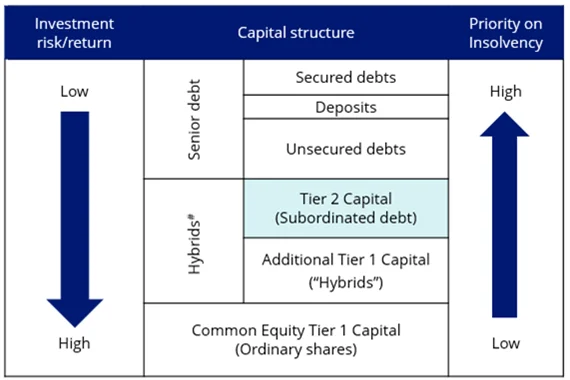

Subordinated debt is issued by banks and insurers as part of their capital structure to meet regulatory requirements, such as those set by the Australian Prudential Regulation Authority (APRA).

Within the capital structure, Tier 2 capital ranks above AT1 instruments (commonly known as hybrids) and ordinary equity. Due to the higher risk profile of subordinated debt when compared to senior paper, Tier 2 typically offers a yield premium relative to senior debt.

Figure 1: Simplified capital structure of a financial institution

#Per ASIC Report 365.

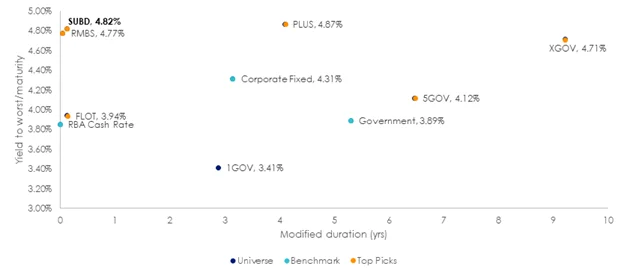

Yield comparison

Floating rate subordinated debt currently offers a yield premium of ~100 basis points above the RBA cash rate1 and is one of the highest yielding asset classes across VanEck’s Australian fixed income suite.

Chart 2: The yield premium offered by subordinated debt relative to other fixed income strategies

VanEck fixed income ETF yield vs duration relative to benchmark

Source: Bloomberg, data as at 30 June 2025. FLOT is Bloomberg AusBond Credit FRN 0+ Yr Index, Corporate Fixed as Bloomberg AusBond Credit 0+ Yr Index, SUBD is iBoxx AUD Investment Grade Subordinated Debt Mid Price Index. 1GOV, 5GOV & XGOV are S&P/ASX iBoxx Australian & State Governments indices. PLUS is iBoxx AUD Corporates Yield Plus Mid Price Index. RMBS is ICE 0.5-3 Year AAA Large Cap Australian RMBS Index. Past performance is not indicative of future results.

Australian Tier 2 market

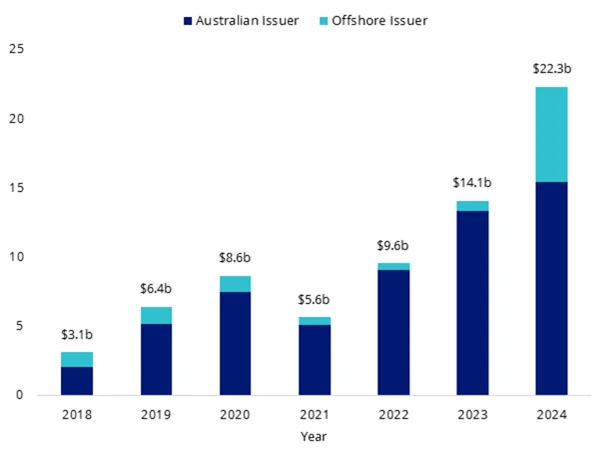

The Australian Tier 2 market has expanded significantly since APRA introduced its Total Loss Absorbing Capacity (TLAC) framework in 2019. This growth has been underpinned by APRA’s increased Tier 2 target of 6.5% of total RWAs on the back of these reforms.

Despite a significant increase in issuance, the market has readily absorbed the additional supply. In particular, 2024 saw issuance volumes increase ~60% YoY. Notably, a significant portion of this growth was driven by foreign bank participation in the AUD T2 market, drawn by attractive pricing and strong investor demand. The increase in issuance has further supported the Australian market’s depth and liquidity.

Recently, APRA announced plans to phase out the use of ASX hybrid instruments to simplify bank capital structures and improve their effectiveness in times of stress. As a result, major banks are expected to replace their ASX hybrids with predominantly Tier 2 capital. This transition is projected to further expand the domestic Tier 2 market to ~$40b by the end of the implementation period in 2032.

Chart 3: AUD Tier 2 issuance

Source: Bloomberg, as at 31 December 2024.

Access subordinated debt

VanEck’s Australian Subordinated Debt ETF (SUBD) is the largest ETF of its kind in Australia, managing more than $2.5 billion in assets. The fund invests in Australian dollar-denominated, floating-rate subordinated debt (Tier 2), subject to an issuance size in excess of $500m. SUBD exclusively holds Tier 2 capital instruments that comply with APRA regulations or equivalent standards set by foreign regulators. This includes both insurers and banks.

Key risks: An investment in our Australian Subordinated Debt ETF carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the VanEck Australian Subordinated Debt ETF PDS and TMD for more details.

Source:

1Subordinated debt is not cash-like and should not be considered as a cash substitute.

Published: 01 August 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

S&P Dow Jones Indices LLC or its affiliates (“SPDJI”). SPDJI is not a related body corporate of VanEck.

The iBoxx AUD Investment Grade Subordinated Debt Mid Price Index (“the Index”) is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and licensed for use by VanEck. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed by VanEck. The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of them makes any representation regarding the advisability of investing in the Fund. Such parties do not accept liability for any errors, omissions, or interruptions of the Index and do not give any assurance that the Fund will accurately track the performance of the index or provide positive investment returns. Inclusion of a security within the index or Fund is not a recommendation by any party to buy, sell, or hold such security.