The bonds getting interest – pun intended

We are in the middle of a major structural shift for Australian banks.

A new product, launched last week, adds another portfolio construction tool to help investors benefit from this shift.

Since APRA called time on hybrids, investors have been considering how to approach their existing allocation to bank capital. Tier 2 capital, which sits higher in the capital structure, could be a consideration for investors. And among Tier 2 funds, the VanEck Australian Subordinated Debt ETF (ASX: SUBD) is the original. This past week, its sister fund, the VanEck Australian Fixed Rate Subordinated Debt ETF (ASX: FSUB) debuted on ASX.

When we launched SUBD in 2019, Tier-2 debt was a growing market after APRA implemented its rules consistent with the international regulatory framework, known as Basel III, that was formulated after the GFC to prevent a similar crisis.

Interest in the Tier-2 subordinated debt market increased more recently when APRA called time on hybrids.

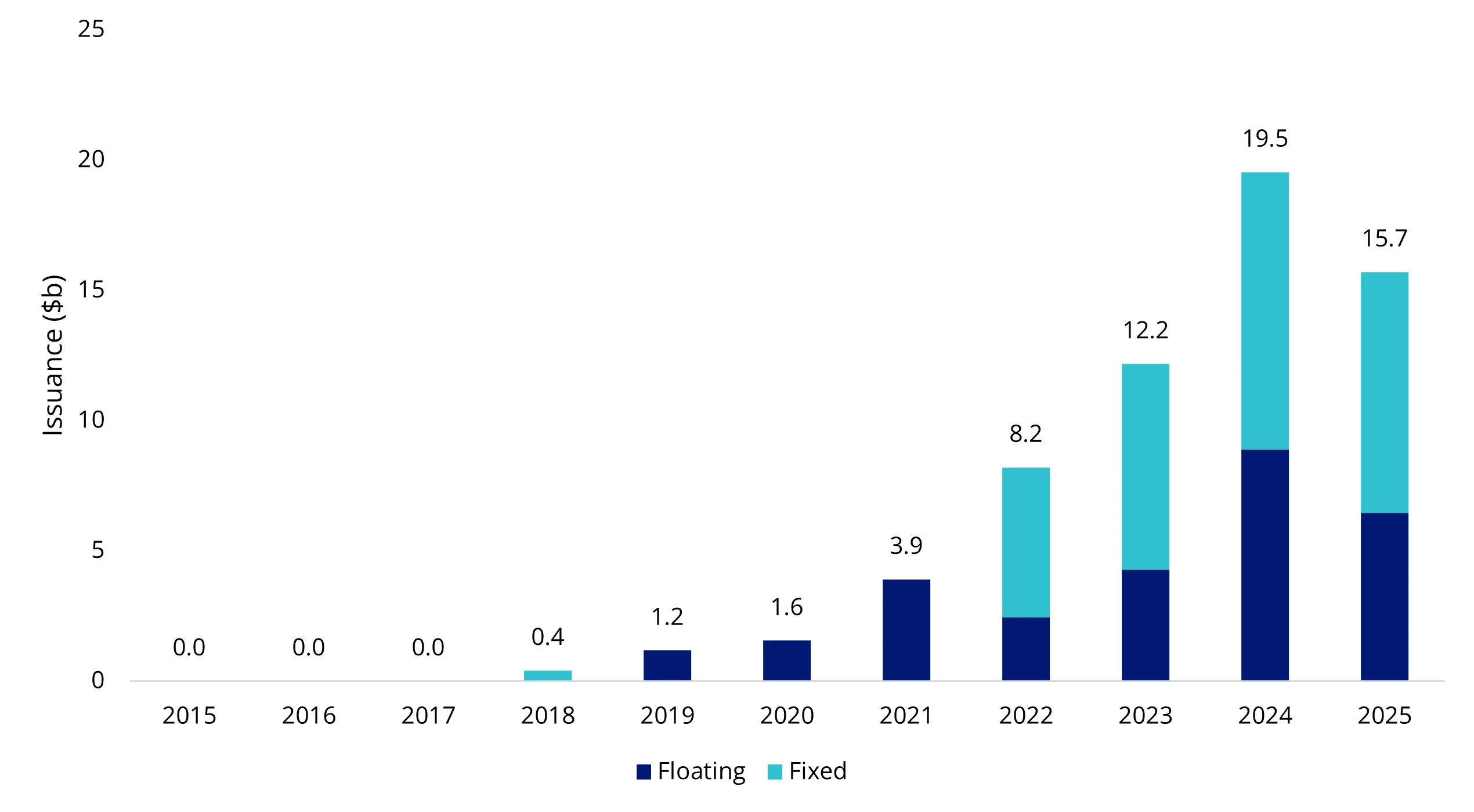

In the interest rate environment of 2019, most subordinated debt issuance was floating-rate. As a result, the index SUBD tracked only included floating-rate notes. However, as the interest rate environment normalised, investor demand shifted toward fixed-rate issuance, prompting Australia’s big four banks to begin issuing fixed-rate subordinated debt in 2022. Since then, it has become common for banks to issue both fixed and floating-rate subordinated bonds, as shown in the chart below.

Chart 1: AUD Subordinated Debt Issuance by Calendar Year

Source: Bloomberg. As at 21 November 2025. This is not a recommendation to act.

We think this is an opportunity for investors. So last week we launched FSUB to enable investors to access a portfolio of investment-grade credit quality fixed-rate subordinated bonds issued by leading banks and financial institutions. These securities sit within the regulated capital structure and qualify as Tier 2 Capital.

Looking ahead, we anticipate that major banks will continue to transition hybrids into Tier 2 debt, as they are called. As the Tier 2 market gets bigger, there will be more demand for these bonds. As Tier 2 bonds trade over the counter (OTC), not on an exchange, there are limited ways investors can access them. ETFs like SUBD and FSUB are allowing investors to access these opportunities. As noted above SUBD includes only floating rate subordinated bonds, while FSUB includes only fixed rate subordinated bonds.

The difference between fixed and floating rate bonds

The key differentiator between floating rate bonds and fixed rate bonds is that the interest coupon payment is variable, that is it changes.

Most bonds carry a fixed coupon interest rate. This means for fixed-rate bonds, the coupon interest rate from the time the bond is issued through to its maturity does not change.

An example of a fixed-rate bond could be one that has a fixed 5% coupon interest rate. This means it will pay investors $5 a year per $100 face value amount in coupon interest payments.

With floating rate bonds, the coupon interest rate is variable, or ‘floating’, which means it tracks short-term interest rates.

This has the effect of preserving the capital value of the bond in a rising interest rate environment. Floating rate coupon interest rates are most commonly set by reference to the 90-day bank bill swap rate (BBSW). For example, a floating rate bond may be issued with a face value of $100 with a coupon of ‘3-month BBSW + 1%’.

This means coupon payments will increase if the benchmark 3-month BBSW interest rate rises or decreases as the 3-month BBSW interest rate falls. The coupon interest rate of a floating rate bond is usually reset each quarter to capture any changes in the benchmark BBSW.

Tier 2 capital and the buffer it provides

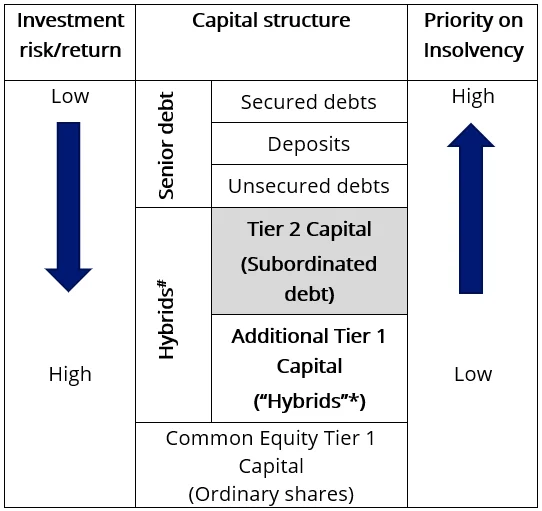

Banks can issue both fixed and floating rate subordinated bonds. Subordinated bonds do have a key difference from other bonds that banks issue. In times of financial stress, they can be converted to shares, or they may be written off completely. They are called ‘subordinated’ because they sit below ‘senior debt’ or traditional bonds in the capital structure, but they also sit above, and take priority over, ordinary shares and hybrids in the event of insolvency. See the shaded area in the chart below. For this reason, subordinated bonds carry more risk than deposits and traditional bonds but are considered less risky than shares and other hybrids.

The following chart provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by financial institutions rank in priority of payment in the event of collapse.

Chart 2: Simplified capital structure of a financial institution

#Per ASIC Report 365. *Per market convention.

How to access the Australian subordinated debt market

There are now two ways to access the Australian subordinated bond market.

1 - SUBD launched in 2019 on ASX, giving investors access to a portfolio of floating rate investment-grade subordinated bonds via a single trade on ASX. Since its launch, SUBD has grown to over $3.1 billion, establishing itself as the go-to subordinated debt strategy.

2 – FSUB launched last week on ASX, giving investors access to a portfolio of fixed rate investment-grade subordinated bonds via a single trade on ASX.

For investors, subordinated bonds can serve two important roles in a portfolio:

- Increase return for a commensurate increase in risk – for investors with large holdings of traditional senior bonds, who are willing to take more credit risk, subordinated bonds issued by financial institutions can enhance income;

- Decrease risk – for investors with large holdings in hybrids or bank shares who are seeking to reduce their overall risk, subordinated bonds may perform a useful role.

Key risks: An investment in the ETF carries risks associated with: subordinated debt, bond markets generally, interest rate movements, issuer default, credit ratings, fund operations, liquidity and tracking an index. See the PDS and TMD for details.

SUBD is likely to be appropriate for a consumer who is seeking capital preservation and a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 3 years, and has a medium risk/return profile.

FSUB is likely to be appropriate for a consumer who is seeking regular income distribution, is intending to use the product as a core, minor or satellite allocation within a portfolio, has an investment timeframe of at least 3 years, and has a medium risk/return profile.

Published: 12 December 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.