All about that base in shaky markets

2025 brings back market volatility and stagflation fear. In this environment, smart investors are shifting their focus to global listed infrastructure assets.

Thus far, 2025 has been characterised by market volatility and stagflation fear1. In this environment, smart investors are shifting their focus to global listed infrastructure assets.

Investors have long favoured listed global infrastructure in times of uncertainty due to its defensive characteristics, including predictable cash flows, inflation-linked revenue streams, lower correlation of broader equities and structural public and private capital commitment.

These properties have led listed global infrastructure (represented by the FTSE Developed Core Infrastructure 50/50 Hedged to AUD Index) to outperform developed market equities in 2025. As of 23 May 2025, it has gained 5.28%, compared to 1.62% for the MSCI World ex Australia $A Hedged Index and 4.40% for the S&P/ASX 200 Index. On the fixed income side, the Australian and International Fixed Income indices delivered 2.19% and 0.09% respectively, as represented by the Bloomberg AusBond Composite Index and the Bloomberg Barclays Global Aggregate Total Return Index $A Hedged.

Although the year-to-date outperformance could be skewed by short-term reaction to extreme US tariff aggression, it represents a sneak peek of the playbook in times of heightened market volatility driven by tariff uncertainty, US fiscal pressure and geopolitical risk.

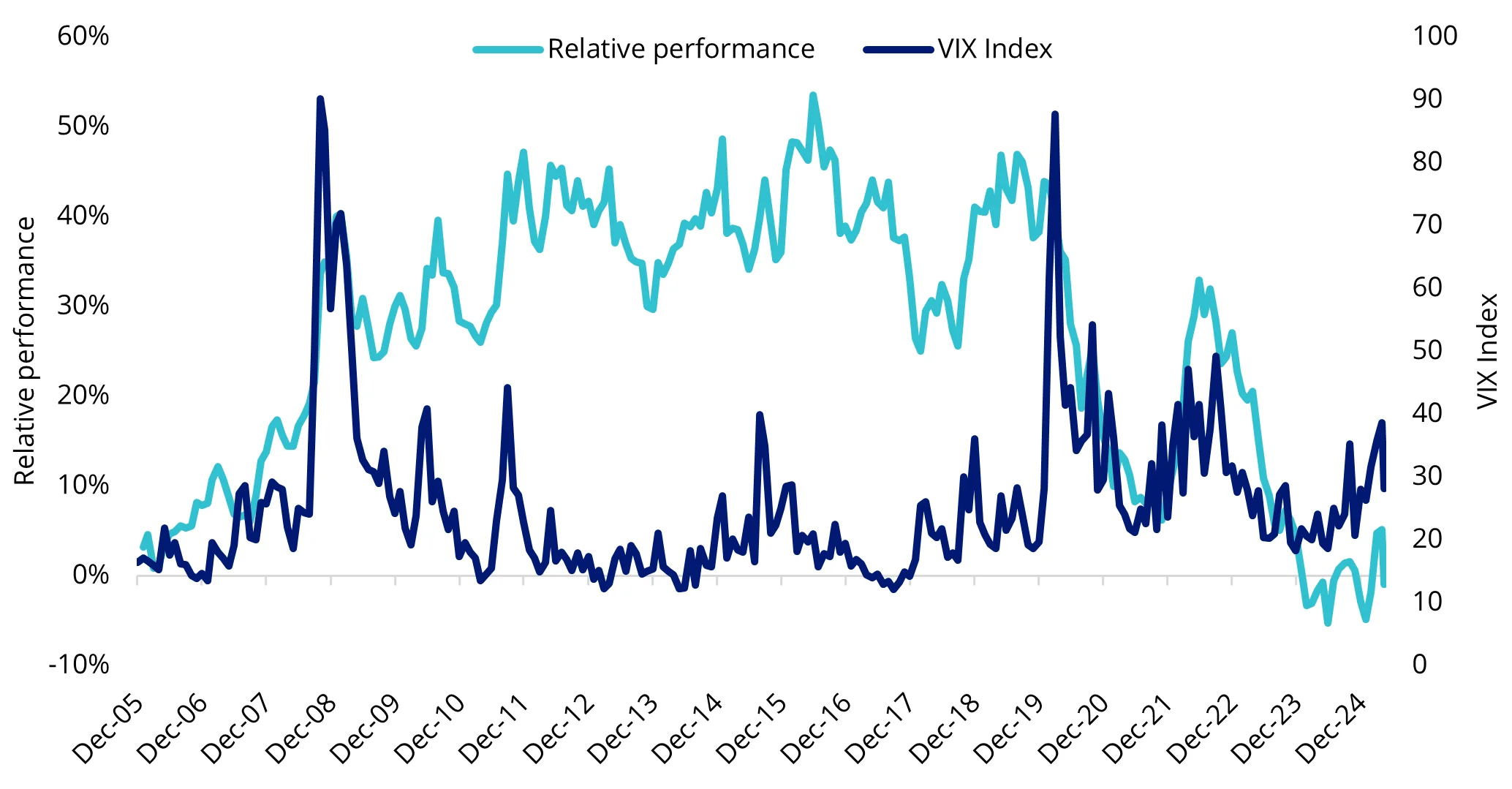

The chart below highlights that listed global infrastructure typically outperforms developed market equities when volatility spikes as represented by the VIX index. This was evident during the later stage of the US-China trade war under Trump 1.0 (from 31 October 2018 to 31 October 2019), where infrastructure outperformed by 4.42%, as well as during various market shocks such as the Global Financial Crisis and 2022 inflation surge.

Chart 1: Listed infrastructure outperformed broader developed market equities amid volatile times

Source: VanEck. Bloomberg. Relative performance is calculated using the performance data of the FTSE Developed Core Infrastructure 50/50 100% Hedged to AUD Net Tax Index and MSCI World NR AUD Hedged Index. Performance in AUD. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Looking at the fundamental health and valuations of this sector, the chart below highlights an increasingly appealing entry opportunity. Following the 2022-2023 global central bank tightening cycle, which led to a sharp P/E compression and rising income yield, the global listed infrastructure sector now offers an income yield close to and valuations below its long-term average respectively.

Chart 2: Income rising back to long-term average and valuations look cheap

Source: VanEck. Bloomberg. Date as of 14 May 2025. Data is the FTSE Developed Core Infrastructure 50/50 Hedged to AUD Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Broad income sources through diversified assets

Several factors contribute to the long-term resilience and growth potential of global infrastructure. Broadly, the sector represents a range of assets, from toll roads to airports, from broadcasting towers to railways, each of which can provide unique defensive characteristics. Diversification across different infrastructure segments enables investors to reap income that adjusts throughout economic cycles and different interest rate environments.

Infrastructure operators, for instance, are typically large, with little competition and protected by high barriers to entry. Some infrastructure companies’ revenues are linked to economic activity, such as railway operators and airports which usually benefit from increased traffic. Others, such as toll roads, have income linked to inflation. Utilities that provide electricity, gas or water typically have earnings that are regulated based on their costs. As those costs rise, so do their revenues.

A well-diversified portfolio of infrastructure securities will therefore continue to generate consistent income throughout the market cycle. Institutional investors, such as large super funds, have used infrastructure for years as an alternative to traditional assets such as equities and bonds.

Looking ahead, in an environment of rising inflation expectations, falling global confidence in US exceptionalism, and escalating geopolitical conflicts, real assets such as infrastructure are regaining momentum. Listed infrastructure could offer effective protection through inflation-linked cash flows, defensive characteristics, and exposure to long-term public and private capital commitments, as countries prioritise building out critical infrastructure networks to protect their economic and political autonomy.

Chart 3: Global listed infrastructure outperformed broader equities when inflation expectations rose

Source: VanEck. Bloomberg. GLI is FTSE Developed Core Infrastructure 50/50 100% Hedged to AUD Net Tax Index. Global equities is MSCI World Index. Performance in AUD. The three time periods are 30 September 2010 to 30 June 2011; 31 December 2020 to 30 June 2022: and 31 December 2024 to 30 April 2025.

VanEck provides investors with a simple way to access a portfolio of 135 global infrastructure securities via the VanEck FTSE Global Infrastructure (AUD Hedged) ETF (IFRA). IFRA was the first global infrastructure ETF on ASX, providing investors exposure to a diversified portfolio of infrastructure securities listed on exchanges in developed markets around the world, with inflation-linked and regulated income that is AUD hedged.

Key risks: An investment in our global infrastructure ETF carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, currency hedging, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck FTSE Global Infrastructure (AUD Hedged) ETF PDS and TMD for more details.

Source:

1Gold in times of turmoil: The impact of tariffs and uncertaintyPublished: 27 May 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.