Don’t judge A-REITs by their index

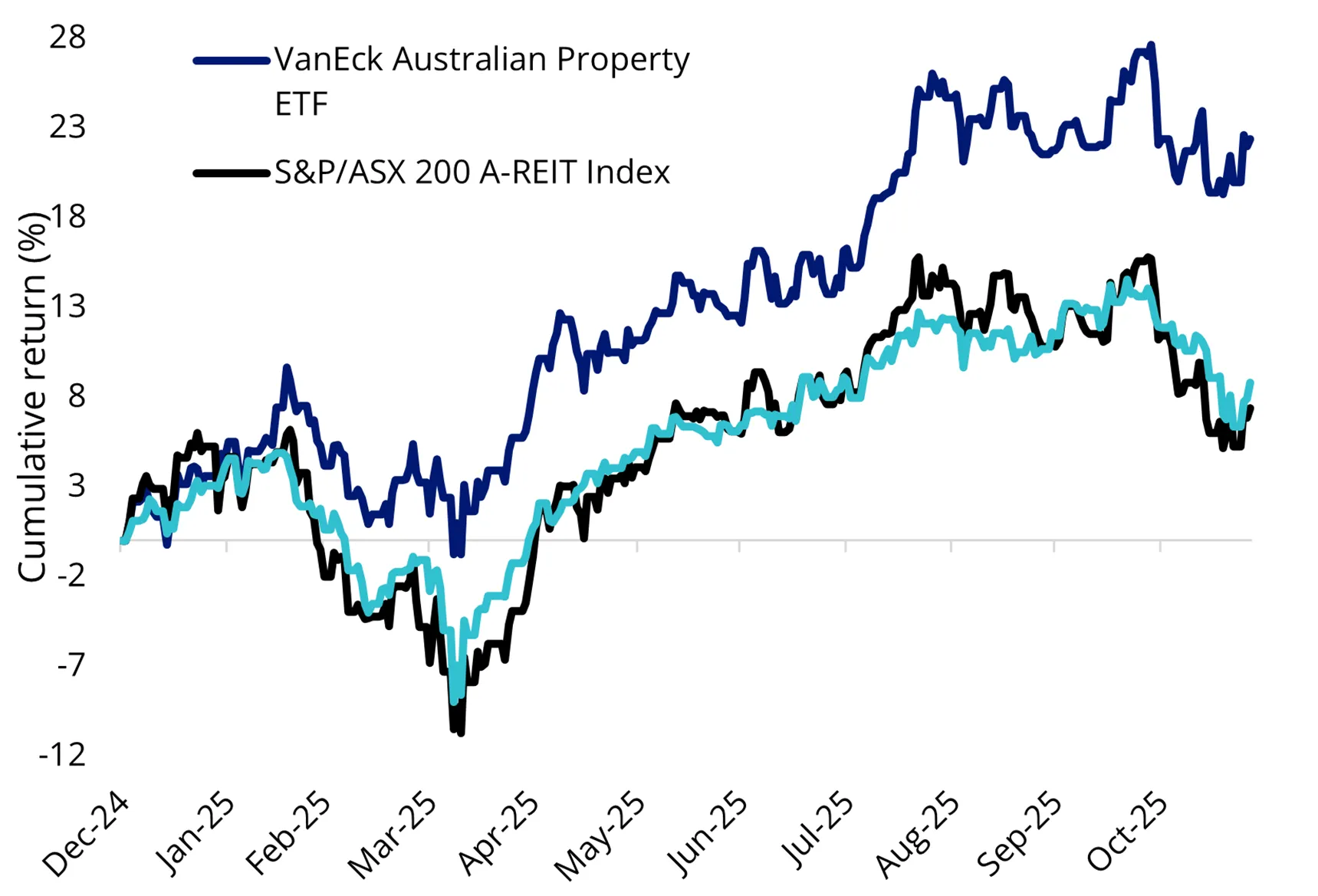

So far in 2025, the S&P/ASX 200 Index has returned 8.8%, outperforming the S&P/ASX 200 A-REIT Index, which has returned 7.38% (source Morningstar Direct, data to 26 November 2025). But it would be a misnomer to suggest that Australian Real Estate Investment Trusts (A-REITs) have been having a relatively poor 2025. The VanEck Australian Property ETF (MVA), which tracks a different A-REIT index, has returned 22.38% over that same time.

Chart 1: Year-to-date performance

Source: Morningstar Direct as at 26 November 2025. Results assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF and taxes. You cannot invest directly in an index. Past performance is not a reliable indicator of future performance of the MVA Index or MVA. The S&P/ASX 200 A-REIT Index is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the largest A-REITs in Australia, from the S&P/ASX 200, weighted by market capitalisation. MVA’s index measures the performance of the largest and most liquid ASX-listed A-REITs, with a maximum weight of 10% in each security at rebalance. MVA’s index has fewer A-REITs and different property sector allocations than the S&P/ASX 200 A-REIT Index. The S&P/ASX 200 Index is shown for information and discussion purposes only and is not a comparable benchmark for MVA.

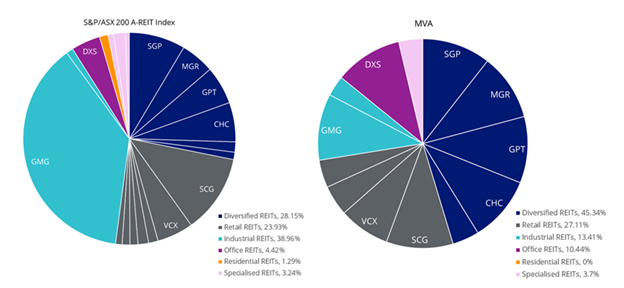

The problem is that the S&P/ASX index data disguises the performance of smaller securities due to its construction methodology. Goodman Group (GMG), by far the largest A-REIT on ASX, represents over 40% of the benchmark Australian A-REIT Index. MVA offers a more balanced approach with increased exposure to office, retail, and diversified subsectors, and it caps constituents at 10% so that one single REIT or subsector does not dominate.

Chart 2: Subsector breakdown

Source: FactSet, 31 October 2025

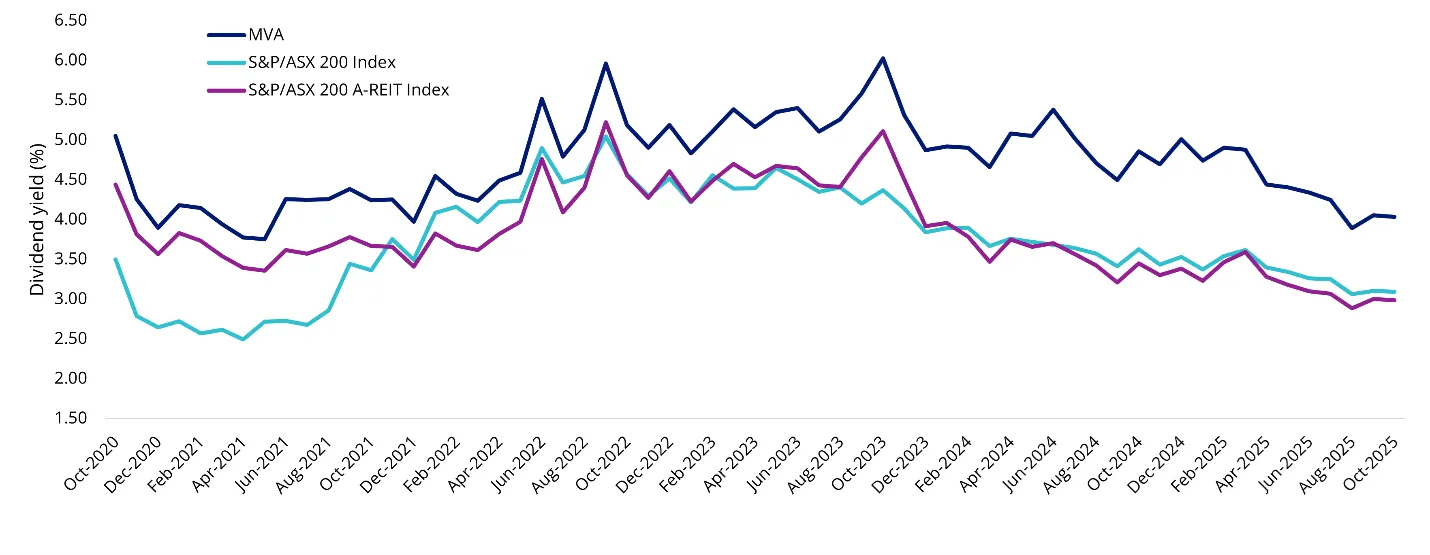

Attracted to yield

Diversification is not the only consideration for A-REIT investors. In the past, Australian investors have considered A-REITs for the steady income they pay, which is linked to rental income. Investors in funds tracking the S&P/ASX 200 A-REIT Index, or similar, may have been disappointed by its dividend yield over the past few years, barely yielding above the broader equity market. MVA’s more balanced approach makes sense if you are allocating to A-REITs for their yield, because Goodman has dragged the income of the benchmark index with one of the lowest dividend yields in the sector (currently less than 1% according to FactSet, data to 26 November 2025).

Chart 3: Dividend yield

Source: FactSet, 31 October 2025. For MVA and S&P/ASX 200 A-REIT Index, the dividend yield is the weighted average of each portfolio security’s distributed income during the prior twelve months. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Tailwinds for the sector

We believe that there are several tailwinds supporting the A-REIT sector. These include:

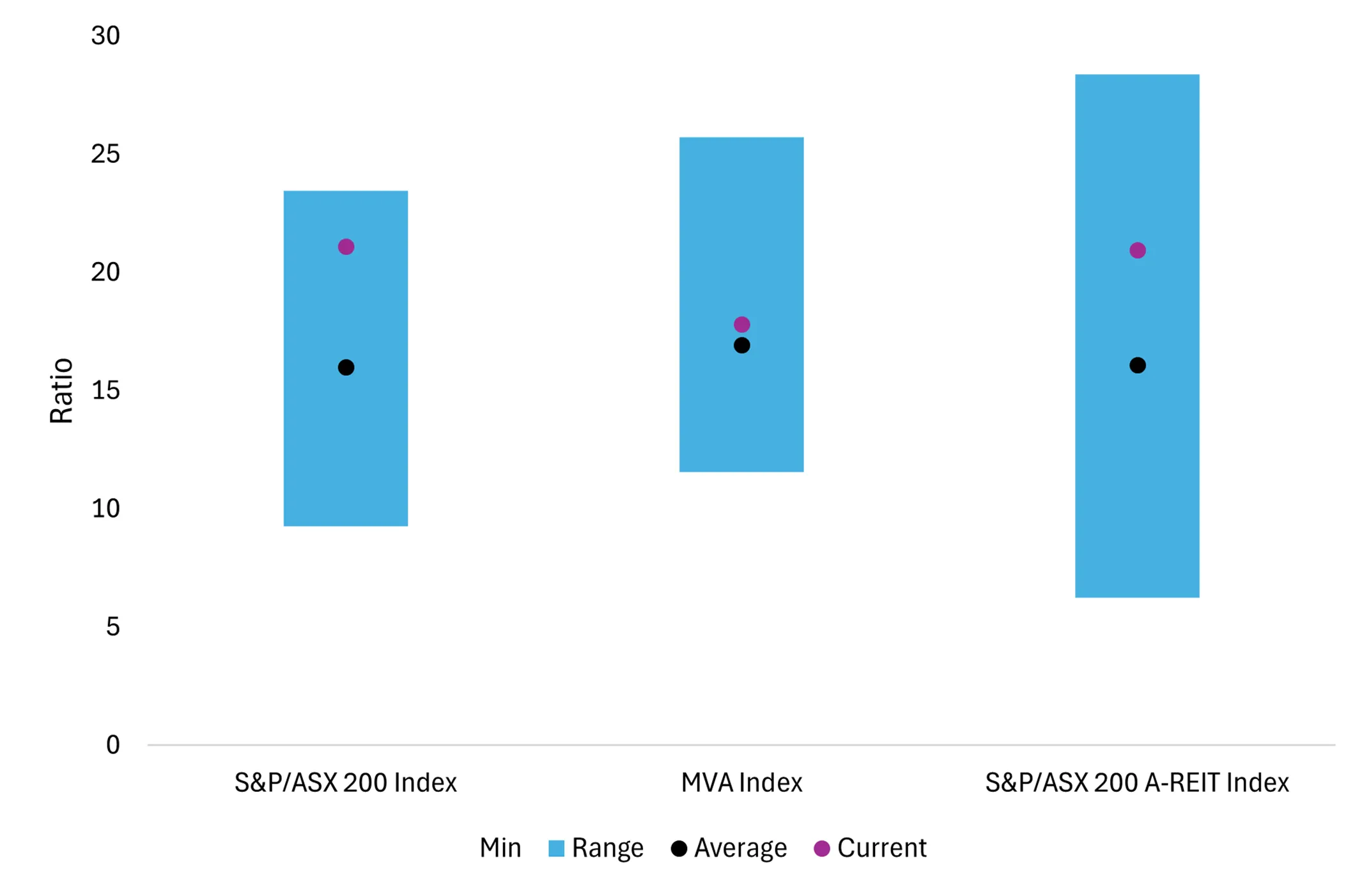

- Valuations, as the sector is relatively cheap relative to the broader equity markets,

- 10-year Australian Government bonds are hitting highs; should these pull back, it may be supportive of the sector; and

- Trends within office and retail sectors, of which MVA is overweight, continue to be positive for the sector.

We think, with the 10-year Australian Government Bond yield creeping above 4.50% to a 6-month high, a properly diversified Australian property portfolio may outperform the broader equity market into and through 2026, should long-dated yields fall as we’ve seen in the US recently.

On a forward price to 12-month earnings basis, the valuations in A-REITs do not appear as stretched as the broader index, far away from historical highs. It is worth noting, considering this metric, MVA’s index is closer to its historical average.

Chart 4: Price to 12m forward earnings

Source: VanEck, Bloomberg to 25 November 2025

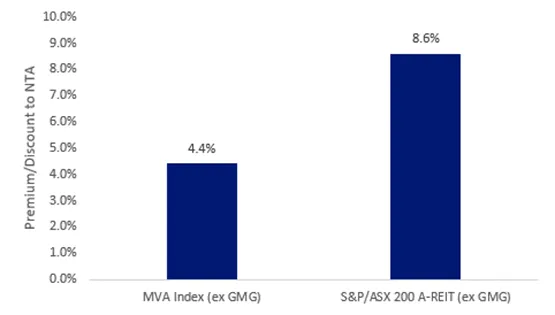

When you consider a more traditional metric for A-REITs, such as price to NTA, MVA again is cheaper than the S&P/ASX 200 A-REIT Index, accounting for GMG.

Chart 5: Price to Net Tangible Assets (NTA)

Source: VanEck, Bloomberg to 25 November 2025

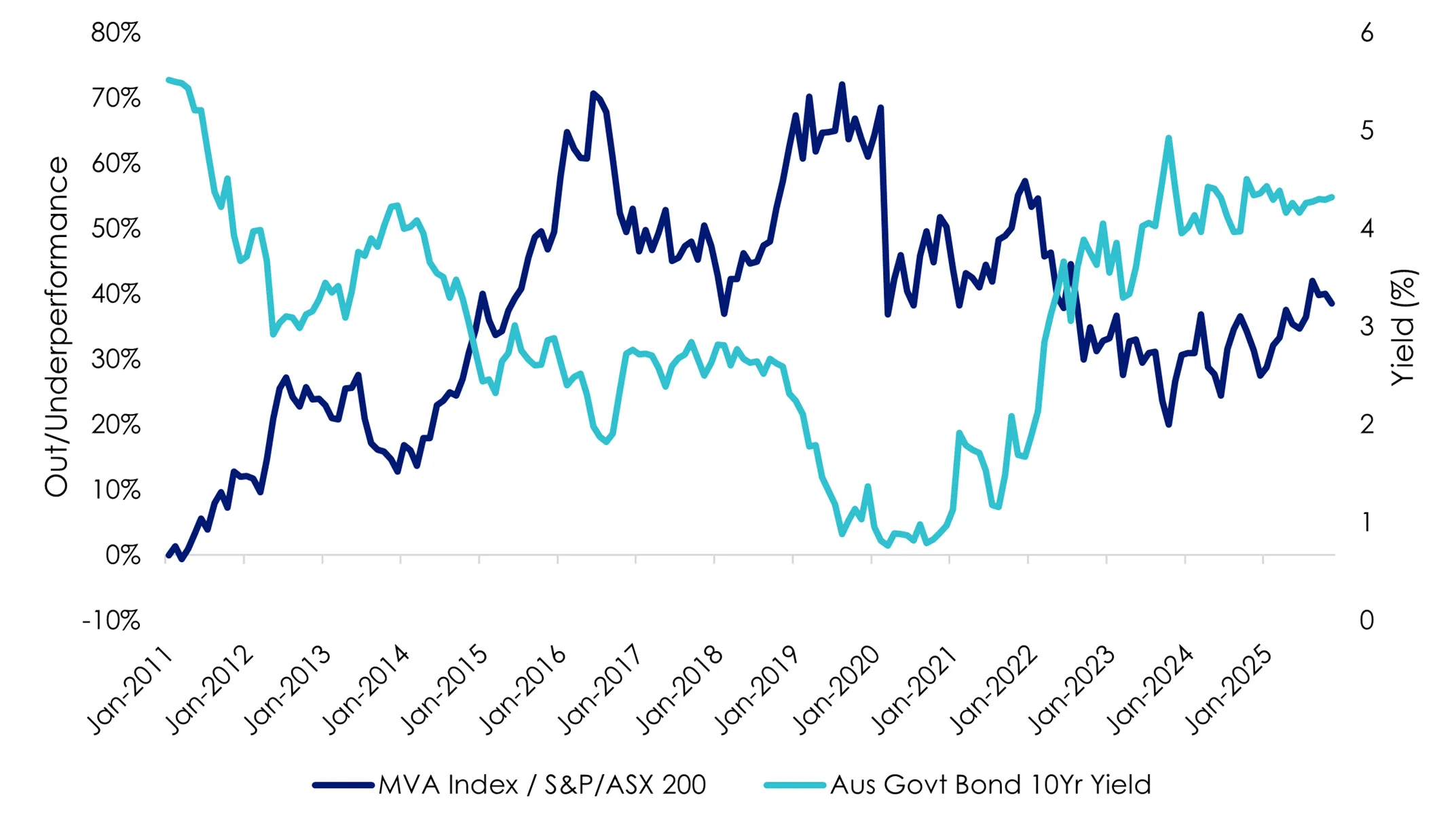

There tends to be an inverse correlation between MVA’s outperformance of the broad Australian equity market and 10-year Australian Government bond yields. 10-year yields have been creeping up recently, and should these pull back, it could benefit the companies in MVA.

Chart 6: MVA performance versus Aus 10 year yield

Source: VanEck, Bloomberg to 25 November 2025. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

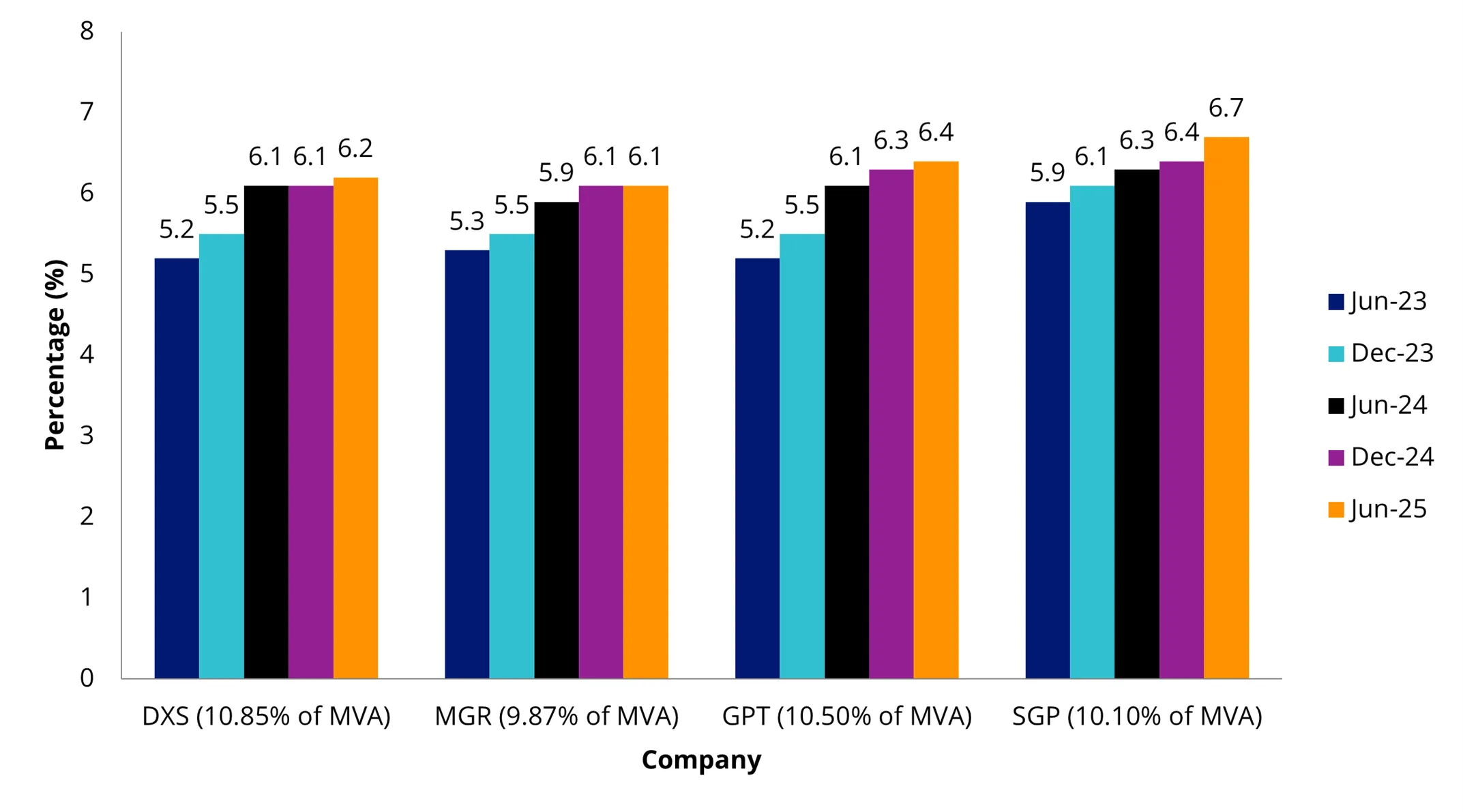

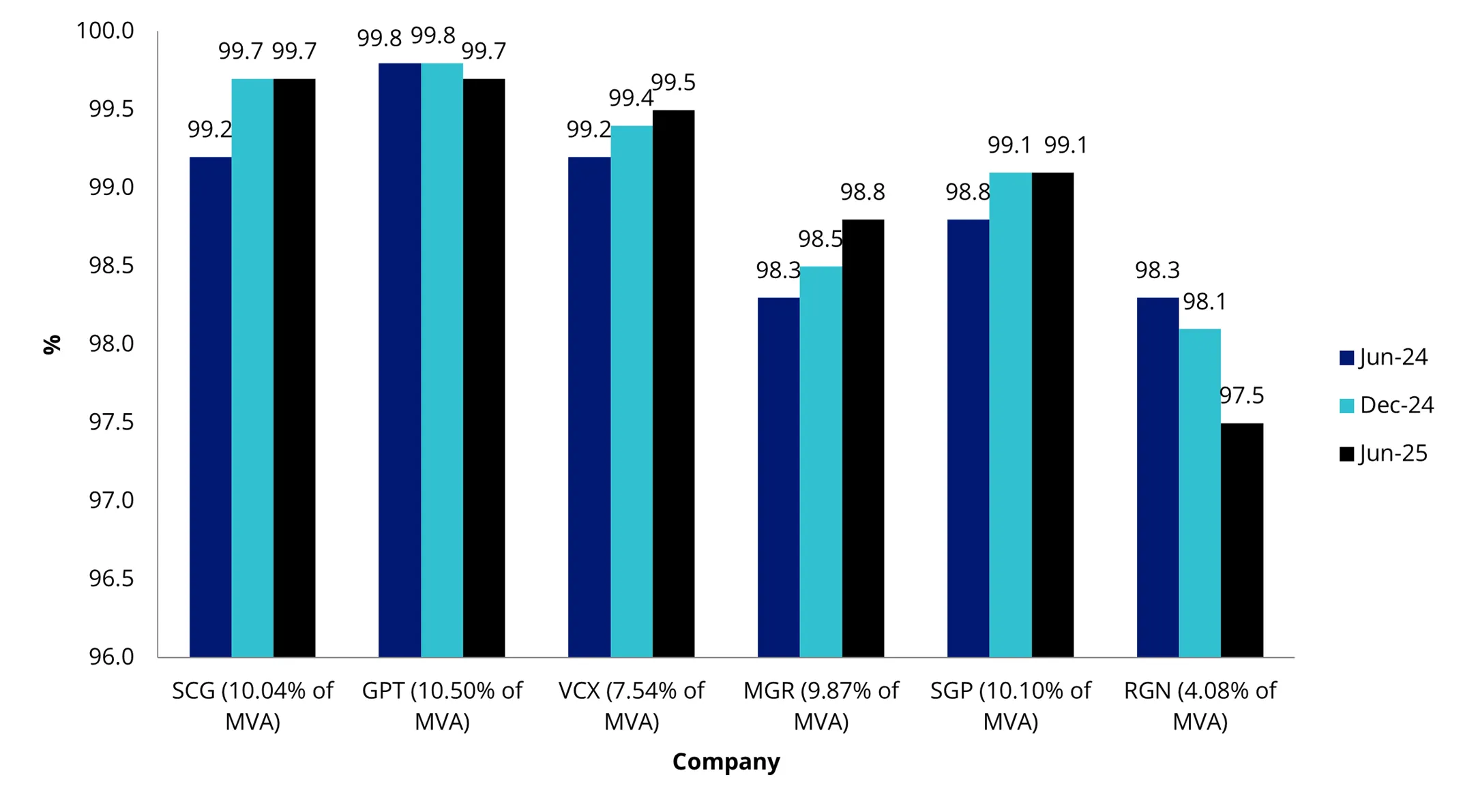

You may have noted in Chart 2 that MVA has significant exposure to Diversified REITs. These are REITs that operate many different types of properties, including across the office and retail sub-sectors, of which MVA is already overweight. You can see in the below that within these sectors, companies, including the diversifieds, are reporting strong numbers.

Chart 7: More attractive office cap rates

Source: CLSA, VanEck, 26 November 2025.

Chart 8: Elevated Retail REIT occupancy rate

Source: CLSA, VanEck, 26 November 2025

Historical outperformance

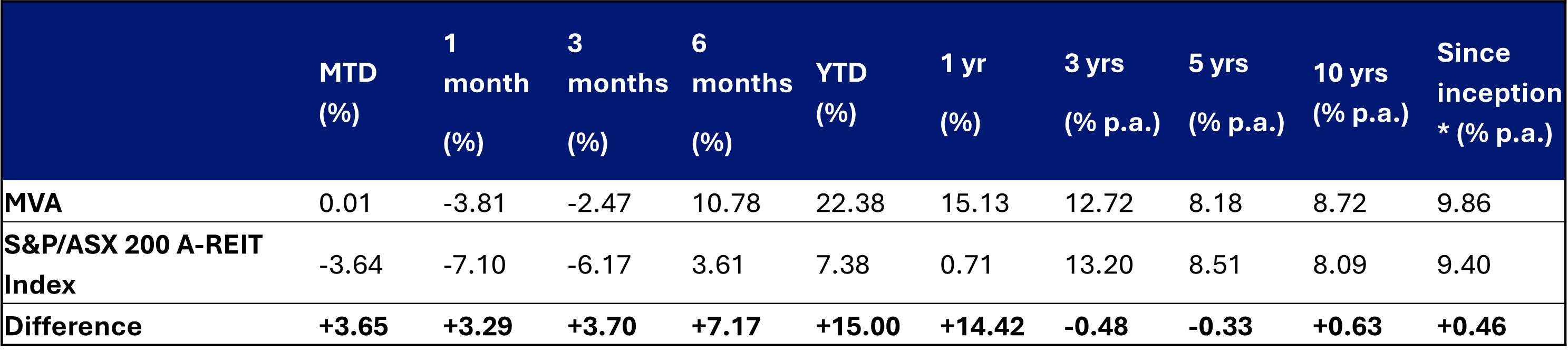

Since its inception on ASX in 2013, MVA has outperformed the S&P/ASX 200 A-REIT Index by 0.46% p.a., noting that past performance should not be relied upon for future performance. What this also means is that, over that time, MVA has outperformed ETFs tracking that index. Investors wishing to achieve a diversified A-REIT exposure for income and capital growth while paying passive fees (only 35 basis points per annum) should consider MVA.

Table 1: Trailing performance to 26 November 2025

* MVA Inception date is 14 October 2013. A copy of the factsheet is here.

Source: Morningstar Direct, VanEck. The table above shows past performance of MVA and of the S&P/ASX 200 A-REITs Index. You cannot invest directly in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. MVA results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance. The S&P/ASX 200 A-REIT Index is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of the largest A-REITs in Australia, from the S&P/ASX 200, weighted by market capitalisation. MVA’s index measures the performance of the largest and most liquid ASX-listed A-REITs, with a maximum weight of 10% in each security at rebalance. MVA’s index has fewer A-REITs and different property sector allocations than the S&P/ASX 200 A-REIT Index. Click here for more details.

We recently showcased MVA at the ASX Investor Day. Your clients might appreciate the abridged version of this presentation, which can be viewed here: Banking on Australian Property

Key risks:

An investment in our Australian Property ETF carries risks associated with: financial markets generally, individual company management, industry sectors, stock and sector concentration, fund operations and tracking an index. See the VanEck Australian Property ETF PDS and TMD for more details.

MVA is likely to be appropriate for a consumer who is seeking capital growth and a regular income distribution, is intending to use the product as a minor or satellite allocation within a portfolio, has an investment timeframe of at least 5 years, and has a high risk/return profile.

Published: 05 December 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

MVIS Australia A-REITs Index (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.