How AI is playing into the video game industry

Discover how artificial intelligence (AI) is reshaping the video game industry and the opportunity in it for investors.

AI plays a crucial role in shaping the future of the video gaming industry by enabling developers to create more immersive, dynamic, and personalised gaming experiences for a global market of nearly three billion gamers. In our view, investing in the video gaming industry is one way to get exposure to AI with diversification. At the same time, the video gaming industry is earning billions in annual revenue, supported by long-term trends that boost its attractiveness, such as demographic shifts and changing consumer demands.

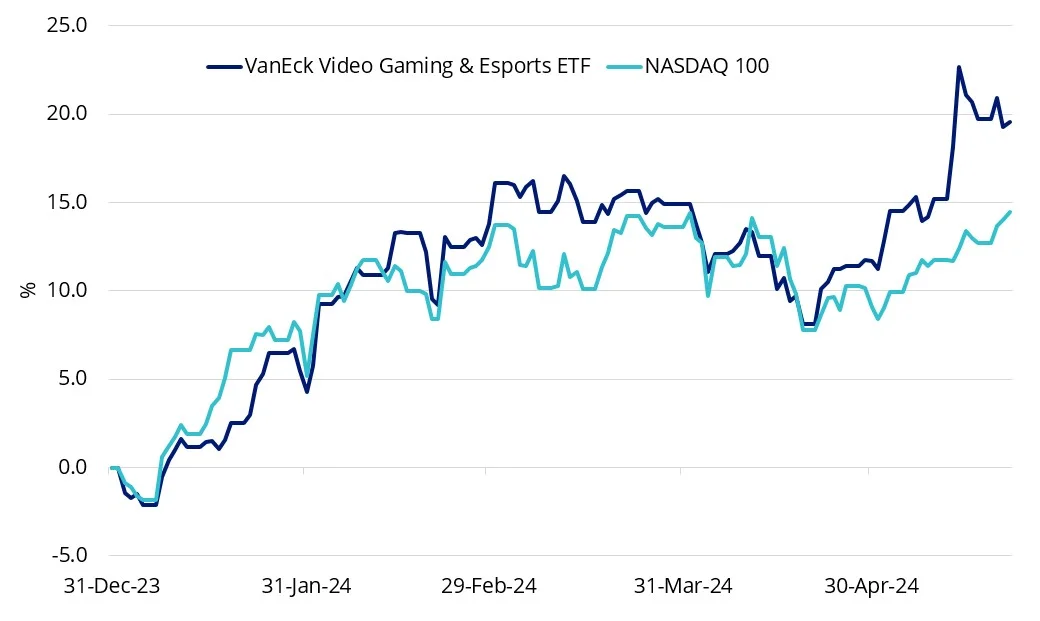

Video game industry rally

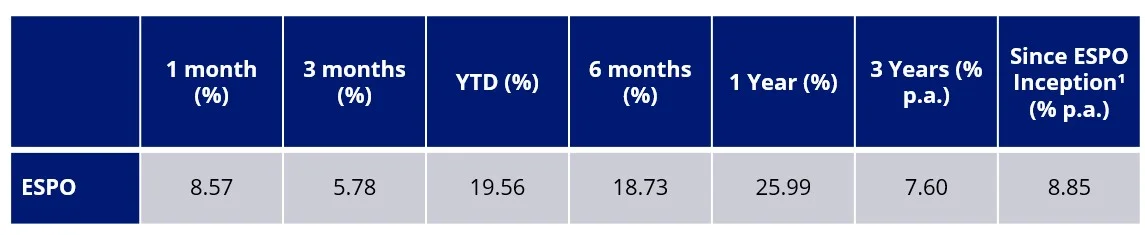

The video gaming industry rally has extended into 2024, outperforming the NASDAQ 100 index year-to-date. ESPO shown in chart 1 that tracks the MVIS Global Video Gaming & eSports Index, which includes companies that generate at least 50% of their revenues from video gaming and/or esports. The ETF has returned almost 20% so far this year, though we would always caution, past performance should not be relied upon for future results. You can view ESPO’s full track record here and in table 4 below.

Emerging tech trends, such as AI, have been one of the key factors bolstering this growth. The industry has been earning billions in annual revenues and we believe there is more to come.

Chart 1: ESPO vs NASDAQ 100 year-to-date performance

Source: Morningstar Direct, VanEck, 22 May 2024. The above chart is a comparison of performance of ESPO and a market capitalisation technology index. You cannot invest directly in an index. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. ESPO results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance. The NASDAQ 100 is shown for comparison purposes as the market benchmark for non-financial securities listed on the NASDAQ Stock Market. The NASDAQ 100 is a modified market capitalisation index heavily allocated towards top performing industries such as technology, consumer services, and health care. ESPO tracks an index which aims to represent the overall performance of companies involved in video game development, eSports, and related hardware and software globally. Consequently ESPO has fewer companies and different sector allocations than the NASDAQ 100.

Semiconductor stocks, such as Nvidia and Advanced Micro Devices, are popular names in the news, as they have performed significantly well in the past year. Both companies produce GPUs (graphics processing units, better known as ‘graphics cards’) tailored to meet the specific demands of AI applications, such as training the generative AI models expected to power the next generation of video games.

Training generative AI models, for instance, requires this type of better and faster chips. One important application of GPUs is in video games, an industry that is more than double the size of the music and movie industry in total and is still growing. The development of high-res and visually realistic games demands high-performing GPUs. With companies accelerating their R&D efforts, video gaming development in turn is levelling up.

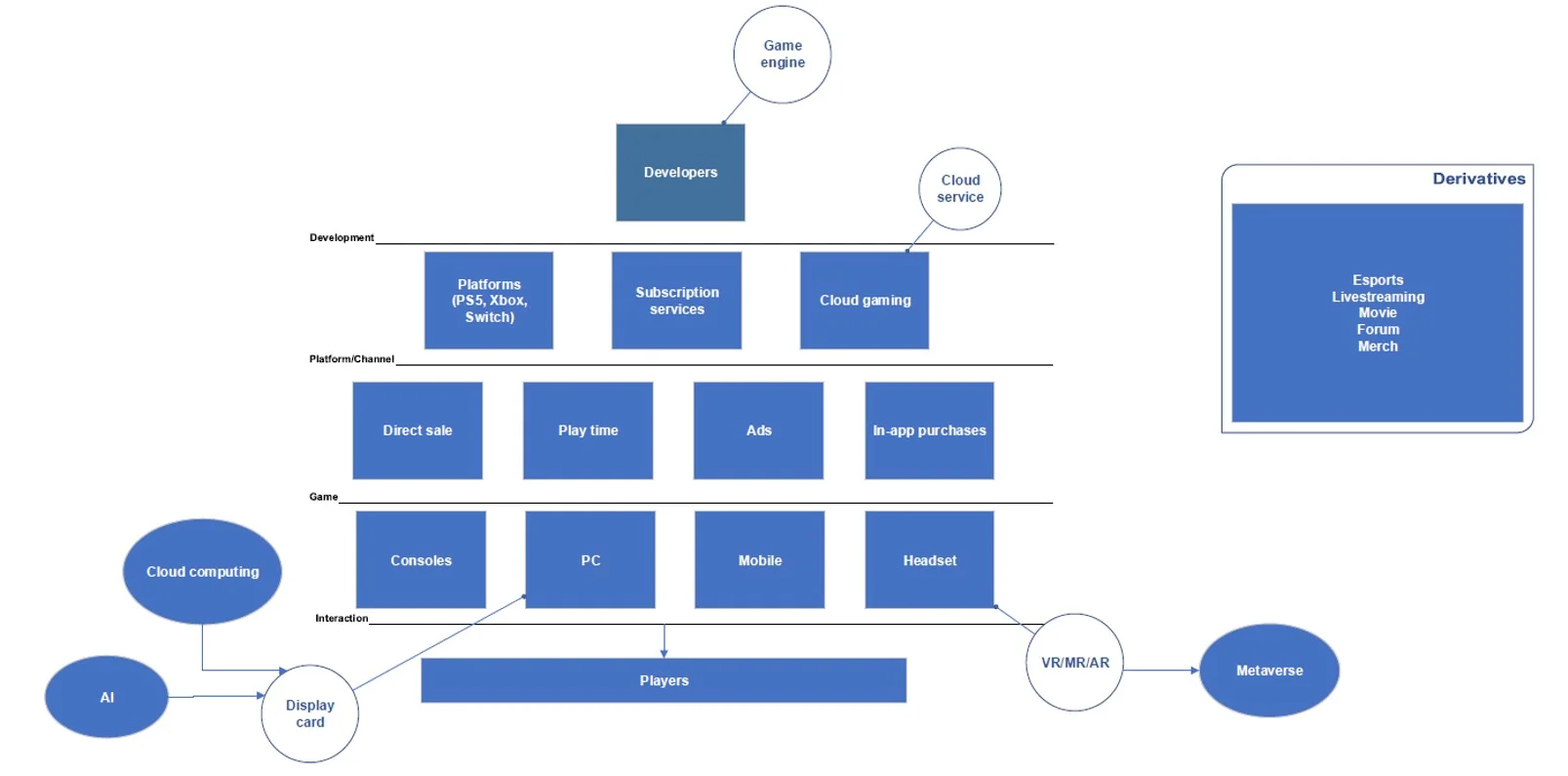

Investing in the video gaming industry is one way to get exposure to AI stocks with diversification. In chart 2, you can see the extensive ecosystem of this industry, categorised by development, platform/channel, games and interaction companies. The AI boom continues to benefit the growth of each sub-category.

Chart 2: Ecosystem of the video gaming industry

Source: VanEck, May 2024.

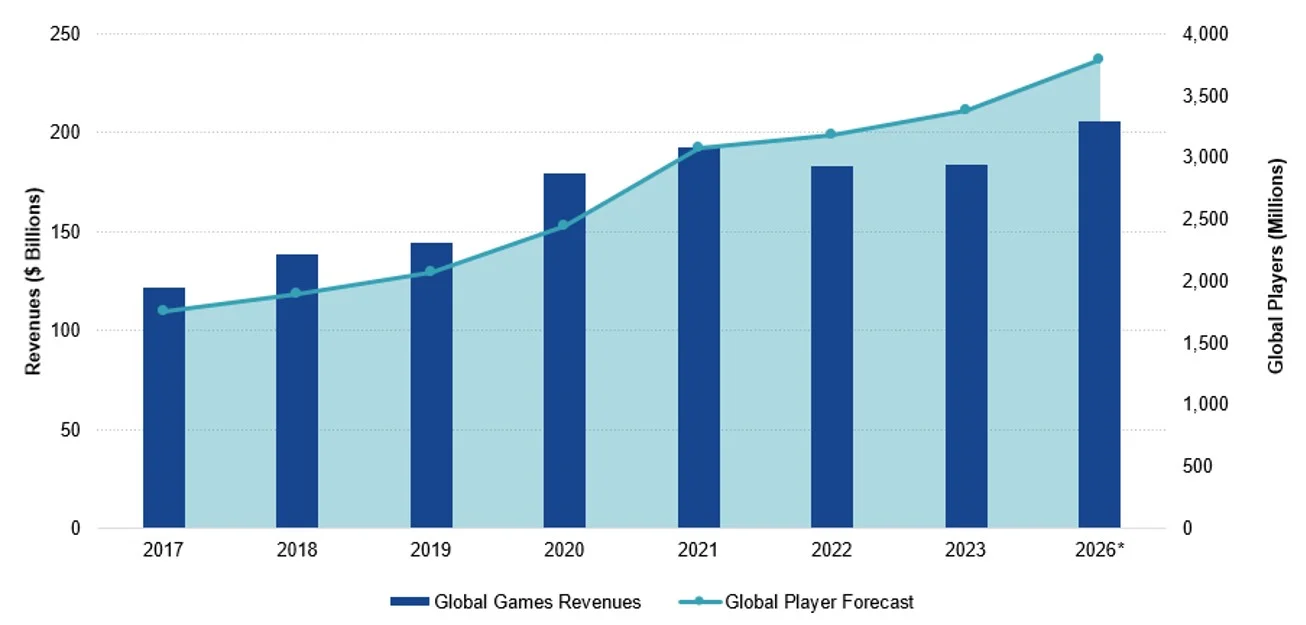

Long-term supportive trends of the video gaming industry

The video gaming industry represents a long-term structural growth story, and it is supported by broader trends such as demographic shifts, changes to consumer preferences and the widening of monetisation avenues through subscription and free-to-play models.

According to Statista, an estimated 2.77 billion people will play video games in 2024, rising to 2.86 billion in 2025. In Chart 3, global games revenues have been increasing and are expected to continue their positive trajectory.

Chart 3: Growing global revenues and players

Source: Newzoo Global Games Market Report, 2017, 2018, 2019, 2020, 2021, 2022, 2023. Past performance is not indicative of future results; current data may differ from data quoted. *Projected by Newzoo.

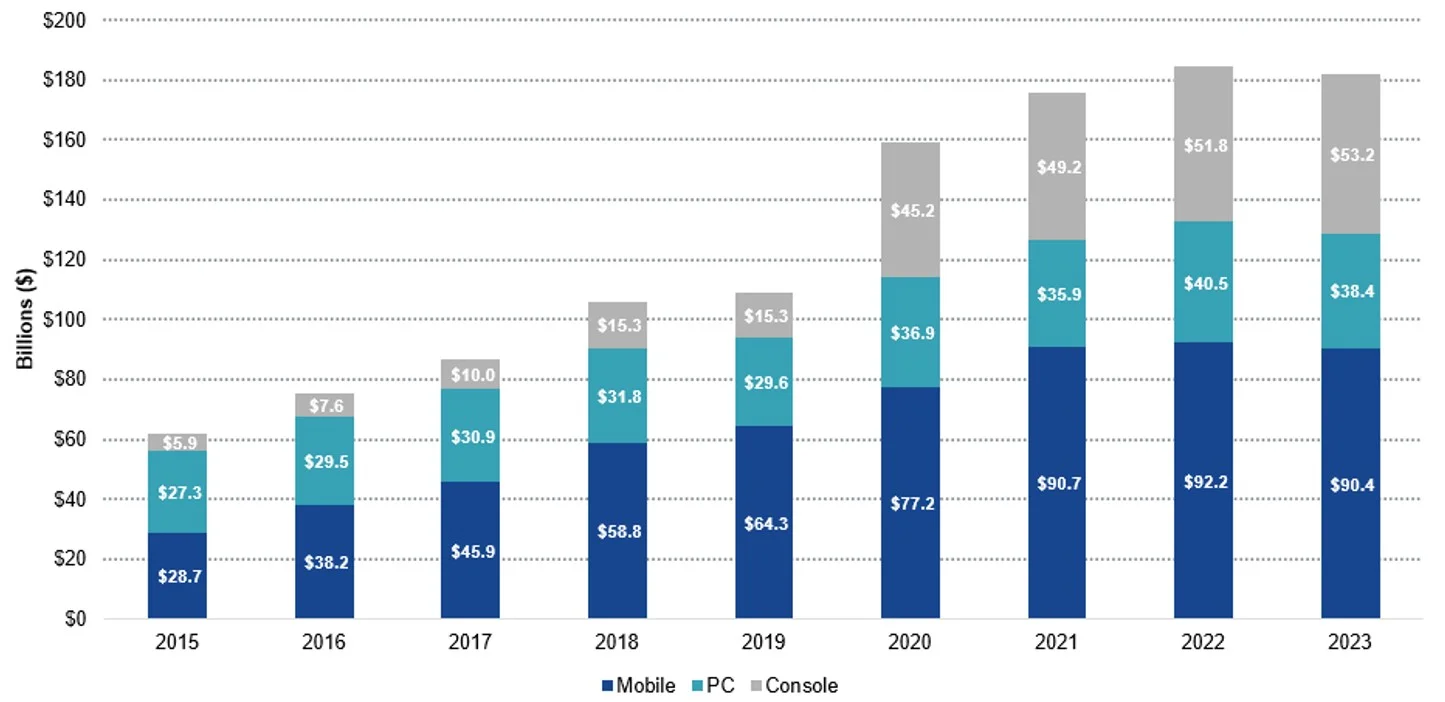

Game publishers have been successful identifying and leveraging emerging technologies to facilitate gaming to as many people as possible. Mobile gaming is a global phenomenon with mass participation in both emerging and developed markets (Chart 4).

Chart 4: Mobile gaming is a core component of global revenue

Source: Newzoo Global Games Market Report, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, 2023. Past performance is not indicative of future results; current data may differ from data quoted.

Consumer preferences have also shifted to desire more interaction. Mixing social media and gaming allows them to bring their friends into the interactive online world. Additionally, games are moving towards a subscription model, similar to Netflix. Such a model provides a more reliable path to monetisation for smaller, quality games that may otherwise lack the marketing or funding to break into the mainstream.

We believe these trends support the long-term structural growth of the industry, reiterating its potential for investors.

One way to gain exposure to AI stocks with diversification

Investors who want to benefit from the growth of this thriving industry can consider the VanEck Video Gaming and eSports ETF (ASX:ESPO).

As of 7 May, ESPO has a 56.3% exposure to AI stocks, and this is broken down below.

Table 1: Chipmaker names that are directly exposed to the AI theme.

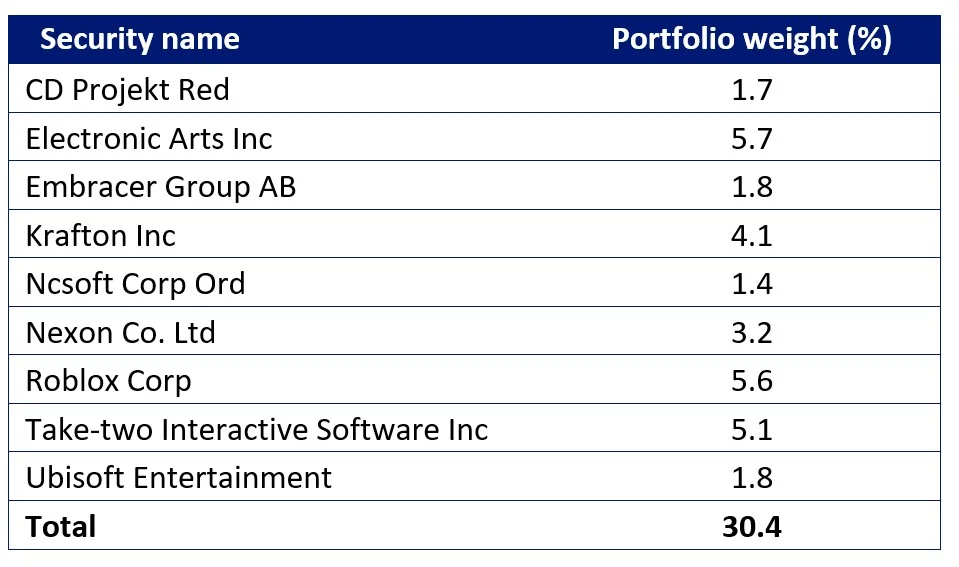

Table 2: Publishers and developers that are adopting generative AI technology to produce the next generation of games faster. Using AI in gaming development could be a cost-saving mechanism for these companies.

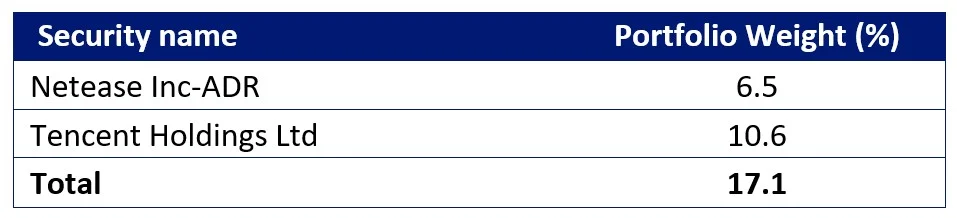

Table 3: Internet platform names in Asia that are potentially able to utilise some form of AI tech.

Table 4: Trailing returns of ESPO to 22 May 2024

Source: VanEck, Morningstar, Bloomberg as at 30 April 2023. Results are calculated to the last business day of the month and assume immediate reinvestment of distributions. ESPO results are net of management fees and other costs incurred in the fund, but before brokerage fees and bid/ask spreads incurred when investors buy/sell on the ASX. Returns for periods longer than one year are annualised. Past performance is not a reliable indicator of future performance.. ‘Click here for more details’.

1ESPO inception date is 8 September 2020 and a copy of the factsheet is here.

Learn more about investing in the video gaming sector.

Key risks

An investment in our video gaming and esports ETF carries risks associated with: ASX trading time differences, emerging markets, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the VanEck Video Gaming and Esports ETF PDS for details.

Published: 23 May 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

MVIS Global Video Gaming and eSports Index (AUD) (‘MVIS Index’) is the exclusive property of MV Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related entity of VanEck. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG to maintain and calculate the MVIS Index. Solactive uses its best efforts to ensure that the MVIS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVIS Index to third parties.