Small caps. Big potential.

Small companies in Australia have been risky and expensive.

Until now.

With interest rates remaining at record lows many investors are looking beyond traditional investments to generate income. As life expectancy increases the need for capital growth in retirement portfolios is also gaining importance. One overlooked opportunity is small cap companies that pay dividends.

Recently equity markets have been extremely focused on: interest rates; the high valuations of blue chip equities; and whether we are approaching a “bubble”. While there is much conjecture about these points, most investors agree they need their portfolios to generate income and this need is expected to increase as investors transition into retirement.

For savvy investors equity income exists beyond large blue chip companies.

Small companies have long presented opportunities for growth but a lack of research coverage. This means that many investment opportunities go unnoticed as small companies are often mispriced and in Australia trade in an inefficient market.

To achieve outperformance in Australian small companies it has been either:

- time consuming and risky for direct investors; or

- costly for indirect investors in actively managed small companies funds.

Until now.

Last week we launched the Market Vectors Small Cap Dividend Payers ETF (ASX code: MVS). MVS is a smart beta ETF that includes only the most liquid small cap stocks that paid their most recent dividend.

There are compelling economic and theoretical reasons for using dividend paying as the stock filter for small companies including:

- according to Wharton Professor Jeremy Seigel, dividends have provided the majority of the stock market’s total return over time and by allocating only to dividend paying stocks Siegel has been able to demonstrate outperformance;1

- companies with the ability to pay out dividends typically have competitive business models and robust balance sheets with strong cash flows;

- dividends are employed to determining stock values and future earnings;

- dividends are an objective measure;

- paying dividends indicates that the company may be profitable;

- dividends typically signal the presence of management teams that have a disciplined approach; and

While not a traditional source of income, Australian smaller companies offer diversification benefits as they have increased allocations to sectors that are underrepresented by larger companies such as industrials and consumer discretionary. Further, small companies are less correlated to larger companies and less correlated to the business cycle.

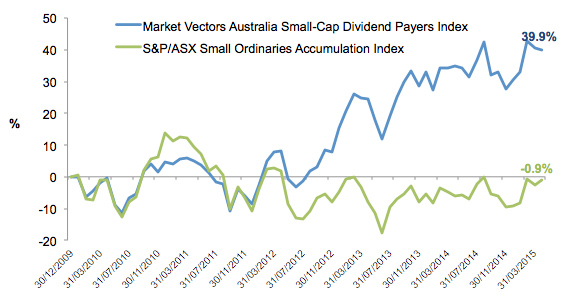

MVS tracks the Market Vectors Australia Small-Cap Dividend Payers Index which has outperformed the S&P/ASX Small Ordinaries Accumulation Index with lower volatility over the last five years.

Hypothetical performance: December 2009 to April 2015

Source: Market Vectors, Morningstar Direct; as at 30 April, 2015

The above graph is a hypothetical comparison of performance of the MVS Index and the S&P/ASX Small Ordinaries Accumulation Index. For performance calculations see below.*

MVS Index has a historic dividend yield including franking credits of 5.2% per annum or 4% net, underpinned by sustainable and robust dividend growth rates.*

MVS gives investors an instant portfolio of dividend paying small company stocks via a single trade on ASX. MVS is a liquid, transparent and diversified small company portfolio with one of the lowest management fees among both active and passive strategies in the market.

1 Future for Investors, 2005

* PERFORMANCE CALCULATION INFORMATION: Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in MVS. You cannot invest directly in an index. MVS Index performance is simulated based on the current MVS Index methodology. Past performance information is not a reliable indicator of current or future performance of the MVS Index, which may be lower or higher.

IMPORTANT NOTICE: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 as responsible entity (‘MVIL’) of the Market Vectors Small Cap Dividend Payers ETF (‘Fund’). MVIL is a wholly owned subsidiary of Van Eck Associates Corporation based in New York, United States (‘Van Eck Global’).

This is general information only and not financial advice. It is intended for use by financial services professionals only. It does not take into account any person’s individual objectives, financial situation nor needs (‘circumstances’). Before making an investment decision in relation to the Fund, you should read the product disclosure statement (‘PDS’) and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

The Fund is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of current or future performance. No member of the Van Eck Global group of companies guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

Market Vectors Australia Small-Cap Dividend Payers Index (‘MVS Index’) is the exclusive property of Market Vectors Index Solutions GmbH based in Frankfurt, Germany (‘MVIS’). MVIS is a related body corporate of MVIL. MVIS makes no representation regarding the advisability of investing in the Fund. MVIS has contracted with Solactive AG (‘Solactive’) to maintain and calculate the MVS Index. Solactive uses its best efforts to ensure that the MVS Index is calculated correctly. Irrespective of its obligations towards MVIS, Solactive has no obligation to point out errors in the MVS Index to third parties.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global.

© 2015 Van Eck Global. All rights reserved.

Published: 09 August 2018