Australian mining stocks surge

Australian mining stocks have surged since late last year as export demand and commodity prices increase.

Australian mining stocks have surged since late last year as export demand and commodity prices increase.

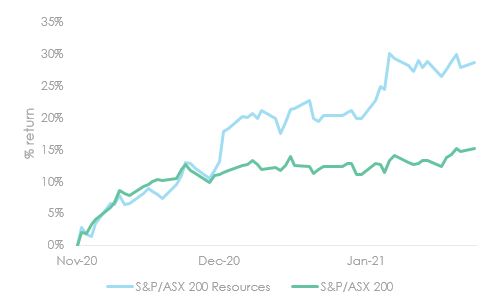

Australian mining stocks have surged since 30 October 2020 following skyrocketing resource prices and export demand. Australian resources stocks and companies that support the resources industry, as represented by the S&P/ASX Resources Index outperformed the broad Australian equity market, as represented by the S&P/ASX 200.

Figure 1 – Australian resources versus S&P/ASX 200 performance

Source: Bloomberg, 30 October 2020 to 25 January 2021

Export demand

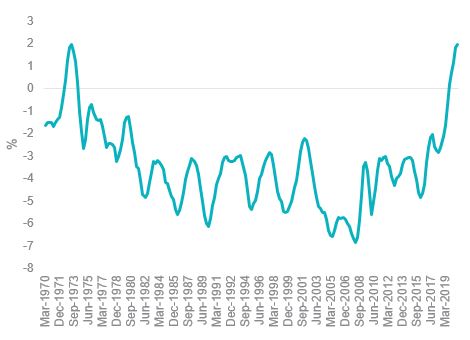

Export demand for Australian resources has surged despite ongoing tensions with China. BHP reported record volume of iron ore production in H2 2020. China iron ore November demand grew 8% YoY (+15% YoY October). Australia’s current account surplus (exports exceeding imports) reached its highest point as a percentage of GDP since 1973 during Q3 2020.

Figure 2 – Australian Current Account (% GDP)

Source: Bloomberg

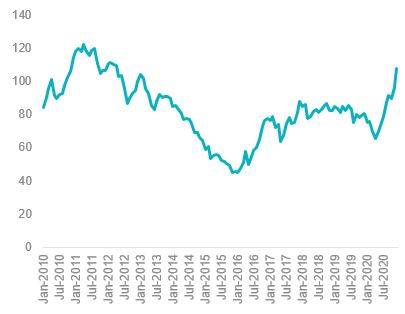

The iron ore price surpassed US$160 per tonne in January 2021, the highest it has been in 10 years. Westpac commodity index which is a composite futures basket weighted according to their contribution to Australia's total commodity exports reached a 9 year high (figure 4). The index includes - gold, crude oil, iron ore, LNG, coal, base metals (such as copper, lead, zinc, nickel and aluminium) and rural commodities (such as cotton, wheat, sugar and wool).

Figure 3 – Iron Ore Spot Price Index 62% Import Fine Ore CFR Qingdao

Source: Bloomberg

Figure 4 – Westpac Australian Export Commodity Futures Index

Source: Bloomberg

Published: 27 January 2021

Issued by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’). This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here. An investment in MVR carries risks associated with: financial markets generally, individual company management, industry sectors, stock and sector concentration, fund operations and tracking an index. See the PDS for details. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.