Finding quality small caps

Often Australian investors’ exposures to international equities are dominated by large- and mid-cap companies. This is because the benchmark index used by Australian managers is the MSCI World ex Australia Index, which aims to capture the performance of these large- and mid-cap companies.

As a result, investors are missing opportunities in the remaining 15% of the international equities market not included in the benchmark. These companies are international small-cap companies.

Here we provide some insightful analysis for our popular International Small Companies ETF (QSML), which launched last year, versus the international equity small companies benchmark.

Australian investors are under invested in international small companies. Adding international small companies to a portfolio can benefit investors in a number of ways beyond performance, they can also provide important diversification. But like with the Australian Small Ordinaries universe, with international small companies investing it pays to be prudent.

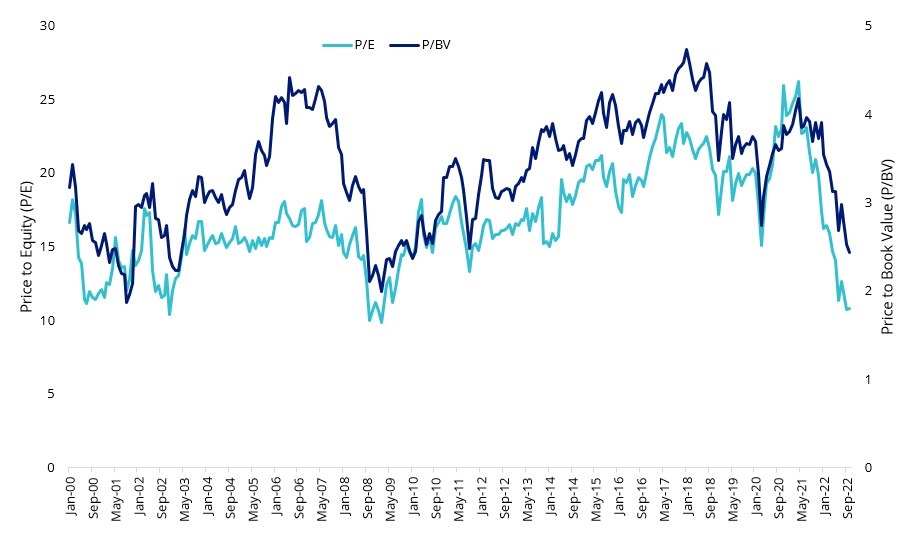

And the time may be right for international small caps. Valuation fundamentals are trading at levels not seen since 2008, making it a relative attractive investment for investors who want to position their portfolios for the next cycle following a looming hard landing in the US. Currently small caps look cheap. If we look at the valuation metrics of the index that the VanEck MSCI International Small Companies (QSML) tracks, MSCI World ex Australia Small Cap Quality 150 Index (QSML Index), its price to book and price to equity valuations are at lows not seen for over a decade.

Chart 1: QSML Index valuation metrics

Source: MSCI.

Part of the driving force behind small caps’ decline in value has been fears of an economic slowdown.

The rationale for considering international small-cap companies is compelling, potentially more so than Australian small-caps. Yet while Australian investors recognise the small-cap opportunity locally, often the international small cap universe is overlooked due to difficulty of access and costs.

To date there has only been two popular approaches to investing in international small companies:

- Via an actively managed fund; or

- Via a passive fund tracking the benchmark index.

The risk of actively managed funds is that performance is uncertain despite costs being high. Many people find this a poor bargain and thus consider lower cost passive funds that tracked traditional indices. In these new funds, costs are low and returns are considered average - not high, not low, just the market average. When it comes to investing in an international small-cap passive fund, the benchmark used is the MSCI World ex Australia Small Companies Index.

QSML is different. It retains the low costs of a passive fund, but it tracks an index different from the market benchmark, in this instance, the MSCI World ex Australia Small Cap Quality 150 Index. You may be aware of our International quality ETF, QUAL that tracks the MSCI World ex Australia Quality Index which targets international companies with a high return on equity (ROE), low leverage and stable earnings. We affectionately call QSML “baby QUAL” because it harvests the Quality Factor, using the same fundamentals as QUAL, but in the International Small Cap universe.

We wrote a research paper “Finding the pawns that will become Queens ”that raises the question: given many Australian portfolios have an allocation to Australian Small Caps, why not International Small Caps? When you consider the long-term risk and return trade-off, the case for international small companies is compelling. It also shows that the quality factor is more pronounced in international small companies than international large companies.

Given valuations, an allocation to international small companies may already be on savvy investors’ radars.

So, let’s walk through the difference between the MSCI World ex Australia Small Cap Quality 150 Index (QSML Index) and the International Small Cap Index.

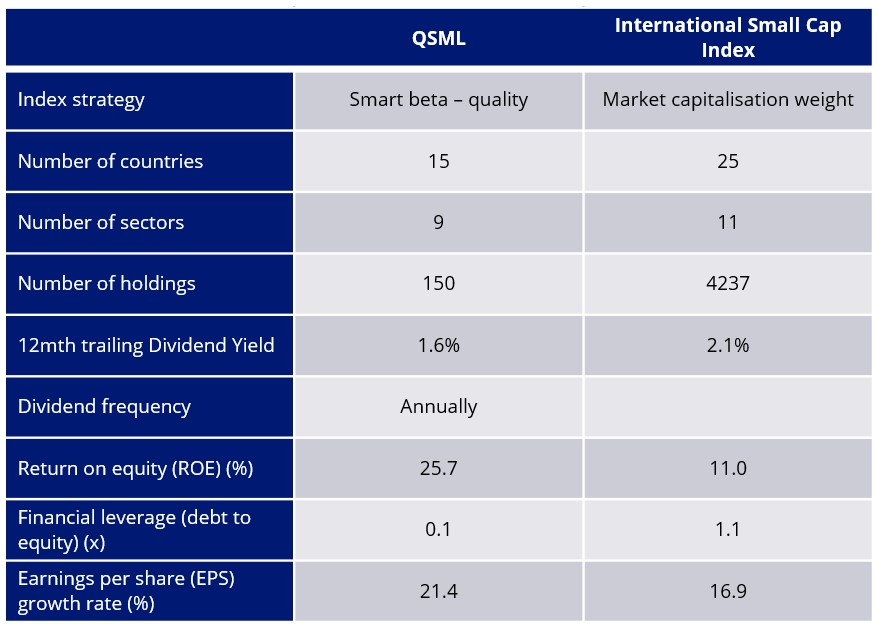

QSML vs International Small Cap Index – Fundamentals

Table 1: Statistics and fundamentals

Source: VanEck, MSCI, FactSet, as at 31 October 2022. You cannot invest directly in an index. International Small Cap Index is MSCI World ex Australia Small Companies Index. Past performance is not indicative of future performance.

As you would expect, QSML has higher ROE, lower debt to equity and a higher EPS growth rate.

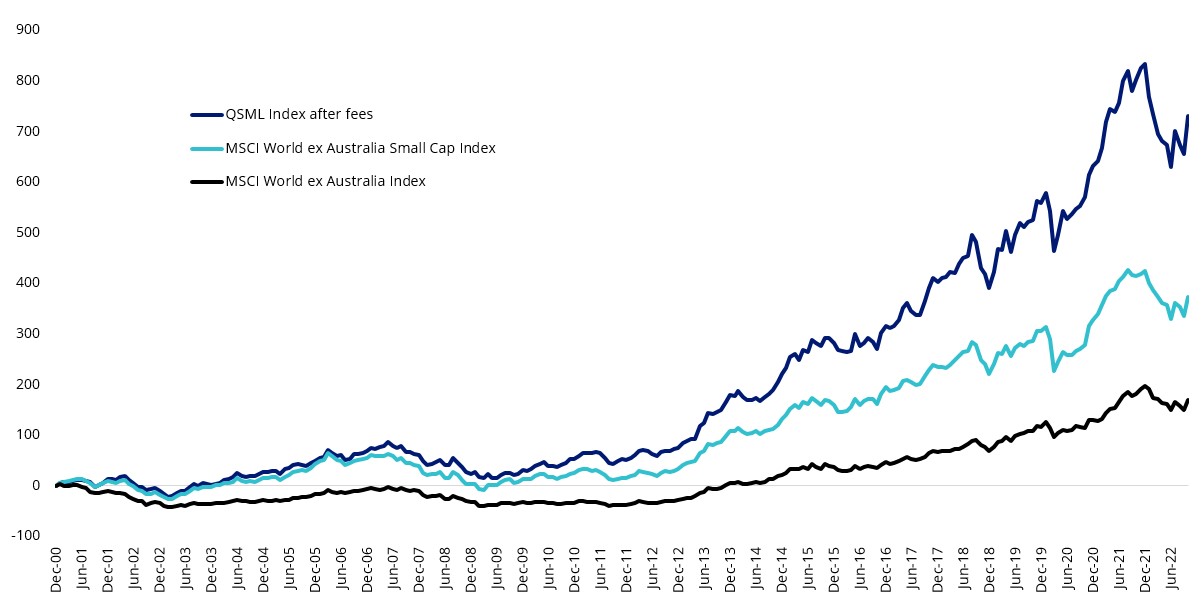

QSML Index vs International Small Cap Index - Performance

Based on back testing after fees, QSML’s Index (net of QSML’s 0.59% p.a. management fee) displays long-term outperformance against the MSCI World ex Australia Small Companies Index, both of which outperform the large capitalisation equivalent, as highlighted by the chart below. Note: as always past performance is by no means an indication of future performance.

Chart 2: Modelled cumulative performance: QSML Index after fees1vs MSCI market capitalisation indices

Table 2: Trailing returns: QSML, QSML Index after fees1vs MSCI World ex Australia Small Companies Index

Chart 2 and Table 2 Source: VanEck, Morningstar, Bloomberg as at 31 October 2022. Past performance is not a reliable indicator of future performance.

1QSML Index results are net of QSML’s 0.59% p.a. management fees, calculated daily but do not include brokerage costs or buy/sell spreads of investing in QSML. You cannot invest in an index. QSML’s Index base date is 30 November 1998. QSML Index performance prior to its launch in February 2021 is simulated based on the current index methodology.

2QSML inception date is 8 March 2021 and a copy of the factsheet is here.

3The MSCI World ex Australia Small Companies Index (Parent Index) is shown for comparison purposes as it is the widely recognised benchmark used to measure the performance of developed market small companies, weighted by market cap. QSML Index measures the performance of 150 companies selected from the Parent Index based on MSCI quality scores. Consequently the QSML Index has fewer companies and different country and industry allocations than the Parent Index. ‘Click here for more details’.

QSML vs International Small Cap Index - Top 10 holdings

Below you can see the top 10 companies. As you would expect, in the International Small Companies Index, with over 4,000 the top 10 weights are small. The biggest holding is only 0.86% of the portfolio. The QSML Index’s holdings have a more meaningful exposure. Some of the names might be familiar to you, Williams Sonoma manufacture cookware, Toro is known for its garden equipment, while Decker’s Outdoor is a footwear company that has a stable of brands including UGG, Teva and Hoka One One – to see all the holdings in QSML and their weightings click here.

|

Table 3: Top 10 holdings QSML |

Weight (%) |

|

Builders FirstSource, Inc. |

1.77 |

|

Graco Inc. |

1.75 |

|

Reliance Steel & Aluminum Co. |

1.63 |

|

Darling Ingredients Inc. |

1.58 |

|

Toro Company |

1.57 |

|

Hubbell Incorporated |

1.55 |

|

Williams-Sonoma, Inc. |

1.35 |

|

United Therapeutics Corporation |

1.34 |

|

East West Bancorp, Inc. |

1.32 |

|

Deckers Outdoor Corporation |

1.30 |

|

Table 4: Top 10 MSCI World ex Australia Small Companies Index |

Weight (%) |

|

Sparx Group Co., Ltd. |

0.86 |

|

First Solar, Inc. |

0.22 |

|

First Horizon Corporation |

0.20 |

|

Ovintiv Inc |

0.20 |

|

Darling Ingredients Inc. |

0.20 |

|

Hubbell Incorporated |

0.20 |

|

Reliance Steel & Aluminum Co. |

0.19 |

|

Lamb Weston Holdings, Inc. |

0.19 |

|

Chesapeake Energy Corporation |

0.19 |

|

Graco Inc. |

0.18 |

Source: Factset, VanEck, MSCI, as at 31stOctober 2022.

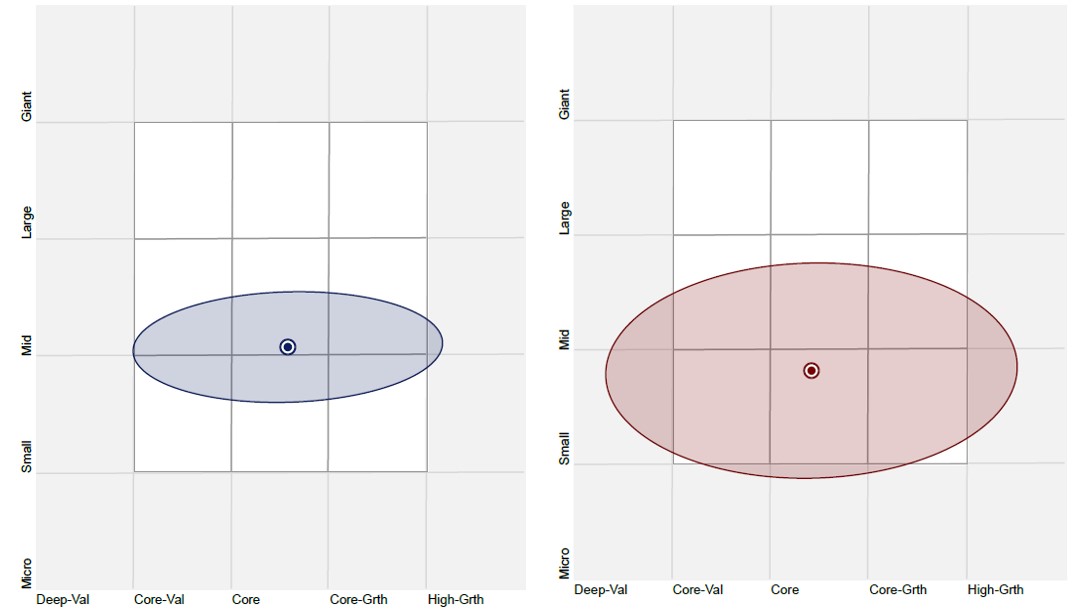

QSML vs International Small Cap Index - Style

When looking at portfolios it is important to determine what style, e.g. value or growth and what size bias a portfolio holds, e.g. giant, large, mid or small. Below we can see QSML’s. QSML skews towards mid-sized companies.

| Chart 3: QSML holdings-based style map |

Chart 4: MSCI World ex Australia Small Companies Index holdings-based style map |

Source: Morningstar Direct, as at 31st October 2022

While each International Small Company ETF has its merit for portfolio inclusion, you should assess all the risks and consider your investment objectives.

Past performance is no guarantee of future performance. The above is not a recommendation. Please speak to your financial adviser or stock broker. For further information you can contact us at +61 2 8038 3300.

Key risks

An investment in QSML carries risks associated with: ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.

Published: 04 November 2022

VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) is the responsible entity and issuer of units in the VanEck MSCI International Small Companies Quality ETF. This is general advice only, not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Read the PDS and speak with a financial adviser to determine if the fund is appropriate for your circumstances. The PDS is available here. The Target Market Determination is available here. No member of the VanEck group of companies guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.

QSML and QUAL are indexed to a MSCI index. QSML and QUAL are not sponsored, endorsed or promoted by MSCI, and MSCI bears no liability with respect to QSML, QUAL or the MSCI Index. The PDS contains a more detailed description of the limited relationship MSCI has with VanEck, QSML and QUAL.